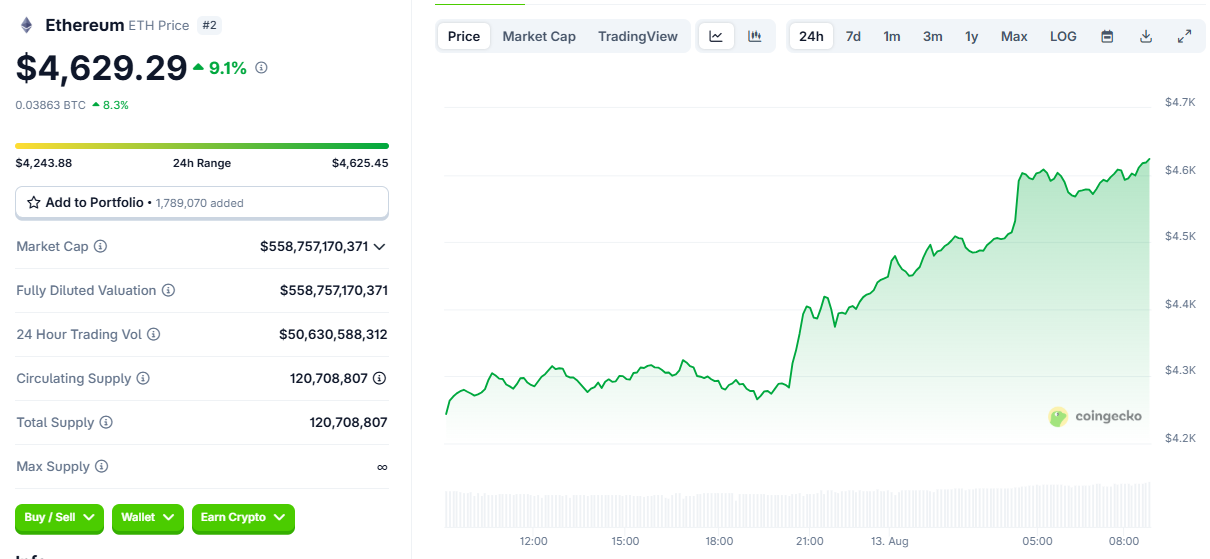

In the early morning of the Asian time zone, while investors were still asleep, ETH once again broke through $4,600, reaching a three-year high, and BTC is targeting the $120,000 mark. A crypto frenzy initiated by institutional capital is sweeping across global markets - ETH, which has surged 228% in just four months (rising from the $1,385 low in April to $4,640), coupled with the macro tailwinds of US stock Nasdaq and Dow indices rising over 1% in intraday trading, has completely ignited this "wild bull market".

BitMine's epic $20 billion financing plan to gobble up ETH, and SharpLink's single-day acquisition of $23.1 million, have pushed institutional FOMO emotions to a boiling point; while the brutal on-chain liquidation of $474 million in 24 hours (with shorts absorbing $344 million) has become the most cruel footnote to this capital feast.

As ETH is just a step away from the historical peak of $4,868, the crypto market has officially entered a new era of "institutional dominance, led by Ethereum".

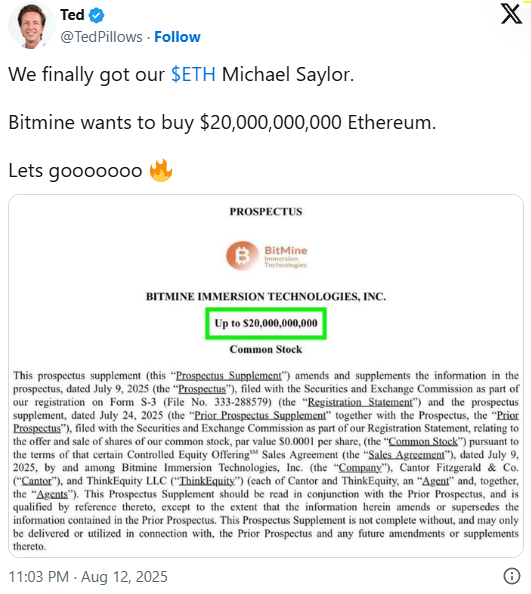

BitMine's Epic $20 Billion Financing: A Paradigm Revolution of Institutional Whales Devouring ETH

The market compares BitMine's chairman Tom Lee to an "Ethereum version of Michael Saylor", replicating MicroStrategy's balance sheet strategy - raising funds through stock issuance and large-scale crypto asset allocation, is reshaping traditional capital's perception of ETH's value.

