As central banks around the world are mired in stagflation, Wall Street's capital giants used an epic short squeeze to push Bitcoin to the historical throne of $120,000 and Ethereum to $3,800 - this is not only a breakthrough in numbers, but also a silent declaration of the collapse of the old financial order.

Institutions use real money to carve new rules: BlackRock's single ETF holdings exceed Switzerland's gold reserves, 125 listed companies have added 847,000 bitcoins to their balance sheets, and 4.3% of the chips in circulation have been permanently frozen; the stablecoin's market value of 250 billion builds a new artery for cross-border payments, and the RWA chain anchors 24.4 billion physical assets. Under the iceberg, a trillion-dollar territory of traditional finance is being devoured by Washington legislation (the GENIUS Act) and Wall Street manipulation (ETFs attract an average of $300 million a day) - and all this is just the prelude to the reconstruction of the global asset landscape by crypto capital in the first half of 2025 - this report will dissect the ice and fire battlefield of this capital reconstruction and review the life and death game of the crypto market in the first half of 2025.

The Washington Thaw: How Regulatory Clarity Became the Bull Market's Core Engine

In the second quarter of 2025, the cryptocurrency market has taken a remarkable independent path in the fog of macroeconomics. While global investors are still anxious about tariff disputes, Fed policies and slowing economic growth, a warm current of regulation from Washington is quietly reshaping the foundation of the entire industry. This is not just a quarterly rebound, but also a structural turning point. The dawn of regulation has paved the way for the large-scale entry of institutions, and the entry of institutions has opened up an unprecedented wave of "Bitcoin corporatization".

Regulatory uncertainty, the sword of Damocles that has long hung over the crypto industry, began to dissipate in the second quarter of 2025. The core driving force behind this round of market sentiment and trends is not the improvement of the macro economy, but the fundamental "thawing" and "de-risking" of the US regulatory environment. This series of changes has created crucial prerequisites for large-scale adoption by institutions and enterprises, which will be detailed in subsequent chapters.

First of all, the foundation of stablecoins is laid. As a bridge between traditional finance and the crypto world, the implementation of the stablecoin regulatory framework is of milestone significance. On June 17, 2025, the U.S. Senate passed the Guiding and Establishing a National Innovation for Stablecoins in the United States (GENIUS Act) with overwhelming bipartisan support. This is the first crypto-specific bill in history to be passed by either house of Congress, and the White House also expressed support for it. The bill establishes a dual regulatory system at the federal and state levels, forcing issuers to provide 1:1 reserve support with high-quality liquid assets and bringing issuers under the jurisdiction of the Bank Secrecy Act. This series of measures provides unprecedented legitimacy and stability for the digital dollar, which is the trust foundation necessary for large-scale participation by institutional players. The passage of the bill directly benefits compliant issuers such as Circle (USDC issuer) seeking to list in the United States, clearing the biggest obstacle for them, and indirectly exerts greater compliance pressure on offshore issuers such as Tether (USDT issuer).

Secondly, Congress has addressed the industry's biggest pain point: the unclear jurisdictional dispute between the SEC and the CFTC. Following the 21st Century Financial Innovation and Technology Act (FIT21) in 2024, the CLARITY Act was also approved by a key House committee in June 2025. The core goal of these two bills is to provide a clear legal framework for the classification and regulation of digital assets, and to clearly grant the spot market jurisdiction of "digital commodities" (such as Bitcoin) to the CFTC. This marks that US crypto regulation is shifting from the adversarial model of "enforcement is legislation" to building a clear and predictable legal path. Behind this shift is the result of years of political lobbying by the crypto industry that cost hundreds of millions of dollars. Coinbase, a16z and other leading institutions have played a key role in successfully transforming the crypto issue from a partisan dispute to a national issue concerning US technological competitiveness and financial innovation.

Finally, there is the shift at the administrative level. In April 2025, the President signed a bill to formally repeal the controversial "DeFi Broker Rule" of the Internal Revenue Service (IRS). At the same time, with the departure of former Chairman Gary Gensler in January 2025, the SEC's regulatory attitude has also changed significantly, reducing enforcement actions and establishing a more industry-friendly working group under the leadership of Commissioner Hester Peirce, known as the "crypto godmother". These three major regulatory developments - the legalization of stablecoins, the clarification of market structure, and the friendliness of administrative attitudes - together build a solid "regulatory tripod" and form a mutually reinforcing positive cycle of confidence. As BlackRock CEO Larry Fink has repeatedly emphasized, ETFs are just "stepping stones to tokenization." A regulated, liquid, and credible digital dollar system is the underlying settlement network necessary for the future trillion-level real-world asset (RWA) tokenized economy.

Through the Macro Fog: Tariffs, the Fed, and the Evolution of Bitcoin’s Narrative

The macroeconomic environment in the second quarter was cloudy. However, it was in this fog that Bitcoin demonstrated increasing resilience, and its performance was increasingly driven by its own powerful, crypto-native catalysts rather than passively controlled by external circumstances.

The main source of macro uncertainty this quarter was the so-called "tariff turbulence." The new administration's intermittent trade policies have roiled global financial markets, causing stocks, bonds, and even Bitcoin to fall in tandem. Data shows that Bitcoin's correlation with the US stock market remained high at the end of the quarter. However, a key narrative tension is that despite such significant macro headwinds, Bitcoin still achieved a strong rebound in the second quarter and hit a record high of more than $118,000 yesterday. This shows that there are more powerful forces than macro sentiment that are driving its price.

The Fed's policy stance has not brought a clear tailwind to risk assets. At both the May and June FOMC meetings, the Fed chose to keep interest rates in the range of 4.25%-4.50%. Economic data presents a contradictory picture: on the one hand, inflation remains sticky; on the other hand, the US economy shrank in the first quarter. Such potential "stagflation" concerns usually curb investors' risk appetite. At the same time, the US dollar index (DXY) has weakened significantly, falling nearly 11% in the first half of 2025, marking the worst half-year performance since 1973. The weakness of the US dollar, coupled with the record fiscal deficit of the US government, makes "fiat currency devaluation" no longer a theoretical discussion, but a reality facing all investors.

