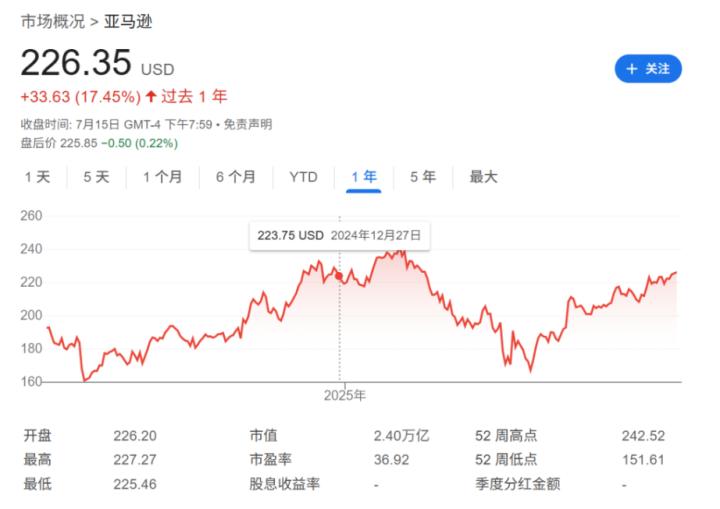

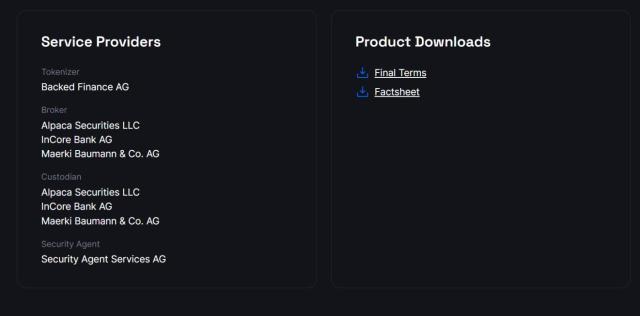

Silicon Valley technology and Wall Street capital collide on-chain again. xStocks, launched by Swiss fintech company Backed Finance, has accumulated a trading volume of over $300 million in four weeks. According to Coindesk, this tokenized stock product allows investors to trade traditional assets 24/7 on the blockchain through 1:1 custody of physical US stocks, becoming an important case of real-world asset digitization.

Solana Becomes Traffic Engine

xStocks leverages Solana blockchain's high speed and low cost, providing instant settlement and a non-stop global trading experience. Besides centralized exchanges like Bybit and Kraken, it quickly integrated into decentralized exchanges (DEX) such as Raydium and Jupiter in its first week.

Solana DEX tokenized stocks reached a trading volume of $20 million in the initial days, accounting for over 90% of similar products, demonstrating that blockchain infrastructure can now support large capital flows.

While trading without time differences is attractive, asset security remains key. Backed Finance states that all target stocks are fully held by regulated custody institutions, with on-chain minting certificates allowing investors to verify inventory at any time, reducing trust costs.

Similarities Between Tokenized Stocks and CFDs

Beyond the hype, fundamental market questions have emerged. FreedX CEO Anton Golub directly states:

"I believe they are just repackaged traditional securities because they do not provide any inherent stock rights, such as voting rights or the ability to become a direct owner of a company or asset."

Although tokenized stocks have physical asset backing, investors still hold issuer certificates, similar to European Contracts for Difference (CFDs) without voting rights. In other words, they have strong price tracking functionality, but shareholder rights are stripped away.

Liquidity and Regulation: Weekend Price Differences and Policy Gray Areas

Another challenge is liquidity. Parsec Finance warns that when traditional stock markets are closed and lack primary market makers, "significant price differences may be seen on weekends". In the short term, retail investors might tolerate price slippage, but attracting institutional-level funds requires proven continuous liquidity.

Regulatory aspects are also not yet settled. Backed Finance currently operates under the Swiss DLT framework, with relatively clear custody and disclosure mechanisms, but cross-border sales and the application scope of US securities laws remain unclear. Policy uncertainty not only affects product design but also determines future circulation range.

Tokenized stocks are considered an important piece of real-world asset (RWA) tokenization, but products like xStocks still need to find a balance between efficiency and compliance. xStocks' $300 million in four weeks tells the market that FinTech has put asset digitization needs on the table, and the next step is market adaptation.