Table of contents

A complete analysis of the stablecoin ecosystem: mechanism comparison, data insights and regulatory trends

1. Overview of Stablecoins

2. Types of stablecoins and anchoring mechanisms

2.1 Asset Reserve Stablecoin

2.2 Crypto Asset Overcollateralized Stablecoins

2.3 Algorithmic Stablecoin

2.4 Interest-bearing stablecoins

2.5 RWA-backed stablecoins

2.6 Public chain/exchange native stablecoin

2.7 Comparison of the advantages and disadvantages of different types of stablecoins

2.8 Programmable Stablecoins

3. Core application scenarios of stablecoins

3.1 Medium of Exchange

3.2 Multiple roles of stablecoins in DeFi

3.3 Payment and Settlement

3.4 Store of value and safe haven assets

3.5 The role of stablecoins in GameFi and the Metaverse

3.6 Stablecoin is the settlement tool of RWA

3.7 Others

4. Market status and development trends

4.1 Total market value and changing trends

4.2 Competition landscape and market structure

4.3 On-chain data analysis

5. Global regulatory policies

5.1 US GENIUS Act

5.2 EU MiCA

5.3 Singapore’s Stablecoin Regulatory Framework

5.4 Regulatory policies of other countries

6. Risks and Outlook

6.1 Risks

6.2 Outlook

refer to

1. Overview of Stablecoins

Stablecoins are cryptocurrencies whose prices are usually linked to a stable asset, such as the U.S. dollar, the euro, gold, or even certain commodities. The emergence of stablecoins is mainly to solve the problem of excessive volatility in cryptocurrencies. One of the earliest stablecoins was Tether (USDT), which was born in 2014. It promised to deposit $1 in the bank as collateral for every USDT issued to ensure that the price of USDT is always anchored to the U.S. dollar. Later, more types of stablecoins gradually emerged, such as asset reserve type, crypto asset over-collateralized type, algorithmic stablecoins, etc.

Stablecoins are of great significance to the crypto market. They can serve as a hedging tool for users. When the market fluctuates too much, users can exchange crypto assets for stablecoins to avoid risks. At the same time, they are the core assets of DeFi. Many DeFi products such as lending, trading, and mining are based on stablecoins. Moreover, they help enhance the liquidity and trust of the crypto market, because users and project parties are willing to use stable-priced assets for settlement and storage. In addition, stablecoins have gradually become a bridge between traditional finance and the crypto world. They can put fiat currencies on the chain and quickly transfer money anywhere in the world, saving cross-border fees. They can also circulate like cash, but faster and at a lower cost.

With the rapid development of the crypto market, stablecoins have gradually become core assets in DeFi, exchanges, on-chain payments, etc. This article will combine the current market development status of stablecoins and make a comprehensive analysis of stablecoins from the aspects of types and mechanisms, application scenarios, policy compliance, challenges and prospects.

2. Types of stablecoins and anchoring mechanisms

2.1 Asset Reserve Stablecoin

Fiat-collateralized Stablecoins are a type of cryptocurrency that is issued with actual legal tender (such as the US dollar, euro, etc.) as reserve assets. Its price is usually anchored to a specific legal tender at a 1:1 ratio. This type of stablecoin is the earliest and most mainstream stablecoin. Usually, the issuer deposits an equal amount of legal tender or legal tender-equivalent related assets into a bank or centralized custodian account to support the number of stablecoins circulating in the market. Users can exchange stablecoins for corresponding legal tender at any time at a 1:1 ratio. Its advantages are stable prices and ease of use, so it is widely used in scenarios such as transactions, payments, and DeFi, but it also requires users to trust that the centralized issuer really has enough reserves, so transparency and audit reports are very important for this type of stablecoin. Typical cases include USDT, USDC , FDUSD, etc.

2.1.1 USDT

At present, USDT has a market value of approximately 153.2 billion US dollars (https://www.coingecko.com/en/global-charts), making it the most valuable stablecoin. USDT is issued by Tether, and each USDT is backed by an equivalent asset reserve to ensure its value stability. Its main reserve asset types include U.S. Treasury bonds, Bitcoin , gold, cash and cash equivalents. In order to allow users to use it with peace of mind, Tether provides daily circulation data and quarterly reserve status, which can be viewed on its official website Transparency page (https://tether.to/en/transparency/?tab=usdt). Tether's reserve report is audited by the independent accounting firm BDO, providing a detailed composition and total amount of its reserve assets, and is published regularly to enhance transparency.

According to the latest data from Tether's official website, USDT's circulating supply increased by approximately $7 billion and the number of user wallets increased by approximately 46 million in the first quarter of 2025. As of March 31, 2025, Tether's total reserve assets were $149.2 billion, exceeding its total liabilities of $143.6 billion, showing approximately $5.59 billion in excess reserves.

Figure 1. The last Reserves Report (March 31, 2025) of Tether. Source: https://tether.to/en/transparency/?tab=usdt

Currently, USDT already supports more than a dozen mainstream blockchains, including Ethereum (ERC-20), TRON (TRC-20), BNB Chain (BEP-20), Solana, Ton, etc. Initially, USDT was mainly issued on the Ethereum chain (ERC-20), but as the handling fee increased, more and more users turned to the TRON chain (TRC-20) with lower transfer costs. Currently, more than half of USDT is circulating on TRON, reflecting users' demand for high-frequency, small-amount, and low-fee cross-border use. This also shows that Tether has flexibility in its on-chain deployment strategy and can quickly adjust its layout based on market feedback.

In addition, USDT has an irreplaceable position in actual usage scenarios. In almost all mainstream centralized exchanges in the world (such as Binance, Coinbase, OKX, etc.), USDT is the default trading unit. In the field of DeFi, it also has a wide range of application scenarios and is the main trading pair of many decentralized trading platforms (such as Curve, Uniswap). In addition, in emerging market countries (such as Argentina, Turkey, etc.) and cross-border payments and OTC transactions , USDT is widely accepted due to its strong liquidity and convenient exchange.

Although USDT is the world's largest and most widely used stablecoin, its compliance journey is not smooth. Tether was fined $41 million by the U.S. Commodity Futures Trading Commission (CFTC) for insufficient information disclosure. To date, USDT has not obtained the electronic currency issuer license required by the EU MiCA, nor has it applied for a federally regulated stablecoin license in the United States. As regulatory frameworks in various countries gradually tighten, USDT still needs to continue to improve its compliance transparency, otherwise it may face the risk of being restricted from circulation in some regions.

With the implementation of EU MiCA and US GENIUS Act, stablecoins will gradually enter an era of strong regulation. If USDT hopes to continue to lead the global stablecoin market, in addition to maintaining its market circulation advantage, it must also improve its regulatory compliance and information disclosure standards. Otherwise, even if it currently has the highest market value, it may lose its first-mover advantage in the new round of compliance reshuffle.

2.1.2 USDC (USD Coin)

USDC (USD Coin) is issued by Circle, aiming to combine the stability of the US dollar with the flexibility of blockchain, providing a digital dollar that can be traded quickly, securely and at low cost around the world. USDC is currently the second largest stablecoin in the world, with a market value of approximately US$61.18 billion, second only to USDT.

USDC is 100% backed by highly liquid cash and its equivalent assets (such as short-term US Treasury bonds, cash and repurchase agreements), and users can exchange it for US dollars at 1:1 at any time. Its capital reserves are mainly composed of Circle Reserve Fund (USDXX) and cash. Among them, USDXX is a 2a-7 government money market fund registered by the US Securities and Exchange Commission (SEC), mainly composed of cash, short-term US Treasury bonds and overnight repurchase agreements. The cash reserves are stored in several top banks with the strongest capital strength, the most sufficient liquidity and the most stringent supervision in the world (such as Bank of New York Mellon).

In terms of transparency and auditing, Circle provides users with real-time reserve assets and circulation data. BlackRock provides independent third-party reports on reserve assets every day, which are publicly available. In addition, an audit report issued by the independent accounting firm Deloitte is released every month to ensure the transparency and security of USDC reserve assets and improve user trust.

According to official data released by Circle, as of June 2025, the total issuance of USDC is 61 billion US dollars, and the total reserve funds are 61.3 billion US dollars. It has been natively issued on more than 15 public chains around the world and listed on more than 100 exchanges. Users can transfer, save, pay and conduct DeFi transactions in more than 180 countries around the world at a very low cost.