This phenomenon reveals a deeper trend: the second quarter of 2025 may mark the beginning of a "great divergence". In this divergence, the internal structural catalysts driving Bitcoin (such as the aforementioned regulatory clarity and institutional adoption) have begun to overwhelm external macroeconomic headwinds for the first time. The market's weighted pricing of crypto-native drivers has exceeded the response to short-term macro noise. This in itself is an important sign of the market's maturity. The weakness of the macroeconomy just provides a realistic problem background for the narrative of "Bitcoin as a solution", greatly accelerating its acceptance as a legitimate macro hedge asset. It was at this time that institutional leaders such as Larry Fink began to frequently define Bitcoin in mainstream financial media as an "international asset" that can hedge geopolitical risks and sovereign currency depreciation. This endorsement from the head of the world's largest asset management company is far more important than the evangelists within the crypto circle.

The institutional floodgates are opening: From ETF highways to corporate coffers

If regulatory thawing is the "right time" and macroeconomic turmoil is the "right place", then the rush of institutions and enterprises into the market is the decisive "right people". In the second quarter, we clearly saw institutional capital pouring into Bitcoin through two main channels: one is the established ETF channel, and the other is the explosive growth of the new wave of corporate vaults.

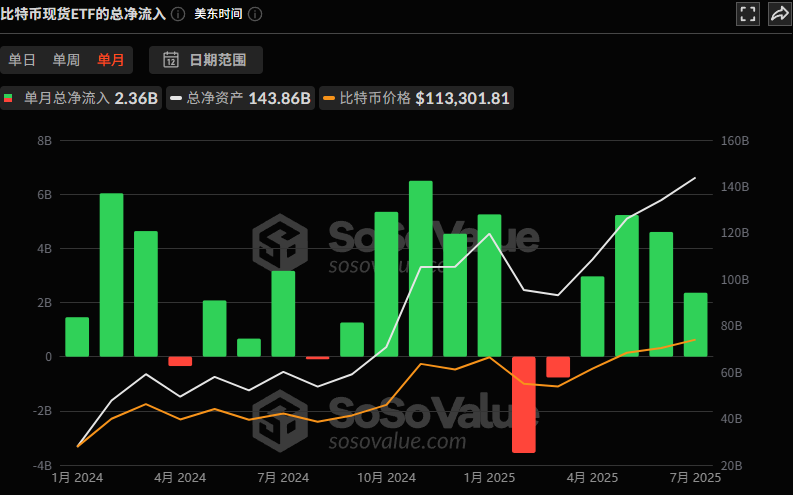

US spot Bitcoin ETFs continued their historic success in the second quarter. Data shows that these ETFs attracted more than $3 billion in net inflows in just one week in April. As of early July, the total assets under management (AUM) of all Bitcoin ETFs has reached $137.46 billion. Among them, BlackRock's IBIT was called "the fastest growing product in ETF history" by its CEO Larry Fink himself, and it attracted nearly $1 billion in inflows in a single day. Fink admitted that he was "surprised" by the demand of this scale and believed that it was far beyond expectations. The success of ETFs lies not only in their ability to attract money, but also in the fact that they have completely changed the investor structure of Bitcoin. The market, which was dominated by retail investors and crypto funds in the past, has now ushered in indirect participation from sovereign wealth funds, pensions and large corporate consortiums.

