Written by: Sam, IOSG

TL;DR

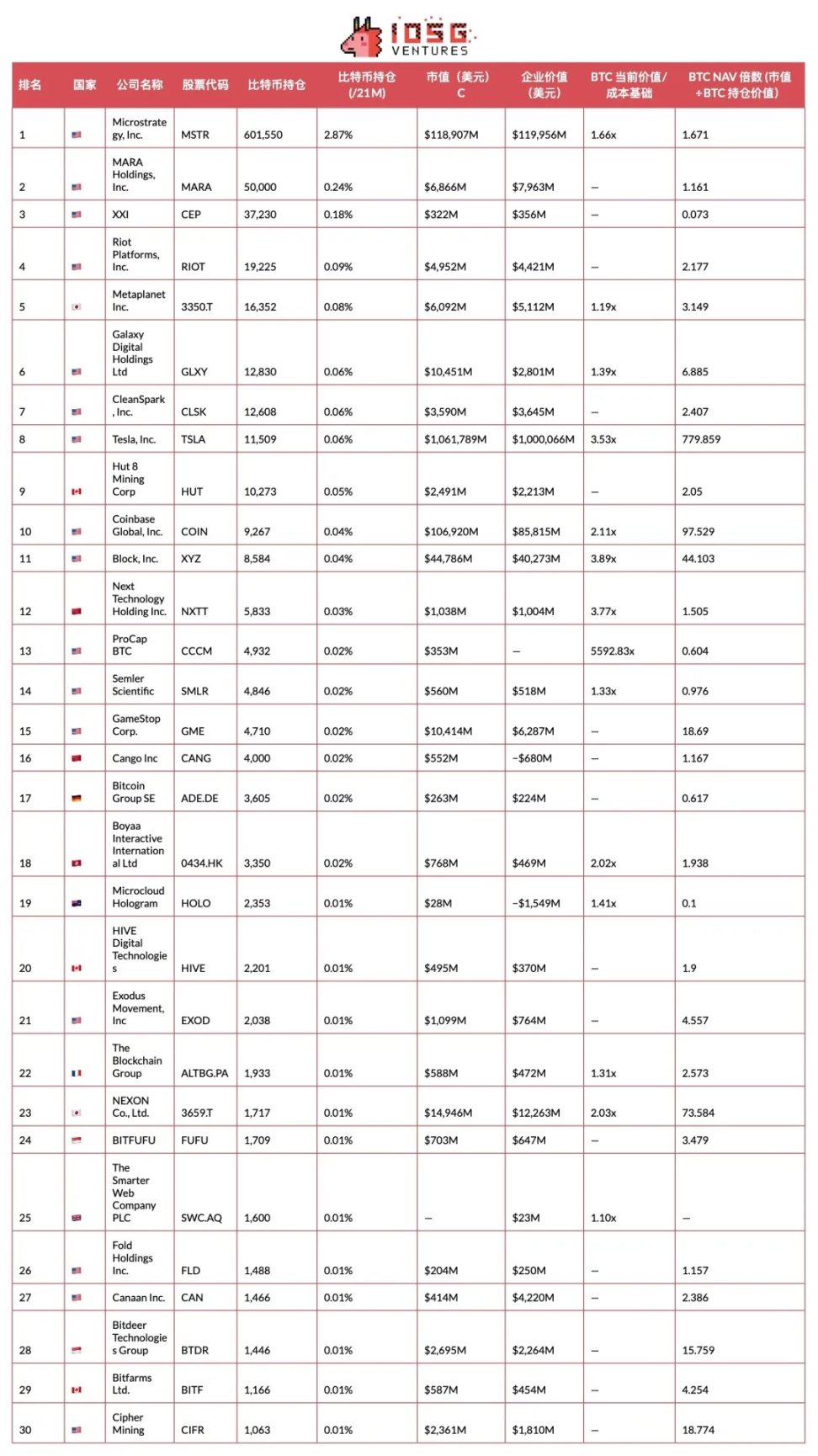

Highly concentrated holdings: MSTR accounts for 2.865% of total listed company BTC, with low ownership ratio outside the Top 10