Figure 2. USDC Reserves composition. Source: https://www.circle.com/transparency

USDC currently supports native issuance of more than 15 mainstream blockchains, including Ethereum, Solana, Avalanche, Base, Polygon, Arbitrum, Optimism, etc. Circle adopts native issuance rather than bridging to effectively reduce cross-chain asset risks. It also strengthens its underlying position in Web3 through in-depth cooperation with multiple L2 ecosystems (such as Base and OP Stack), and is currently one of the most integrated stablecoins between DeFi and CeFi.

In terms of compliance, USDC has always taken compliance as its core strategy and actively promoted license application and regulatory docking around the world. It is one of the few stablecoins that has actively applied for an EMT (electronic currency token) license under the EU MiCA framework, and is also a stablecoin issuer recognized by many states in the United States. Circle also holds a BitLicense issued by the New York State Department of Financial Services (NYDFS) and a money transmission license in California, demonstrating its strong regulatory adaptability. This makes USDC the most compliance-friendly stablecoin currently, and it is also more likely to be favored by institutions, corporate users and government departments.

In terms of global applications, USDC is not only an on-chain stablecoin, it is also rapidly evolving towards a payment bridge between Web2 and Web3. Circle has established partnerships with payment giants such as Visa, Mastercard, Stripe, and Worldpay to promote the application of USDC in real-world payments, merchant settlements, and cross-border remittances. For example, Visa has piloted the use of USDC for cross-border settlements in many countries, bypassing the traditional banking system and significantly reducing costs and time delays. This gives USDC the potential to be a real-world financial bridge that goes beyond traditional stablecoins.

2.1.3 FDUSD

FDUSD (First Digital USD) is issued by FD 121 Limited, a subsidiary of First Digital Labs in Hong Kong, and is an asset reserve-backed stablecoin. It adopts a 1:1 reserve mechanism, that is, for each FDUSD issued, the issuer must deposit an equivalent amount of US dollars or its cash equivalents (such as short-term government bonds, money market instruments) in a regulated custodial account to ensure that each FDUSD is backed by $1 in assets. The reserve assets are supervised and managed by the regulated custodian First Digital Trust Limited, and are subject to third-party audits to ensure that the on-chain circulation is completely consistent with the off-chain reserve assets.

First Digital Labs is affiliated to the First Digital Group in Hong Kong. It is the technology and product department of the group that focuses on the development and issuance of stablecoins. It is responsible for the contract deployment, cross-chain issuance and ecological expansion of FDUSD, and works closely with the custodian First Digital Trust Limited to ensure that the issuance process is compliant and safe. The agency has registered as a virtual asset service provider (VASP) in Lithuania and actively applied to be included in the Hong Kong Monetary Authority (HKMA)'s proposed stablecoin regulatory framework. In addition, FDUSD adopts an asset isolation protection mechanism, that is, user funds and the company's own assets are completely isolated, and even if the company goes bankrupt, it will not affect user assets.

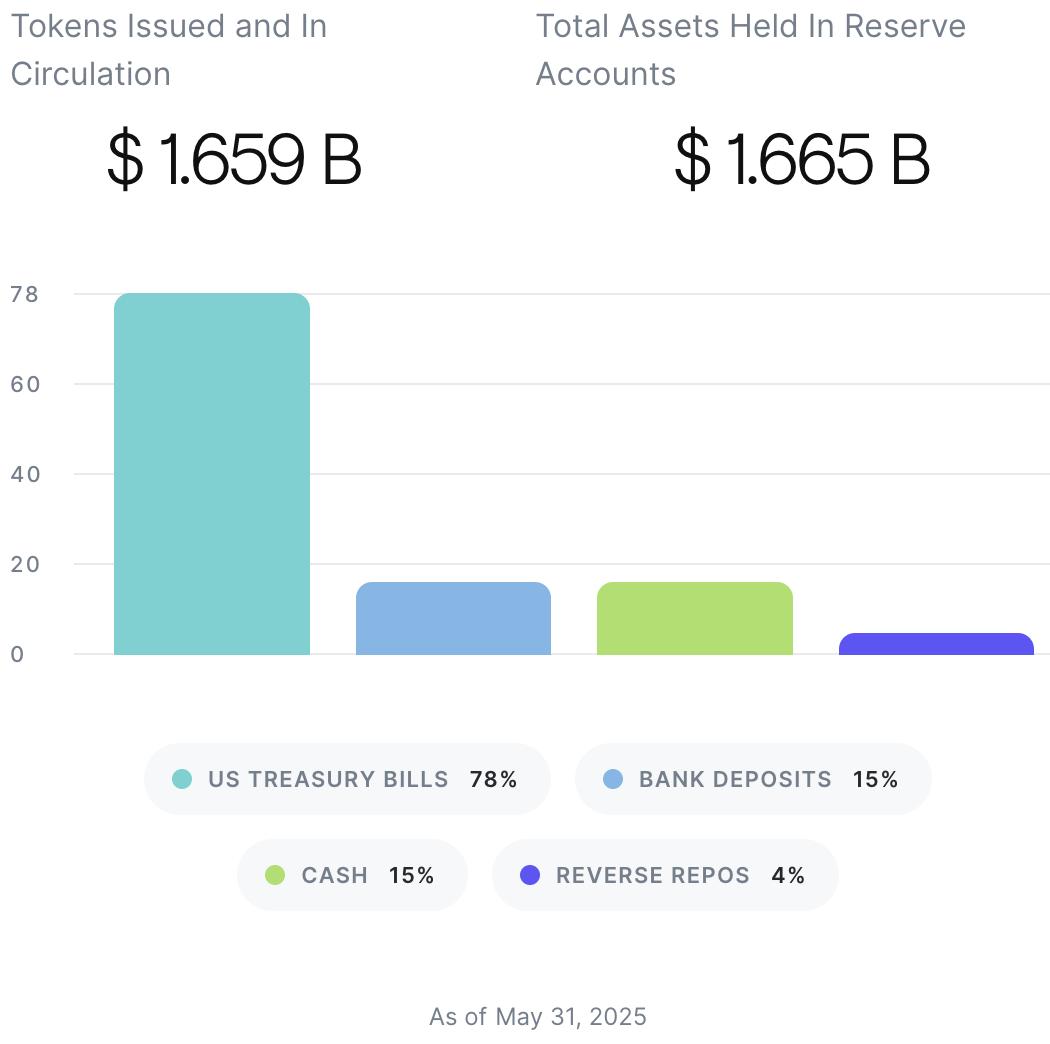

FDUSD has a current market value of 1.54 billion US dollars and is deployed on mainstream public chains such as Ethereum, Solana, Sui, and BNB Chain. According to the latest data updated on the official website of First Digital Labs on May 31, 2025, the total amount of FDUSD tokens issued and circulated is currently 1.659 billion US dollars, while the total assets in the reserve account are 1.665 billion US dollars. The reserve assets are slightly higher than the total amount of circulating tokens, ensuring a 1:1 reserve support. Its reserve assets are divided into US Treasury Bills (78%), Cash (Cash) (15%), Reverse Repos (Reverse Repos) (4%), Bank Deposits (Bank Deposits) (15%), etc.

Figure 3. FDUSD Data. Source: https://firstdigitallabs.com/transparency

In terms of cooperative promotion, FDUSD and Binance have a close cooperative relationship. In early 2023, due to regulatory pressure on Paxos, the issuer of BUSD (Binance's own stablecoin), Binance stopped supporting and promoting BUSD, and urgently needed to find a compliant, safe and sustainable new generation stablecoin alternative. FDUSD has become the focus of Binance's support due to its good compliance structure, stable asset reserves, public audit mechanism and regulatory expectations from the Hong Kong market. Although there is no equity or financial relationship between Binance and FDUSD, Binance provides FDUSD with extensive access at the exchange level, including mainstream currency trading pairs, zero-fee support, cross-chain deposit and withdrawal functions, and deep integration in Binance's financial management and earning products, which improves FDUSD's liquidity and market usage. Compared with other stablecoins, FDUSD has stronger support and more promotion resources in the Binance ecosystem, making it the priority promotion target after BUSD.

Although FDUSD has not yet obtained a formal stablecoin issuance license in Hong Kong or other major jurisdictions, First Digital Labs is actively applying for it and maintaining communication with the government and regulators. This makes FDUSD's compliance path clear and its market recognition high, giving it the potential to become a mainstream compliant stablecoin.

2.1.4 USD1

USD1 is a stablecoin issued by World Liberty Financial (WLFI) and pegged to the US dollar at a 1:1 ratio. It aims to provide users with a stable, secure, and auditable digital dollar option. Each USD1 is backed by an equivalent amount of US dollar assets, including short-term US Treasury bonds, bank deposits, and cash equivalents. Its reserves are kept by institutional-grade custodian BitGo and verified in real time on the chain through Chainlink's Proof-of-Reserves (PoR) mechanism to enhance transparency and user trust. In addition, WLFI stated that it will conduct a third-party accounting audit every quarter, but the specific audit agency or the content of the audit report has not yet been disclosed.