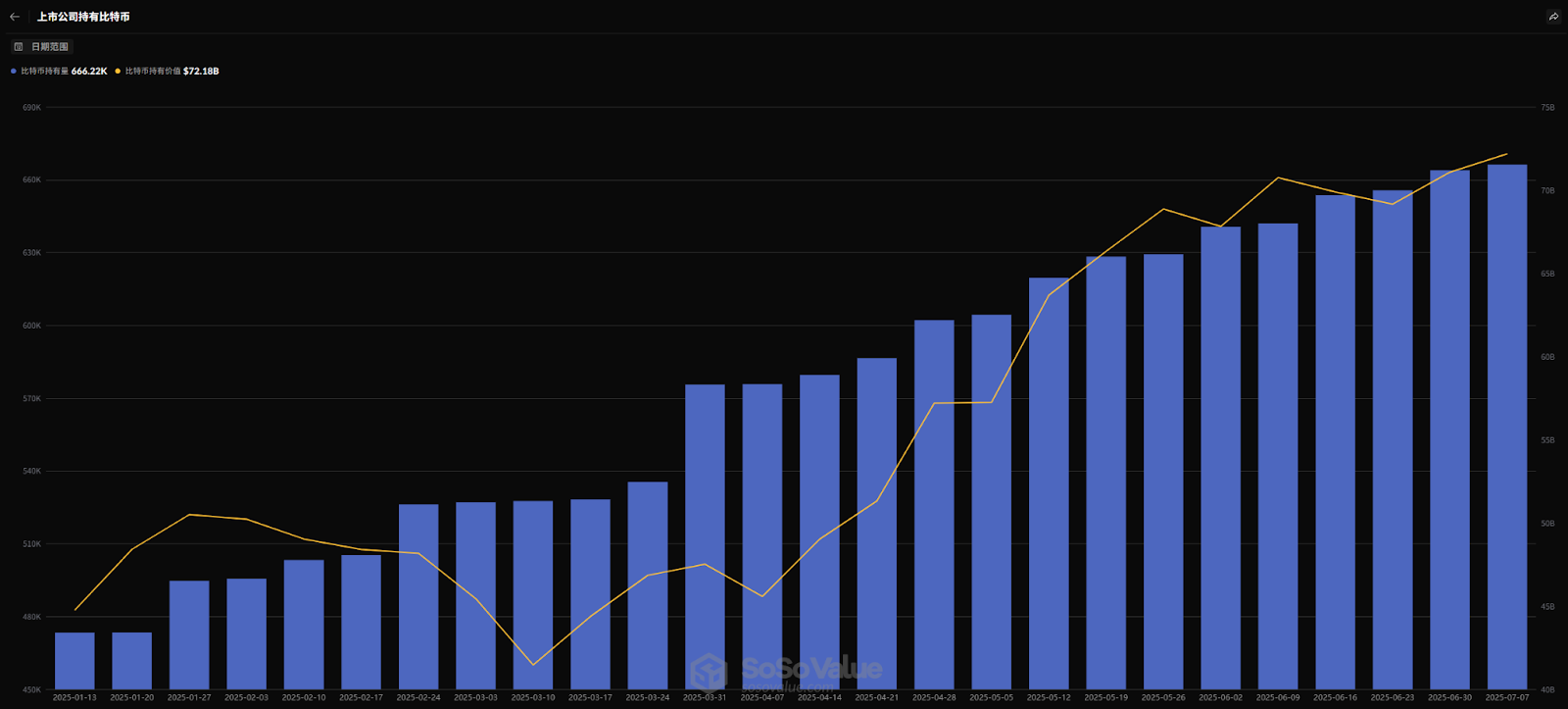

A more profound structural shift than ETFs is the rise of the "Corporatization of Bitcoin" wave. More and more listed companies no longer view Bitcoin as just a speculative product, but as a core inventory reserve asset. Data shows that in the second quarter of 2025 alone, global listed companies increased their holdings by about 131,000 bitcoins, increasing their total holdings by 18%. As of July 4, corporate treasuries held a total of 944,109.2 bitcoins. This movement is no longer a one-man show for MicroStrategy, but has evolved into a global, cross-industry corporate finance revolution. The entry of Metaplanet, a Japanese listed company, is particularly representative. The company explicitly stated that the purchase of Bitcoin is to hedge the risk of long-term depreciation of the yen, which has opened up a new paradigm of "Bitcoin as a national currency hedging tool."

Behind this trend is a deeper logic of adoption. ETFs are an "exposure" tool, while using Bitcoin as the company's main inventory reserve asset is a core "integration" strategy. It means that the company's management believes in Bitcoin as a long-term store of value, and even believes that it is better than cash. The new rules implemented by the Financial Accounting Standards Board (FASB) at the end of 2024 allow companies to measure their crypto assets at fair value, which greatly improves the presentation of financial statements and clears technical obstacles for more CFOs to include Bitcoin in their balance sheets. A brand-new "Bitcoin Vault Company" sector is taking shape, which provides traditional equity investors with a way to obtain leveraged exposure to Bitcoin through the stock market, thereby embedding Bitcoin more deeply into the traditional financial system.

Echoes on the blockchain: On-chain data verifies institutional beliefs

If regulation and institutional dynamics are the market’s “narratives,” then on-chain data is the “facts” that validate those narratives. On-chain metrics for the second quarter of 2025 paint a clear picture of institutional-led accumulation based on long-term conviction.

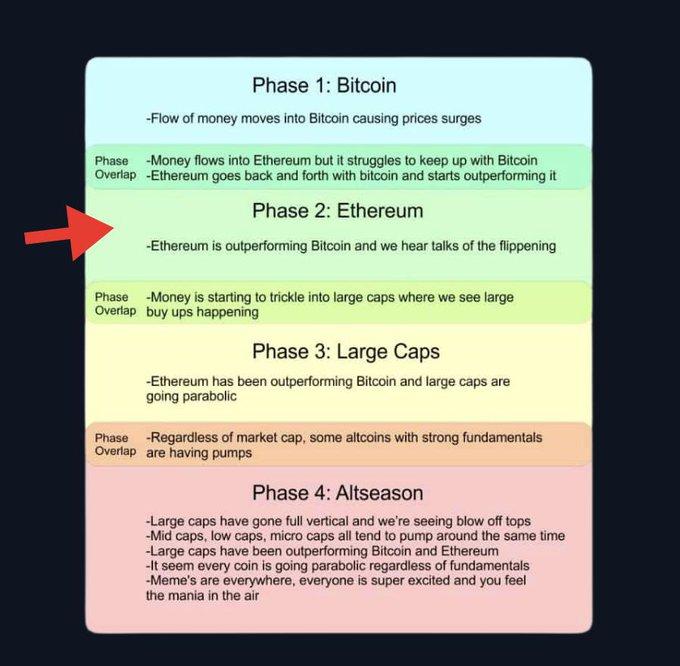

First, amid market volatility, capital showed a classic "flight to quality" feature. Bitcoin's dominance index soared to 63%, a new high since the beginning of 2021. At the same time, the total market value of cryptocurrencies excluding Bitcoin fell sharply. This dramatic differentiation shows that in the face of uncertainty, capital quickly concentrated on the most liquid and institutionally recognized asset - Bitcoin. This is completely consistent with the behavioral pattern of institutional investors to first ensure the allocation of core assets during risky periods.

Second, the key “Long-Term Holder” (LTH) indicator shows firm accumulation behavior. Despite the sharp price fluctuations, the supply of Bitcoin held by LTH increased by a net 600,000 in the second quarter. The joint report of Coinbase and Glassnode confirmed that “long-term holders are accumulating again”. These Bitcoins were transferred to addresses with a statistically low probability of spending, which is consistent with the behavior pattern of institutions and enterprises establishing long-term strategic positions. More importantly, we see that the realized market value (Realized Cap) has risen steadily, indicating that new capital is entering the market at a higher cost price, consolidating the price foundation of the market.