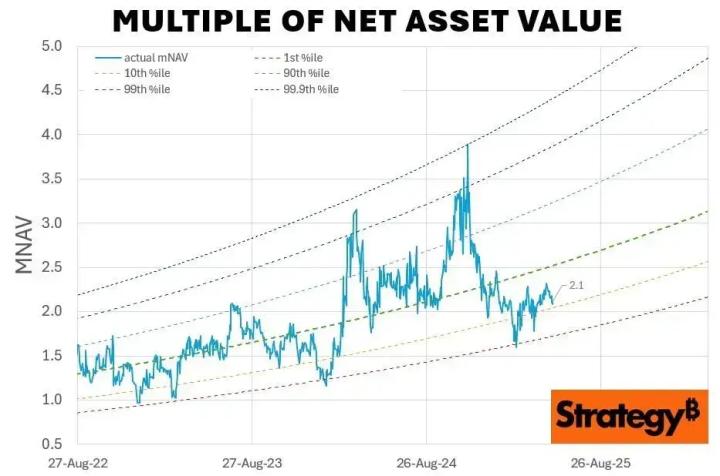

Severe project homogenization: Most reserve projects lack sustainable advantages, and long-term NAV premium or relative advantages of quality projects may fade

Valuation bubble emerging: NAV multiples generally >2× (only a few <1×), stock prices are easily driven by announcements, and bear market risks can quickly erode premiums

Metaplanet finances through zero-interest convertible bonds + SAR, profiting from the difference between 20% dividend tax and 55% Bitcoin trading tax

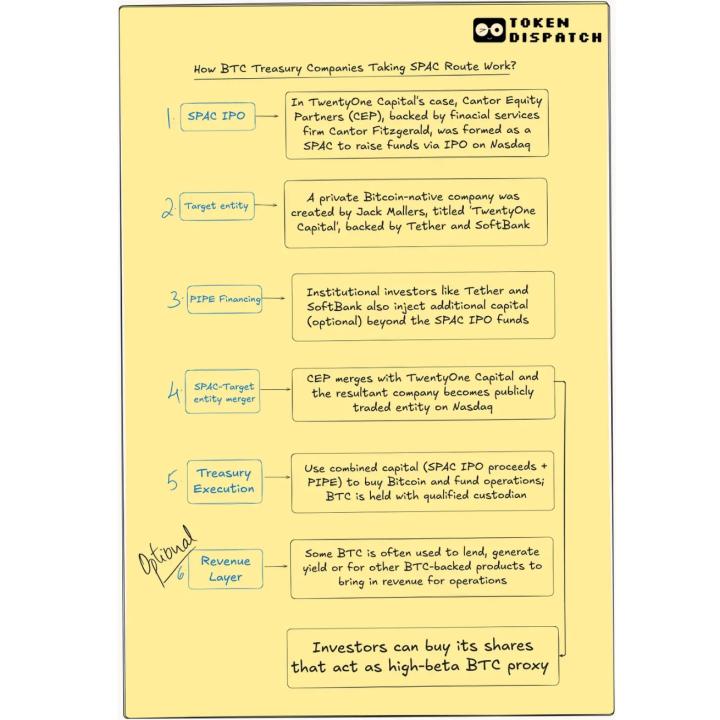

SPAC/PIPE/Convertible bonds/Physical promises are mainstream, TwentyOne and ProCap achieve full reserves upon listing through multi-step mergers

SharpLink raised over $838 million, almost fully pledging ETH, with Joseph Lubin joining the board and OTC delivering 10,000 ETH with the Ethereum Foundation.

BTCS innovatively borrows USDT from Aave to purchase ETH for staking, while being sensitive to borrowing rates and on-chain liquidity

Crypto funds layout strategic reserve stocks through PIPE and other methods, establishing dedicated funds; industry veterans serve as strategic advisors, providing practical support and professional experience.

Introduction

The wave of listed companies turning to cryptocurrency reserve strategies shows no signs of abating. Some companies see this as their last attempt to save their business, while others simply copy MicroStrategy's approach, but a few truly innovative projects stand out.

This article will explore the leaders in Bitcoin and Ethereum strategic reserves - analyzing how they provide alternatives to spot ETFs, deploy complex financing structures, achieve tax optimization, create staking rewards, integrate DeFi ecosystems, and leverage unique competitive advantages.

