Biotech company Profusa signs equity line of credit with Ascent Partners, committing to invest all revenue into BTC as the primary reserve asset.

Profusa Inc. made a bold move into the digital asset world when this Nasdaq-listed biotech company announced signing a $100 million equity line of credit with Ascent Partners Fund. Under this breakthrough agreement, all net revenue after maintaining a minimum cash balance of $5 million will be used to purchase bitcoin as the primary treasury reserve asset.

This move marks an important turning point in the financial strategy of a digital healthcare company, reflecting the increasingly expanding trend of organizations adopting bitcoin beyond traditional technology sectors. Profusa becomes one of the first biotech companies to implement a large-scale bitcoin treasury strategy.

According to the agreement mechanism, Ascent Partners will purchase Profusa's common stock at 97% of the volume-weighted average price of the lowest five trading sessions after the stock is issued. Each capital withdrawal, the company can raise up to $5 million, depending on the most recent medium trading volume, creating a flexible mechanism to deploy the bitcoin investment strategy.

Chairman and CEO Ben Hwang explained the philosophy behind this decision: "It is important that we leverage opportunities to manage resources to optimize shareholder value. Holding bitcoin on the balance sheet is a strategic move to protect shareholder value and position the company in the digital future."

Operational Mechanism and Practical Deployment

Profusa has established a clear priority mechanism for using capital from the credit line. If the company's cash balance falls below the $5 million threshold, revenue from the ELOC will be prioritized to supplement the cash fund before continuing BTC purchase transactions. This mechanism ensures the necessary liquidity for the company's daily operations.

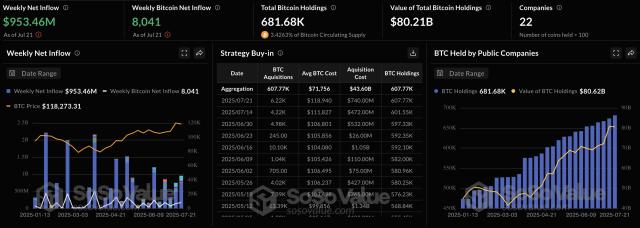

The company expects to make its first bitcoin purchases this week and commits to disclosing its holdings on a quarterly reporting cycle, creating transparency for investors about the new treasury strategy. Bitcoin becoming the primary reserve asset demonstrates the high level of trust by Profusa's leadership in the long-term potential of the world's leading cryptocurrency.