Author: kevin

Translated by: TechFlow

While the cryptocurrency community has long been enthusiastic about tokenization and on-chain assets as a means of enhancing accessibility, the most significant progress has actually come from integrating cryptocurrencies with traditional securities. The recent surge of interest in digital asset Treasury strategies in the public market perfectly embodies this trend.

Michael Saylor pioneered this strategy through MicroStrategy (TechFlow note: now renamed "Strategy"), transforming his company into an entity worth over $100 billion, even surpassing Nvidia. We provided a detailed analysis of this blueprint in our article about MicroStrategy (an excellent reference for those new to asset management). The core argument of these financial strategies is that publicly issued stocks can obtain cheaper, unsecured leverage, which ordinary traders simply cannot access.

Recently, attention has expanded beyond Bitcoin, with Ethereum-based asset management platforms like Sharplink Gaming ($SBET, led by Joseph Lubin) and BitMine ($BMNR, led by Thomas Lee) gaining more attention. But do ETH asset management platforms really make sense? As we stated in our MicroStrategy analysis, asset management companies are essentially trying to arbitrage the long-term compound annual growth rate (CAGR) of the underlying asset against its capital costs. In a previous article, we outlined the arguments for ETH's long-term CAGR. It is a scarce programmable reserve asset that plays a fundamental role in securing the on-chain economy as more assets migrate to blockchain networks. This article will elaborate on why ETH assets have a directionally bullish trend and provide operational recommendations for enterprises adopting such asset management strategies.

Obtaining Liquidity: The Cornerstone of Asset Management Companies

One of the primary reasons tokens and protocols seek to create these asset management companies is to provide avenues for obtaining traditional financial (TradFi) liquidity, especially as liquidity in Altcoins declines. Typically, these asset management companies acquire liquidity through three main methods to obtain more assets. Importantly, these liquidity/debts are unsecured, meaning they are non-redeemable:

Convertible Bonds: Raising funds by issuing debt that lenders can convert into stocks and use the proceeds to purchase more Bitcoin.

Preferred Stocks: Raising funds by issuing preferred stocks that pay fixed annual dividends to investors.

At-the-Market (ATM) Issuance: Directly selling new stocks in the open market to raise flexible, real-time funds for purchasing Bitcoin.

Why ETH Convertible Bonds Are Superior to BTC Convertible Bonds

[The rest of the translation follows the same professional and accurate approach]