USD1 is one of the few stablecoins that supports Chainlink PoR. PoR is an oracle-based on-chain reserve verification system that synchronizes the balances of reserve assets such as US dollars and treasury bonds hosted by BitGo to the blockchain in real time for free query by the public. This provides unprecedented asset transparency for users, auditors and third-party developers. However, although WLFI claims that it will conduct regular audits in the future, it has not yet provided any specific audit agency names or detailed reports, and further information disclosure is still needed to enhance credibility.

One of the important reasons why USD1 has attracted widespread attention is the political background behind it. Its issuer WLFI is currently controlled by the Trump family. Trump is known as an advocate of encryption in the project. His sons Eric Trump and Donald Trump Jr. serve as Web3 ambassadors, and his youngest son Barron Trump is also known as a DeFi pioneer. Although WLFI claims that its governance mechanism has community characteristics, in fact, the core decision-making power involving the Trump family is not open to ordinary token holders, and decentralized governance is still obviously controversial. This strong political color makes USD1 generally known as the Trump-affiliated political stablecoin, forming a unique label in the market.

USD1 has been deployed on Ethereum and BNB Chain, and plans to expand to more mainstream chains. Users can purchase it with US dollars or other stablecoins (such as USDT, USDC) through centralized exchanges that support this stablecoin (such as Binance), or obtain it through OTC or DEX transactions. At the same time, large users or institutions that support off-chain bank transfers can mint or redeem in real time through the platform controlled by BitGo, and the process requires strict KYC certification.

Regarding compliance, USD1 has not yet publicly obtained relevant licenses from the EU MiCA or US financial regulators. Its strict KYC mechanism and custody arrangements show its intention to meet the compliance requirements of major jurisdictions, but due to the lack of public third-party audit reports and regulatory approval documents, the market remains cautious about its compliance. Compared with stablecoins on the market that have actively applied for and hold compliance licenses (such as USDC and FDUSD), USD1 still has room for improvement in transparency and regulatory cooperation.

USD1 was officially launched in March 2025. With the help of strong political background and market expectations, it won the support of multiple mainstream exchanges in just a few months and quickly broke through the cold start stage. As of now, its market value has exceeded 2.1 billion US dollars, ranking among the top ten stablecoins in terms of market value. This performance reflects the market's high attention to its political endorsement and reserve model, and also highlights the unique appeal of political capital + financial instruments in the current crypto market.

In the future, if USD1 can improve audit transparency and clarify regulatory approval, it will be more conducive to its obtaining legal circulation qualifications in major global markets and enhance the confidence of users and institutional investors.

2.2 Crypto Asset Overcollateralized Stablecoins

Crypto-asset over-collateralized stablecoins ensure the value of stablecoins by pledging more cryptocurrencies than the amount issued. For example, if a user wants to obtain $100 of stablecoins, they need to lock $150 or more of crypto assets (such as ETH , BTC, etc.) into a smart contract. This over-collateralization method can cope with the risk of large fluctuations in cryptocurrency prices and ensure that stablecoins always have enough assets to support their value. If the value of the collateralized assets drops sharply, the system will trigger a forced liquidation mechanism to ensure the repayment ability of the stablecoin.

This mechanism does not require the intervention of a centralized institution, so it has a high degree of decentralization and security. However, since it requires more assets to be pledged than the amount of stablecoins issued, the capital efficiency is relatively low, and compared with centralized stablecoins, the threshold for users to use it is relatively high.

2.2.1 DAI (USDS)

DAI is a decentralized stablecoin launched by MakerDAO. Its value is pegged to the US dollar at a 1:1 ratio, and an over-collateralization mechanism is used to ensure stability. Users can deposit supported crypto assets such as ETH, WBTC, and stETH into the Maker Protocol's Vault to generate a corresponding amount of DAI. At the same time, users can also purchase DAI directly through exchanges for payment, storage, trading, and other purposes. In response to market fluctuations, the system requires users to over-collateralize, usually with a collateral ratio between 110% and 200%; if the value of the collateralized assets is lower than the minimum requirement, the system will automatically liquidate part of the collateral to ensure the stable anchoring of DAI.

The Maker Protocol also introduced the Dai Savings Rate (DSR) mechanism, which allows users to earn interest income by depositing DAI. DSR has no minimum threshold and can be deposited and withdrawn at any time. This mechanism is also one of the important tools to stabilize the price of DAI: MKR holders can adjust the DSR through governance voting. When the price of DAI is higher than $1, the interest rate can be lowered to reduce demand. Conversely, the interest rate can be raised to attract users to hold DAI, thereby balancing market supply and demand. At present, the market value of DAI has exceeded 3.5 billion US dollars, becoming one of the most important stablecoins in the DeFi ecosystem.

In September 2024, MakerDAO announced a rebranding, upgraded to Sky Protocol, and launched a new stablecoin USDS and governance token SKY. USDS is positioned as an upgraded version of DAI, and is also a decentralized over-collateralized stablecoin anchored to $1. It supports a variety of collateral assets, including ETH, USDC, USDT, RWA (real-world assets), etc. Users can voluntarily convert DAI to USDS at a ratio of 1: 1, or directly exchange USDC, USDT, ETH or SKY for USDS through the Sky.money platform. At the same time, the original MKR token can also be exchanged for SKY at a ratio of 1: 24,000. It should be emphasized that DAI and MKR will continue to circulate, and users can choose whether to migrate as needed.

USDS further enhances mechanism design and user incentives while maintaining decentralization. Users can deposit USDS into the Sky Savings Rate (SSR) module to obtain sUSDS savings certificates, which will automatically increase with the interest rate set by the agreement and can be redeemed at any time. At the same time, users can also obtain STRs (Sky Token Rewards) points for subsequent redemption of rights or participation in governance. The entire operation is completely automatically executed by smart contracts, and assets are managed by users independently, with both security and transparency.

As of now, USDS market value has exceeded 7.15 billion US dollars, becoming the world's third largest stablecoin after USDT and USDC. Its rapid development not only reflects the market's trust in the Maker/Sky system, but also shows the new balance between compliance and mechanism innovation found by decentralized stablecoins.

Although USDS is an upgraded version of decentralized stablecoin with advanced mechanism and transparent operation, it also has some risks. For example, it relies on crypto assets as collateral. Once the market fluctuates drastically (such as ETH crash), it may trigger large-scale liquidation and affect stability. Secondly, some collateral assets are real world assets (RWA), which involve off-chain compliance and execution issues and may bring legal risks. Overall, the innovation of USDS is worthy of recognition, but users still need to pay attention to the uncertainties that may arise in its operation.

In terms of compliance, both DAI and USDS are decentralized, over-collateralized stablecoins that emphasize censorship resistance and self-management, but compliance still faces certain challenges under the current mainstream regulatory framework. DAI was launched by MakerDAO and is generated entirely based on an on-chain mechanism. It has no centralized issuer, has not obtained a financial license, or provided external audits, and is difficult to meet the requirements of laws such as the EU MiCA and Singapore SCS for identity authentication, reserve compliance, and redemption mechanisms. Although USDS is a new generation of stablecoins launched after MakerDAO changed its name to Sky Protocol, it has introduced some more compliant assets (such as USDC and RWA) to enhance credibility, but it has not been included in any regulatory licensing system as a whole. Although both are widely used in DeFi scenarios, they lack a lot in terms of compliance.

2.3 Algorithmic Stablecoin

Algorithmic stablecoins are different from asset-reserve or over-collateralized stablecoins. They usually do not rely on fiat currency or crypto assets as reserves, but instead control supply and demand through smart contracts to maintain a 1:1 anchor with the US dollar or other fiat currencies.

2.3.1 Terra USD (UST)

TerraUSD (UST) is an algorithmic stablecoin launched by the project Terra, which aims to maintain a 1:1 peg between UST and the US dollar through a linkage mechanism with its sister token LUNA. The core of UST's price stability lies in its exchange relationship with LUNA. When the price of UST is higher than $1, users can mint UST by destroying LUNA, increasing the supply of UST in the market and thus lowering the price. When the price of UST is lower than $1, users can destroy UST to mint LUNA, reducing the supply of UST in the market and thus raising the price. This mechanism relies on arbitrage behavior by market participants to maintain the price stability of UST.