Bitcoin

Comprehensive Overview

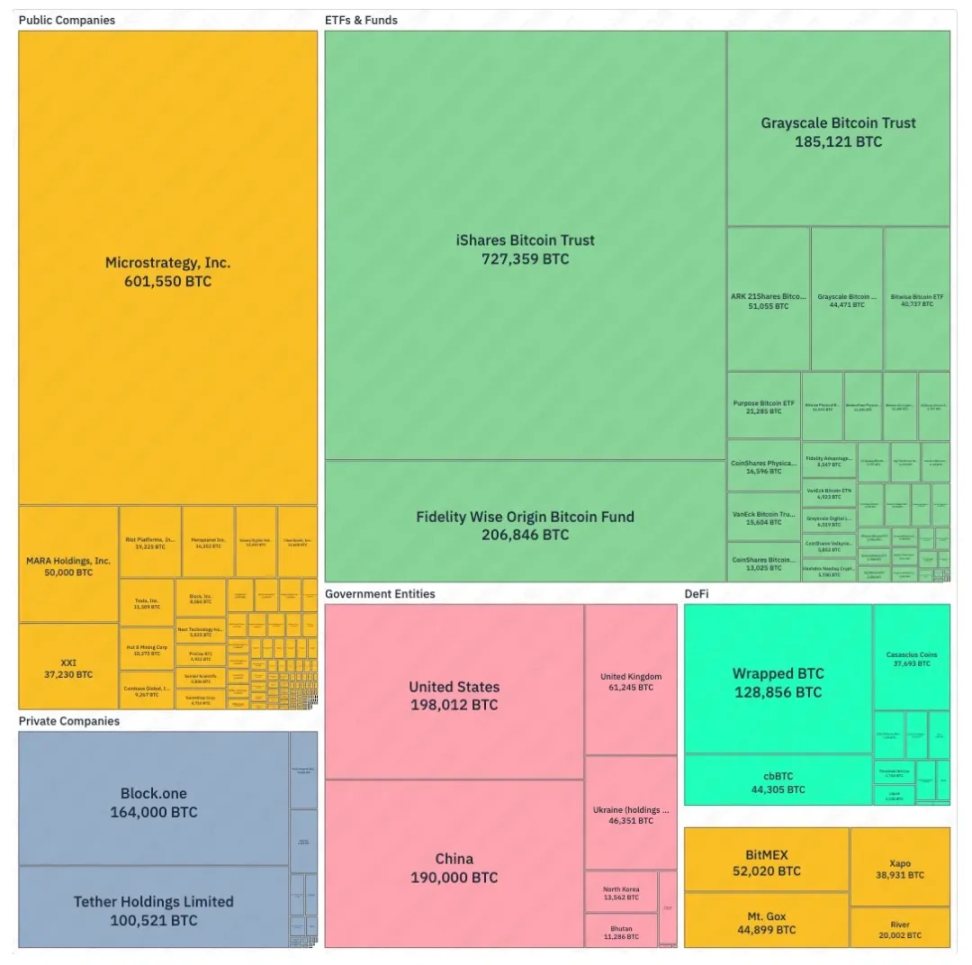

According to BitcoinTreasuries.net's treemap, among publicly disclosed holdings, MicroStrategy has quickly risen to become the largest corporate holder - second only to iShares Bitcoin Trust - controlling nearly 2.865% of the 21 million total supply today.

▲ bitcointreasuries.net

Nevertheless, ETFs and trusts still dominate, led by iShares, Fidelity, and Grayscale. At the sovereign level, the United States and China hold the most Bitcoin, with Ukraine also maintaining significant reserves. In the private sector, Block.one and Tether Holdings are at the forefront.

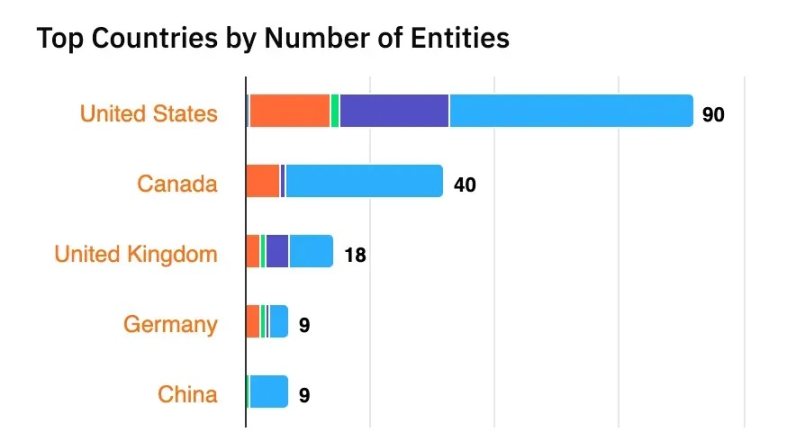

Among all Bitcoin-holding entities, the United States and Canada top the list, followed by the United Kingdom. However, it's worth noting Japan's Metaplanet (ranked 5th) and China's Next Technology Holding (ranked 12th).

