Title: The United States Wants to Eat Up the Crypto Market Cake, and Asian Countries Are Getting Anxious

Written by: Tiger Research

Translated by: AididiaoJP, Foresight News

Summary

Regulation and Government Dynamics

Hong Kong plans to introduce stablecoin regulations in August to consolidate its position as a digital financial center.

Singapore implements a strict licensing system, prohibiting unauthorized companies from operating locally.

Thailand launches G-Tokens, becoming the first country to issue government digital bonds.

Corporate Activities

Japanese listed companies are increasingly adopting Bitcoin as a reserve fund strategy, driving institutional investment.

Chinese enterprises are circumventing domestic restrictions through Hong Kong licenses and beginning to accumulate Bitcoin.

Policy Shifts

After the Korean election, the Korean won stablecoin has become a focus, but regulatory fragmentation remains an issue.

Vietnam has historically transitioned from banning cryptocurrencies to full legalization.

The Philippines adopts a dual-track strategy, combining strict regulation with a sandbox framework.

Asian Web3 Market in Q2: Regulations Stabilizing, Corporate Investments Increasing

Although the focus of the Web3 market has clearly shifted to the United States, the development of major Asian markets remains crucial. Asia not only has the world's largest cryptocurrency user base but continues to operate as a core hub for blockchain innovation.

To this end, Tiger Research continues to track the main trends in Asian Web3 quarterly. In the first quarter of 2025, regulatory bodies across Asia laid the policy foundation: introducing new regulations, issuing licenses, and launching regulatory sandboxes, with cross-border cooperation also beginning to take shape.

The regulatory foundation in the second quarter drove substantive commercial activities and accelerated capital deployment. Policies introduced in the first quarter were tested in the market, prompting further refinement and implementation of regulations.

Institutional and corporate participation has significantly improved. This report analyzes the progress in the second quarter by country and assesses how policy shifts in various countries shape the global Web3 ecosystem.

Key Developments in Major Asian Markets

2.1. South Korea: Intersection of Political Transition and Regulatory Adjustment

... (rest of the text continues in the same manner)Interest in RMB stablecoins has also warmed up at the end of the quarter. Due to concerns about the dominance of USD stablecoins and RMB depreciation, related discussions have become increasingly active. On June 18, PBOC Governor Pan Gongsheng proposed a vision of constructing a multipolar global monetary system, implying an open attitude towards stablecoin issuance. In July, Shanghai's State-owned Assets Supervision and Administration Commission initiated a research discussion on RMB stablecoin development.

2.6. Vietnam: Cryptocurrency Legalization and Digital Control Strengthening

Vietnam officially announced the legalization of cryptocurrency in the second quarter, marking a significant policy shift. On June 14, the Vietnamese National Assembly passed the Digital Technology Industry Law, which recognizes digital assets and outlines incentive measures for areas such as artificial intelligence, semiconductors, and digital infrastructure.

This marks a historic reversal of Vietnam's cryptocurrency ban, potentially becoming a catalyst for widespread cryptocurrency application in Southeast Asia. Given Vietnam's previous restrictive stance, this move signifies a major adjustment in the region's cryptocurrency policy.