In 2022, when the price of UST fell below $1, the system's algorithm allowed users to exchange discounted UST for LUNA at $1 and profit from it. This resulted in a large amount of UST being destroyed, and new LUNA being minted. As more and more LUNA was released into the market, the price of LUNA fell rapidly, and LUNA was the only support for the value of UST. When the price of LUNA plummeted, market confidence in UST further declined, causing more people to sell UST and LUNA, creating a panic. This death cycle eventually caused the price of UST to fall to a few cents, the price of LUNA to almost zero, and the entire Terra ecosystem collapsed.

The collapse of UST and LUNA has had a direct and far-reaching negative impact on the algorithmic stablecoin track, which has caused the entire Web3 market to question the mechanism of algorithmic stablecoins. Algorithmic stablecoins incentivize users to mint or destroy tokens through price differences to maintain anchoring, but once market confidence is shaken, the arbitrage mechanism is difficult to work, resulting in a significant increase in the risk of de-anchoring. In addition, algorithmic stablecoins do not hold sufficient or high-quality collateral assets, and cannot provide stable value support in the face of large-scale redemptions. To date, although algorithmic stablecoins have not completely disappeared, their market value has shrunk massively, and many countries regard them as high-risk assets. Coupled with the pressure of regulatory policies, algorithmic stablecoins may find it difficult to survive if they do not make changes.

2.3.2 FRAX

Frax was originally a partially collateralized, partially algorithmically regulated stablecoin, which uses a portion of assets (such as USDC) as collateral, and the other portion is automatically adjusted by the system's algorithm to maintain price stability. When the price of the stablecoin deviates from the target price, the algorithm will use an arbitrage mechanism to incentivize users to actively mint or destroy FRAX, and maintain price stability by adjusting the supply and demand relationship. For example, when the price of FRAX is $1.02, which exceeds $1, the system will encourage users to mint more FRAX to increase supply: users can mint 1 FRAX with collateral worth $1 (such as USDC + FXS), and then sell it on the market at $1.02, earning a $0.02 spread. In this way, the number of FRAX in the market increases, and the price will fall back to around $1. On the contrary, when the price is lower than $1 (such as $0.98), users will be encouraged to destroy FRAX: users can buy FRAX on the market with $0.98, and then redeem the collateral assets according to the system settings, with a total value of $1, and earn the difference. This will cause FRAX to be destroyed, the amount on the market will decrease, and the price will naturally rise. This mechanism is similar to "market self-regulation", which keeps FRAX around $1 as much as possible through changes in supply and demand.

Although algorithmic stablecoins are highly decentralized, the entire market has lost confidence in algorithmic stablecoins after the collapse of Terra/UST. Although Frax is not a 100% algorithmic stablecoin, its partial collateral + algorithmic adjustment model is still considered to be high-risk. At the same time, various countries have begun to tighten their supervision of stablecoins, especially emphasizing that there must be clear, real, and transparent reserve assets behind stablecoins.

In order to adapt to changes and retain users, Frax has made important improvements in the latest version V3. Frax V3 abandons some of the original algorithmic mechanisms and fully turns to a model that is 100% collateralized by external assets. That is, each FRAX stablecoin is backed by assets of equal value and no longer relies on the market value of the governance token FXS. Users can deposit specific assets, such as USDC, sDAI, short-term US Treasury bonds, Federal Reserve Repurchase Agreements (ON RRP) or FDIC-protected US dollar deposits, into the protocol vault and mint FRAX at a 1:1 ratio. This "full collateralization" model (Full Collateralization) greatly improves stability and compliance. Frax V3 also introduces a dynamic collateralization rate mechanism. The protocol uses AMO (algorithmic market operations) and on-chain governance to ensure that the overall collateralization ratio (Collateralization Ratio, CR) is always not less than 100%, and will be moderately adjusted when necessary to enhance the system's risk resistance.

After the tightening of global regulation and the crisis of trust in algorithmic stablecoins, Frax turned to a new model in version V3 that is 100% supported by real asset collateral, such as USDC, sDAI and short-term US bonds. This transformation helps it get closer to regulatory requirements such as EU MiCA and Singapore MAS. However, as of now, Frax has not obtained a stablecoin issuance license from any major country, nor has it conducted regular third-party audits. Its asset custody is still managed internally by the protocol and lacks an authoritative independent custody mechanism. Therefore, although Frax is actively moving towards compliance, from a regulatory perspective, it is still some distance away from compliance. If it hopes to develop in the European and American markets in the future, it needs to make more efforts in audit disclosure, license application and risk isolation.

2.4 Interest-bearing stablecoins

Interest-bearing stablecoins are a type of stablecoin that can automatically generate income during the holding period. It not only anchors the value of fiat currencies such as the US dollar, but also generates income through protocol income or on-chain hedging, and returns the interest income brought by the underlying assets to the coin holders.

The biggest feature of this type of stablecoin is that users only need to hold it to automatically earn income, without having to participate in mining or staking. They usually have interest-bearing assets behind them, such as U.S. bonds, on-chain lending or staking tokens, and the interest generated will be distributed to coin holders through a certain mechanism. It is anchored to the US dollar like ordinary stablecoins, and it is also like an interest account, allowing your funds to grow slowly while maintaining stability. Interest-bearing stablecoins can meet the needs of some users who pursue low risks. It can bring certain interest to users while maintaining stability.

2.4.1 Ethena USDe

USDe is a synthetic dollar stablecoin launched by Ethena. It is backed by crypto assets and adopts on-chain custody and centralized liquidity income. Combining synthetic asset mortgage and smart hedging strategy, it achieves the characteristics of 1:1 anchoring to the US dollar and bringing its own income.

USDe uses over-collateralization of crypto assets. After users pledge crypto assets such as stETH and ETH to the Ethena protocol, in order to hedge the risk of price declines of these assets, Ethena will establish corresponding short positions on centralized exchanges, such as short ETH perpetual contracts, thereby building a portfolio that is insensitive to market fluctuations. This strategy is called "delta neutral hedging," and its goal is to avoid drastic fluctuations in the value of the asset portfolio and keep the dollar value of the collateral relatively stable. The essence of this mechanism is not to directly control the price of USDe, but to stabilize the value of the underlying assets and provide guarantees for the 1:1 casting of USDe.

But this cannot directly determine whether USDe is equal to $1. To this end, the Ethena protocol has designed a core arbitrage mechanism based on the delta neutral strategy to regulate market supply and demand and stabilize the anchor price. When the price of USDe in the secondary market is lower than $1 (for example, it falls to $0.98), arbitrageurs can buy USDe from the market at a lower price, and then go to the Ethena protocol to redeem these USDe at a price of 1:1 for the underlying crypto assets of equal value (such as ETH or stETH). Since the internal price at the time of redemption is still $1, arbitrageurs have obtained a 2% risk-free return through the "buy at 0.98, redeem at 1.00" operation. This arbitrage operation will increase the market's demand for USDe, thereby pushing up its price and prompting it to gradually return to $1.

On the contrary, when the market price of USDe is higher than $1 (for example, it rises to $1.02), users can pledge crypto assets (such as ETH) to the protocol, generate new USDe at a ratio of 1:1, and then sell it on the market for profit. For example, a user generates 1 USDe with ETH worth $1 and sells it at $1.02, making a 2% profit. This will increase the supply of USDe in the market, thereby alleviating the imbalance between supply and demand, and the price will gradually fall back to around $1. This mechanism guides the price of USDe to fluctuate around $1 through market forces to ensure stability.

In this process, the Ethena protocol will obtain protocol cash flow through two main channels: one is funding income and the other is staking income. In the perpetual futures market, in order to keep the contract price consistent with the spot price, a funding rate mechanism will be set. When the market is bullish (long enthusiasm), those who long have to pay funding fees to those who short. When the market is bearish (shorts are many), those who short have to pay funding fees to longs. If the current market is bullish (generally long), Ethena's short positions can stably obtain funding income. In addition, some assets that have interest-bearing capabilities, such as stETH (staking version of ETH, which will produce ETH staking rewards itself), Ethena can also obtain this part of staking income. Therefore, the entire protocol has cash flow, and USDe itself is indeed an interest-bearing stablecoin supported by interest-bearing assets.

However, the income will not be automatically distributed to every user holding USDe. Only when the user pledges USDe for sUSDe will the protocol dividend be obtained. In other words, USDe is an interest-bearing stablecoin, but its income is distributed through sUSDe, and holding USDe itself does not directly enjoy interest. Users can redeem sUSDe for USDe at any time and exit the interest-bearing state.

In addition, Ethena adopts an off-chain custody mechanism. All assets supporting USDe are always stored in an institutional-grade off-exchange custody system. Assets will only flow to the exchange briefly when settling funding fees or actual profits and losses, thereby reducing the risk exposure of centralized exchanges.