Furthermore, the Bitcoin balance on exchanges continues to decline, which is a strong bullish signal. When investors intend to hold for the long term, they tend to withdraw assets from exchanges to self-custodial wallets or institutional-grade custody solutions. The reduction in the supply of liquidity available for immediate sale within exchanges directly exacerbates the imbalance between supply and demand in the market in the face of huge demand from ETFs and corporate vaults. According to statistics, the amount of Bitcoin absorbed by ETFs every day once exceeded 10 times the daily output of miners. This structural imbalance between supply and demand is the most fundamental driving force behind price increases.

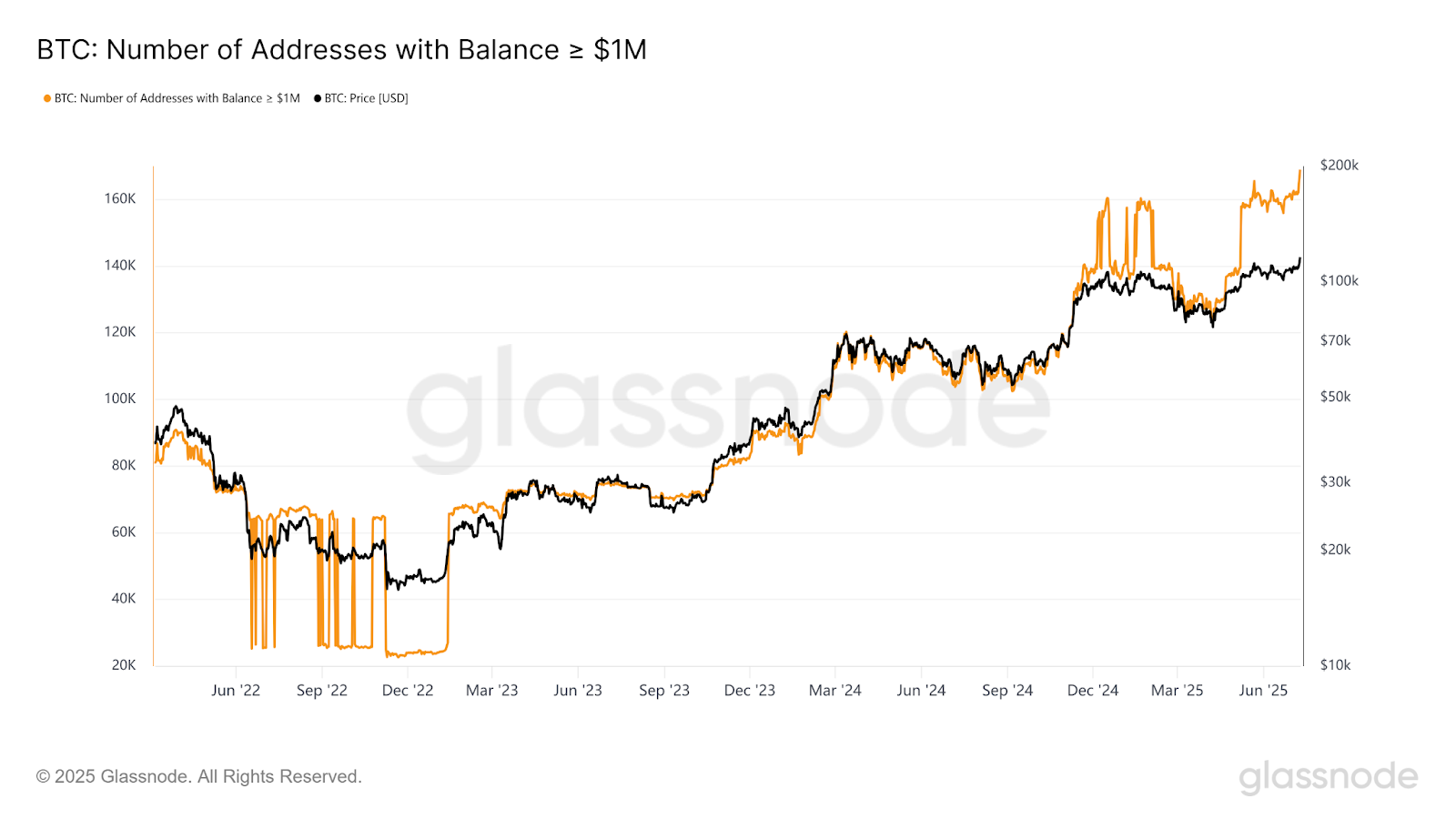

Finally, the number of "whale" addresses holding more than $1 million worth of Bitcoin increased from about 124,000 in mid-March to more than 160,000 in June. The significant increase in these large addresses is a strong circumstantial evidence of the entry of institutions and high-net-worth individuals. Together, these on-chain data constitute the "behavioral fingerprint" of institutional capital, which is in stark contrast to the characteristics of the surge in exchange inflows and increased supply of short-term holders that were common in previous retail-dominated cycles, and clearly reveals the fundamental changes in the behavioral patterns of market participants. A new Bitcoin cycle led by institutions and with value storage as the core narrative is leaving its solid footprint on the blockchain.

SEC's new policy, from "innovation exemption" to "on-chain finance", DeFi summer may reappear

Overall progress of the track and regulatory changes

In the first half of 2025, the DeFi sector will see a key regulatory breakthrough. On June 9, the U.S. SEC proposed an "innovation exemption" framework, which explicitly supports the intermediary-free nature of blockchain technology and emphasizes that developers should not bear securities law liability for publishing code.