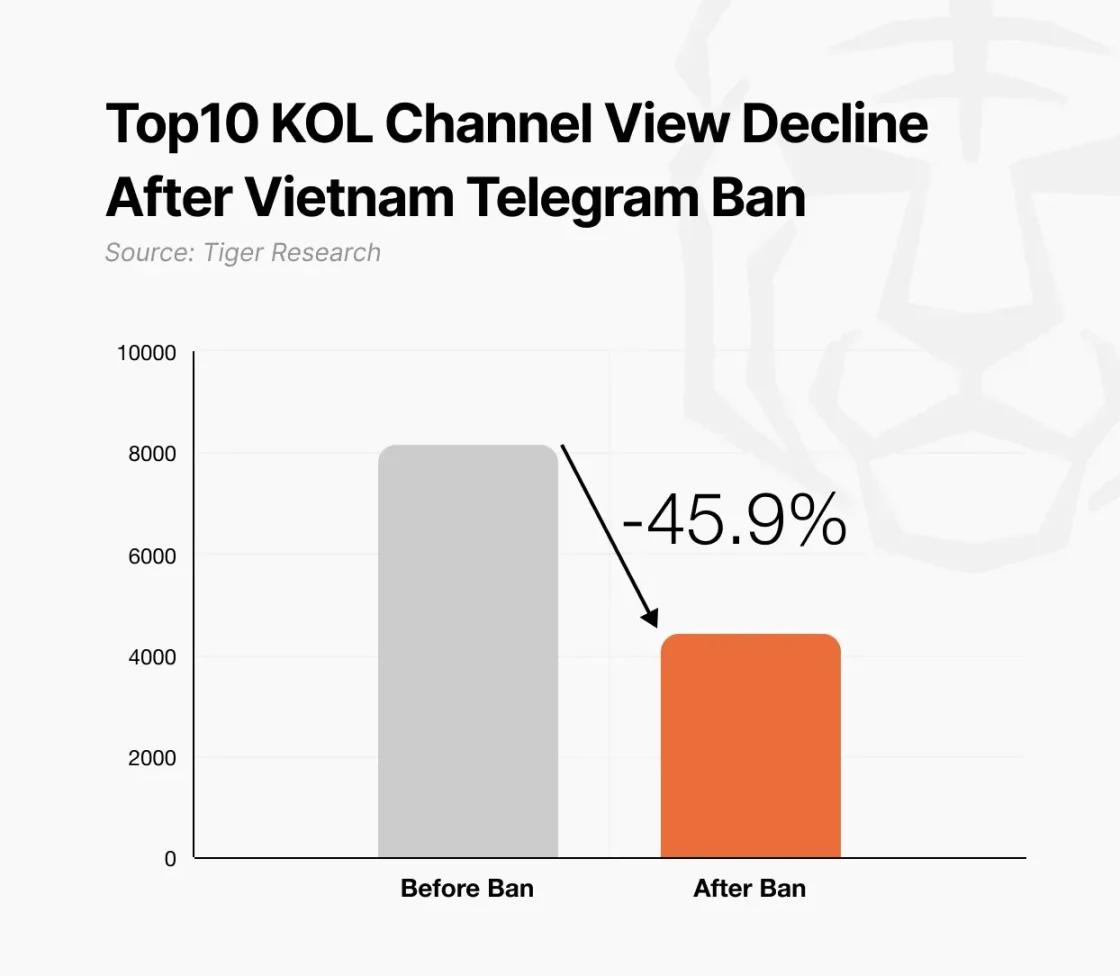

Simultaneously, the government is strengthening digital platform control. Authorities have required telecommunications operators to block Telegram, citing fraud, drug trafficking, and terrorism. Police reports show that 68% of the platform's 9,600 active channels are involved in illegal activities.

This dual approach of legalizing cryptocurrency while combating digital abuse reflects Vietnam's intention to allow innovation within strict monitoring. Although digital assets are now legally recognized, their use in illegal activities is facing more stringent law enforcement.

2.7. Thailand: Government-Led Digital Asset Innovation

Thailand advanced government-led digital asset plans in the second quarter. The Securities and Exchange Commission (SEC) proposed allowing exchanges to launch their own functional tokens, relaxing previous strict listing rules.

More notably, the government announced the issuance of digital bonds. On July 25, Thailand will issue $150 million in "G-Tokens" through an approved ICO portal, with tokens not usable for payment or speculative trading.

This move becomes a rare case of direct public sector participation in digital asset issuance, providing an early template for tokenized finance globally.

2.8. Philippines: Strict Regulation and Innovation Sandbox in Parallel

The Philippines implemented a "regulation + innovation" dual-track strategy in the second quarter. The central bank and Securities and Exchange Commission (SEC) strengthened control over token listings, significantly expanding VASP registration and anti-money laundering compliance requirements.

Particularly notable are new regulations targeting influencers. Content creators promoting crypto assets must register with authorities, with potential imprisonment of up to five years for violations, becoming one of the strictest enforcement systems in the Asia-Pacific region.

Simultaneously, an innovation support framework was launched. The SEC opened applications for the "StratBox" sandbox program, providing a controlled experimental environment for crypto service providers.

【Disclaimer】Markets carry risks, and investments require caution. This article does not constitute investment advice. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at the user's own risk.