According to Ethena's official website, USDe has been deployed on 24 public chains, with 713,000 users and a market value of US$5.89 billion. It is currently the fourth largest stablecoin by market value, with the top three being USDT, USDC, and USDS (DAI).

2.4.2 USDY

USDY (US Dollar Yield Token) is a yield-generating stablecoin issued by Ondo Finance. The official definition of it is a tokenized note. It is backed by short-term U.S. Treasury bonds and bank demand deposits, and is held and guaranteed by trust institutions (such as Ankura Trust), ensuring that each USDY is backed by an equivalent amount of U.S. dollar assets. The current market value of USDY is 580 million U.S. dollars.

There are two versions of USDY. One is the cumulative USDY, whose token value increases daily with earnings, reflecting asset appreciation. The other is rUSDY, whose price is constant at $1, and interest income is returned in the form of additional tokens. For example, if a user buys 100 rUSDY at $1 each, when the underlying asset earnings cause the USDY unit price to rise to $1.01, the corresponding rUSDY price remains $1, but the holder's wallet will automatically become 101 rUSDY. The whole process will be automatically executed every day based on the earnings. The two versions can be exchanged with each other, and users can choose according to their preferences.

USDY is mainly open to non-US individual and institutional investors. After completing KYC, users can purchase USDY through bank wire transfer or using stablecoins (such as USDC, USDT), and the system will start to accrue interest. It takes 40-50 days for Ondo to mint transferable tokens, during which users will receive temporary certificates, so the real USDY tokens are usually issued to users' wallets after 40-50 days. After the user's subscription funds enter the system, Ondo Finance will use these funds in the background to purchase low-risk, high-quality US dollar assets such as short-term US Treasury bonds and bank demand deposits, and set a certain proportion of excess reserves to ensure the full collateral and redemption safety of USDY. According to the interest income generated by these underlying assets every day, the USDY in the hands of users will gradually appreciate (or automatically increase the amount every day in the form of rUSDY), thereby achieving the effect of stable peg to the US dollar and automatically earning income. Throughout the process, users do not need to pledge or operate manually, and the income is automatically generated and distributed.

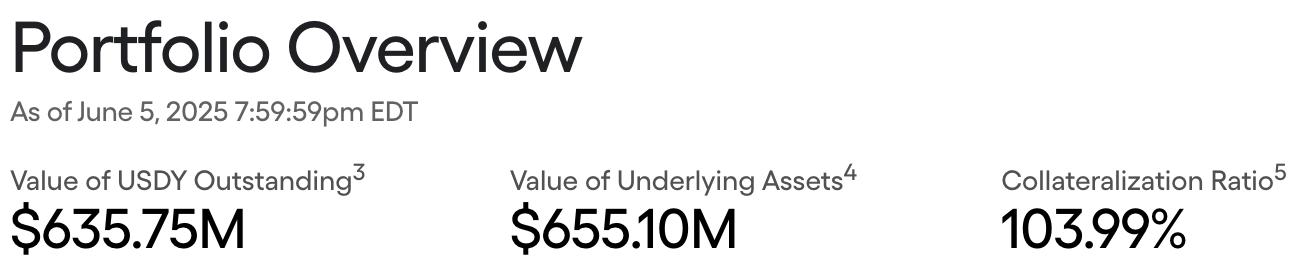

USDY ensures the transparency of assets and the security of reserves in a variety of ways. Ondo Finance regularly discloses the assets held by USDY, including short-term U.S. Treasury bonds, demand deposits of regulated banks, etc., and manages them through a trusted custodian. Every week, the official will release a transparency report, detailing the total supply of USDY, the holding ratio of various underlying assets, cash reserves and yields. According to the latest information updated on the official website on June 5, the USDY system has issued $636 million in stablecoins, which are supported by real assets worth $655 million, with a mortgage rate of 103.99%, reflecting a high level of fund security and sufficient asset protection.

Figure 4. USDY portfolio overview. Source: https://ondo.finance/usdy

2.5 RWA-backed stablecoins

RWA (Real World Assets)-backed stablecoins refer to stablecoins issued with real assets (such as cash, government bonds, commercial bills, etc.) as reserve support. Such stablecoins usually emphasize asset transparency, compliance, and audit mechanisms.

2.5.1 USD0

USD 0 is an RWA-backed stablecoin launched by Usual Protocol. All minted USD 0 are fully backed by real assets, that is, the reserve amount is greater than or equal to the circulation amount, ensuring a 1: 1 anchor.

The collateral assets supported by Usual are mainly U.S. Treasury bonds (T-Bills), but it does not directly hold these real-world assets itself, but achieves access through cooperation with professional RWA (real-world asset) platforms. For example, platforms such as Hashnote, Ondo, and Backed hold real short-term U.S. Treasury bonds and tokenize them. Usual works with these platforms to introduce the on-chain T-Bills assets they issue into the protocol as collateral support for the USD 0 stablecoin. In order to simplify the user experience, Usual packages T-Bills assets from different platforms into a universal collateral asset - USYC. When using it in practice, users do not need to care about which institution the specific assets come from, they just need to interact with USYC.

There are two ways for users to participate. The first is users who hold tokenized RWA. Such users usually obtain tokenized T-Bills through third-party platforms (such as Hashnote) and pledge these qualified assets to the protocol through Usual's daoCollateral contract. The contract will automatically mint USD 0 stablecoins at a ratio of 1: 1. When redeeming, users can also exchange USD 0 for the original collateral assets through the contract. The second is users who do not have RWA assets but want to obtain USD 0. Such users can choose to participate indirectly: just deposit USDC, and the Usual protocol will call the USYC assets that have been pre-pledged by other providers (Collateral Provider) in the system to mint an equal amount of USD 0 for the user. At the same time, the USDC paid by the user will be transferred to the Collateral Provider as its source of liquidity income, and the provider can also receive USUAL token incentives.

Through the above mechanism, users can smoothly participate in Usual's stablecoin system regardless of whether they own tokenized RWA. The design of USYC helps the protocol integrate multiple sources of real-world assets behind the scenes, while ensuring stability and compliance, and providing users with a simple, safe and efficient experience.

At the same time, Usual has also launched a derivative product of USD 0, USD 0++, which is equivalent to USD 0 with income. Users can deposit their USD 0 into Usual's Yield Pool and receive an equal amount of USD 0++, which represents the principal (USD 0) deposited by the user and the interest accumulated in the pool. The protocol uses the USD 0 deposited by the user to pledge mint more USYC or execute other low-risk RWA strategies. The generated income will be distributed to USD 0++ holders in proportion, and USD 0++ itself will continue to appreciate. When redeeming, users can exchange USD 0++ for more USD 0 and obtain income. The incentives of USD 0++ are released linearly, with the longest release period of 4 years. If the user exits or withdraws the assets midway, the unlocked incentives will be partially deducted or cannot be received. In this way, Usual encourages users to participate in the long term and enhances the financial stability and liquidity security of the protocol.

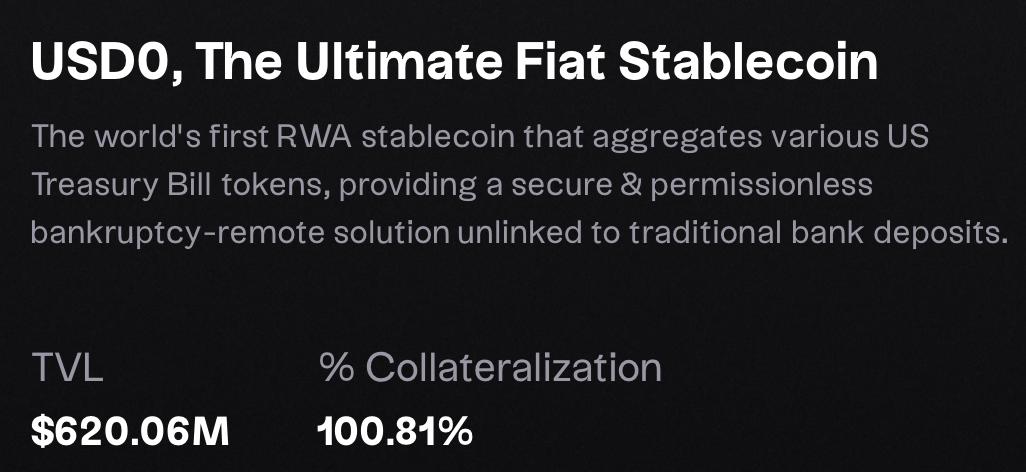

The current market value of USD 0 is about 619 million US dollars. According to the official data of Usual, the collateral assets of USD 0 are about 620 million US dollars (mainly USYC), and the collateral rate is 100.81%, showing sufficient capital reserves.