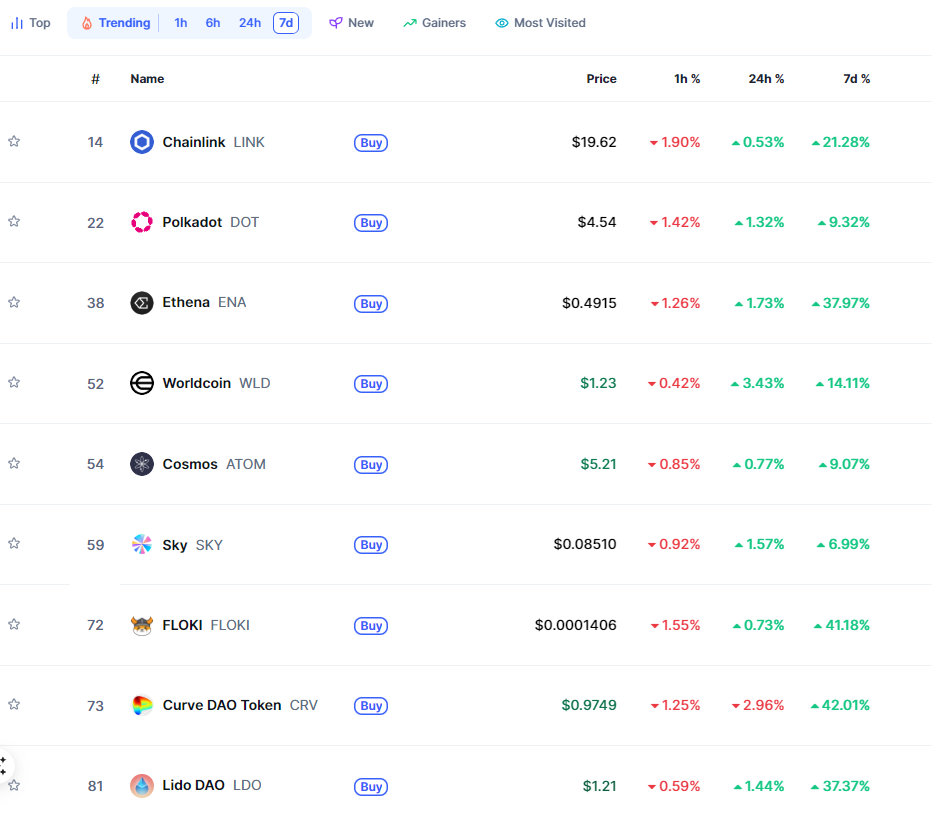

This policy shift significantly eased regulatory uncertainty, and DeFi tokens subsequently rose by 20%-40%, which was seen as the starting point for the institutional reconstruction of the industry.

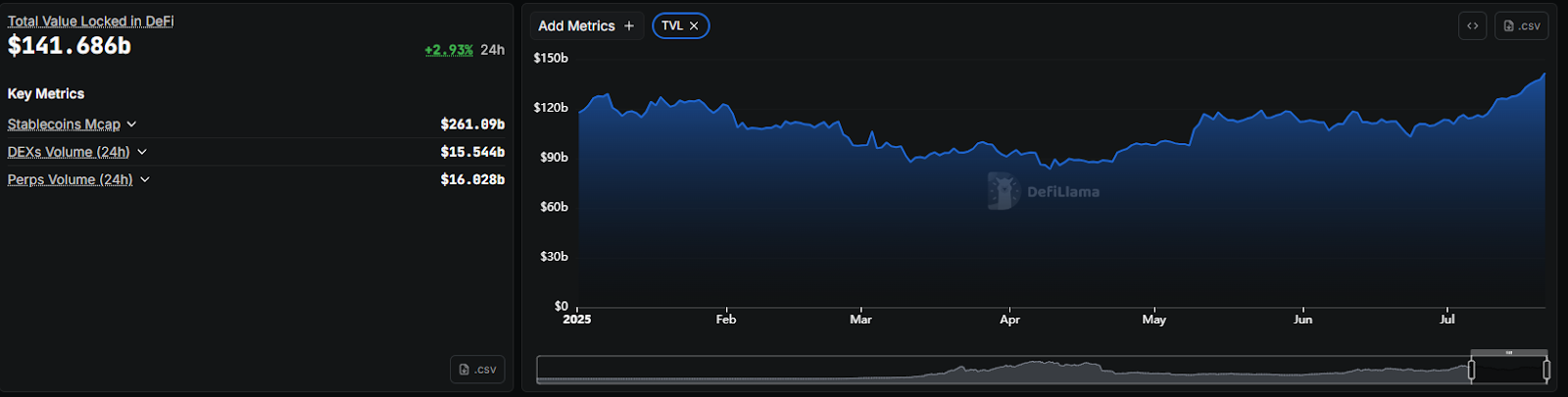

TVL total volume is rising steadily

Overall TVL: Affected by Trump’s tariff policy at the beginning of the year, DeFi TVL dropped from US$129 billion at the beginning of the year to US$83.6 billion in April, but rebounded from April as the market recovered.

AAVE lending volume hits new high, with scale and synergies driving growth

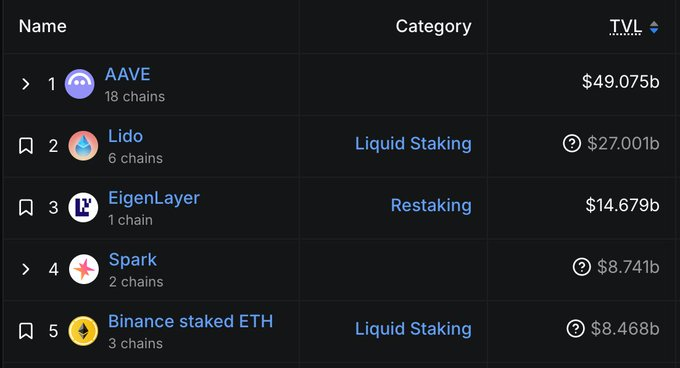

AAVE has built a strong network effect barrier in the DeFi field. Relying on five years of market development, massive users and top liquidity in the industry, projects developed based on AAVE naturally enjoy scale advantages that are difficult to replicate.

