In July 2025, NASDAQ and the Asian Economic Zone almost simultaneously released a significant signal: BNB, previously viewed as an "exchange platform token", is gradually entering the asset allocation list of mainstream capital. From corporate reports to national reserves, it seems to be transforming BNB from a retail participation tool on exchanges to an asset recognized by sovereign nations and institutions, with some even listing it alongside Bitcoin (BTC) and Ethereum (ETH) as digital asset reserves - a trend worth long-term observation.

Two Major Listed Companies Enter: Buying BNB at Low Points

On July 16th, NASDAQ-listed Windtree Therapeutics (stock code: WINT) announced signing a securities purchase agreement worth $60 million with Build and Build Corp, with a total potential amount of $200 million. According to the agreement, these funds will be used to establish a corporate crypto Treasury centered on BNB, providing direct BNB price exposure for the company.

This is not an isolated case. CZ mentioned in June that there is more than one such company. In early July, another NASDAQ-listed company, a chip manufacturer (stock code: NA), announced purchasing 74,315 BNB at an average price of $672.45 per coin, investing $50 million.

Nano Labs stated this is part of a long-term allocation strategy aimed at gradually converting $1 billion in assets to BNB, with $500 million coming from convertible bonds. According to public company information, Nano Labs currently holds digital assets totaling $160 million, indicating a long-term and aggressive digital asset allocation. Yesterday (23rd), Nano Labs increased its holdings by 120,000 BNB, demonstrating its crypto reserve determination.

Wall Street Mainstream Signal: BNB Reserves in Demand

From the actions of these two NASDAQ companies, BNB is not seen as a simple exchange ecosystem token, but as a corporate-level asset allocation tool. This reflects how the traditional capital world is adjusting its risk perception and investment ideas about digital assets.

As early as May, VanEck, one of the world's top five fund companies managing $80 billion in assets, had already seen potential opportunities. SEC filing documents show that a BNB-related ETF has been submitted, including staking yield, indicating that mature Wall Street mainstream companies have long recognized customer demand for tokens like BNB and are seeking early positioning.

Recently, CZ's YZi Labs even announced support for 10X Capital to establish a BNB reserve company, with plans to go public via IPO, reflecting that the BNB ecosystem is entering mainstream capital options and has the opportunity to ride this crypto listing wave.

BNB Enters Sovereign Strategic Reserves

Beyond the corporate level, BNB is even being incorporated into sovereign-level asset reserve systems, becoming a value store and economic foundation. For example, Bhutan's Gelephu Mindfulness City (GMC) Economic Zone has officially added BTC, ETH, and BNB to its official strategic reserve asset list.

According to the zone's website, BNB was chosen for its high market value, strong liquidity, and operation on a mature and secure public chain (BNB Chain).

In May 2025, during CZ's visit to Kyrgyzstan, he also suggested that the local government consider including BNB and BTC in its planned "national-level crypto asset reserves". Although the related policy has not yet been officially implemented, BNB's "sovereign asset potential" is being seriously evaluated by some countries.

On-chain Transaction Volume Doubles, BNB's Reserve Value

When BNB was first created, it was an incentive mechanism for Binance exchange users to reduce transaction fees; over the years, it has gradually become the core asset supporting the entire BNB Chain ecosystem, and the first global exchange token successfully transformed into a chain's core token, now evolving into a "strategic asset".

BNB has sufficient market value and liquidity, providing predictability in price and risk management; on the other hand, its BNB Chain ecosystem and global business layout make BNB no longer an isolated token; the third aspect is its role as a value carrier connected to blockchain infrastructure, decentralized finance (DeFi), and even real-world assets (RWA) on the BNB public chain.

According to on-chain data company Nansen, BNB Chain's on-chain data and transaction volume have shown significant growth, with transaction volume doubling since April, breaking through 140,000 daily transactions.

These characteristics have made BNB begin to possess higher "integrability" and "functional flexibility" in the eyes of enterprises and national investors, capable of being embedded into various capital structures and reserve models.

The Era of Diverse Crypto Asset Reserves Arrives, Where Are the Opportunities for Retail Investors?

Bitcoin and Ethereum, as digital gold and smart contracts, have long been viewed as mainstream assets. When businesses and sovereigns begin to place BNB alongside these two, entering enterprise treasuries and national reserves, this may mean that "crypto assets" have entered a diversified stage.

We cannot simply view token scarcity, but instead look at it from the crypto practical perspective and shift towards the mainstream - transforming from an "alternative asset" resistant to traditional finance to a "new standard allocation" integrating with traditional finance.

In the race of capital restructuring, enterprises and national sovereigns are considering what assets can still be participated in and have ready ecosystems and solid value recognition in a world where fiat currencies face risks, besides high-cost options like Bitcoin and Ethereum.

For retail investors, in this new digital asset reserve era, new tokens being adopted for reserves could be a track not yet fiercely competed. Past crypto experiences tell us that early adopters usually reap substantial rewards.

Returning to the beginning of the news, BNB's reserve recognition proves the arrival of a new era, where assets with ecosystems, application scenarios, and stable value are worth being considered as a form of reserve.

Will BNB Price Break $1,000 This Year?

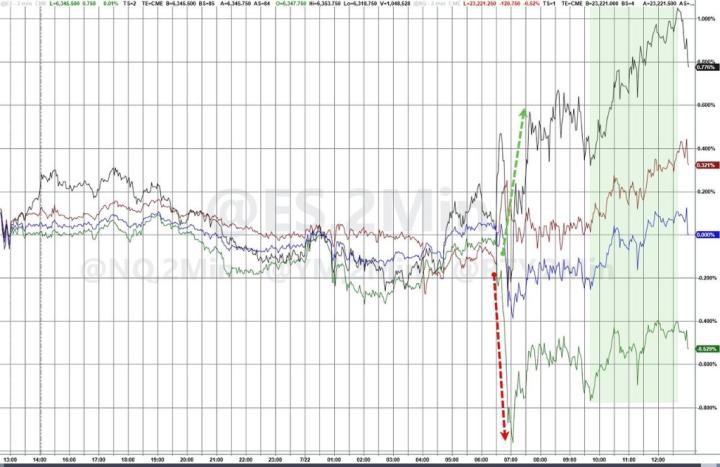

Recently, BNB has broken through multiple key intervals, such as $700–723, $723–748, and broke the $800 mark on the 23rd, creating a new historical high. Consecutive new highs show a strong upward trend, with many more concerned about where institutional and market estimated target prices might be.

In May, Standard Chartered once called out a target price of $2,725 for BNB in 2028, causing a stir in the industry; however, Nano Labs founder Kong Jianping recently revealed that he believes BNB's market value is only one-third of ETH, so a short-term $1,000 target is not difficult, and he is optimistic about potentially breaking $2,000 in this bull market.

A Turkish economist and Halkbank financial analyst also noticed this BNB boom, believing it might touch the $900 level short-term, with potential for correction, but hopes to challenge the $1,162 interval after a while.

Overall, after BNB's new high, the appearance of an emerging asset is gradually being accepted, and the bullish statements from institutions like Standard Chartered are being re-evaluated.

Uniqueness is the most important attribute in crypto assets, and after Bitcoin and Ethereum, people may be seeking more distinctive asset reserve attributes. For retail investors, holding BNB with its independent public chain ecosystem and exchange capital might offer more potential opportunities than ETH or BTC. Whether a trend of retail investors adding BNB positions or even purchasing BNB reserve company stocks will emerge is worth continued observation.