From 2025, four U.S. stock companies represented by SharpLink Gaming, Bitmine Immersion Tech, Bit Digital, and BTCS Inc. have built a "ETH Microstrategy" different from MicroStrategy's position normalization by massively purchasing ETH and engaging in on-chain staking. This strategy not only reshaped corporate balance sheet structures but also promoted Ethereum's narrative transition in the capital market. This article systematically combs through the core logic of these four companies in terms of capital paths, on-chain deployment, strategic motivations, and risk governance through ten key questions.

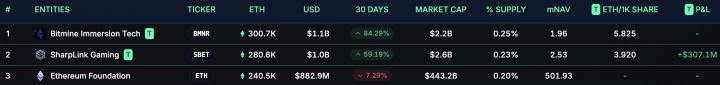

Question 1: Which U.S. listed companies currently hold the most ETH, and how much do they each hold?

As of July 2025, SharpLink Gaming, Bitmine Immersion Tech, Bit Digital, and BTCS Inc. are the companies with the most ETH holdings in the U.S. stock market. SharpLink Gaming holds approximately 358K ETH, Bitmine follows closely with about 300.7K; Bit Digital holds about 120.3K, and BTCS Inc. discloses holdings of 31.9K. Although Coinbase holds about 137.3K ETH as a trading platform, it is mainly for operational needs and not considered a strategic position, thus typically not included in the "microstrategy" category. These four companies constitute the representative camp of the current Ethereum "microstrategy" trend in the U.S. stock market.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms and preserving the original formatting.]BTCS: Adopting a diversified approach, it has staked approximately 10,460 ETH through Rocket Pool and solo staking, with about 4,382 ETH still in the queue. Meanwhile, the company has also pledged some ETH to Aave to earn lending income, constructing a diversified on-chain revenue path.

Bitmine: Although it has not yet disclosed its staking implementation, it has repeatedly stated that it will launch an ETH staking plan after financing is completed.

The four companies have demonstrated different trade-offs and technical paths in staking methods, node control, and on-chain operational strategies.

Question 6: Have the companies disclosed their ETH profit and loss situations? Are their on-chain addresses transparent?

SharpLink: It is currently the only enterprise with a publicly traceable ETH address, with its fund flows and staking paths fully verifiable through platforms like Arkham. The company has also disclosed an average ETH purchase price of $2,825, realizing an unrealized gain of approximately $260 million by July 2025.

Bit Digital: It has not disclosed on-chain addresses but continues to update key information such as ETH holdings and staking income through financial reports, maintaining a basic level of transparency.

BTCS: Similarly, it has not disclosed addresses, but has detailed the ETH allocation structure in Rocket Pool, solo staking, and Aave lending on its website and SEC filings, with a clear asset path.

Bitmine: Its latest disclosed holdings reach 300,657 ETH, with a total market value exceeding $1 billion, an average purchase price of around $3,461.89, funded by a private placement completed in early July; however, its on-chain address and staking details have not been made public.

Overall, SharpLink is the most comprehensive in terms of profit and loss disclosure and on-chain transparency. The other three companies, while not disclosing addresses, provide key information in their financial reports, forming a basically traceable framework.

(The translation continues in the same manner for the rest of the text.)- First, ETH's asset properties are more complex. Unlike BTC as a fixed-supply, non-stakable "value storage asset", ETH has earnings attributes and a dynamically adjusted supply mechanism, making it more like a composite financial instrument rather than a pure reserve asset. This multi-positioning makes it difficult for enterprises to build a single narrative anchoring around ETH.

- Secondly, there are higher thresholds in on-chain strategy execution. ETH micro-strategies often require enterprises to operate or host staking nodes, or participate in more complex on-chain yield deployments, with technical complexity and security risks far exceeding simple asset allocation behaviors, making it difficult for most enterprises to replicate at scale.

- Thirdly, the market capitalization of related companies is generally small, financing tools are limited, and a collaborative mechanism similar to MSTR's "valuation premium + convertible bonds + media narrative" has not yet been formed, nor has a financial flywheel been established that can drive secondary market emotional resonance.

- Finally, the current ETH market lacks a "representative enterprise" with high consensus, broad coverage, and strong leverage capabilities. To become a true "Ethereum version of MicroStrategy", it not only needs to continuously accumulate ETH but also form a closed loop in multiple dimensions such as financing capabilities, on-chain deployment, narrative control, and valuation transmission.