BTC Faces Renewed Pressure Ahead of Jackson Hole

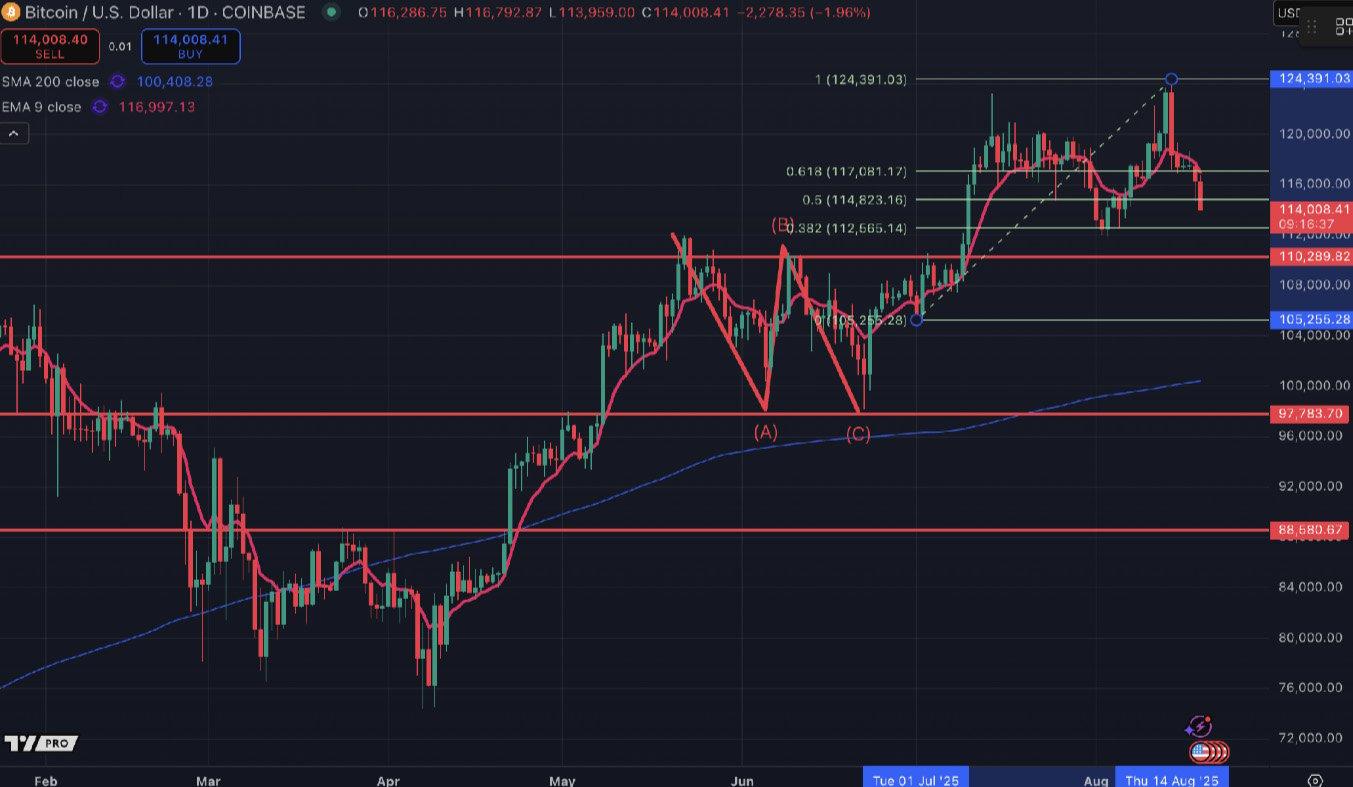

Bitcoin fell after roughly $600M of long liquidations overnight, sliding from $118k to $113k and extending last week’s ~5% pullback from record highs. Perp funding turned negative over the weekend—often a precursor to corrections—and traders are de-risking into Jackson Hole remarks from Fed Chair Powell.

On the bid side, Tokyo-listed Metaplanet disclosed a 775-BTC purchase over the weekend. Spot remains mid-range: buyers show up near $112k while supply caps rallies around $120k.

