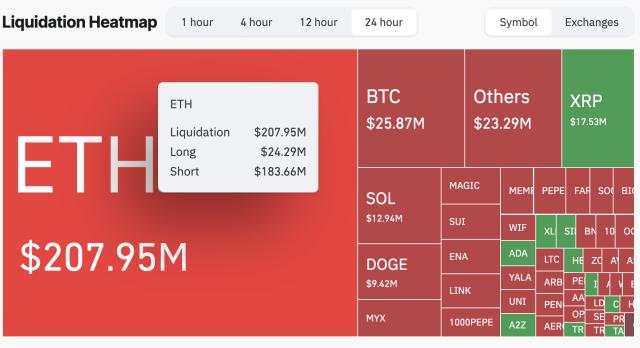

MEMEFI surged nearly 200% today after Binance delisted its perpetual contracts, pushing trading volume to a new high. This strong surge, mainly due to forced short position closures, has attracted widespread attention—and increasing skepticism—in the cryptocurrency community.

Meanwhile, today's market movement has raised doubts about MEMEFI's long-term prospects.

Delisting Causes Short Squeeze and Record Volatility

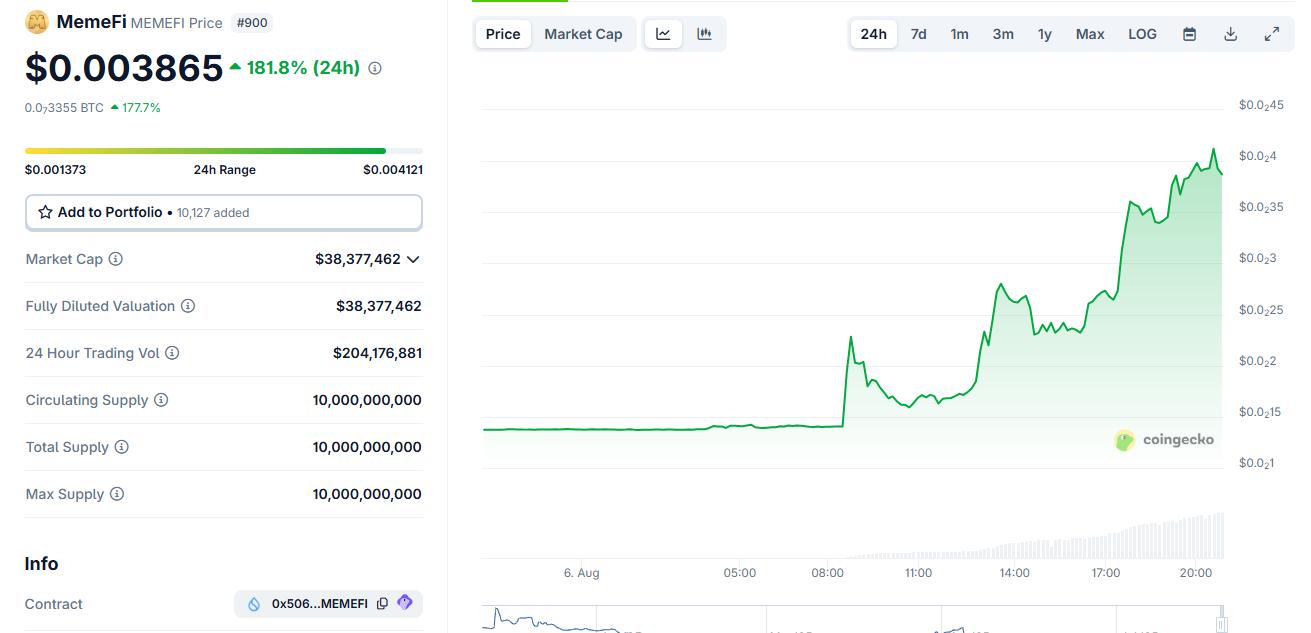

MEMEFI's strong surge began when Binance announced it would delist MEMEFI perpetual contracts from its futures platform on 11/08/2025.

Traders holding short positions were forced to quickly close, leading to strong buy orders that pushed MEMEFI's spot price up by over 190% in 24 hours.

