The adoption of Bitcoin by companies is increasingly growing, with many publicly listed companies worldwide shifting their treasury strategies from cash to digital assets.

Although investor sentiment varies, the overall market is witnessing increased consensus among institutions regarding Bitcoin as a reserve and strategic asset.

MicroStrategy Leads in Bitcoin Adoption

MicroStrategy (MSTR) remains one of the leading companies in corporate Bitcoin adoption. The company recently announced plans to issue 5 million Series A STRC preferred shares to raise Capital for additional BTC purchases.

These funds aim to meet working Capital requirements and clearly align with the long-term Bitcoin reserve strategy.

Not only MicroStrategy, but other companies are also actively incorporating Bitcoin into their balance sheets. The US-listed company, Profusa, has secured a $100 million equity line of credit to build Bitcoin reserves. Similarly, EV startup Volcon has purchased over 280 BTC and completed a $500 million private funding round to support further accumulation.

In Europe, the Swedish-listed H100 Group has increased its holdings to over 510 BTC after purchasing an additional 140 BTC.

Perhaps the most symbolic move comes from Grupo Murano, a large real estate group in Mexico, which has declared Bitcoin a "core strategic asset" with an initial $1 billion investment. This demonstrates the growing consensus among companies that Bitcoin is not just a speculative tool but becoming part of global financial policy.

Public Companies' Bitcoin Purchasing Trend

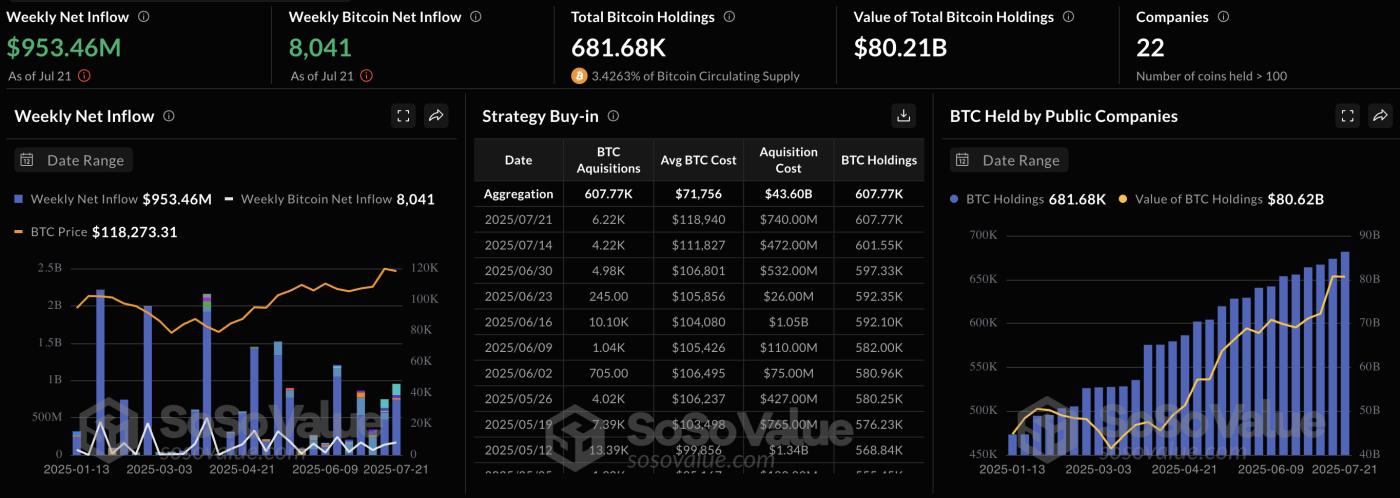

Recent data shows that public companies have net purchased Bitcoin worth $953 million in just the past week, with MSTR accounting for over $700 million.

Weekly net cash flow. Source: sosovalue

Weekly net cash flow. Source: sosovalueThis increase coincides with a significant rise in Google Trends searches for "Buy Bitcoin", indicating a revival of interest from retail investors alongside institutional momentum.