▲ bitcointreasuries.net

The following list shows the Bitcoin holdings of the top 30 publicly traded companies, with MicroStrategy holding a significant lead.

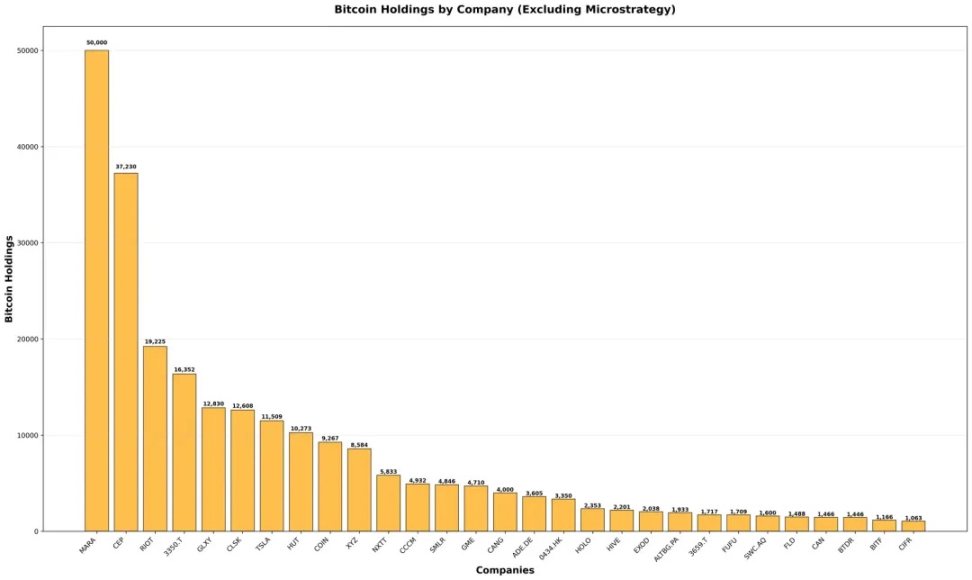

Even excluding MicroStrategy, MARA and Twenty One Capital still rank at the top, but holdings remain highly concentrated - most companies outside the top ten hold Bitcoin quantities that are only moderate compared to the leaders.

