Original Title: 'When Stablecoins Set Their Sights on the Payment Market, Can Traditional Payment Giants Hold Their Throne?'

Original Author: 100y

Original Translation: Saoirse, Foresight News

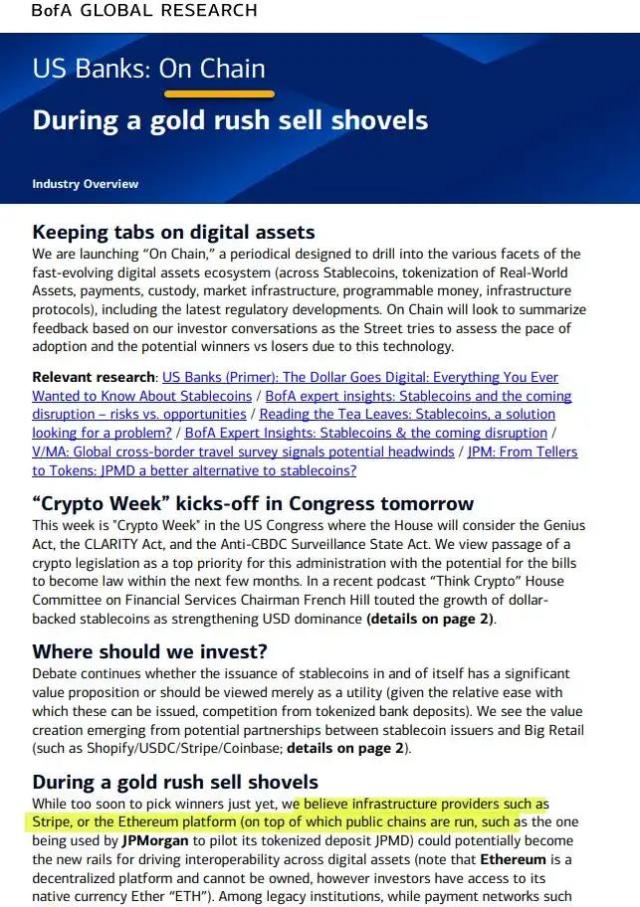

Translator's Introduction: Today, the presence of stablecoins is no longer limited to the cryptocurrency trading circle. With the potential to transform the backend of the financial system, they are quietly knocking on the door of the payment market. You might wonder how this emerging role will disrupt the traditional payment landscape. The answer lies in the article: on one side, attempting to collaborate with card organizations like Visa and Mastercard to embed stablecoin functionality in existing networks; on the other, trying to bypass card organizations and banks to build a new payment system. PayPal's PYUSD and the USDC payment system launched by Shopify are vivid examples of this transformation. Will stablecoins become a threat to traditional payment giants, or will they give birth to a new industry ecosystem? This article will explore the context and direction of this payment sector revolution with you.

[The rest of the translation continues in the same professional and accurate manner, maintaining the original meaning and tone while translating into English.]The acquiring institution will deposit the payment amount into the merchant's account after deducting relevant fees, typically completed through ACH or wire transfer.

Reconciliation

Finally, the merchant checks whether the funds received match their records, verifying if there are any discrepancies in amount, missing transactions, or duplicate charges.

What Problems Exist in Current Payment Systems?

The two most frequently criticized issues in traditional card systems are high transaction fees and slow settlement speeds. Are these defects unavoidable, or can they be resolved?

Regarding Payment Fees

Let's first examine the fee structure of card payments. From a merchant's perspective, card transactions involve three main types of fees:

Interchange Fee: The largest proportion, collected by the issuing bank.

Card Organization Service Fee: Fees charged by card organizations for transaction processing.

Acquiring Bank Markup Fee: Service fees collected by the acquiring bank.

Can blockchain and stablecoins reduce these fees? The first potential cost-saving point is in global transactions. When merchants and cardholders are in different countries, settlement must go through the SWIFT system. By replacing this process with blockchain or stablecoins, costs can be significantly reduced.

The second cost-saving point is bypassing card organizations and issuing banks. Card organizations essentially are communication networks connecting customers' issuing banks with merchants' acquiring banks. If stablecoin payments are fully adopted, customers can directly transfer from their self-hosted stablecoin wallets to merchants' Web3 accounts through blockchain networks.

Regarding Settlement Time

Next, let's look at settlement time. Transaction authorization for card payments is almost instantaneous, and in this aspect, public blockchain networks' scalability may be far inferior to centralized card organizations. However, in traditional card payments, clearing typically requires an additional 1-2 days, while settlement takes 1-5 days.

There are multiple reasons for settlement delays, some of which can be resolved, while others are difficult to avoid:

Clearing Cycle: Card payments typically aggregate daily transactions in batches, clearing only once per day. Fully blockchain or stablecoin-based systems would not need to follow this daily clearing cycle.

Disputes, Suspicious Transactions, Cancellations, and Refunds: These issues cannot be eliminated even with stablecoin payments. Since such situations are difficult to avoid during the payment process, settlement delays remain necessary.

Cross-border Payments: During cross-border transactions, funds must be settled through the SWIFT system, which further exacerbates delays. Clearly, blockchain can provide solutions in this area.

Stablecoin-based Payment Systems

Recently, various financial institutions and enterprises have been turning to stablecoin-based payment systems. I believe this significant transformation is primarily advanced through two strategies: the first led by card organizations like Visa and Mastercard, and the second attempting to completely bypass card organizations and issuing banks.

(The translation continues in the same manner for the rest of the text.)Stablecoin-based payment is an inevitable trend in the future. The issuance stage is crucial, and the circulation stage cannot be overlooked. As Robbie Petersen from Dragonfly pointed out, enterprises with large merchant and user bases will increasingly adopt stablecoin payments, thereby bypassing card organizations and issuing banks. Stablecoins may even enable interconnectivity between such closed-loop payment systems. Given these trends, stablecoins may pose a real threat to card organizations and issuing banks, and they need to explore new opportunities in this unstoppable stablecoin wave.

[Disclaimer] The market involves risks, and investment requires caution. This article does not constitute investment advice. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at the user's own risk.