The Bitcoin reserve strategy pioneer MicroStrategy Strategy (formerly MicroStrategy) has issued four preferred stocks in just half a year, offering over 8% annual dividend yield and impressive stock performance. This allows investors who dislike Bitcoin's high volatility to invest in Bitcoin-related stocks and create stable cash flow.

Table of Contents

ToggleWhat are the differences between STRD, STRF, STRK, and STRC?

MicroStrategy has issued four different preferred stocks, and ABMedia has compiled their differences in the following table:

[The rest of the translation follows the same professional and accurate approach, maintaining the structure and translating all text while preserving any HTML tags.] The final paragraph about SharpLink would be translated as: The online gaming company SharpLink has once again increased its ETH holdings, quickly accumulating 360,807 ETH, becoming the largest institutional ETH holder, competing with Wall Street veteran Tom Lee's BitMine. The ETH reserve company is attracting massive investor inflow, with Cathie Wood's ARK Invest even making a substantial purchase of BitMine stocks worth approximately $175 million.ToggleSharpLink Buys ETH Again, Holding Over 360,000 Coins

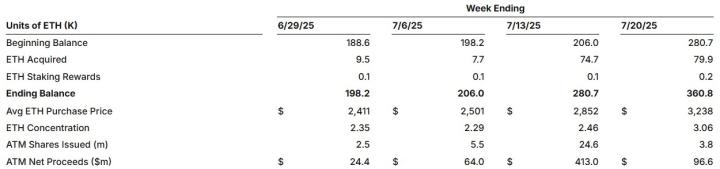

SharpLink announced its entry into the Ethereum (ETH) strategic reserve at the end of May and currently holds approximately 360,807 ETH. Between July 14 and 20, SharpLink acquired about 79,949 ETH at a price of approximately $259 million, with an average price of $3,238. This acquisition is the largest weekly acquisition to date. The ETH Concentration has risen to around 3.06. There are still approximately $96.6 million available for ETH acquisition in the future.

Continuously Issuing New Stocks to Raise Funds for ETH, SBET Stock Price Fluctuates Dramatically

SharpLink Gaming previously submitted an S-3 filing, expecting to raise $1 billion through the issuance of common stocks, preferred stocks, warrants, and bonds, in one or multiple issuances. Last week, they applied to add another $5 billion, expanding the fundraising amount to $6 billion, preparing to make a large-scale purchase of Ethereum. However, the move to significantly dilute equity somewhat shook investor confidence, with the stock price falling from around $40 last Friday to $25, and then surging 8.54% to $27.4 yesterday on the news of cryptocurrency buying.

ETH Reserve Strategy Successfully Attracts Investor Attention

Ethereum reserve companies, backed by Wall Street celebrities like Tom Lee and Peter Thiel, are attracting a large number of investors. Even Cathie Wood's ARK Invest has made a substantial purchase of approximately $175 million in stocks of the ETH reserve company BitMine.

(ARK's Cathie Wood Sells Coinbase, Robinhood, and Block, Adds $175M to Buy Bitmine)

The trend of companies incorporating Ethereum into their balance sheets continues to heat up. From U.S. online gaming company SharpLink, Bitcoin miners BitMine and Bit Digital, these ETH reserve companies have purchased over 1.65 million ETH since early April, totaling approximately $5.9 billion.

These companies' strategies are essentially trying to replicate MicroStrategy's model in the Bitcoin market, successfully attracting traditional investors' attention. However, due to small market capitalization and prices easily manipulated, stock prices of these companies rise and fall sharply with news announcements, often triggering circuit breakers and suspending trading. Investors must pay attention to their own risk management.

Risk Warning

Cryptocurrency investment carries high risks, and prices may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.