Written by: Prathik Desai

Translated by: Luffy, Foresight News

In 2020, Strategy (then known as MicroStrategy) began exchanging debt and stocks for Bitcoin. Under the leadership of co-founder and chairman Michael Saylor, this company, originally selling enterprise software, transformed by injecting company funds into Bitcoin, becoming the largest Bitcoin holder among listed companies.

Five years later, Strategy is still selling software, but its operational gross profit contribution has been steadily declining. In 2024, operational gross profit dropped to about 15% compared to 2023; in the first quarter of 2025, this figure decreased by 10% compared to the same period last year. By 2025, Strategy's model had been replicated, adapted, and simplified, paving the way for over a hundred listed entities to hold Bitcoin.

The model is simple: issue low-cost debt with corporate collateral, buy Bitcoin, and then issue more debt to buy more Bitcoin after its appreciation - forming a self-reinforcing cycle that turns the corporate treasury into a leveraged crypto fund. Maturing debt is repaid by issuing new stocks, diluting existing shareholders' equity. However, the appreciation of Bitcoin holdings drives up the stock price, offsetting the impact of equity dilution.

Most companies following Strategy's footsteps have existing businesses, hoping to benefit their balance sheets through Bitcoin as an appreciating asset.

Strategy was previously a pure enterprise analysis and business intelligence platform; Semler Scientific, the 15th largest listed Bitcoin holder, was once a pure health technology company; GameStop, which recently joined the Bitcoin reserve club and drew attention, was previously a well-known game and electronic product retailer, only recently venturing into Bitcoin treasury building.

