Bitcoin (BTC)

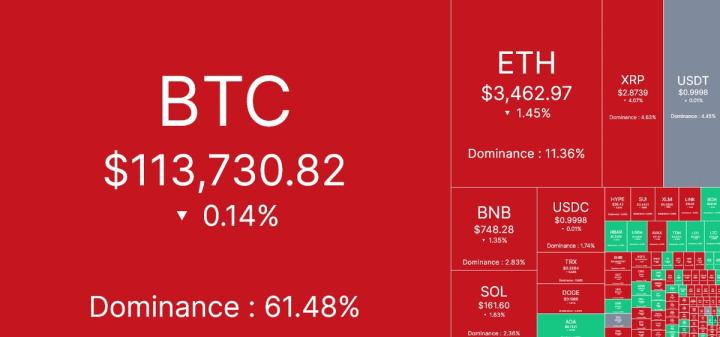

Remember that feeling when you check your phone in the morning and just know it’s going to hurt? Yeah, that was Bitcoin midweek. We went from roughly $119K down to $111K overnight, and then spent the rest of the week slowly crawling back to around $114K. In terms of technicals, the 50-day moving average is tilting down, almost like it’s shrugging at the price action, and the RSI slipped deep into oversold territory on the plunge before curling back up.

BTC/USDT 4H Chart. Source: TradingView

Why did it happen? Well, this wasn’t exactly “Bitcoin being Bitcoin” – macro smacked us around this time. Blame it all on Trump’s tariff drama, which hit stocks first.

Source: Cointelegraph

Crypto just sort of followed like the overly caffeinated risk asset it is. The Fed didn’t help either; Powell played the “we’re not cutting yet, but maybe soon” card, which kept the dollar firm and risk appetite wobbly.

Source: MSN

And yes, some crypto-specific stuff still piled on. At one point, ETFs bled $800M, then a 14-year-old BTC whale moved 80K coins (cue the “quantum threat” conspiracy tweets), and then everyone just started doomposting.

Bitcoin ETFs see outflows. Source: SoSoValue

All in all, it was no wonder we dropped so hard.

Source: Simon Gerovich

And yet somehow we didn’t break. That $111K support held, and as always, a few brave corporates – hi, Metaplanet – showed up to buy the dip. The market feels bruised, if you will, but not broken. I’m thinking if we can push back above $116K, the market will breathe again. If not, we might be playing limbo with $111K for a while.

Ethereum (ETH)

ETH was basically Bitcoin’s shadow this week. It also slid from $3,880 down to $3,360, then did the same slow crawl back toward $3,540. Like in Bitcoin, the 50-day MA here is easing downward, RSI dipped toward oversold during the flush and is now curling up.