Daily trading volume also skyrocketed, with CoinMarketCap showing over $209 million traded as the price nearly tripled in a single session. This pattern aligns with typical "delisting pump" scenarios where forced short positions drive spot prices up rapidly.

MemeFi surges strongly after being delisted from Binance. Source: CoinGecko

MemeFi surges strongly after being delisted from Binance. Source: CoinGeckoForced derivative contract closures can trigger powerful but temporary pumps in the spot market. Binance has witnessed similar events, such as the strong surge after delisting ALPACA perpetual contracts.

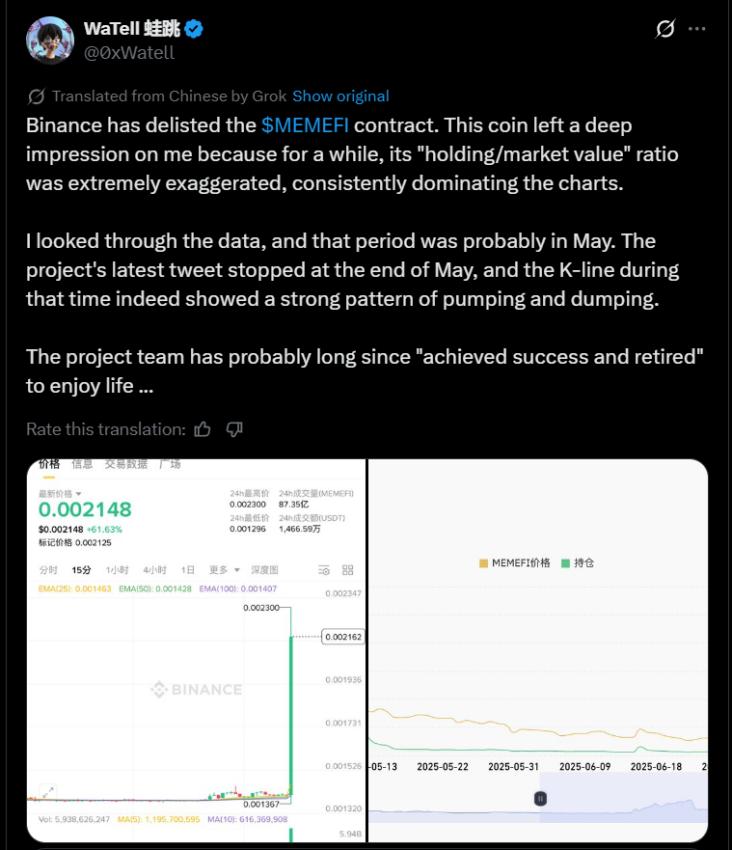

Is MemeFi a Rug Pull?

Despite MEMEFI's price surge, skepticism remains prevalent. Many observers believe this surge is primarily due to mechanical short position closures rather than genuine belief. On social media, many express doubts about whether MEMEFI's momentum can be sustained.

"Wait a minute, @Vindicatedchidi will soon post an optimistic post about #MemeFi due to this artificial surge. A token still down over 80% from its all-time high. What a naive trader," wrote famous KOL Tola Joseph Fadugbagbe.

The surge was so significant that market observers warned about potential manipulation in low-liquidity markets. Delisting often creates fear or confusion, but contrarian traders might see this news as an opportunity for volatility.

Futures delisting might signal decreased interest, but paradoxically, this reduction in activity could make the market more volatile.

Meanwhile, today's large pump also raises concerns for traders. Especially due to the prolonged silence from MEMEFI's developers.

MemeFi's official X account has not posted since late May (until today), raising concerns about project abandonment and transparency issues.

Analyst concerns about MemeFi

Analyst concerns about MemeFiRisks, Key Points, and Investor Guidelines

Short squeezes like MEMEFI's are rarely sustainable, especially in thinly traded tokens. After forced short position closures, demand typically decreases, and prices can drop as quickly as they rose.

This case emphasizes how derivative market structure and exchange policy changes can significantly impact spot token prices.

Investors should be cautious. Binance's guidelines recommend users approach volatile stages carefully and always remain vigilant about liquidation risks.

MEMEFI's surge demonstrates both the risks and unpredictability of the cryptocurrency market, reminding us to focus on fundamental factors—even during attention-grabbing price movements.