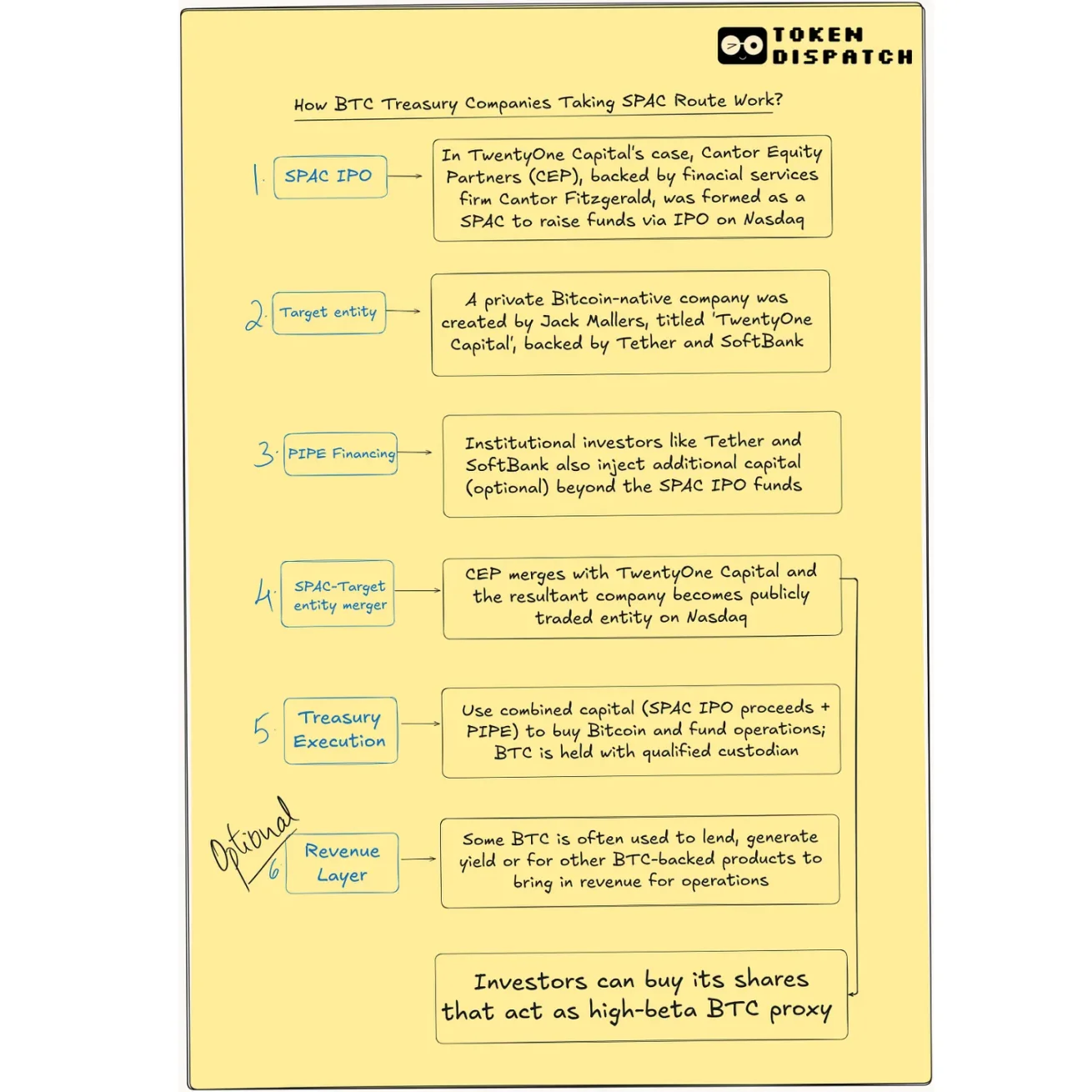

Now, a new wave of companies desires to enjoy Bitcoin's dividends without bearing the burden of establishing a physical business. They have no customers, no profit model, and no operational roadmap. They only need a balance sheet filled with Bitcoin and a channel to quickly enter the public market through financial shortcuts. Thus, Special Purpose Acquisition Companies (SPACs) emerged.

These Bitcoin asset SPACs, such as ReserveOne, ProCap (supported by Anthony Pompliano), and Twenty One Capital (supported by Tether, Cantor Fitzgerald, and SoftBank), are launching simple packaging solutions. Their claim is clear: raise hundreds of millions of dollars, buy Bitcoin in bulk, and provide public market investors with a stock ticker to track all this. That's it, that's the entire business.

These new entrants' approach is completely opposite to Strategy's: first accumulate Bitcoin, then consider the business part. This model is more like a hedge fund than a corporation.

However, many companies are still queuing up to choose the SPAC path. Why is this?

A SPAC is a pre-financed shell company that raises funds from investors (usually a group of private investors), goes public on a stock exchange, and then merges with a private company. It is often described as a shortcut to an IPO. In the cryptocurrency field, this is a way to quickly list entities with large Bitcoin holdings, avoiding unfavorable market sentiment or regulatory shifts - speed is key.

Although this "speed advantage" is often illusory. SPACs promise to complete listing in 4-6 months, while IPOs take 12-18 months, but in reality, regulatory review for cryptocurrency companies takes even longer. For example, Circle's attempt to go public via SPAC failed, and it was only successful through a traditional IPO.

But SPACs still have their advantages.

They allow these companies to paint bold visions, such as "Bitcoin holdings reaching $1 billion by year-end," without immediately facing the strict scrutiny of traditional IPO processes. They can introduce post-listing private investments (PIPE) from heavyweight companies like Jane Street or Galaxy, pre-negotiate valuations, package themselves as SEC-compliant shell companies, while avoiding being labeled as "investment funds".

The SPAC route only makes it easier for companies to sell their strategies to stakeholders and investors because there's nothing else to sell besides Bitcoin.

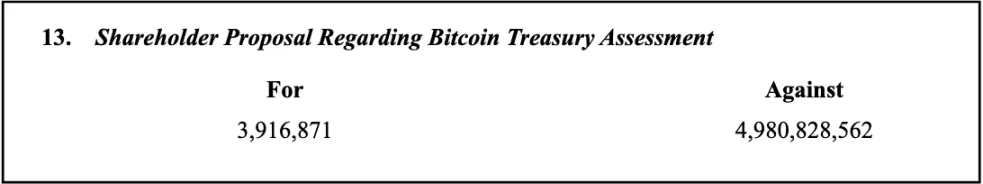

Remember when Meta and Microsoft considered adding Bitcoin to their treasury? They faced overwhelming opposition.

For public investors, SPACs seem to offer pure Bitcoin exposure without directly touching cryptocurrency, similar to buying a gold ETF.

But SPACs also face acceptance issues among retail investors, who prefer more popular channels to gain Bitcoin exposure, such as Exchange Traded Funds (ETFs). The 2025 Institutional Investor Digital Assets Survey shows that 60% of investors prefer to access cryptocurrencies through registered investment instruments like ETFs.

Nevertheless, demand still exists. Because this model contains leverage potential.

After buying Bitcoin, Strategy did not stop but continued to issue convertible notes (likely redeemed by issuing new stocks). This method helped the former business intelligence platform become a Bitcoin "turbocharger": during Bitcoin's rise, its stock price increase exceeded Bitcoin itself. This blueprint remains in investors' minds: a SPAC-based Bitcoin company can replicate this acceleration model - buy Bitcoin, issue more stocks or debt to buy more Bitcoin, and repeat.