Figure 5. USD 0 reverse data. Source: https://usual.money/

In terms of compliance, since Usual does not directly custody real-world assets (such as government bonds), but obtains tokenized versions of these assets (such as t-bills tokens) through compliant RWA platforms and integrates them by the protocol, most of these platforms themselves have already complied with relevant financial and securities regulatory standards, and the tokenized T-bills issued by the platform are carried out under a legal framework, which gives Usual the basis for a compliant asset source. At the same time, the Usual protocol itself is decentralized, and all mortgage, minting, and redemption processes are completed through on-chain smart contracts. It does not custody user assets and does not involve centralized liquidators, thereby achieving bankruptcy isolation and security and transparency. The overall design avoids the reliance of traditional stablecoins on bank custody and reduces compliance risks, but it is still necessary to pay attention to regulatory policy changes that the cooperative platform may face in the future.

2.6 Public chain/exchange native stablecoin

More and more public chains and exchanges are choosing to launch their own native stablecoins. This is a type of stablecoin that is issued by the public chain team or its core ecosystem and designed specifically for the chain ecosystem. It is deeply integrated into the core modules of transactions, lending, governance, etc. on the chain, aiming to reduce dependence on external stablecoins such as USDT and USDC, and enhance the stability and autonomy of the on-chain financial system.

2.6.1 BUSD (Binance USD)

BUSD was originally issued by Binance in cooperation with Paxos Trust Company and is an asset reserve-backed stablecoin. Each BUSD is backed by $1 of real reserve assets, including bank deposits or short-term U.S. Treasury bonds, which are managed by Paxos, a regulated financial institution in the United States, and are regularly audited by third parties to ensure that the amount of BUSD on the chain fully corresponds to the dollar reserves off the chain.

BUSD adopts an off-chain custody and on-chain issuance model. Reserve assets are stored in the traditional financial system (such as bank accounts and money market instruments), while the on-chain BUSD (ERC-20 token) is minted and distributed by Paxos, and users can redeem it with US dollars. Through the Paxos official website, users can submit redemption requests to redeem BUSD back to off-chain US dollars.

In February 2023, the New York Department of Financial Services (NYDFS) asked Paxos to stop issuing BUSD, mainly due to its regulatory compliance review. Although Paxos was not explicitly accused of violating the law, regulators were concerned about its compliance risks. Therefore, BUSD officially announced that it would stop minting new coins, and existing BUSD could still be redeemed for US dollars and continued to be protected by custody. Subsequently, Binance successively stopped new lending businesses related to BUSD, cancelled trading pairs, closed withdrawal channels, etc., and gradually converted users' BUSD balances into new coins such as FDUSD. It is currently impossible to mint new BUSD through any official or legal channels. Over time, the circulation of BUSD will gradually decrease and eventually exit the market. As of now, the market value of BUSD is approximately US$310 million.

The BUSD incident highlights the importance of stablecoin compliance supervision. Compliant stablecoins are more secure for long-term operation. At the same time, this incident also reflects the regulatory risks faced by centralized stablecoins and the strong demand for transparency. Third-party audits and asset disclosure are the key to winning user trust.

In addition to BUSD, major public chains have also begun to explore and plan their own native stablecoins in recent years to enrich the ecosystem and enhance user experience. For example, Berachain issued the collateralized stablecoin Honey, relying on its multi-asset collateral mechanism to achieve price anchoring; Base plans to launch USDb, aiming to create a native stablecoin anchored by the US dollar to support a wider range of DeFi applications; Layer 2 such as Arbitrum and Optimism are also actively exploring the launch of their own stablecoins to solve cross-chain and expansion needs. This type of stablecoin usually adopts an over-collateralized or asset reserve model, taking into account both security and liquidity, and helping the ecological prosperity and efficient capital circulation.

2.7 Comparison of the advantages and disadvantages of different types of stablecoins

The types of stablecoins mentioned above include: asset reserve, crypto-collateral, algorithmic, RWA-supported, and interest-bearing. Different types of stablecoins have their own advantages and disadvantages in terms of stability, security, decentralization, and compliance.

Fiat-backed stablecoins (such as USDC, USDT, and FDUSD) are currently the most widely used and most regulated stablecoins. These stablecoins are usually backed by assets such as the US dollar or short-term US Treasury bonds at a 1:1 ratio and are managed by centralized institutions. This makes them excellent in terms of price stability and user acceptance, but they also have problems such as centralization and uneven transparency. Some projects (such as USDT) have been questioned for insufficient information disclosure.

Crypto-collateralized stablecoins (such as DAI and USDS) use on-chain crypto assets such as ETH and stETH as collateral to generate stablecoins through over-collateralization. This mechanism is highly decentralized and funds are self-custodied, but due to the volatility of the underlying assets, it may cause liquidation risks. In addition, the low collateral efficiency also limits its large-scale use.

Algorithmic stablecoins (such as the collapsed TerraUST) have tried to maintain their pegs by adjusting supply and demand through system algorithms, but they are prone to collapse when market confidence is insufficient, so they have been gradually eliminated in recent years. Some projects (such as the original FRAX) use partial algorithmic mechanisms, but have now also transformed to 100% collateral to adapt to stricter regulatory requirements.

RWA-backed stablecoins (such as USD1, Frax V3, sDAI) combine blockchain and traditional financial assets, using real assets such as short-term U.S. Treasury bonds and money market funds as collateral. This type of stablecoin has obvious advantages in security and compliance, and is increasingly favored by policies, but it also has problems such as centralized custody and audit reliance.

Interest-bearing stablecoins (such as USDe and USDY) embed an income function on the basis of the stablecoin mechanism, and users automatically earn interest by depositing into the protocol. While satisfying the basic anchoring requirements, this type of stablecoin can also incentivize users to hold and lock positions, increase stability and usage. However, if the source of its interest (such as protocol income, RWA returns, etc.) is unsustainable, it will also bring repayment pressure and risks, especially in extreme market conditions, which may affect the repayment ability.

In summary, the future development trend of stablecoins is to be more transparent, compliant, and secure. Asset reserve and RWA stablecoins may gain a larger market driven by policies, while crypto-collateralized stablecoins will continue to play their value in the decentralized ecosystem. Each type has its own application scenarios and risks, and users and developers need to make reasonable choices based on their needs.

2.8 Programmable Stablecoins

In addition to the types of traditional stablecoins mentioned above, the concept of programmable stablecoins has gradually emerged in the public eye in recent years.

2.8.1 Programmable Currency

With the development of blockchain technology, the role of digital currency is no longer just electronic cash, but has gradually acquired the ability to come with its own rules, that is, the currency itself can automatically operate and pay according to preset conditions. This concept is called programmable money, which essentially combines currency with program code to make the use of funds more flexible, safe and intelligent.

The idea of programmable currency first appeared in the early days of Bitcoin. Some technical communities wanted to allow funds to be transferred only when certain conditions were met. However, due to the very limited functions of Bitcoin's scripting language, this idea always remained at the theoretical level.

In 2015, Ethereum introduced smart contracts, which made digital currencies truly programmable for the first time from a technical perspective, allowing currencies to be automatically transferred, frozen, and destroyed under certain conditions. For example, users can set complex logic such as payment only after someone completes a task, and funds are automatically unlocked at a certain point in time. Since then, currency can not only circulate, but also automatically abide by the rules. Since then, the rise of the DeFi protocol has further promoted this trend. From loan liquidation, income distribution, to pledge release, DeFi manages and executes programmable assets through smart contracts. The use logic of digital assets has become more complex, and the demand for automatic currency operation has continued to increase.

At the same time, central banks around the world are increasingly paying attention to the value of programmable capabilities when promoting digital currencies (CBDC). For example, China's digital RMB already supports earmarked use and periodic expiration in some scenarios; the European Central Bank's digital euro is also testing the function of limiting use. These developments all indicate that programmable currency is becoming a new trend.

2.8.2 Programmable trend of stablecoins

As the concept of programmable money is gradually being implemented, stablecoins, as one of the most widely used types of digital assets, are also evolving in a smarter and more controllable direction. The core advantage of stablecoins is that their prices are anchored to fiat currencies, such as the US dollar or the euro, making them a key tool for hedging volatility, payment settlement, and asset pricing in the crypto ecosystem. Whether users are buying and selling assets on exchanges or lending and staking in DeFi protocols, stablecoins play the role of a basic on-chain dollar.

