Written by: Binance Research Institute

Translated by: Chopper, Foresight News

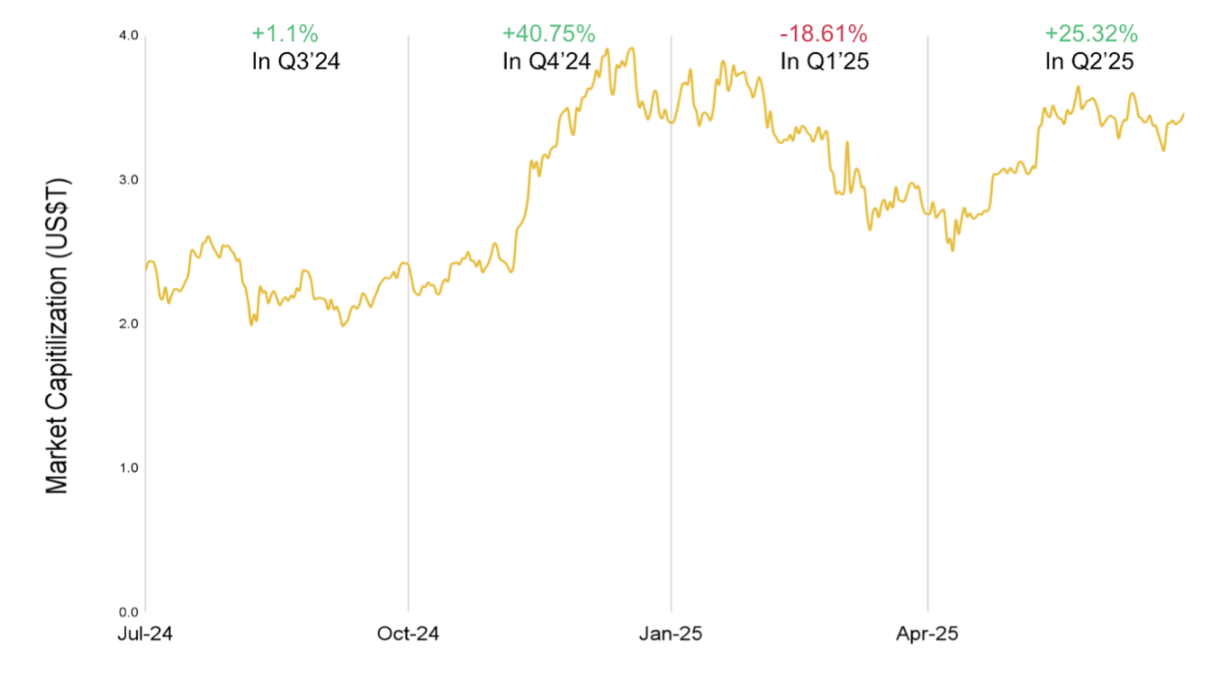

In the first half of 2025, the crypto market showed a "first suppressed, then rising" oscillating pattern: the total market value dropped by 18.61% in the first quarter, rebounded by 25.32% in the second quarter, ultimately showing a slight year-on-year increase of 1.99% in the first half of the year.

Year-to-date, the crypto market's total market value increased by 1.99%

This dynamic stems from multiple factors:

The Federal Reserve's expected rate cuts in the second half of 2024 and regulatory relaxation after the US election pushed the market to reach $3 trillion;

Inflation stickiness, weak economic data, and the universal tariffs implemented by the Trump administration in April suppressed market sentiment in early 2025;

Recent tariff suspension and improved clarity in stablecoin and DeFi regulation have driven market recovery.

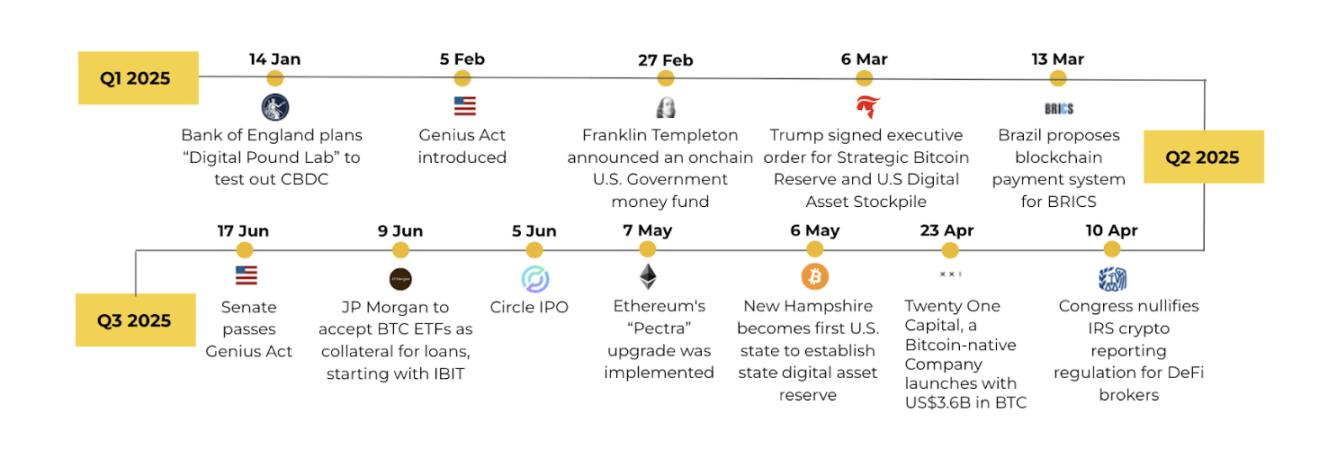

Timeline of important events in the first half of 2025

The core narrative of the crypto market in the first half of the year focused on Bitcoin investment tools, stablecoins, AI agents, and tokenized real-world assets (RWA). Looking forward, global monetary policies, trade tariff dynamics, institutional entry, the convergence of cryptocurrencies and AI, and the next round of crypto IPOs after Circle will be key points of attention.

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology.]Asia: Hong Kong attracts innovation through open licenses and tax incentives; Singapore cracks down on regulatory arbitrage, leading to business migration.

Second Half Outlook

The Federal Reserve's policy shift, U.S. crypto legislation advancement, TradFi and crypto merger wave, stablecoin payment penetration, and RWA explosion will dominate the crypto market's direction in the second half of the year.