Partners can quickly access ready-made ecological resources - strong infrastructure, active user groups and deep liquidity pools, eliminating the long infrastructure construction period. This is the manifestation of the "AAVE effect".

As the largest TVL protocol in DeFi history, AAVE dominates the industry with 21% of TVL and an overwhelming 51% lending market share. Its $49 billion in net deposits forms the cornerstone of system stability. Its core advantage lies in its unique role as a capital hub, which can effectively catalyze ecological synergy and achieve geometric growth in liquidity:

Examples demonstrate significant synergy:

- After Ethena's sUSDe was connected to AAVE, deposits surged 55 times in just two months, jumping from US$2 million to US$1.1 billion.

- A few weeks after Pendle assets were supported by AAVE, users deposited $1 billion worth of PT tokens, and that number has now doubled to $2 billion, making AAVE the primary supply market for Pendle tokens.

- After KelpDAO gained AAVE protocol integration on rsETH, its TVL increased nearly 4x in four months, soaring from 65,000 ETH to 255,000 ETH.

In addition, AAVE supports nearly half of the active stablecoin market and has become the primary hub for circulating Bitcoin in the DeFi field. What is particularly noteworthy is that it has achieved nearly $1 billion in TVL on four independent blockchain networks, demonstrating a rare depth and breadth of layout.

The first half of 2025 is the turning point for DeFi to move from the regulatory winter to institutionalization. Aave has consolidated its "lending hegemony" with its liquidity depth, demand creation ability and multi-chain expansion, but its tokens have not yet fully reflected their value; and the capital repatriation and innovation relaxation caused by the SEC's new policy are pushing DeFi into the "final battle" of integration with traditional finance.

A Panorama of Cryptocurrency Public Chains in the First Half of 2025: Breakthrough and Evolution of Ethereum, Solana, BNB Chain, and Hyperliquid

1. Ethereum: ETF funds support the bottom line, and technology upgrades reconstruct the ecological moat

Token price: Deep V rebound confirms institutional confidence

At the beginning of 2025, Ethereum started at a high of $3,700, but due to the stickiness of macro inflation, the Trump administration's tariff policy and the contraction of market liquidity, it plummeted to a low of $1,385 in April. The turning point began with the implementation of the Pectra upgrade in May: the upgrade increased the upper limit of single-node staking from 32 ETH to 2048 ETH, and introduced account abstraction (EIP-7702 standard), significantly improving network efficiency and user experience, driving ETH to surge 40% in 72 hours.

Since then, with the continued inflow of the US Ethereum ETF, US-listed companies such as SBET and BMNR have strategically reserved ETH, and relevant bills such as the GENIUS Stablecoin Act and the Digital Asset Market Clarity Act have been passed, and institutional funds have continued to flow into Ethereum.

As of July 20, ETH broke through $3,800 to hit a new high for the year, with a year-to-date increase of more than 20%. Spot ETFs have seen net inflows for two consecutive months, with a cumulative scale of $13.7 billion. BlackRock's IBIT single product accounts for more than 40% of holdings.

Ecological evolution: from DeFi hegemony to diversified expansion of RWA and L2

Despite facing competition from public chains such as Solana, Ethereum's dominance in the DeFi field has not been shaken - the total locked value (TVL) has reached US$103.3 billion, of which private credit-driven RWA (real world assets) on-chain has become a new growth pole, with a scale exceeding US$24.4 billion.

Layer2 solutions have become the core carrier for capacity expansion: Arbitrum, Optimism, etc. process 90% of transactions on the entire network, and promote the implementation of institutional-level applications such as JPMorgan's deposit token JPMD on the Base chain.

In addition, the Ethereum ecosystem is extending to AI and compliance: Consensys is working with Microsoft to develop an enterprise-level smart contract platform, and the implementation of MiCA regulations in the EU has further enhanced the penetration rate of compliant stablecoins such as USDC, injecting long-term stability into the ecosystem.

2. Solana: Speed Revolution and Ecological Explosion under the MEME Frenzy

Token price: Geopolitical catalysis volatility, technical advantages support rebound

