In the crypto market's battle between bulls and bears, Ethereum is rapidly approaching the psychological barrier of $4,000. As of July 21, 2025, ETH price remains firmly above $3,765, with a weekly surge of 27%, just 6.8% away from breaking the critical resistance level of $4,000.

This assault led by institutional capital is reshaping the asset landscape of the crypto market, also triggering profound doubts about whether an altcoin season has truly arrived.

I. Institutional Whales' Billion-Dollar Bet: The Underlying Fuel of Ethereum's Frenzy

Capital flows are surging into the Ethereum ecosystem at an unprecedented scale.

Blockchain analysis company glassnode's monitoring data shows that on July 20 alone, two newly created institutional wallets swept up 58,268 ETH, valued at approximately $212 million, with these funds entering through compliant channels like Galaxy Digital and FalconX. This is not an isolated incident—on-chain analyst EmberCN simultaneously captured another massive purchase of $50 million, with 13,462 ETH withdrawn from Binance exchange by a whale, with an average cost basis locked at $3,714.

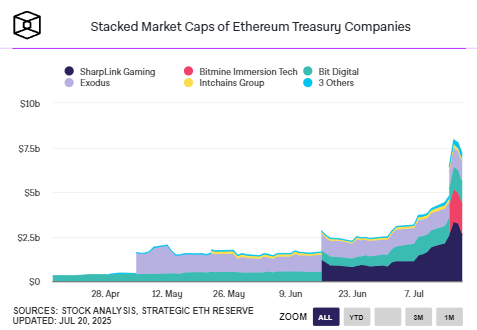

Enterprise-level buying has pushed accumulation to a climax. The listed company SharpLink has added 157,140 ETH this month, worth nearly $493 million, becoming Ethereum's largest corporate holder. Its strategy is quite clear: by continuously buying to dilute cost, it has added 4,904 ETH worth $17.45 million in just the past 24 hours.

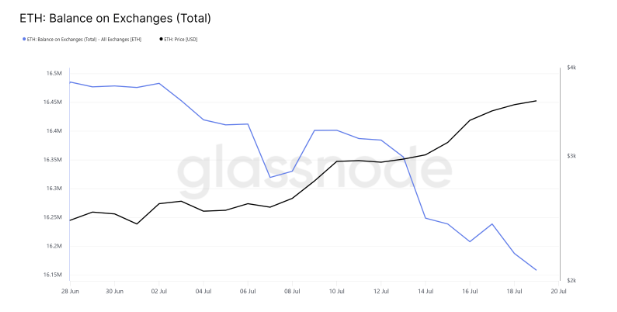

Exchanges are experiencing unprecedented ETH outflows.

Ethereum Exchange Balance

glassnode on-chain data reveals that since early July, over 317,000 ETH (valued at $1.18 billion) have been withdrawn from trading platforms. This large-scale withdrawal directly causes exchange supply tightening, forming a classic bullish structure of "demand greater than supply". When investors transfer tokens to cold wallets for long-term holding, it often signals market confidence in the asset's long-term value.

II. ETF Frenzy: Traditional Finance's "Golden Channel" Embracing Ethereum

Ethereum spot ETF has become the core allocation channel for institutions.

SoSoValue statistics show that in the past five trading days, ETH spot ETF net inflows reached $2.2 billion, more than doubling the previous week's $1 billion, creating the longest consecutive fund inflow record since approval in September 2024. "Consecutive record-breaking weeks. In the past two weeks, 5 out of the 4 largest inflow days since launch," ETF expert Nate Geraci emphasized this historic moment on social media.

BlackRock's ETHA ETF demonstrates dominant performance, with assets under management jumping to $9.17 billion, almost occupying half of the entire Ethereum ETF market. This strong momentum confirms Presto Research analyst Min Jung's observation: "Ethereum price benefits from institutional investor drive, with more and more listed companies beginning to incorporate ETH into their treasury. Recent ETH spot ETF net inflows hit historical highs, with inflows during the same period higher than BTC ETF."

Traditional finance's integration with the Ethereum ecosystem is accelerating.

Token plans from institutions like JPMorgan and Robinhood are built on the Ethereum network, carrying over 60% of tokenized real-world assets (RWA). As asset management giants like BlackRock continue to focus on Ethereum's infrastructure value in stablecoins, DeFi, and asset tokenization, Ethereum's financial ecosystem is transitioning from a mere cryptocurrency to a global settlement layer.

III. The Battle for $4,000: Technical Indicators Reveal Pullback Concerns

The battle of bulls and bears at the key psychological level has entered a white-hot stage.

Technical charts show that Ethereum has formed a golden cross at the daily level—the 50-day moving average crossing above the 200-day moving average, a classic signal of establishing a medium-term upward trend. The Relative Strength Index (RSI) continues to climb, with the Average Directional Index (ADX) soaring to 38, reaching its peak since May 17, indicating that the current rebound momentum is still strengthening.

But market saturation signals have turned yellow.

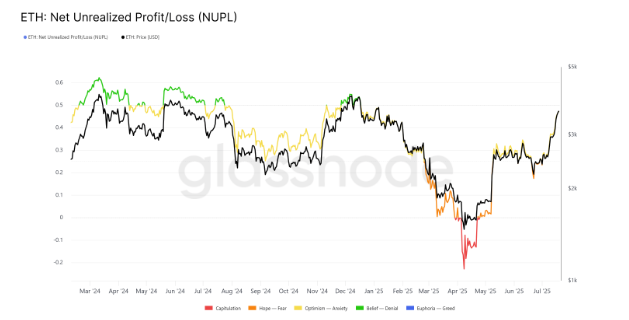

Ethereum's Network Value to Transactions (NUPL) ratio is approaching the "Belief-Denial" zone. Historical data shows that when NUPL enters this area, Ethereum prices often experience short-term adjustments. This indicator is essentially a "overheating detector" of market sentiment, and when the proportion of profitable investors is too high, it can easily trigger a wave of profit-taking.