However, although stablecoins themselves run on an open and transparent blockchain, their functions are still relatively simple. Most stablecoins are just tokens that can be transferred and traded, lacking deeper control capabilities. For example, although we can track from which address a sum of money was transferred to which address on the chain, we cannot know whether it was used for the designated purpose, nor can we prevent it from being used in non-compliant scenarios. For governments, enterprises or financial institutions, simple address tracking is far from meeting the needs of regulatory audits or fund use management.

In addition, most of the current mainstream stablecoins (such as USDT and USDC) adopt a basic account model where you transfer and I receive, and there are no built-in usage restrictions or automated rules. For example, you cannot set conditions such as that the money can only be used to pay wages, automatically issued only at the end of the month, or can only be transferred to certified suppliers. Once the funds are received, the issuer loses control. This is obviously limited in scenarios that require refined fund management.

For this reason, the market demand for stablecoins is extending from price stability to rule control and automatic execution. More and more companies, institutions and even the public sector hope that stablecoins can not only maintain value, but also automate tasks. They hope to use a conditional stablecoin so that the purpose, time and object of funds can be flexibly managed and automatically executed on the chain, thereby improving efficiency, reducing risks and meeting compliance requirements.

This is exactly the background in which "programmable stablecoin" came into being.

2.8.3 Definition and advantages of programmable stablecoins

In the summary above, we mentioned that the market's call for the intelligentization of stablecoins is growing. Against this background, programmable stablecoins have entered the public eye. Simply put, programmable stablecoins are based on the anchoring of asset prices by traditional stablecoins, and further introduce executable rules and conditional logic, making them not only price-stable, but also self-managed and rule-abiding.

Traditional stablecoins are like US dollar cash on the chain, which can be freely transferred and used, but after being issued, how the funds are used, who they are used for, and when they arrive are all controlled by humans. Programmable stablecoins are more like smart checks with instructions and timers, which can pre-set who can receive, when to issue, and where to use, and automatically execute on the chain, which not only reduces human intervention, but also improves fund security and compliance.

This type of stablecoin is particularly suitable for some scenarios that require fine control. For example, on the enterprise side, programmable stablecoins can be used to set up contractual payment logic such as automatic salary payment and disbursement after delivery. In government scenarios, it can be used to limit the use of education subsidies to designated schools and medical subsidies to hospitals.

In terms of financial compliance, the biggest feature of programmable stablecoins is that they can write regulatory rules into the code to achieve automatic control of funds during use. For example, through the on-chain identity system, it can be set that only users who have passed KYC verification can receive or use such stablecoins, which is equivalent to establishing a whitelist system on the chain. For another example, once a transaction is detected to be abnormal, the smart contract can automatically freeze the funds and wait for review or authorization before unlocking them, which improves the risk control ability. In addition, each transaction can be marked and recorded to facilitate tracking the use of funds and meet regulatory requirements such as auditing and anti-money laundering (AML). Compared with traditional stablecoins that cannot be controlled once they are issued, programmable stablecoins have the ability to self-regulate, making them more potential for application in scenarios with high compliance requirements such as corporate finance, government subsidies, and cross-border settlements.

From a technical perspective, programmable stablecoins are usually hosted and controlled by on-chain smart contract systems, and work together with identity systems (such as DID) and compliance interfaces (such as on-chain KYC and AML modules) to build a new digital currency system with automation, controllability and compliance. Specifically, the DID (decentralized identity) system can assign an on-chain identity to users, binding their real-name information, credit status or qualification certification. Smart contracts can use this to determine who has the right to use the funds and automatically execute whitelist verification, permission allocation and other logic. The compliance interface provides on-chain KYC (user identity verification) and AML (anti-money laundering) functions to verify whether the user is compliant, whether the address is at risk, and whether the funds are used for designated purposes. When an abnormal situation is detected, it can also trigger operations such as automatic freezing or audit reminders.

Because of these capabilities, programmable stablecoins are no longer just payment tools, but compliant digital assets that can identify users, understand rules, and automatically execute. This makes it have obvious advantages in scenarios with high regulatory requirements, such as corporate financial management, government subsidy issuance, and cross-border payments. Many countries and institutions have begun related pilots and explorations, which will be discussed in the next summary.

2.8.4 Typical Cases

As the concept of programmable stablecoins gradually moves from technical ideas to reality, central banks, financial institutions and Web3 projects around the world have launched related explorations, trying to integrate functions such as payment within rules, use restrictions, and compliance control into the stablecoin system to adapt to diverse scenarios such as cross-border payments, public fund management, and institutional settlement. The following are several representative practical cases.

mBridge: A model of CBDC cross-border programmable payment

The mBridge project, jointly initiated by the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the United Arab Emirates and the Digital Currency Research Institute of the People's Bank of China, is one of the most influential cross-border central bank digital currency (CBDC) experiments in the world. The goal of mBridge is to build a multilateral digital currency platform dedicated to cross-border settlement and payment to solve the pain points of low efficiency, high fees and slow arrival in the current cross-border payment system.

It is worth noting that mBridge does not issue stablecoins. It uses CBDC (Central Bank Digital Currency) issued by the central banks of participating countries, which is a digital legal tender endorsed by the national central bank and legally enforceable. In layman's terms, CBDC is an electronic RMB, electronic Thai baht, etc. issued by the state and circulated on the blockchain. It is different from stablecoins such as USDC and USDT issued by enterprises and anchored to the US dollar. It is a digital form of sovereign currency.

The innovation of the mBridge platform lies not only in opening up the settlement channels between CBDCs of multiple countries, but also in introducing preliminary programmable payment capabilities. Users can set conditions for transactions, such as transactions will only be automatically executed after identity verification is passed, trade content is compliant, and the time is reached. This mechanism not only improves the security and compliance of cross-border settlement, but also enables CBDC to have flexible rule control capabilities similar to programmable stablecoins.

As an official cross-border collaborative experiment, mBridge provides a clear template for the digitalization and intelligence of future cross-border payments, and also reflects the trend that global sovereign digital currencies are evolving towards automation and rule-based payments.

Circle and Tether: Stablecoin companies explore permission control

Currently, mainstream stablecoin issuers are also actively exploring the technical implementation methods of controllable stablecoins. Although these mechanisms cannot be fully called programmable stablecoins, they have initially taken shape in the form of rule-based management, especially in terms of authority management and risk control.

Take Circle, the issuer of USDC, for example. Its stablecoin contract has built-in functions for freezing and recovering funds. Simply put, Circle has the ability to freeze USDC on a certain address, making it temporarily unable to transfer funds, and even recover these funds when necessary. These mechanisms are usually used to handle scenarios such as judicial investigation, freezing of stolen assets, or management of sanctions lists. Although this capability has brought doubts about centralized control, from a technical point of view, it has taken the first step to regularize and control funds.

Similarly, Tether (the issuer of USDT) also has similar capabilities. Tether has frozen wallet addresses suspected of crimes many times at the request of law enforcement agencies. This shows that the smart contract behind its stablecoin is also embedded with the on-chain permission interface and has certain dynamic management capabilities.

However, these functions are currently mainly used for risk control and security purposes, and are still passive controls rather than active programmable logic. In other words, they do not automatically execute complex conditional logic on the chain, but are in the form of platform intervention + manual operation, so full programmability is not achieved.

Is it really possible for stablecoins like USDT and USDC to develop into fully programmable forms in the future?

At present, it is difficult for them to truly achieve flexible programmability. First of all, this type of stablecoin is widely used in exchanges, DeFi and daily payments, and users value the characteristics of no threshold and free transfer the most. Once restrictions and usage are added, it will affect liquidity and acceptance. Second, programmability means restrictions and rules, and stablecoins currently assume the function of on-chain US dollars. If it is necessary to bind identities and specify usage, many users and protocols will lose convenience.

At the same time, although USDT and USDC are deployed on multiple decentralized public chains such as Ethereum, Solana, and Polygon, users can freely transfer money, participate in DeFi protocols, and other operations. From the perspective of the technical operating environment, they do have the characteristics of decentralized circulation. However, from the perspective of the underlying architecture, these stablecoins are still hosted and issued by centralized companies (such as Circle and Tether), and the core control of the contract is firmly in the hands of the issuing institution. This means that only the issuer can perform key operations such as additional issuance, recovery, and freezing of assets, and its contract logic cannot be modified or governed by the community. Therefore, although they can be used for various on-chain transactions, the smart contracts themselves do not have native programming flexibility and it is difficult to embed complex automated logic, such as phased payments, identity-based limited use, and automatic distribution of income.