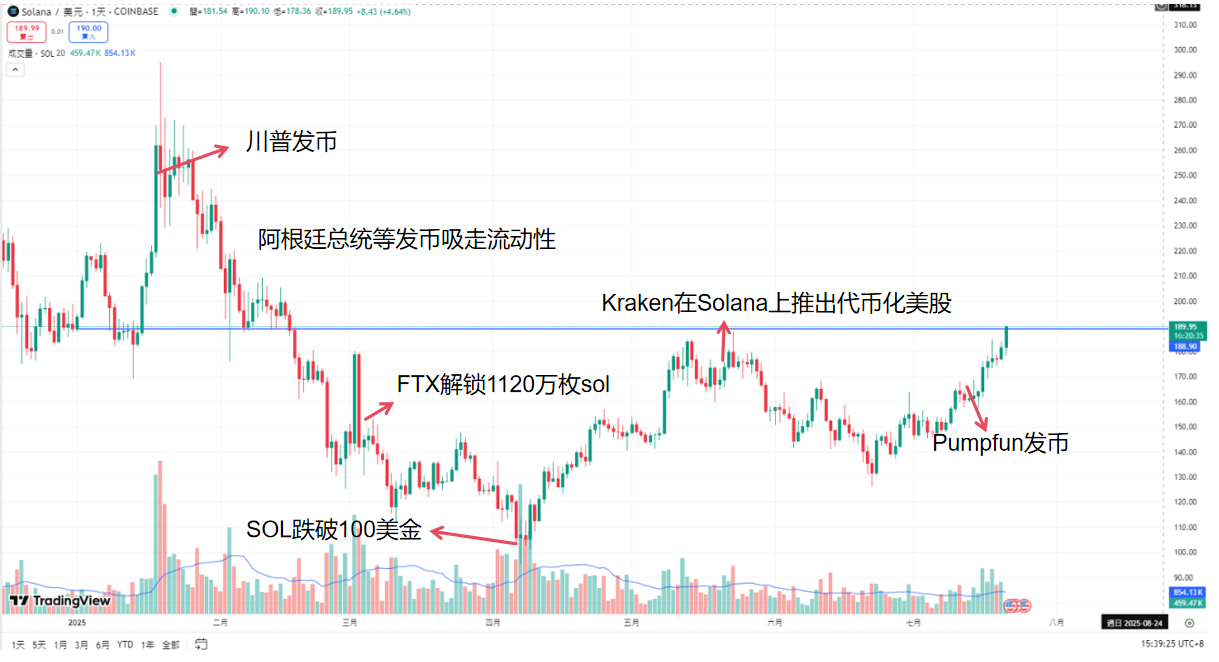

At the beginning of the year, Trump's issuance of the "TRUMP" token ignited the Solana ecosystem and also absorbed a large amount of liquidity. SOL soared to a historical high of $295 in January and then fell rapidly. In April, due to the impact of macroeconomic negatives, the price fell below $100.

Since then, relying on the underlying performance advantages and deepening strategic cooperation, SOL has started a volatile rebound: in May, PayPal integrated the Solana payment system, and Visa expanded its stablecoin settlement pilot, pushing the price back to US$190 (as of July 20), an increase of nearly 90% from the low point.

The market has significant differences in its valuation - 21Shares gives a fair range of US$520-1,800 based on a discounted cash flow model, implying an extreme expectation for the growth of on-chain transaction volume.

Ecological evolution: From a "Nasdaq-level" trading platform to an AI agent testing ground

Solana reshapes the public chain competition paradigm with speed and cost: 0.44 second block time, $0.00025 transaction fee and 65,000 TPS performance, enabling it to crush competitors in retail payment and high-frequency trading scenarios.

In January and February 2025, the transaction volume on the chain reached 364.3 billion US dollars, surpassing Coinbase and Ethereum, and close to 50% of Nasdaq's scale in the same period. The ecological explosion is driven by three engines:

- MEME coin infrastructure: Pump.fun platform’s cumulative fee income exceeded US$575 million, becoming the core entry point for retail speculation;

- Enterprise-level payment network: The access of PayPal, Stripe, and Shopify makes Solana the "next generation Visa";

- AI agent explosion: DePIN and AI agent projects surged, and the market value of on-chain stablecoins exceeded US$10.9 billion, a 600% increase in half a year.

- The number of developers increased by 83% year-on-year, surpassing Ethereum for the first time. The Firedancer upgrade plan may push TPS to the million level, further consolidating the technical barriers.

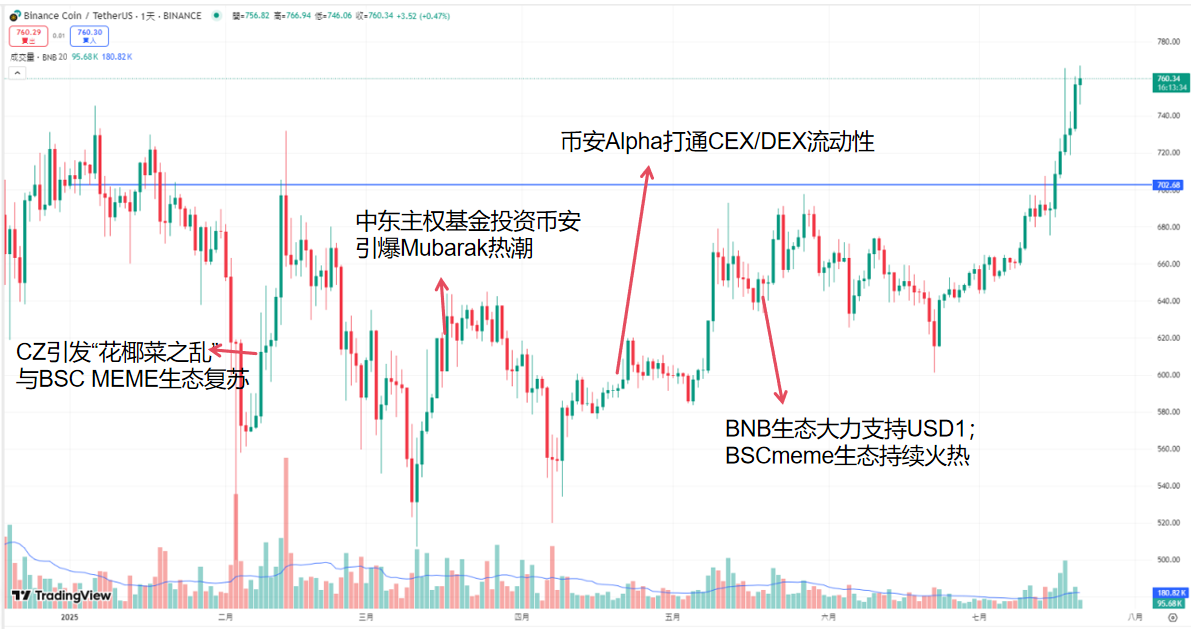

3. BNB Chain: Ecological Diversification and Value Resilience under CZ’s Influence

Token price: revaluation under regulatory pressure

BNB fell from a high of $740 at the beginning of the year and hit a low of $500 in April.

Since then, the ecosystem's self-healing ability has become apparent: CZ has continued to output industry compliance initiatives on Twitter, building the BSC ecosystem and boosting market confidence; the Memecoin craze and RWA projects have poured into BSC, stimulating BNB to rebound to US$766 in July, approaching its historical peak.

