Bitcoin (BTC)

What a week, right? Between August 4 and August 11, the market did one of those dramatic turnarounds that makes last week’s panic look almost silly in hindsight. We went from that gut-wrenching flush down to ~112K straight into a rip back above 122K, and now BTC’s pressing right up against the 124K all-time-high line like it never existed. On the 4-hour chart, we’re cruising well above the 50-MA around 116K. The RSI’s hanging out in the high-70s, which, let’s be honest, is great for momentum, but also the kind of heat that usually cools off sooner or later.

BTC/USD 4H Chart, Coinbase.

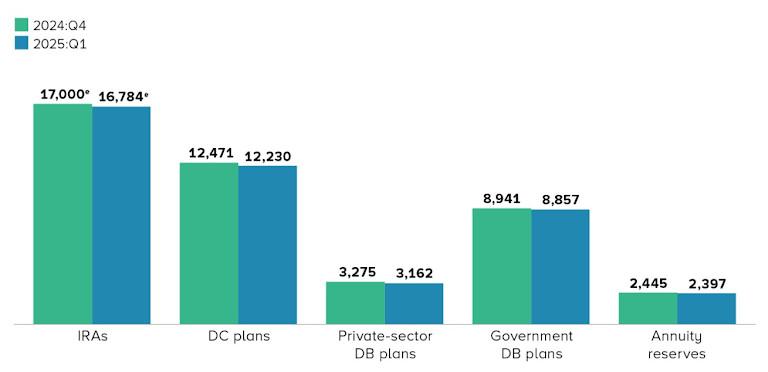

So, why the reversal? The mood shift really started when the White House dropped that executive order letting 401(k) retirement plans hold crypto. That, if you ask us, was a pretty unambiguous green light for long-term capital to start dipping into Bitcoin.

Retirement assets by type.

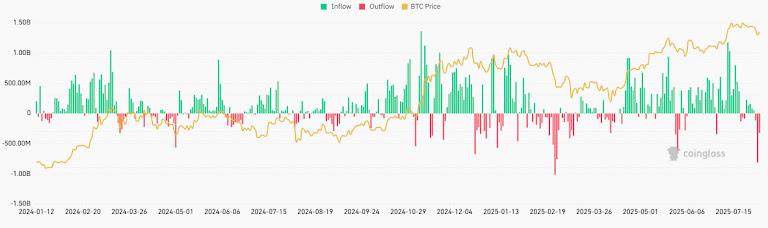

And once that landed, it felt like the market collectively went, “Ah, so this isn’t over.” Sure enough, ETF inflows picked up. After a few sluggish weeks, spot BTC funds were back in the green, and that’s when the bounce stopped feeling like a dead-cat and started looking like a move with legs.

Bitcoin BTC inflows 30-day moving average (screenshot).

Then the institutional flexing started. Harvard’s endowment popped up with a stake in BlackRock’s IBIT – symbolically huge, because let’s be honest, Harvard doesn’t exactly chase hype. Right after that, the Michigan state pension fund boosted its own BTC ETF holdings, basically confirming that big, patient money is using these dips to quietly build positions.

Spot Bitcoin ETF flows.

Even regulators, who’ve been happy to play the villain all year, weren’t in a wrecking-ball mood. The CFTC hinted at adding more structure to spot crypto trading, which, love it or hate it, at least gives the market a clearer playbook.

All of this was happening while the U.S. dollar softened up, which only added fuel to the fire. We’ve got a friendlier-than-usual macro backdrop, institutions buying dips, and policy that wasn’t actively trying to ruin the party. So, no wonder we went from “BTC looks shaky” to “let’s take a run at the highs” in just a few sessions.

Bottom line: Bitcoin’s got the momentum. Just remember, with RSI this hot, a quick tag of the highs followed by a pullback into the 116–118K zone wouldn’t be a surprise.

Ethereum (ETH)

Okay, now over to Ethereum, where the picture last week was actuall pretty similar. From August 4 to August 11, ETH climbed back over 4K and is now leaning toward that 4.86 – 4.9K all-time-high zone. On the daily chart, price is sitting comfortably above the 50-MA down at ~3.24K, and RSI’s in the low-to-mid 70s.

ETH/USD 4H Chart, Coinbase.

But ETH’s run wasn’t just spillover. One of the big sparks was that “mysterious institution” quietly scooping up nearly $1B worth of ETH in a single week (as per Lookonchain).

The ETF picture was a little messier though. Early in the week, spot ETH ETFs saw their largest single-day outflow on record – $465M led by BlackRock’s fund – which naturally rattled some nerves.