"This pattern has been repeating over the past 16 months," on-chain analysts warn in the report, "Despite the current strong rebound momentum, caution is needed when approaching the $4,000 threshold, as selling pressure may emerge."

The key price levels for bulls and bears are now clear:

- Upward breakthrough scenario: If successfully breaking above $4,000, it will trigger a Short Squeeze, pushing prices towards the Fibonacci trend expansion point of $4,400

- Pullback risk scenario: If blocked at the $4,000 level, it may fall back to the $3,530 support; losing this position could lead to a drop to $3,131, erasing recent gains

IV. Regulatory Tailwind: A "Systemic Turning Point" for Cryptocurrencies

US crypto legislation achieves a historic breakthrough. On July 17, the US House of Representatives passed three key legislations: the GENIUS Act, Clarity Act, and Anti-Central Bank Digital Currency Act, which were signed into effect by Trump the next day. This marks the first time the crypto industry has received cross-party institutional recognition, especially the GENIUS Act, the first comprehensive federal legislation on stablecoins, providing a clear regulatory framework for digital assets.

Political forces' embrace of crypto assets has become a trend. Trump's World Liberty Financial continues to accumulate Ethereum, with the latest on-chain transaction showing a $5 million ETH purchase within 24 hours. This high-level endorsement, echoing Zerohedge's observation that "BlackRock ETF bought ETH for 29 out of 30 days in July," highlights traditional capital's keen grasp of regulatory shifts.

Improved regulatory transparency directly impacts the staking economy. BIT Mining's chief economist Youwei Yang points out: "If the US regulatory environment becomes clear in the crypto space, especially in staking, it is expected to attract more institutional and traditional financial participants. Currently, under the spot ETF framework, institutional investors' participation in ETH staking is limited. Once policy restrictions are lifted, it will bring billions of dollars in incremental funds to Ethereum."

V. Altcoin Season's Uncertainty: The "Double-Edged Sword" of Institutionalization

Bitcoin's dominance is quietly loosening.

TradingView data shows that Bitcoin's market dominance has dropped to 61%, decreasing by 6.37% over the past month. While Bitcoin stabilizes at the $118,500 high, altcoins led by Ethereum are gaining strength, seemingly showing early signs of an altcoin season.

However, the institutional wave may reshape market logic. Presto analyst Min Jung remains cautious: "The current rebound is primarily driven by institutions, so it's uncertain whether this strong momentum will extend from large 'dinosaur coins' to the broader altcoin market." This reveals the fundamental difference from previous retail-driven bull markets - as institutions like BlackRock allocate cryptocurrencies through ETF channels, their focus remains on high-liquidity assets like Bitcoin and Ethereum, making it difficult for small altcoins to enter their portfolios.

The derivatives market has shown signs of overheating. On July 21, the total Ethereum futures contract open interest broke through $56 billion, continuing to set a new historical high. When leverage accumulates and coincides with high prices, any slight movement could trigger a chain of liquidations. Technical indicators show that Ethereum's daily RSI once touched the 75 overbought area, while MACD golden cross is running but with shortening red bars, indicating a potential weakening of short-term upward momentum.

VI. Macro Variables: Federal Reserve Policy and Market Liquidity Game

Traders are closely watching for any signs in US economic data.

Upcoming initial jobless claims, service and manufacturing PMI data will directly impact the Federal Reserve's interest rate decision path. Currently, the CME Fed Watch tool shows a 95.3% probability of maintaining the 4.25-4.50% interest rate at the July 30 meeting.

Rate cut expectations remain a potential catalyst for the crypto market. LVRG Research Director Nick Ruck notes: "As the crypto industry gains more regulatory support globally, we optimistically believe this trend will continue to grow." Historical data suggests that when the Federal Reserve signals rate cuts, risk assets often see liquidity-driven rallies. If the US dollar index continues its weak trend of a 10% decline this year, cryptocurrencies might become a core target for capital seeking non-US asset allocation.

Conclusion: Ethereum's "$4,000 Era" and the New Crypto Order

Standing at the $4,000 threshold, Ethereum is experiencing a historic transformation from "altcoin leader" to "institutional-grade asset". The billions in whale accumulation, unprecedented ETF fund inflows, and breakthrough regulatory framework collectively build a solid foundation for this rally. However, technical overbought signals, leverage accumulation in derivatives markets, and the uncertainty of altcoin surge cast shadows on its short-term trajectory.

The market needs to clearly recognize that this institution-led bull market is reshaping the value distribution logic of cryptocurrencies. Assets with clear business models, institutional-level liquidity, and regulatory compatibility will continue to attract traditional capital, while small tokens lacking fundamental support may be ruthlessly eliminated in this evolution.

Ethereum's push towards $4,000 is not just a price breakthrough, but a milestone of cryptocurrency's integration into the global mainstream financial system. With the GENIUS bill paving the way for stablecoin compliance and giants like BlackRock using Ethereum as infrastructure for RWA, this charge that began with price numbers will ultimately point to a reconstruction of the financial paradigm. As regulatory fog dissipates and traditional capital flows freely, blockchain networks represented by Ethereum may truly become the new foundation for global value flow in the coming decade.