BitMine's filing with the SEC

Blockchain technology giant BitMine Immersion Technologies (BMNR) submitted a filing to the US Securities and Exchange Commission (SEC) on August 13, announcing plans to raise an additional $20 billion to acquire Ethereum (ETH), which will push its disposable ETH purchase fund total to $24.5 billion (including the previously disclosed $4.56 billion).

If the plan is completed, BitMine's ETH holdings will account for nearly 5% of global circulation.

Stimulated by this news, BitMine's stock price surged 5.6% in a single day, with a cumulative increase of over 600% this year.

Three Major Engines of ETH's Wild Surge: Institutions, ETF, and Short Squeeze

Institutional Capital Flood Overturns Supply-Demand Landscape

Spot ETF Continues to Attract Funds: US spot ETH ETF has seen net inflows for 14 consecutive weeks, with a cumulative scale exceeding $25.7 billion. On August 12, Ethereum achieved its first single-day net inflow of over $1 billion, with institutions fully FOMO.

Listed Companies "ETH MicroStrategy-ization": 85 US stock companies have incorporated Ethereum into their balance sheets, with total holdings rising from 0.7% of circulation in 2023 to 1.9%. Giants like SharpLink and BitMine have holdings valued over $3.5 billion.

On August 13, SharpLink launched another buying spree, acquiring 5,226 ETH (about $23.1 million), with total holdings reaching 604,000 ETH, valued at $2.69 billion, firmly holding the second place in institutional holdings;

On August 13, new force billionaire Peter Thiel acquired 7.5% of Ethereum treasury company ETHZilla (ATNF)'s shares, driving its stock price to surge 146% in a single day, with a trading volume of $689 million.

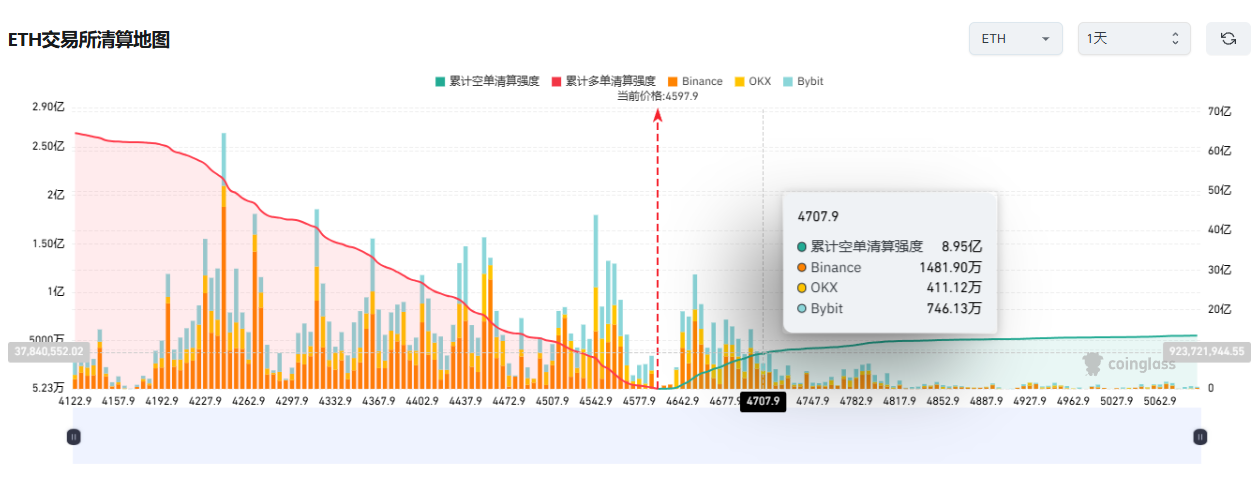

Short Liquidation Triggers Positive Feedback Loop

As ETH breaks through $4,600 and BTC approaches $120,000, the network-wide 24-hour liquidation amount has soared to $474 million, involving over 110,000 people