Daily total inflows and outflows for Spot Ether ETFs.

But as soon as Bitcoin started charging toward its highs, ETH’s flows steadied, and traders remembered that ETH tends to lag BTC on the way up before playing catch-up fast.

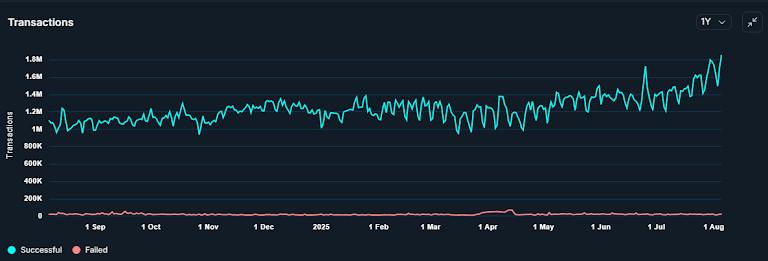

One-year chart of transactions on the Ethereum network.

On-chain, activity has been picking up too. Ethereum transaction volumes hit a year-high, partly thanks to the ongoing drama over SEC staking rules. While the agency didn’t exactly roll out the red carpet for staking protocols, it didn’t shut the door either – and that “not bad news” was good enough for traders to stay risk-on.

Bottom line: if BTC clears 124K and holds, ETH has a clean shot at running into that 4.6 – 4.9K zone. The daily RSI says a breather is due, so a dip toward low-4Ks wouldn’t break the trend. In fact, it could set up the kind of reset that’s healthy before a real ATH attempt. But with sentiment flipping this fast, don’t be surprised if ETH takes that shot sooner rather than later.

Toncoin (TON)

While Bitcoin and Ethereum were busy chasing their all-time highs, TON did what TON usually does: its own thing entirely. Between August 4 and August 11, it’s been in “bounceolidation” mode after last week’s drop – hovering in the 3.3–3.5 range, holding above its 50-MA around 3.12, and keeping its RSI in a pretty calm mid-50s zone.

TON/USD 4H Chart.

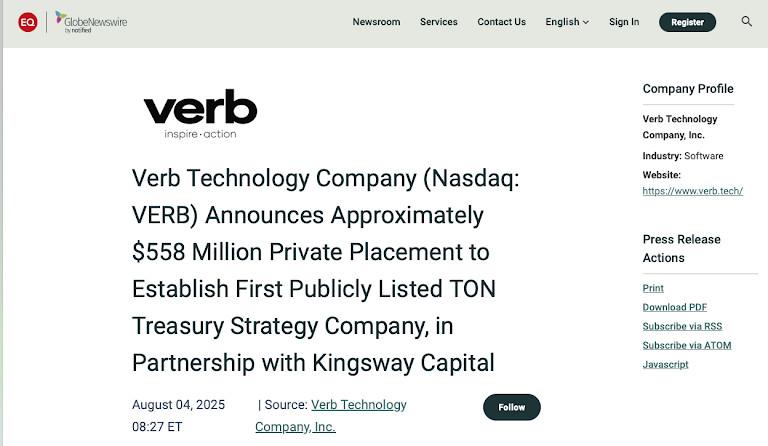

The week kicked off with a big one – Verb Technology announced a $558 million raise to create TON Strategy Co., the first publicly listed company with Toncoin as its treasury asset, in partnership with Kingsway Capital.

If that wasn’t enough institutional spice, Telegram itself moved over 119 million TON (about $400 million) into the newly announced TON Strategy fund. So, the platform is putting serious skin in the game.

Also, the visibility push kept rolling. Amazon Web Services added TON to its Public Blockchain Datasets program, giving anyone free access to full chain data through AWS’s cloud tools. For developers, analysts, and anyone building on TON, that’s a major infrastructure boost.

And, as the cherry on top, TON ranked as the most-trending coin on CoinGecko this week. Clearly, the ecosystem is pushing real hard to broaden its reach beyond Telegram’s backyard.

All told, TON’s price action was quieter than the news cycle, but the underlying story was still solid: a mix of deep-pocket institutional moves, quirky-but-on-brand product launches, some real infrastructure progress to back it all.

In our opinion, as long as Bitcoin keeps its momentum, TON has room to extend toward 3.6–3.8 without much resistance. But if BTC stumbles, expect TON to drift back toward the 50-MA before making another attempt higher. The difference this time is that it’s doing so with some of the most high-profile ecosystem support we’ve seen yet.

The post From Shaky To Surging: Bitcoin Eyes $124K As ETH And TON Join The Mid-August Push appeared first on Metaverse Post.