Written by: Long Yue, Wall Street Insights

Blockchain technology is trying to disrupt the traditional stock market, but reality is more complex than ideals.

The start of tokenized stocks has not been smooth. Currently, digital tokens designed to track popular stocks like Amazon and Apple have experienced severe price deviations since their launch two weeks ago.

Robinhood Markets is facing scrutiny from European regulators after launching a token allowing investors to bet on OpenAI without the AI startup's permission. The Wall Street Journal reported that industry professionals are concerned that such "tokenization" of stocks creates opportunities for illegal insider trading and market manipulation that are difficult to detect.

At the end of June, multiple cryptocurrency exchanges, including Robinhood, Kraken, Gemini, and Bybit, released blockchain-based versions of US stocks and ETFs for non-US customers. Crypto executives claim this is a way for global investors to invest in popular securities like Tesla, NVIDIA, and SPDR S&P 500 ETF, especially in countries where purchasing US stocks through local brokers is challenging.

Severe Price Deviation Raises Doubts

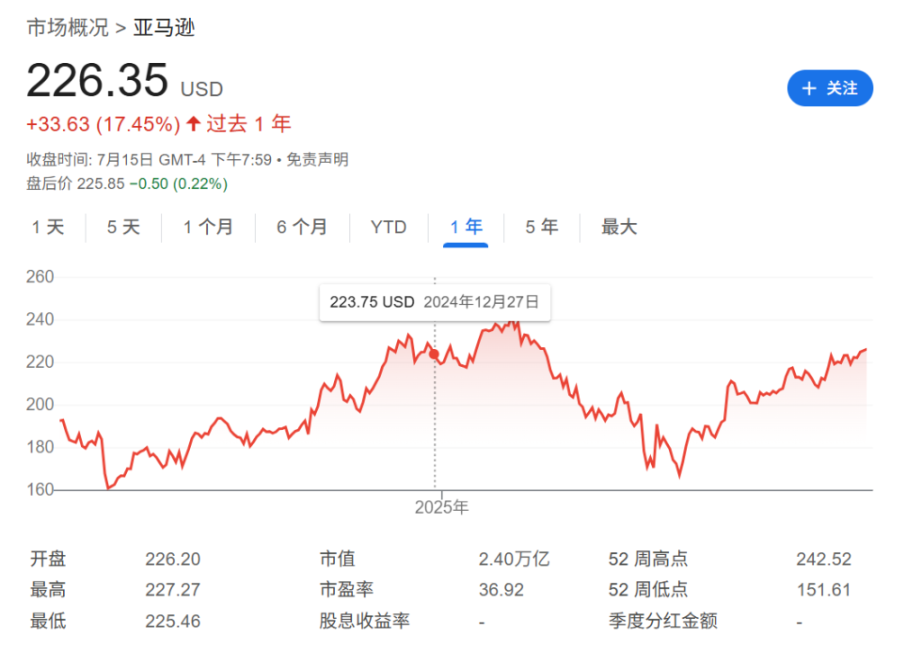

However, the performance of tokenized stocks has been chaotic. According to data provider CoinGecko, on July 3, the Apple-tracking token AAPLX briefly surged to $236.72, a 12% premium over the stock's trading price. A similar Amazon-tracking token rose to $891.58 on July 5, four times the previous trading day's closing price.

More extreme cases occurred on the peer-to-peer cryptocurrency trading platform Jupiter. Blockchain data shows that on the morning of July 3, an unidentified user attempting to purchase about $500 of Amazon token AMZNX momentarily pushed its price to $23,781.22, over 100 times the previous day's closing price.

These tokens, called "xStocks", were issued by Switzerland-based Backed Finance, which collaborated with Kraken and Bybit to launch dozens of stock-tracking tokens on June 30.

However, due to thin trading on multiple cryptocurrency exchanges, these xStocks are prone to extreme price volatility when users buy and sell beyond market capacity. This volatility can be exacerbated during nighttime and weekend market closures. A Backed spokesperson stated: "We are actively tracking any price misalignments and working with exchanges to address this issue."

Regulatory Scrutiny Intensifies

Robinhood launched tokenized stocks at a grand event in France on June 30. To promote this Europe-only product, the company gave away tokens linked to OpenAI and SpaceX performance, neither of which are publicly listed.

OpenAI denied these tokens, stating on Twitter: "We have not collaborated with Robinhood, are not involved, and do not endorse this." The Lithuanian Central Bank, which regulates Robinhood's European operations, said it has contacted Robinhood to explain these tokens and their marketing approach.

A Robinhood spokesperson said: "We are confident in our project and are engaging with regulators to resolve any issues."

Skeptics worry that tokenized stocks might become a way to circumvent regulations. In US markets, exchanges monitor manipulation and other abuses, and brokers must know their customers' identities, enabling regulators to investigate suspicious activities and identify individuals involved.

Backed claims that transactions on public blockchains are more transparent than traditional finance, making monitoring and detecting illegal activities possible.

However, other industry participants are concerned that tokenized stocks traded on anonymous platforms are a source of trouble. Carlos Domingo, CEO of tokenization startup Securitize, said such an arrangement could encourage abuses like insider trading: "This is Pandora's box, and it will eventually explode because people will find ways to do illegal things with these tokens."