Shorts Washed Out: In the past 24 hours, short positions were liquidated for $344 million, with Ethereum shorts accounting for 76% ($262 million); short covering further accelerated buying, forming a "rise-short squeeze-rise again" positive cycle.

Multi-Short Pattern Reversal

Currently, Ethereum's position amount has broken through $63 billion, reaching a new high. Coinglass data shows that if Ethereum breaks $3,700, over $800 million in short liquidation will occur.

ETH/BTC exchange rate rises to 0.038, recovering all declines since 2025, with a clear trend of funds migrating from Bitcoin to Altcoins.

Bitcoin Consolidates at High Levels: Preparing to Assault the $135,000 Historical Peak

BTC/USDT 4-hour chart.

BTC/USDT 4-hour chart.

Despite ETH stealing the spotlight, Bitcoin remains stable at the $120,000 key level, just about 2% away from the historical high of $123,200 set in December 2024. The technical landscape shows a stalemate between bulls and bears:

- Daily Level: 20-day moving average ($116,779) and 50-day moving average ($114,366) form support, with RSI maintaining a positive zone. If breaking the $123,200 resistance, it may open up the $135,000 upward space;

- 4-hour Level: Price is running along an upward channel. If effectively holding $123,200, it may accelerate towards $127,700, further challenging the $135,000 target.

Altcoin Season Erupts: Technical Breakthroughs for BNB, Chainlink, Uniswap

BNB: Consolidating for a Potential Breakthrough

BNB/USDT 4-hour chart.

BNB/USDT 4-hour chart.

Daily Level: Price consolidating in the $792-827 range. Breaking $827 resistance may accelerate towards $861 or even $900; 20-day moving average ($787) is a key support;

4-hour Chart: Bearish divergence signal appears. If breaking below the 50-day moving average, short-term trend weakens.

Chainlink (LINK): Strongly Breaking Through $22.7

LINK/USDT 4-hour chart.

LINK/USDT 4-hour chart.

Daily Level: Breaking $22.7 resistance initiates accelerated upward movement, targeting $27, potentially challenging $30 if holding; $20.83 is the bull-bear watershed;

4-hour Chart: 20-hour moving average provides strong support, RSI overbought indicates bull dominance.

Uniswap (UNI): Preparing to Assault the $12 Mark

UNI/USDT 4-hour chart.

UNI/USDT 4-hour chart.

Daily Level: 50-day moving average ($9.05) forms strong support. Breaking $12 resistance targets $15; 20-day moving average ($10.19) is the pullback defense line;

4-hour Chart: Bulls defend 20-hour moving average. Breaking $12 will open $14-15 space.

Wild Bull Market Begins: ETH Pointing to a New Historical Era of $5,000

Current technical indicators are all bullish on ETH:

- Target Price: After breaking through $4,600, the short-term target moves up to $4,868 (previous high), and standing firm will open up a space of $5,000-6,000;

- Long-term Momentum: Standard Chartered Bank raised ETH's year-end target to $4,000, with institutions like TokenAlchemist bullish on $15,000; if the technical side replicates the 2017 "expanding wedge" pattern, it is expected to hit $7,000-8,000 by the end of the year.

Market Wisdom: When BlackRock attracts $255 million in a single day, corporate ETH reserves exceed 3.04 million coins, and ETH occupies 83.69% of the RWA tokenization market, this is no longer retail investor frenzy, but an epic institutional capital reallocation. Ethereum co-founder Joseph Lubin's assertion is becoming a reality: "We are not building cryptocurrencies, but the operating system of the digital economy."