Over the past week, the "heat map" of the crypto market has been quietly redrawn. As Bitcoin's price fluctuates, funds are quietly accelerating towards Altcoins - from mainstream narratives to niche tracks, multiple sectors have seen unexpectedly high gains. Data shows that not only have star projects led the way, but structural follow-up gains are also spreading across sectors, forming a "multi-point blooming" market.

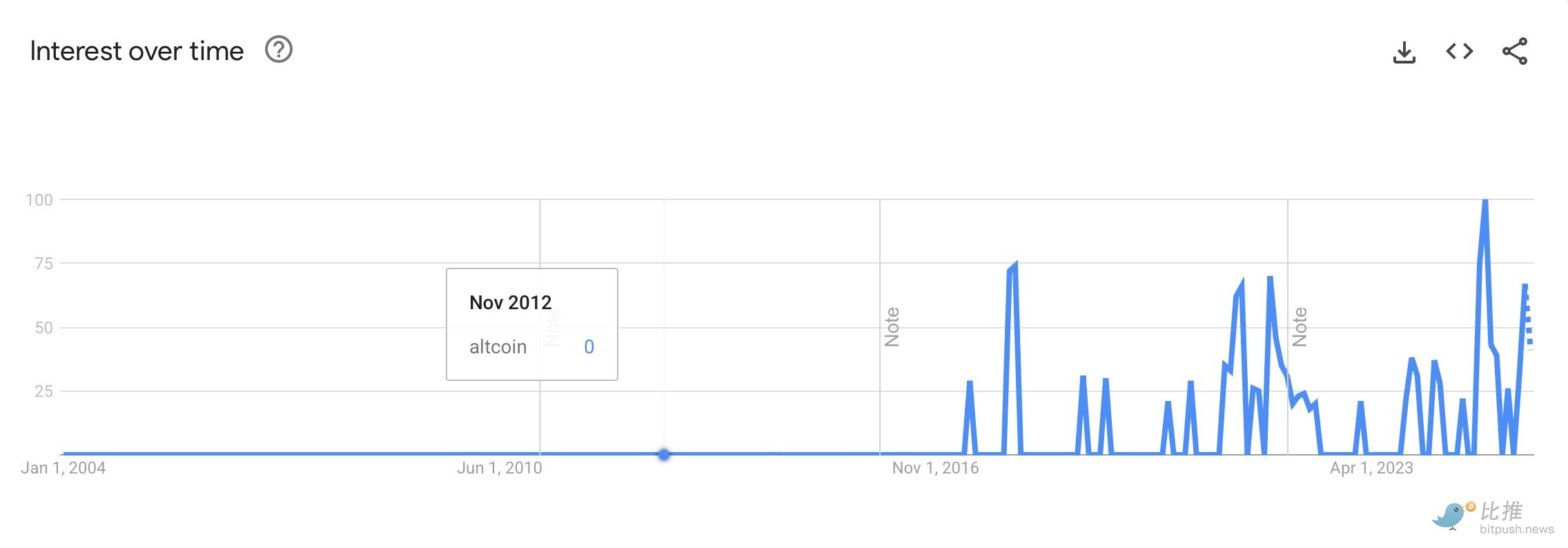

Google Trends data shows that "Altcoin" search popularity has hit a five-year high, with "Ethereum" search volume reaching a two-year peak.

