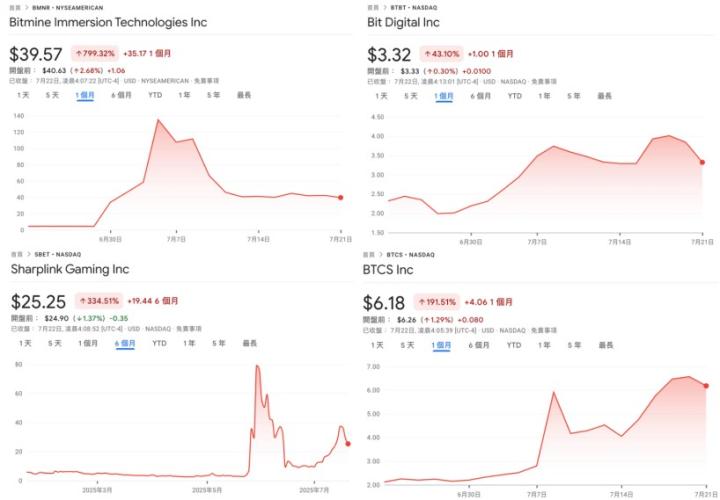

The online gaming company SharpLink has once again increased its ETH holdings, rapidly accumulating to 360,807 coins, becoming the largest ETH holder, competing with Wall Street veteran Tom Lee's BitMine. The Ethereum Treasury company is attracting massive investor inflows, with Cathie Wood's ARK Invest even making a substantial purchase of approximately $175 million in BitMine stocks.

Table of Contents

ToggleSharpLink Buys ETH Again, Holding Over 360,000 Coins

SharpLink announced its entry into the Ethereum (ETH) strategic treasury in late May and currently holds approximately 360,807 ETH. Between July 14 and 20, SharpLink acquired about 79,949 ETH at a price of approximately $259 million, with an average price of $3,238. This acquisition is the largest weekly acquisition to date. The ETH Concentration has risen to around 3.06. There are still approximately $96.6 million available for future ETH acquisitions.

Continuously Issuing New Stocks to Raise Funds and Buy ETH, SBET Stock Price Fluctuates Dramatically

SharpLink Gaming previously submitted an S-3 filing, planning to raise up to $1 billion through the issuance of common stocks, preferred stocks, warrants, and bonds. Last week, they applied to add another $5 billion, expanding the fundraising amount to $6 billion, preparing to make a large-scale purchase of Ethereum. However, the significant equity dilution slightly shook investor confidence, with the stock price falling from around $40 last week to $25, and then surging 8.54% to $27.4 yesterday on the news of coin buying.

ETH Treasury Strategy Successfully Attracts Investor Attention

The Ethereum Treasury company, backed by Wall Street veterans like Tom Lee and Peter Thiel, is attracting massive investor inflows. Cathie Wood's ARK Invest has even made a substantial purchase of approximately $175 million in stocks of the ETH reserve enterprise BitMine.

(ARK's Cathie Wood Reduces Coinbase, Robinhood, and Block Holdings, Adds $175M in Bitmine)

The trend of companies incorporating Ethereum into their balance sheets continues to heat up. From online gaming companies like SharpLink, Bitcoin miners BitMine and Bit Digital, these ETH reserve enterprises have purchased over 1.65 million ETH since early April, totaling approximately $5.9 billion.

These companies are essentially trying to replicate MicroStrategy's model in the Bitcoin market, successfully attracting traditional investors' attention. However, due to their small market capitalization and price susceptibility to manipulation, their stock prices fluctuate dramatically with news announcements, often triggering circuit breakers and trading halts. Investors must be cautious about risk management.

Risk Warning

Cryptocurrency investments carry high risks, with potentially significant price volatility. You may lose all your principal. Please carefully assess the risks.

Wall Street traders are preparing for the high-risk large-cap stock earnings season, maintaining the market at historical highs. The crypto greed index remains in the 67 greed zone, with Bitcoin returning to 120K, showing over 2% growth in 24 hours. Ethereum slightly declined but remains above $3,700. Solana has surpassed $200, overtaking BNB in market capitalization and ranking among the top five cryptocurrencies.

Table of Contents

ToggleTesla and Alphabet Will Announce Financial Reports

Google's parent company Alphabet and Tesla will announce their financial reports in the early morning of Thursday Taiwan time, kicking off the earnings release of the "Seven Tech Giants". These large tech companies are expected to make significant contributions to this quarter's earnings growth.

Bloomberg industry research data shows that the earnings of the seven giants are expected to grow by 14% in the second quarter, while earnings of other U.S. stock benchmarks are expected to remain relatively flat.

Lauren Goodwin from New York Life Investment Company stated:

"Tech giants remain crucial to market health. We expect AI-driven companies to continue to support the growth of the tech industry. Enterprise-level AI applications are continuously improving, but the application of this technology is just beginning to be tested."

8/1 Tariff Deadline Approaches, Market Volatility May Intensify

The market is also focusing on the latest tariff developments. U.S. President Trump announced an agreement with the Philippines, imposing a 19% tariff on Philippine export products. Canadian Prime Minister Carney tried to lower expectations of reaching an agreement within the next 10 days but said he hopes to stabilize relations with the United States.

U.S. Treasury Secretary Besent stated that he will hold the third round of trade negotiations with the Chinese Finance Minister in Stockholm next week, aiming to extend the tariff truce and expand the scope of negotiations.

Ulrike Hoffmann-Burchardi from UBS Global Wealth Management said:

"We expect market volatility to intensify before the tariff deadline in August, with the Federal Reserve's independence and geopolitical uncertainties continuing to persist."

Crypto Market Remains Greedy, SOL Market Cap Surpasses BNB

The crypto greed index remains in the 67 greed zone, slightly down from last week's 70. As funds flow into ETH and other Altcoins, BTC's dominance has dropped to 60%.

Bitcoin returned to 120K, with a 24-hour increase of over 2%, while Ethereum slightly declined but remained above 3,700. Solana crossed the $200 mark, with its market cap surpassing BNB and ranking among the top five cryptocurrencies. The recent rise of SOL reserve strategy companies has also boosted its trend, with SOL reserve strategy company DeFi Dev Corp. holding nearly a million SOL.

Risk Warning

Cryptocurrency investment carries high risks, and its price may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.