In contrast, true programmable stablecoins often embed logical rules directly in contracts, and can automatically execute processes such as fund transfer, usage restrictions, and authorization verification based on user identity (such as DID), time conditions, or external events. This capability is particularly critical for scenarios such as enterprises, institutions, and governments that have fine-grained control over fund flows, but current mainstream stablecoins do not yet have this level of native programmability.

Based on these realistic challenges, USDC and USDT are more likely to participate in this trend in another way, such as launching scenario-customized stablecoins, which are dedicated to scenarios that require compliance and refined control, such as corporate payroll, government subsidies, and cross-border settlements. For example, Circle has expressed plans to cooperate with on-chain identity service providers (such as Polygon ID) and compliance platforms to explore USDC versions with whitelists, usage restrictions, automatic liquidation, and other functions to meet the specific needs of enterprises and financial institutions.

In general, although the programming capabilities of mainstream stablecoins are currently limited, their permission control mechanisms have laid the foundation for building a more compliant and intelligent stablecoin system in the future. We still need to continue to observe how they will develop in the future.

Digital Euro pilot: testing limited-use functionality

The European Central Bank is promoting the development of the digital euro and conducting pilots in multiple countries. In some pilots, the central bank is testing a restricted use payment mechanism, such as setting the digital euro to be used only in specific consumer categories such as transportation, education, and medical care. This mechanism reflects the huge potential of programmable currency in scenarios such as the use of public funds and subsidy management, and also provides direction for the functional design of future eurozone stablecoins or CBDCs.

2.8.5 Challenges and potential

challenge

Although programmable stablecoins are being continuously verified and implemented as a concept and technical path, their widespread application still faces many practical challenges in the current context where the global compliance environment and user habits are not yet fully mature.

Programmable stablecoins are often closely tied to on-chain identity recognition (such as DID) and KYC/AML mechanisms to achieve accurate control and compliance of funds. However, this process inevitably involves information such as user identity, transaction path, and purpose, which may cause concerns about privacy leaks. How to protect user privacy while ensuring compliance is a problem that policymakers and developers must face together.

Second, programmability means setting rules, binding identities, authorization conditions and other steps. For ordinary users, the operation cost and understanding threshold are significantly increased. Once the process is too complicated, it may affect the user's willingness to use it and even reduce the efficiency of the system. Finding the right balance between controllability and usability is an important prerequisite for promoting its popularization.

Third, different countries and regions have different attitudes towards the controllability of funds. For example, in Europe, the digital euro is testing limited-use payments, while in some countries that emphasize financial free markets, limiting the use of funds may face more legal and political resistance. This difference in compliance awareness may lead to fragmentation in cross-border use, which is not conducive to building a global unified programmatic payment network.

potential

Programmable stablecoins are an ideal tool for corporate and government payments. Compared with the free transfer model of traditional stablecoins, programmable stablecoins can provide more refined payment control capabilities for enterprises, institutions, and governments. For example, enterprises can set project funding to be released according to progress and employee wages to be adjusted according to performance. The government can set subsidies to be limited to public expenditure scenarios such as medical care and education, thereby improving capital efficiency and reducing the risk of abuse.

At the same time, as smart contracts on the chain become increasingly complex, transactions are no longer just a matter of you sending and I receiving, but involve multi-dimensional triggering factors such as time, authority, conditions, and identity. Programmable stablecoins are just the value-bearing tool for such on-chain financial contracts, improving execution security and flexibility.

Finally, when programmable stablecoins are linked with on-chain identity (DID), on-chain audit, real assets (RWA) and other systems, more reliable and transparent fund flows and asset mapping can be achieved. For example, in supply chain finance, payments can be automatically bound to commodity delivery nodes. In RWA investment, stable returns can be distributed to qualified investors according to contract rules. This combination is expected to truly open up the channel between the chain and the real economy and promote the deep integration of Web3 and the real economy.

In general, the future of programmable stablecoins is not just a smarter payment tool, but a digital infrastructure that links identity, assets, contracts, and compliance. It is not only an extension of real compliance and regulatory logic on the chain, but also a key fulcrum for the on-chain economy to become institutionalized and standardized. Although it is still in the exploratory stage, its evolution path has gradually become clear, and it has long-term value and imagination space in the directions of enterprise-level finance, public fund management, and RWA clearing and settlement.

3. Core application scenarios of stablecoins

As an important part of the cryptocurrency market, stablecoins have stable prices and are widely used in multiple scenarios such as payment, cross-border settlement, DeFi, trading, value storage, and risk hedging.

3.1 Medium of Exchange

The three functions of currency include medium of exchange, value scale and value storage. The medium of exchange refers to a medium that is widely accepted for the exchange of goods or assets. Stablecoins can be used as a medium of exchange for on-chain transaction matching and clearing, especially in centralized exchanges (CEX) and decentralized exchanges (DEX), for pricing and settlement. Stablecoins act as on-chain digital dollars and are widely accepted in the crypto market as an intermediate medium for exchange between assets and a general tool for on-chain value circulation. Because its price is anchored to the US dollar and has low volatility, users use it more in crypto asset transactions. For example, most trading pairs in exchanges such as Binance, OKX, and Coinbase are denominated in USDT or USDC, and stablecoins usually appear on the right side of the trading pairs.

Figure 6. Stablecoins as a medium of exchange. Source: https://www.binance.com/en/trade/BTC_USDT?type=spot

In DEXs like Uniswap, Curve, and Balancer, stablecoins are also an important component of liquidity pairs, mainly as an intermediate bridge for various asset transactions. Users can use stablecoins to more intuitively judge the price and value of other crypto assets and avoid trading losses caused by drastic market fluctuations. At the same time, many DEX asset exchanges are not matched through order books, but through liquidity pools. Each pool consists of two assets, called a liquidity pair, such as ETH/USDT, BTC/USDC, etc. Liquidity providers (LPs) deposit these two assets in pairs in the pool for others to trade. This helps users buy and sell crypto assets more smoothly and improves the overall trading experience. Stablecoins can also circulate quickly between different protocols, becoming the most commonly used and important medium for value transfer on the chain.

3.2 Multiple roles of stablecoins in DeFi

Stablecoins play a core role in the DeFi ecosystem and are widely used in multiple scenarios such as lending, trading, liquidity provision and re-staking.

In the lending scenario, stablecoins can be used as both borrowing assets and collateral assets. For example, in mainstream lending protocols such as Aave and Compound, users can pledge crypto assets and borrow a certain proportion of stablecoins to meet liquidity needs. For example, if a user holds 10 ETH but does not want to sell it, he can choose to pledge ETH to lending protocols such as Aave and borrow stablecoins equivalent to 60%-75% of the ETH collateral value, such as USDC, DAI, etc. Stablecoins have stable prices and good liquidity, and can be used for other investments, participation in other projects, purchase of goods, etc. In this way, users not only retain their long-term holdings of ETH, but also obtain stablecoins that can be used flexibly. If market fluctuations cause the value of the collateral assets to fall to a certain threshold, the protocol will automatically liquidate the collateral assets to prevent bad debts.

At the same time, for users with lower risk appetite, stablecoins can also be used as collateral to lend other tokens. For example, a user with 10,000 USDC can pledge it in a lending agreement and lend ETH and other tokens to participate in liquidity mining, leverage operations, or simply earn deposit interest. This method is relatively less risky because stablecoins have small price fluctuations and are easy to redeem, making it suitable for conservative investors.

According to CoinLaw statistics ( https://coinlaw.io/stablecoin-statistics/ ), the total locked value (TVL) of the entire DeFi system reached US$120 billion in 2024, of which stablecoins contributed 40%, showing the important position of stablecoins in lending, trading, liquidity pools, etc.

In addition, stablecoins also play a key role in the Liquidity Repository (LRT) and Restaking protocols. Represented by EigenLayer, such protocols regard stablecoins as underlying assets with low risk and high liquidity. On the one hand, stablecoins are often used to set up risk buffer pools to help users deal with pledge losses or slashing events; on the other hand, many protocols use stablecoins as a means of revenue distribution to avoid the uncertainty caused by platform currency fluctuations. Some protocols also support the use of stablecoins and other assets as composite collateral to improve the efficiency of capital utilization. For institutional users with low risk appetite, the participation of stablecoins also increases their trust in and willingness to participate in the restaking ecosystem.

Overall, stablecoins have become an indispensable value anchor and liquidity engine in the DeFi system, which not only improves protocol security and capital efficiency, but also provides users with a more robust way to participate.

3.3 Payment and Settlement

Stablecoins are gradually being used for global payments and cross-border settlements. Their biggest advantages are fast transfers, low fees, and global applicability. They can replace the slow and high-cost transfer process in the traditional banking system.