When a new Bitcoin company announces receiving $1 billion in institutional PIPE investment, it itself transmits credibility, signaling to the market that big money is paying attention. Think about how much credibility Twenty One Capital gained by having heavyweight companies like Cantor Fitzgerald, Tether, and SoftBank supporting it.

SPACs allow founders to achieve this goal in the early stages of the company's lifecycle without first building a revenue-generating product. This early institutional endorsement helps gain attention, capital, and momentum while reducing potential investor resistance faced by already-listed enterprises.

For many founders, the appeal of the SPAC route lies in flexibility. Unlike IPOs, which have very strict information disclosure timing and pricing, SPACs have greater control over narrative, predictions, and valuation negotiations. Founders can tell forward-looking stories, develop capital plans, retain equity, and avoid the endless financing cycle in the traditional "VC → IPO" path.

The packaging itself is attractive. Public stock issuance is a well-known language: stock tickers can be traded by hedge funds, added to retail platforms, and tracked by ETFs. It's a bridge connecting crypto-native concepts with traditional market infrastructure. For many investors, this packaging is more important than the underlying mechanism: if it looks like a stock and trades like a stock, it can be integrated into existing portfolios.

If SPACs can be established and listed without any existing business, how will they operate? Where will revenue come from?

SPACs also allow creativity in structure. A company can raise $500 million, invest $300 million in Bitcoin, and use the remaining funds to explore revenue strategies, launch financial products, or acquire other crypto enterprises that can generate income. This hybrid model is difficult to achieve in ETFs or other models with stricter rules and more rigid authorizations.

Twenty One Capital is exploring structured fund management. Its Bitcoin reserves exceed 30,000 coins, while using part of them for low-risk on-chain yield strategies. The company merged with a SPAC supported by Cantor Fitzgerald and raised over $585 million through PIPE and convertible debt financing to buy more Bitcoin. Its roadmap includes building Bitcoin-native lending models, capital market tools, and even producing Bitcoin-related media content and promotional activities.

Nakamoto Holdings, founded by David Bailey of Bitcoin Magazine, took a different path to achieve similar goals. It merged with a listed medical company, KindlyMD, to build a Bitcoin treasury strategy. This deal secured $510 million in PIPE and $200 million in convertible note financing, becoming one of the largest crypto-related financing deals. It hopes to securitize Bitcoin exposure into stocks, bonds, and hybrid instruments that can be traded on major stock exchanges.

Pompliano's ProCap Financial plans to provide financial services based on the Bitcoin treasury, including crypto lending, staking infrastructure, and building products that help institutions obtain Bitcoin returns.

ReserveOne takes a more diversified route. Although Bitcoin remains the core of its portfolio, it plans to hold a basket of assets including Ethereum, Solana, and utilize these assets for institutional-level staking, derivatives, and over-the-counter lending.

Supported by companies like Galaxy and Kraken, ReserveOne positions itself as a crypto-native BlackRock, combining passive exposure with active income generation. Theoretically, its revenue comes from lending fees, staking rewards, and managing the spread between short-term and long-term bets on crypto assets.

Even if entities have found sustainable income methods, the "public company" label still brings paperwork and challenges.

Post-merger operations further highlight the necessity of sustainable income models. Fund management, custody, compliance, and auditing become crucial, especially when the only product is a highly volatile asset. Unlike ETF issuers, many SPAC-backed companies are built from scratch, with custody potentially outsourced and controls potentially weak, allowing risks to accumulate silently.

Moreover, there are governance issues. Many SPAC sponsors retain special rights, such as enhanced voting rights, board seats, and liquidity windows, but they often lack cryptocurrency expertise. When Bitcoin prices crash or regulations tighten, experts are needed to steer the ship. During market rises, no one pays attention; but when it falls, problems are exposed.

So, how should retail investors respond?

Some will be attracted by potential upside, thinking a small bet on a Bitcoin SPAC might replicate Strategy's prosperity. But they also face multiple risks, such as equity dilution, volatility, redemption, and unproven management teams. Others might prefer the simplicity of spot Bitcoin ETFs, or even direct Bitcoin ownership.

Because when you buy Bitcoin stocks listed through a SPAC, you're not directly holding Bitcoin, but buying a plan for someone else to buy Bitcoin for you, hoping they'll succeed. This hope comes at a cost, and in a bull market, this cost seems worth paying.

However, you still need to understand exactly what you're buying and how much.