ETH/USDT 4H Chart. Source: TradingView

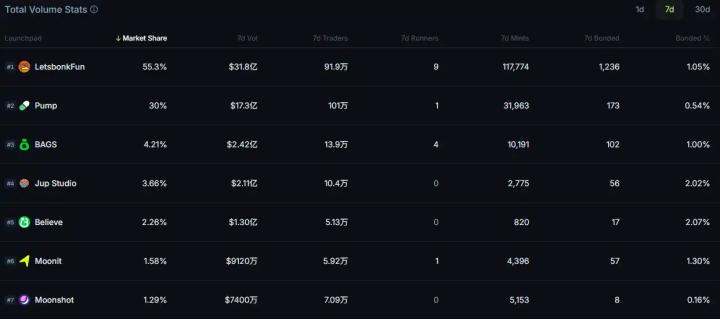

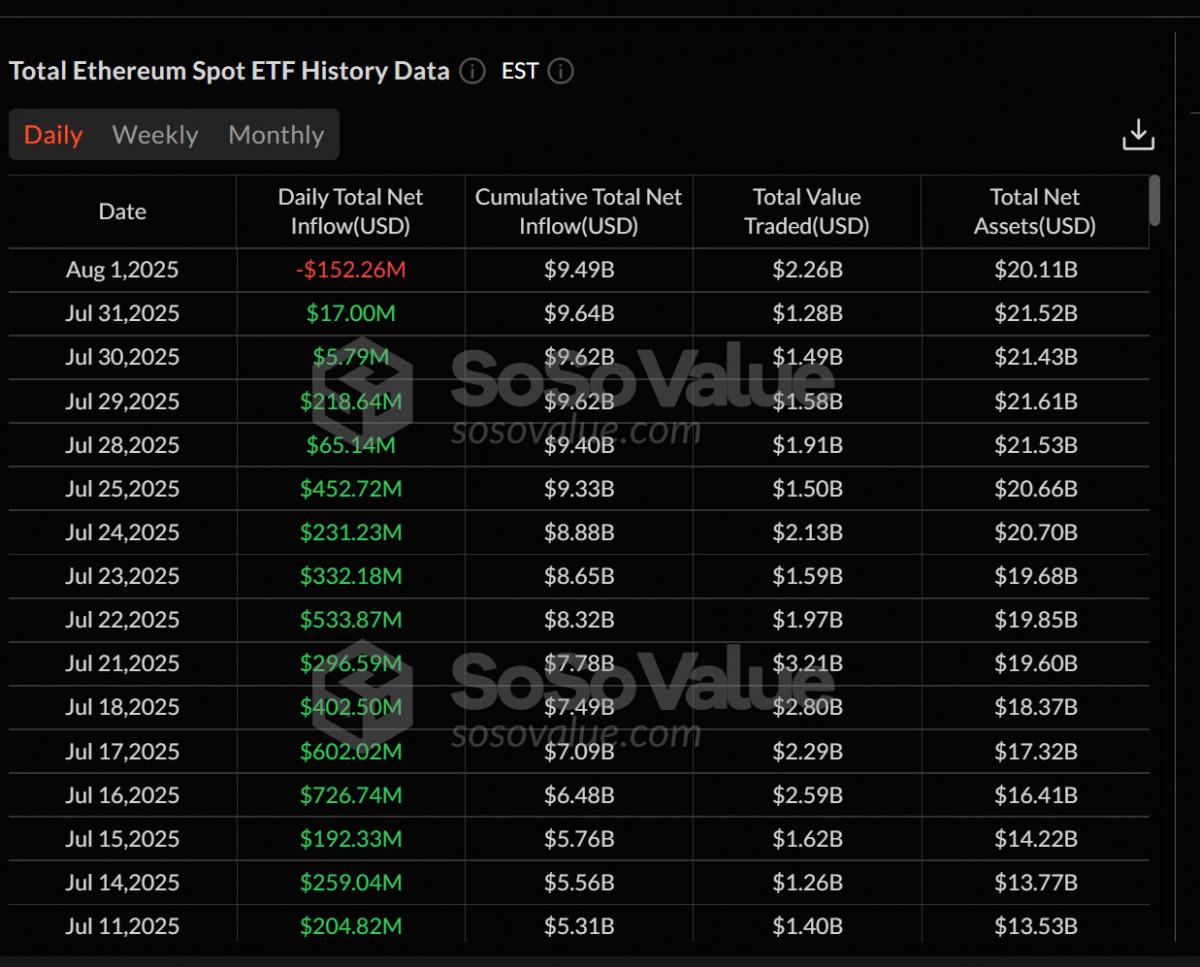

The reasons are basically the same – macro jitters, ETF outflows – but ETH had its own little drama: its spot ETF inflow streak broke after 20 days, losing $152M.