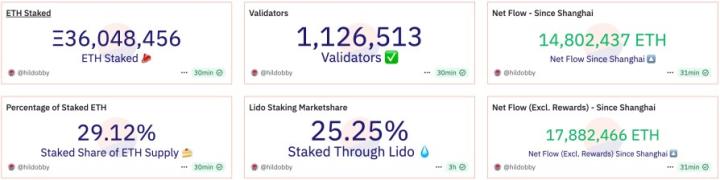

Here's the English translation: However, many institutions may not want to directly hold a long position in ETH. ETH asset management companies can act as intermediaries, absorbing directional risk while providing institutions with returns similar to fixed income. Preferred shares issued by institutions $SBET and $BMNR are designed specifically for this purpose as on-chain fixed income staking products. They can be enhanced through advantages such as priority trading inclusion and protocol-layer incentives, making them more attractive to investors seeking stable returns without bearing full market risk. Why ATM Issuance is More Beneficial for ETH Assets One of the most commonly used valuation metrics by financial companies is mNAV (market multiple to net asset value). Conceptually, mNAV functions similarly to the price-to-earnings ratio: it reflects how the market prices future per-share asset growth. Due to Ethereum's native yield mechanism, ETH assets inherently guarantee a higher net asset value premium. These activities generate recurring "yields" or per-share ETH value appreciation without incremental capital. In contrast, BTC asset management companies must rely on synthetic yield strategies, such as issuing convertible bonds or preferred shares. Without these institutional products, their yields would be difficult to justify when BTC asset market premiums approach net asset value (NAV). Most importantly, mNAV has reflexivity: higher mNAV enables asset management companies to raise funds more effectively through ATM issuance. They issue stocks at a premium and use the proceeds to purchase more underlying assets, thereby increasing per-share assets and reinforcing the cycle. The higher the mNAV, the greater the value captured, making ATM issuance particularly effective for ETH asset management companies. Obtaining capital is another key factor. Companies with stronger liquidity and broader financing capabilities naturally have higher mNAV, while companies with limited market access often trade at a discount. Therefore, mNAV typically reflects a liquidity premium—the market's confidence in the company's ability to effectively acquire more liquidity. How to Screen Asset Management Companies from First Principles A useful mental model is to view ATM issuance as a way to raise funds from retail investors, while convertible bonds and preferred shares are typically designed for institutional investors. Therefore, the key to a successful ATM strategy lies in building strong retail influence, which usually depends on having a trustworthy and charismatic leader and a consistently transparent strategy that allows retail investors to believe in its long-term vision. In contrast, successfully executing convertible bonds and preferred shares requires strong institutional sales channels and relationships with capital market departments. Based on this logic, I believe $SBET is a stronger retail-driven company, mainly due to Joe Lubin's leadership and the team's consistent transparency in ETH per-share accumulation. Meanwhile, $BMNR under Tom Lee's leadership seems more capable of leveraging institutional liquidity due to its close ties with traditional finance. Why ETH Assets are So Important to the Ecosystem and Competitive Landscape One of Ethereum's greatest challenges is the increasing centralization of validators and ETH staking, especially within liquid staking protocols like Lido and centralized exchanges like Coinbase. ETH asset management companies can help balance this trend and promote validator decentralization. To support Ethereum's long-term resilience, these companies should distribute their ETH across multiple staking providers and operate their own validators when possible. In this context, I believe the competitive landscape of ETH asset management companies will be fundamentally different from BTC asset management companies. In the Bitcoin ecosystem, the market has evolved into a winner-takes-all scenario, with MicroStrategy holding 10 times more BTC than the second-largest holder. With its first-mover advantage and strong narrative control, MicroStrategy dominates the convertible bond and preferred share market. In contrast, Ethereum's assets are starting from scratch. No entity currently dominates, with multiple ETH assets being launched simultaneously. This lack of first-mover advantage is not only beneficial for the network but also creates a more competitive and rapidly developing market environment. Given the relatively similar ETH holdings of major participants, I believe we are likely to see a duopoly between two giants: $SBET and $BMNR. Valuation: MSTR + Lido Comp Broadly speaking, the ETH financial model can be seen as a fusion of MicroStrategy and Lido, tailored for TradFi. Unlike Lido, ETH asset management companies have the potential to capture a larger share of asset appreciation due to owning the underlying assets, making this model more advantageous in value accumulation. From a rough valuation perspective: Lido currently manages about 30% of total ETH staking, with an implied valuation exceeding $30 billion. We believe that within a market cycle (4 years), $SBET and $BMNR are highly likely to grow beyond Lido's scale, driven by the speed, depth, and reflexivity of TradFi capital flow, just as MicroStrategy's growth strategy demonstrates. Background: BTC's market cap is $2.47 trillion, while ETH's is $428 billion (17-20% of BTC). If $SBET and $BMNR are around 20% of MicroStrategy's $120 billion valuation, this implies a long-term value of about $24 billion. Currently, the total valuation of both companies is slightly below $8 billion, indicating massive growth potential as ETH assets mature. Conclusion The convergence of cryptocurrency and traditional finance through digital asset management strategies represents a significant transformation, with ETH assets now becoming a powerful force. Ethereum's unique advantages, including higher volatility of convertible bonds and native yields of preferred issuance, enable ETH asset management companies to achieve distinctive growth. Their potential in promoting validator decentralization and fostering competition further distinguishes them in the BTC asset domain. Combining MicroStrategy's capital efficiency with Ethereum's intrinsic yields can unlock tremendous value and drive on-chain economics deeper into TradFi. Rapid expansion and growing institutional interest signal transformative impacts on cryptocurrency and capital markets in the coming years.