Macro uncertainty persists after hotter-than-expected US PPI, clouding the Fed’s near-term path ahead of September. Implied vol is subdued, pointing to range-bound trade until policy clarity improves. The setup underscores how quickly conditions can shift, even near highs.

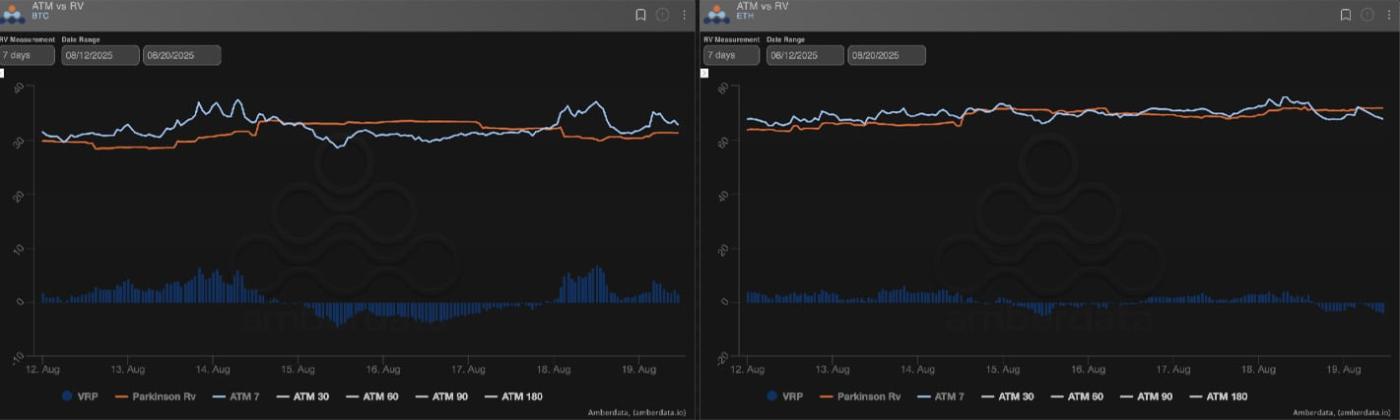

Volatility Snapshot: BTC Heavy, ETH Resilient

Realized vol steady: BTC ~30, ETH ~65. Front-end BTC vol remains heavy; ETH front-end continues to firm. Carry slightly positive in BTC; negative in ETH. BTC’s OHLC has breached lower several times post-top; ETH is holding its implied range given higher vols. Short gamma at these inflection levels carries elevated risk.

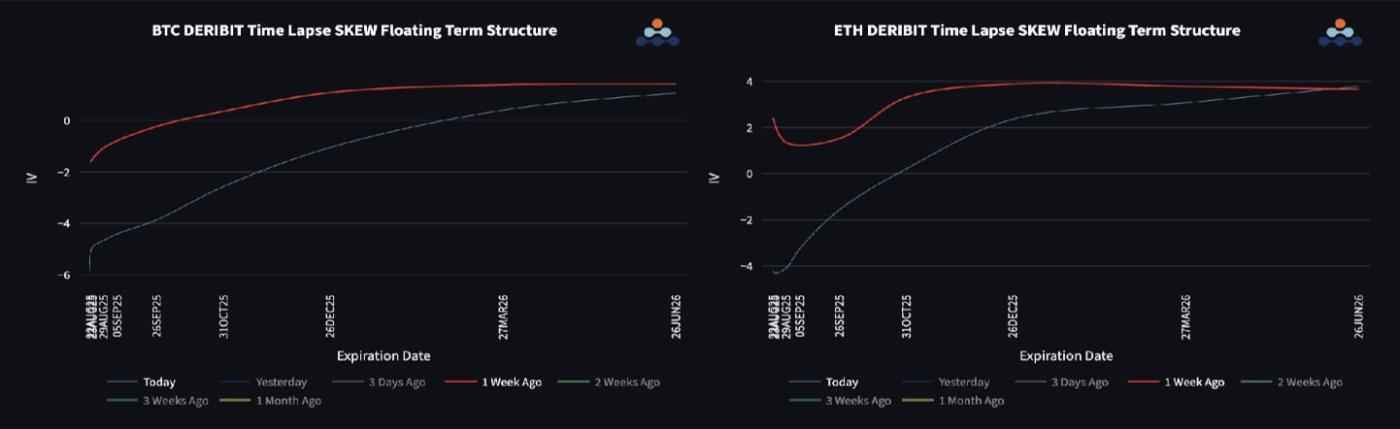

Skew Shifts Toward Puts as Traders De-Risk

BTC and ETH skews are pulling toward put premium as markets correct. ETH skew flips back to calls from the October expiry; BTC doesn’t show call premium again until Mar ’26. The move lower triggered buying of August/September puts around the 110k strike. Calls and call spreads are being sold as longs de-risk into Powell’s Jackson Hole speech on Friday.

