Written by: Shao Jiadine, Huang Wenjing

Introduction

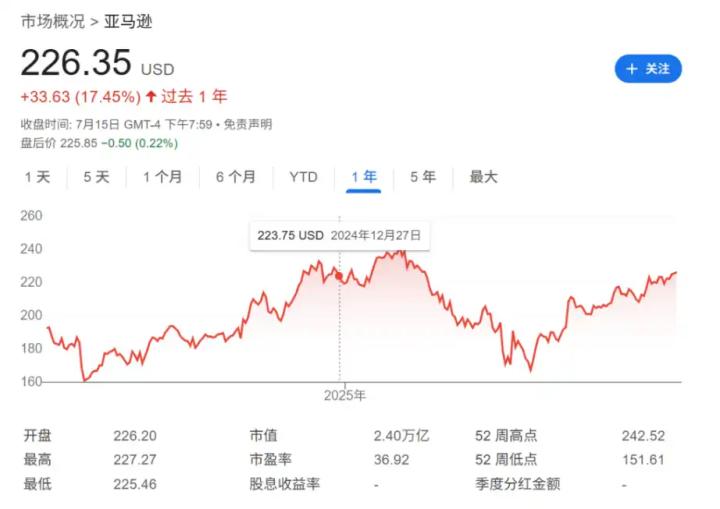

RWA (Real-World Assets on Chain) is rapidly becoming the mainstream narrative in the Web3 world, and stock tokenization is currently one of the most feasible directions.

The reasons are simple:

The underlying assets are mature enough and do not require effort to "prove value";

The technical threshold is relatively controllable, with existing tools for on-chain issuance and mapping;

Regulatory pathways are gradually becoming clearer, especially in Europe and some offshore regions, with real projects already implemented.

However, many people immediately wonder when they hear the word "stocks": Is this a security? Can it be sold to retail investors? Is a license mandatory?

In reality, some projects have found ways to "balance both sides". They can reduce compliance pressure while reaching the retail market, with representative cases being:

Robinhood: The most popular retail securities platform in the United States;

xStocks: Implementing stock token trading in non-EU and non-US regions, tradable on-chain.

As a lawyer focused on Web3 compliance, I have been frequently receiving similar consultations:

How exactly do stock tokenization platforms operate?

Do small and medium-sized teams have a chance to do this?

If we want to do it, where should we start, and how to structure it legally?

This article will focus on answering one question:

If you want to create a stock tokenization platform that retail investors can participate in with controllable compliance pressure, how should you do it?

[The rest of the translation follows the same approach, maintaining the structure and translating all text while preserving any <> tags]Clearly define what your token represents

Avoid crossing the red lines of users, markets, and laws

This market is not saturated, but rather in a period where institutions are interested but cautious, and entrepreneurs are intrigued but hesitant to enter. Stop watching what others are doing. The stock tokenization track is not yet crowded; once giants occupy the space, you'll be left as just a user.