Written by: imToken

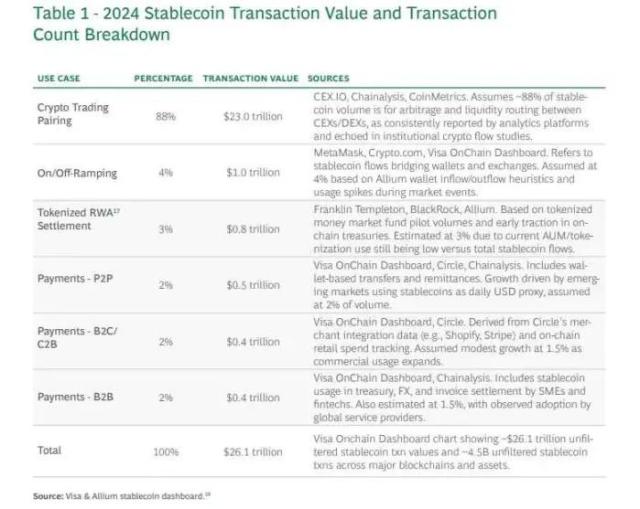

This morning Beijing time, the U.S. House of Representatives passed three crypto-related legislations: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. Among these, the GENIUS Act is expected to be signed into law by Trump on local time Friday. This not only marks the first national regulatory framework for stablecoins in the United States but also sends a clear signal that stablecoins are moving out of the gray area and approaching the edge of the mainstream financial system. Meanwhile, major financial centers like Hong Kong, China, and the European Union are accelerating their steps, and the global stablecoin landscape is undergoing a reshaping. Looking back at the past few months, we'll find that stablecoins have almost overnight transformed from a financial variable under regulatory scrutiny to a new infrastructure officially recognized. What happened behind this, who is driving stablecoins to become the new protagonist on the global financial stage, and how should we rationally understand this wave? From Web3 narrative to national strategy, who is driving this? From the beginning of the year to now, stablecoins have undoubtedly risen to become the global financial policy and narrative focus. However, this wave is not accidental, nor is it a product of natural technological evolution, but a structural shift driven by policy forces, especially the policy turn during the Trump era, which played a highly disruptive "carp role". On one hand, Trump has always been clearly opposed to Central Bank Digital Currency (CBDC), explicitly supporting a market-driven digital dollar route. On the other hand, from endorsing the family enterprise's USD1 to promoting and soon signing the GENIUS Act, Trump is practically fulfilling his campaign promise to loosen the crypto market. These signals have directly forced global regulators to re-examine stablecoins. Therefore, in just a few months, stablecoins have leaped from a marginal topic in the crypto circle to a focus of national strategic-level discussions. Besides Hong Kong, China setting a timeline for the Stablecoin Regulation, major global economies are unanimously beginning to seriously consider and accelerate establishing clear compliance frameworks for stablecoins: - The EU's Markets in Crypto-Assets (MiCA) Regulation, effective in 2024, comprehensively covers crypto asset compliance and provides detailed classification of stablecoins; - The ruling party of South Korea's new president Lee Jae-myung proposed the Digital Asset Basic Law, clearly stipulating that as long as a Korean company has at least 500 million won (about $370,000) in capital and ensures refund through reserve funds, it can issue stablecoins; Objectively speaking, the passage of the GENIUS Act is not just the United States loosening restrictions on stablecoins, but a clear choice of the digital dollar route - abandoning Central Bank Digital Currency (CBDC) while supporting compliant, privately issued dollar stablecoins. It can be foreseen that the United States' stance will become a reference paradigm for other countries' regulatory designs, promoting stablecoins into the global financial policy's common discussion framework. The path of stablecoins is changing In the past few years, the stablecoin market landscape has been long dominated by Tether (USDT) and Circle (USDC), representing two paths of "circulation efficiency" and "compliant transparency": - USDT focuses on cross-platform circulation and matching efficiency, dominating exchanges and gray settlement networks; - USDC emphasizes asset compliance and transparency, deeply cultivating regulatory-friendly scenarios and institutional client systems; In terms of overall scale, stablecoins have maintained growth since 2025 - according to CoinGecko data, as of July 18, the total stablecoin market value was about $262 billion, growing over 20% compared to the beginning of the year. This means that in the crypto market's recovery, stablecoins remain the core "liquidity entry point". The duopoly of USDT and USDC remains solid - USDT's total market value exceeds $160 billion, accounting for over 60%; USDC remains around $65 billion, accounting for about 25%, with their combined share close to 90%. From 2024 onwards, more and more Web2 financial enterprises and traditional capital forces are entering the field, building on-chain settlement tools with stablecoins. For example, PayPal's PYUSD and USD1, backed by emerging political capital, are two representative signals: PYUSD (PayPal USD) is launched by payment giant PayPal, naturally possessing cross-border settlement scenarios and global merchant networks. USD1 aims at on-chain compliant deposit/withdrawal and cross-border business, supported by political and commercial resources endorsed by Trump, cutting into enterprise settlement scenarios. It can be said that under the support of institutions and national forces, these emerging stablecoin projects are driving the function of stablecoins from "Web3 liquidity tools" to value bridges connecting Web3 and real economic systems, with usage scenarios gradually penetrating from exchanges and wallets to supply chain finance, cross-border trade, freelancer settlements, OTC scenarios, and multiple other uses. Behind the surge, what are the real challenges for stablecoins? Objectively speaking, while the GENIUS Act grants stablecoins institutional recognition, it also brings more compliance requirements, setting clearer rule boundaries for their development. For instance, issuers need to accept KYC/AML management, funds must have custody isolation and third-party audits, and there might be issuance quota or usage restrictions in extreme cases. This means stablecoins have gained a legal identity but have also formally entered the "regulated monetary role". From this perspective, whether stablecoins can break through the application limitations of the Web3 label is key to achieving incremental landing. Looking further, the greatest growth potential of stablecoins is not within the Crypto internal circle, but in the broader Web2 and global real economy. Just like the main increments of USDT and USDC no longer come from on-chain interactive users, but are spread across small and medium enterprises and individual merchants with strong cross-border settlement needs, emerging markets and financially disadvantaged regions unable to access the SWIFT network, residents of inflationary countries wanting to escape local currency volatility, content creators and freelancers unable to use PayPal or Stripe. In other words, its future largest increment is not in Web3, but in Web2 - the killer application of stablecoins is not the "next DeFi protocol", but "replacing traditional dollar accounts". This means that once stablecoins become the basic carrier of digital dollars globally, they will inevitably touch sensitive nerves of monetary sovereignty, financial sanctions, and geopolitical order. Therefore, the next stage of stablecoin growth will be closely related to the new map of US dollar globalization and will become a new battlefield among governments, international institutions, and financial giants. Written at the end The essence of currency issuance has always been an extension of power, depending not only on asset reserves and clearing efficiency but more on national credit, regulatory permission, and international status endorsement. Stablecoins are no exception. To truly penetrate the real economic system from the Crypto world, market mechanisms or commercial logic alone are ultimately insufficient. Therefore, the compliance boost brought by the global policy turn in 2025 is indeed an important driving force for stablecoins to enter the mainstream, but it also means they must survive in a more complex game. This is a long-cycle game, and we are at the stage of its true beginning.With the implementation of the GENIUS Act, how should we view stablecoins moving towards mainstream finance?

This article is machine translated

Show original

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content