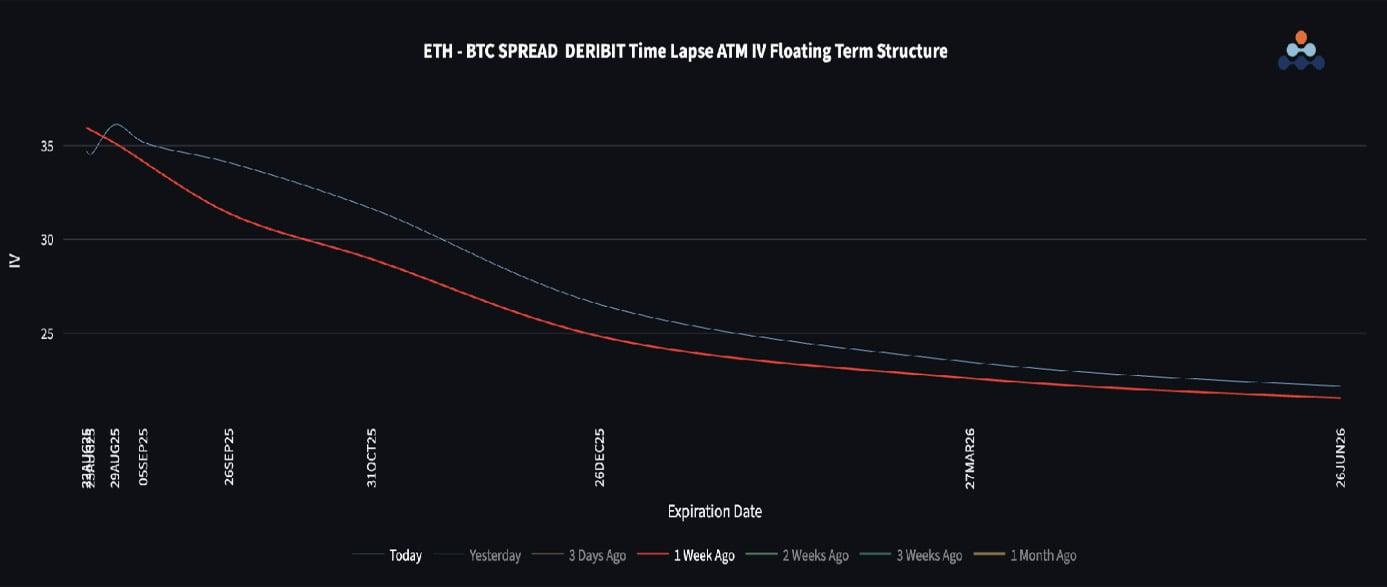

ETH/BTC Stalls at Resistance; Vol Structures Adjust

ETH/BTC stalled at long-term downtrend resistance near 0.039 and has retraced ~7%. Front-end vol spread steady around 35; other tenors are being pulled higher as ETH’s swings persist. Front-end skew spread is moving toward flat as ETH corrects after a parabolic run. Long-dated skew still leans to ETH upside, peaking near +3.5 vols in December.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Imran Lakha is an expert at using institutional options strategies to capitalize on investment opportunities across global macro asset classes. Learn more here.

RECENT ARTICLES

BTC Longer Dated Skew Flipping Into Put Premium

Imran Lakha2025-08-20T09:39:17+00:00August 20, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 34

Block Scholes2025-08-20T08:37:36+00:00August 20, 2025|Industry|

BTC Eyes Highs, ETH Extends Lead

Imran Lakha2025-08-13T10:43:17+00:00August 13, 2025|Industry|

The post BTC Longer Dated Skew Flipping Into Put Premium appeared first on Deribit Insights.