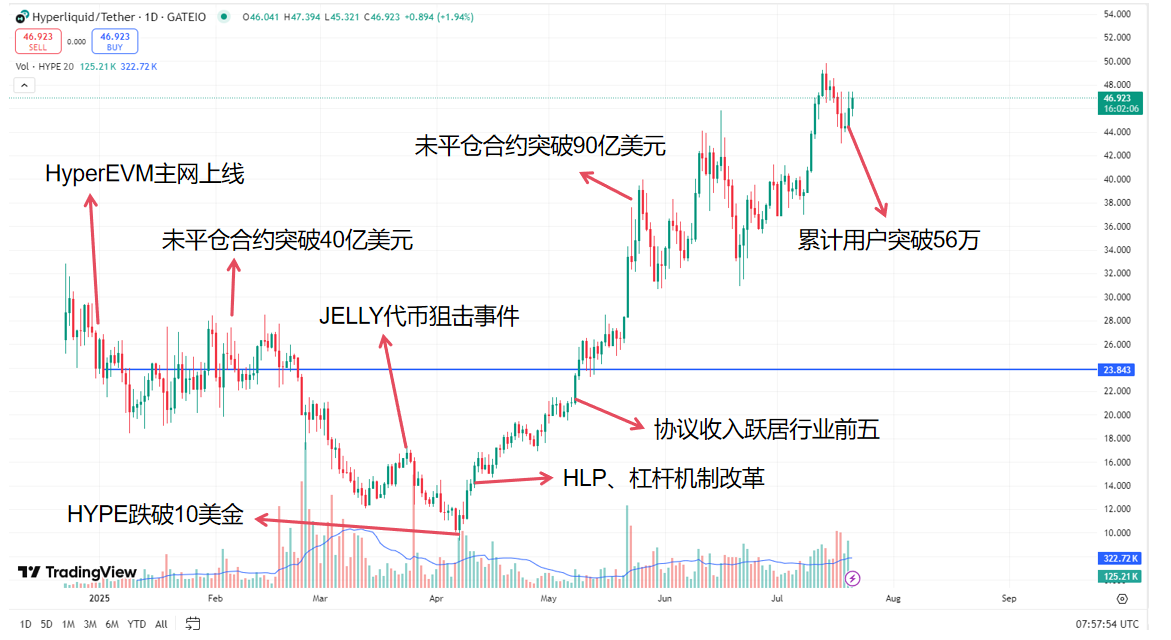

4. Hyperliquid: The counterattack logic of the dark horse of decentralized derivatives

Token price: whale escort and value discovery under the deflation model

HYPE token started its downward trend from $28 at the beginning of the year, and fell below $10 in April due to the HLP fund attack caused by the "Jelly incident". Then it started a counterattack with the fee repurchase mechanism and the explosion of trading volume: the platform's daily trading volume exceeded $15 billion, and 50% of the daily fee income was used to destroy HYPE, pushing the token to $49.8 on July 20, a surge of 398% from the low point.

On-chain data shows that whale addresses such as James Foye continue to increase their holdings, accounting for more than 15% of their holdings, forming a liquidity moat.

Ecological evolution: from derivatives island to full-chain application ecosystem

Hyperliquid is an institutional-grade derivatives protocol that will achieve three major leaps in 2025:

- Product matrix expansion: perpetual contract leverage increased to 50 times, new foreign exchange and commodity derivatives added, attracting hedge funds to settle in;

- Chain abstraction architecture: compatible with Ethereum and Solana cross-chain asset transactions through account abstraction, reducing multi-chain operation friction;

- Ecological Incubation Plan: Hyperliquid Foundation invested 20 million US dollars to support Perp DEX, option agreements and RWA projects, and the first lending agreement Lendify TGE raised more than 48 million US dollars.

- The average daily number of independent transaction addresses exceeded 120,000, proving that it has transformed from a "niche protocol" to the core layer of derivatives infrastructure.

Final Chapter: Public chain competition enters the era of "multi-dimensional war"

The public chain landscape in the first half of 2025 reveals the cruel truth: A single point advantage is not enough to win. Ethereum maintains its basic market with ETF and L2 ecology, Solana breaks through with speed and payment scenarios, BNB Chain is reborn with traffic operation and compliance transformation, and Hyperliquid counterattacks with a vertical deflation model.

Core trends have emerged:

- RWA and stablecoins have become new traffic entrances. Bank of America and Citigroup announced that they will issue their own stablecoins;

- The end of regulatory arbitrage: the US GENIUS Act and the EU MiCA force public chains to build compliance frameworks;

- Token economic innovation: shifting from PoS staking income to pragmatic models such as fee destruction (such as HYPE) and ecological incentive dividends.

When the market value of Altcoin exceeds 1.5 trillion US dollars, and the growth of competing coins has outperformed BTC in the near future, the end of the public chain war is no longer the "killer application", but the anti-fragility and institutional design of the ecosystem.

In the second half of 2025, Solana’s Firedancer upgrade, Ethereum’s Verkle tree integration, and Hyperliquid’s cross-chain derivatives will push the war to a new dimension.

Conclusion

As human civilization moves from the roar of steam to the flow of bits, history always repeats a similar script: every exploration of the technological frontier is accompanied by the shaking of the old order and the coronation of new rules.

The crypto market in the first half of 2025 is the climax of this power transfer - Washington's regulatory iron curtain has thawed amid the lobbying, the Federal Reserve's interest rate scepter has been eclipsed by the cloud of stagflation, and the blockchain, with its roaring Bitcoin mining machines, has already built a new world in the digital age.

At this moment, we are standing between the cracks of two eras: in the cracks of old finance, the Bitcoin reserves in corporate vaults are stacked like the vaults in Fort Knox, and the capital torrent of ETFs has broken down the last arrogant wall of Wall Street; in the map of the new world, the Stablecoin Act has become the constitution of cross-border payments, DeFi's smart contracts have rewritten the rules of profit distribution, and the computing power race of public chains has ignited the on-chain industrial revolution of AI and RWA.

And all this is just the prologue.