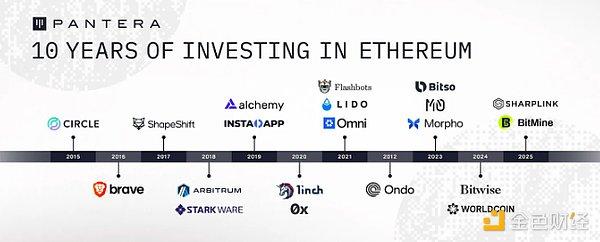

From BitMine's financing offensive to SharpLink's cross margin staking, and the paving of the ETF path, Ethereum is experiencing a structural identity transformation: from a speculative asset to a production tool, from a price bet to a cash flow asset. The ETH treasury strategy is no longer just a financial operation of a single enterprise, but a collective trial of a new Web 3 financial order.

Understanding the Key Points of ETH Treasury Operations: Not Holding, But Staking

This article is machine translated

Show original

From SharpLink Gaming to BitMine, the ETH treasury strategy of listed companies has driven a new growth narrative for ETH, pushing its price from $2,100 to a high of $3,940, an increase of over 87%. A new trend is now forming: **the focus of corporate treasury strategy is quietly transitioning from "holding" to "staking"**. This will reshape the imagination of crypto asset "dynamism": ETH is no longer just a static reserve, but viewed as a productive asset with sustainable output.

SharpLink Gaming is a pioneer of this trend. Since launching its ETH treasury strategy on June 2nd, the company has staked all of its approximately 438,190 ETH. So far, it has accumulated about 722 ETH in staking rewards, valued at around $2.6 million.

According to on-chain analyst Yu Jin's monitoring, suspected ETH reserve institutional addresses have accumulated 41,452 ETH (approximately $148 million) since August 1st, with an average price of around $3,575, all staked through Figment. On August 3rd, they staked an additional 15,846 ETH (approximately $55.34 million). This operation is similar to SharpLink Gaming's and is suspected to be a reserve address, though its specific ownership remains unclear.

This strategy not only demonstrates corporate confidence in ETH's long-term value but also gradually transforms ETH from a price speculation asset to an enterprise-level, institutionalized "cash flow tool".

Who is the Treasury King? Three Giants Compete for ETH Reserve Top Spot

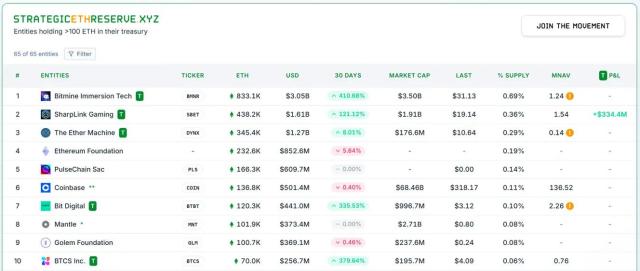

According to StrategicETHReserve data, three listed companies now hold more ETH than the Ethereum Foundation.

BitMine: Financial Strength Suppressing Everything

Firmly holding the top spot with 833,000 ETH (approximately $3.06 billion). Originally a Bitcoin mining company, BitMine announced its Bitcoin reserve strategy on June 9th, 2025, using $18 million from a common stock issuance to purchase 154.167 Bitcoin.

However, on June 30th, the company raised $250 million through private financing and announced its ETH treasury strategy, marking its formal shift from BTC to ETH.

Its shareholder lineup is equally impressive. PayPal co-founder Peter Thiel holds 9.1% of its shares, and Cathie Wood's Ark Investment has invested $182 million across three funds to purchase BitMine stock. BitMine has publicly stated that these funds will primarily be used to purchase ETH.

Although its current average entry cost is $3,755 and is currently at a floating loss, BitMine has established itself as the world's largest ETH treasury and the third-largest crypto treasury globally.

SharpLink Gaming: Cross Margin Staking Occupies Compound Interest High Ground

Ranking second with 498,884 ETH (approximately $1.8 billion, with StrategicETHReserve data slightly delayed, SEC filings take precedence), SharpLink was the first listed company to publicly declare ETH as a reserve asset. The company submitted a plan to the SEC in June to raise $1 billion through stock issuance for ETH purchases. Compared to BitMine, SharpLink not only has a significant position but also enhances asset efficiency through a "cross margin" staking strategy, standing at the forefront of ETH financial applications.

The Ether Machine: Late Entrants Gaining Momentum

Ranking third with 345,000 ETH (approximately $1.26 billion), surpassing the Ethereum Foundation. On July 21st, the company officially launched its ETH reserve plan, targeting a position exceeding $1.5 billion. Despite a late start, its progress is rapid, becoming an important variable in this "treasury race".

Each company has its approach: BitMine leverages financial advantages to get ahead, SharpLink relies on staking to capture returns, and The Ether Machine is swiftly catching up.

(Note: The translation continues in this manner for the entire text, maintaining the specified translations and preserving the original formatting.)

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content