▲ bitcointreasuries.net, IOSG

▲ Metaplanet Investor Deck

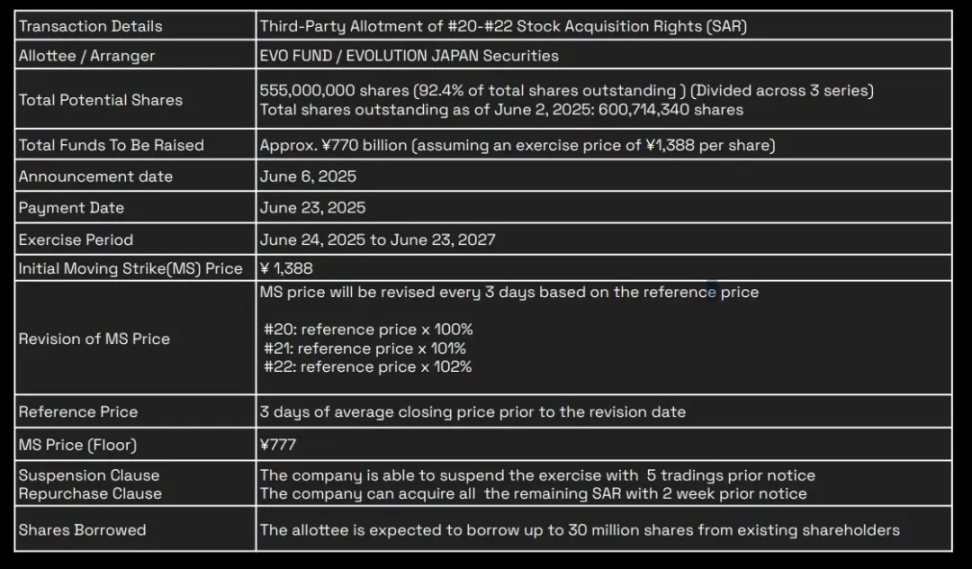

The "5.55 Billion Plan" (Stock Appreciation Rights #20-#22) launched on June 6, 2025, is Metaplanet's largest single financing scheme to date. A total of 555 million Stock Appreciation Rights (SARs) were issued, equivalent to 92.4% of the circulating shares of 600.7 million, with a potential maximum financing of 770 billion yen. The initial floating exercise price is 1,388 yen per share, with a reset every three trading days at 100%/101%/102% of the average closing price of the previous three days, but not lower than the guaranteed minimum price of 777 yen.

The EVO Fund can exercise at any time between June 24, 2025, and June 23, 2027, during which Metaplanet will issue new shares and obtain exercise funds. To control equity dilution and market impact, Metaplanet can suspend exercise by announcing five trading days in advance or notify a repurchase of unexercised shares two weeks in advance.

Tax advantages constitute another core value: In Japan, stock capital gains and dividends are subject to a single tax rate of around 20%, while spot BTC trading profits are classified as miscellaneous income, requiring a progressive national tax rate of 5%-45%, plus a 10% local resident tax (and additional taxes), with a potential comprehensive tax rate reaching up to 55%. For high-tax-bracket investors seeking BTC exposure, Metaplanet becomes an extremely attractive alternative—especially since Japan has not yet approved a spot BTC ETF listing.

[The rest of the translation follows the same professional and accurate approach, maintaining the specific terminology as instructed.]Block (formerly Square) first "staked" in October 2020 by purchasing 4,709 BTC for $50 million, representing about 1% of its assets at the time. In the first quarter of 2021, it added another $170 million (3,318 BTC), raising its reserves to over 8,000 BTC. Since then, Block has maintained its BTC position. In April 2024, Block launched an enterprise-level dollar-cost averaging plan, using 10% of monthly BTC product gross profit to systematically buy through over-the-counter liquidity providers at a two-hour weighted average price.

Coinbase officially confirmed its corporate BTC strategy in August 2021, with the board approving a one-time $500 million digital asset purchase and committing to invest 10% of quarterly net revenue into a portfolio including BTC.

In January 2021, Tesla's board approved a $1.5 billion BTC purchase, stating "we believe in the long-term potential of digital assets as an investment and as an alternative to cash flow". Months later, CEO Elon Musk said Tesla sold about 10% of its BTC "to prove liquidity", realizing $128 million in gains in the first quarter of 2021; in the second quarter of 2022, Tesla sold approximately 75% of its remaining position, with Musk explaining this was to "maximize cash position during production challenges caused by COVID in China", while emphasizing "this should not be viewed as a negative judgment on BTC".

Ethereum

Many companies have joined the Ethereum reserve camp with the same enthusiasm as MicroStrategy's BTC strategy—driven by bullish ETH expectations, staking rewards, and the current fact that ETH ETFs cannot participate in staking. As Wintermute founder Evgeny Gaevoy said on July 17: "Clearly, it's almost impossible to buy ETH on Wintermute's OTC trading desk."