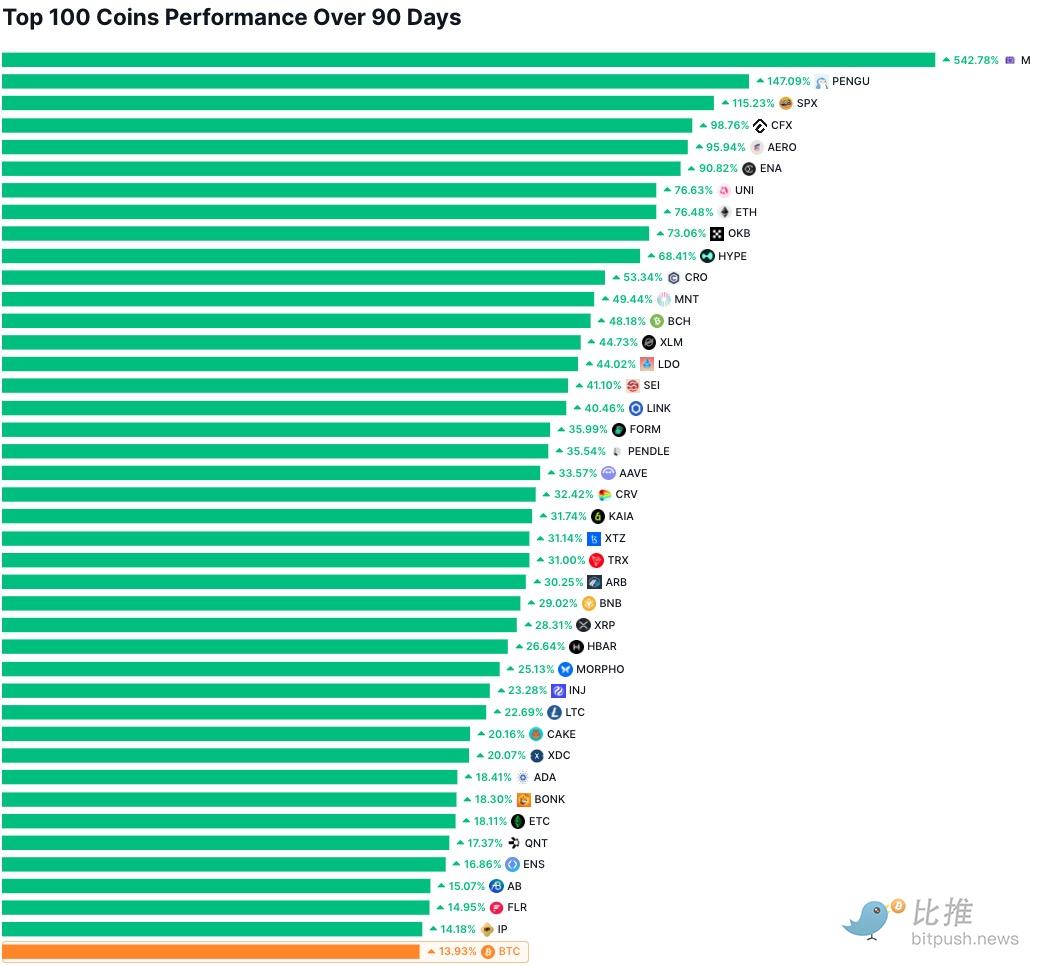

Simultaneously, the global cryptocurrency total market value has increased to $4 trillion, with the Altcoin sector significantly outperforming Bitcoin (data below is as of the US stock market close on August 14th Eastern Time):

Ethereum has risen 79% in the past 90 days, while Bitcoin has only increased by 14% during the same period.

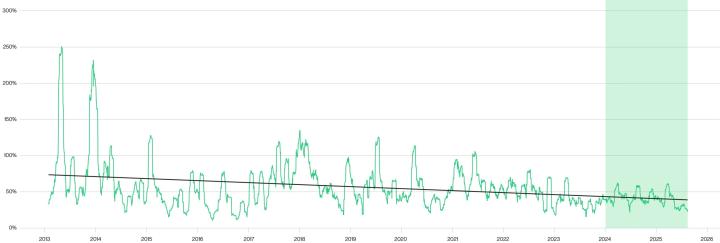

Altcoin Season Index has risen from 29 to 40 a month ago.

The US has received 31 Altcoin spot ETF applications in the first half of the year, covering mainstream public chains and ecosystem tokens such as SUI, SOL, XRP, LTC, DOGE, ADA, DOT, HBAR, and AVAX.

In terms of capital flow, ETFs and corporate treasuries are changing the supply and demand structure:

The Ethereum spot ETF alone has recorded $2.3 billion in net inflows in just three days, equivalent to 500,000 ETH.

Corporate treasuries are diversifying their allocations, with Ethereum, Solana, and Chainlink being held in large amounts and staked for earnings.

DeFi Total Value Locked (TVL) has returned to $9.69 billion, approaching the historical high of 2021.

This resonance of capital and narrative provides solid ground for a comprehensive Altcoin rotation.

Special Narrative / Derivative Track

SPX's strength has been mentioned in previous articles, but projects like HBAR and INJ are also gaining re-evaluation opportunities through differentiated narratives (such as DAG architecture, derivatives trading depth). Especially at the current stage, projects that can provide additional risk-return curves outside mainstream narratives often receive unexpected capital support at the end of a market trend.

From the overall performance, the catch-up of these tracks confirms a trend: capital is migrating from major assets to targets with more elasticity and sector depth, attempting to find new alpha sources.

Summary

The current rotation market makes the entire market more like a multi-layered chess game: main track assets continue to attract attention, but other squares on the board are quietly lighting up. Whether it's long-term stable infrastructure or short-term explosive concept coins, they are providing different risk appetite choices for capital.

Moving forward, market differentiation may become more obvious - some assets will continue to rise through narrative, capital, and fundamental overlays, while others will quickly recede when lacking sustained momentum. For investors, the real challenge is not finding rising coins, but determining how long they can continue to rise and when to exit.

After all, this market is never short of surprises, but also never short of unexpected turns.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush Telegram Community: https://t.me/BitPushCommunity

Bitpush Telegram Subscription: https://t.me/bitpush