Ether ETFs end 20-day inflow streak. Source: SoSoValue

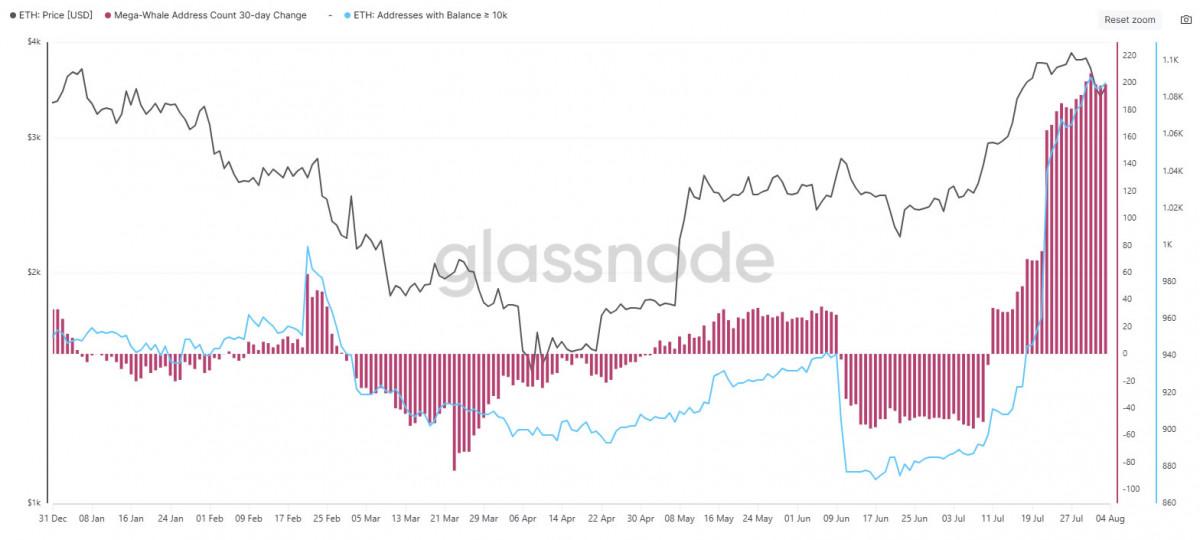

That was a gut check for the “ETH is institutional now” crowd. But the funny thing is: ‘mega whales’ kept buying into the dip, and corporate treasuries keep adding ETH like it’s the new altcoin gold.

ETH ‘mega whale’ address count surges. Source: Glassnode

So, our reckoning is that If BTC holds steady, ETH could easily retest $3,800. If Bitcoin decides to go cliff diving again, though, $3K is the soft pillow waiting below. For now, ETH is still in big-brother-follow mode.

Toncoin (TON)

And then there was TON – just sort of living its own life the whole week. While BTC and ETH were getting wrecked, TON actually rallied from $3.20 to $3.70. The RSI here never panicked the way BTC and ETH did; it cooled a bit midweek and then perked right back up, while the moving average is trending comfortably upward.

TON/USDT 4H Chart. Source: TradingView

What kept TON so lively was likely a string of ecosystem moves. As you may know, Telegram and TON are practically Siamese twins now, and this week the bond got louder. There were a few quiet but significant movements inside the app: the first native FDUSD stablecoin went live on TON, which gives the ecosystem a proper dollar backbone.

Source: TON Blog

Meanwhile, Telegram itself just kept shipping like nothing happened. The in-app gift marketplace started accepting TON directly, and suddenly all those “Telegram Stars” have real economic hooks. It’s like the app is slowly morphing into a mini-Web3 economy.

Source: Telegram

There was some real DeFi momentum, too. For one, STON.fi raised fresh capital to expand DeFi on TON.

Source: STON.fi

All of this gave TON the aura of a chain that’s quietly building a world you can touch.

Even so, we don’t think TON is fully immune to Bitcoin gravity – if BTC had nuked below $110K, we’re sure the smug little chart would have flinched. But for this week, it was the one coin in the room that felt like it was having fun, MA trending up, RSI healthy, and its ecosystem actually humming.

The post Weekly Market Wrap: BTC Holds $111K, ETH Shadows, TON Steals the Show appeared first on Metaverse Post.