▲ strategicethreserve.xyz

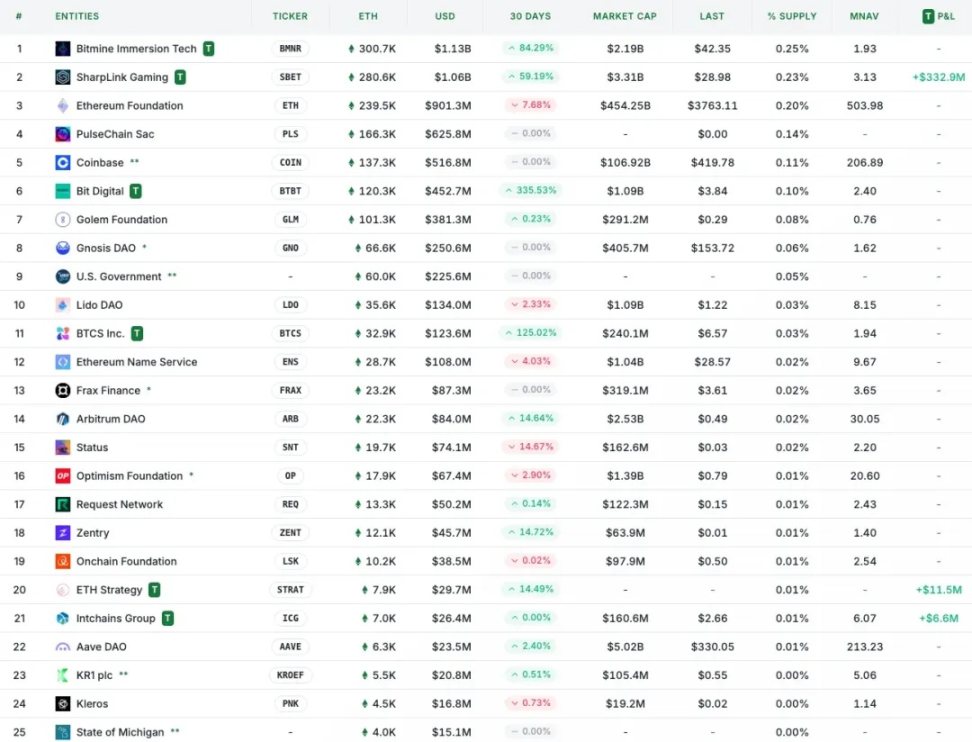

Companies participating in the Ethereum reserve strategy are marked with a "T" symbol. Leading companies include BitMine, SharpLink, Big Digital, and BTCS, each showing significant position increases in the past 30 days, reflecting an active ETH accumulation stance.

Although BitMine and SharpLink's holdings exceed the Ethereum Foundation, their individual positions are moderate compared to MicroStrategy controlling nearly 2.865% of BTC circulating supply—approximately 0.25% and 0.23% of total supply respectively. Additionally, most of these Ethereum reserve projects were initiated between May and July this year, still being very recent developments.

[The translation continues in the same professional manner for the rest of the text, maintaining the specified translations for technical terms and maintaining a precise, professional tone.]On July 7, 2025. Bit Digital, originally focused on Bitcoin mining, announced the completion of its transformation to an Ethereum reserve strategy. According to its press release that day, Bit Digital raised approximately $172 million through public stock offering and liquidated 280 BTC from its balance sheet, reinvesting the proceeds into Ethereum. As a result, the company's total ETH holdings reached approximately 100,603 tokens (continuously accumulated through staking since 2022).

GameSquare Holdings (NASDAQ: GAME)

On July 10, 2025. Digital media/gaming company GameSquare launched an Ethereum reserve plan of up to $100 million. In the announcement that day, GameSquare confirmed an initial investment of $5 million, purchasing approximately 1,818 ETH at around $2,749 per token. The company initially raised $9.2 million through a public stock offering, followed by an additional commitment of $70 million in follow-on placement (which can be over-allocated to $80.5 million) to further expand its ETH reserves.

Conclusion

The wave of corporate crypto asset reserves has far exceeded Bitcoin and Ethereum—many companies are expanding their reserve layouts to SOL, BNB, XRP, HYPE, and others, seizing the opportunity.

However, most projects are highly homogeneous, lacking sustainable competitive advantages, and their NAV premiums will likely be eroded over time by competitors with more strategic advantages.

Truly advantageous enterprises often possess stronger financing structures and strategic partnerships. For example, Metaplanet benefits from Japan's favorable tax treatment of stocks and the lack of a BTC spot ETF market; Twenty One employs a complex financing structure to utilize all available channels for acquiring Bitcoin—and has established strategic partnerships with Tether, Bitfinex, and SoftBank, becoming the third-largest holder and maximizing its scale advantage. Meanwhile, SharpLink is led by ConsenSys and top crypto VCs, with Joseph Lubin joining its board, and BTCS is involved in the Ethereum DeFi ecosystem.

For public investors, caution is crucial: Under massive hype, many companies remain at high NAV multiples, with stock prices often fluctuating due to announcements—while investors lack the transparent, real-time information needed to assess company changes. Additionally, broader market risks, especially during bear markets, can quickly erode any premiums from these strategies.

In the institutional realm, an increasing number of crypto funds are allocating crypto reserve stocks, even launching dedicated funds. Simultaneously, experienced industry veterans are intervening as strategic advisors.