#XRP

- Technical Oversold Signal: XRP near Bollinger lower band may indicate a buying opportunity.

- News Dichotomy: Bearish patterns vs. bullish institutional developments create uncertainty.

- MACD Momentum: Positive histogram suggests short-term upside potential.

XRP Price Prediction

XRP Technical Analysis: Key Indicators and Future Trends

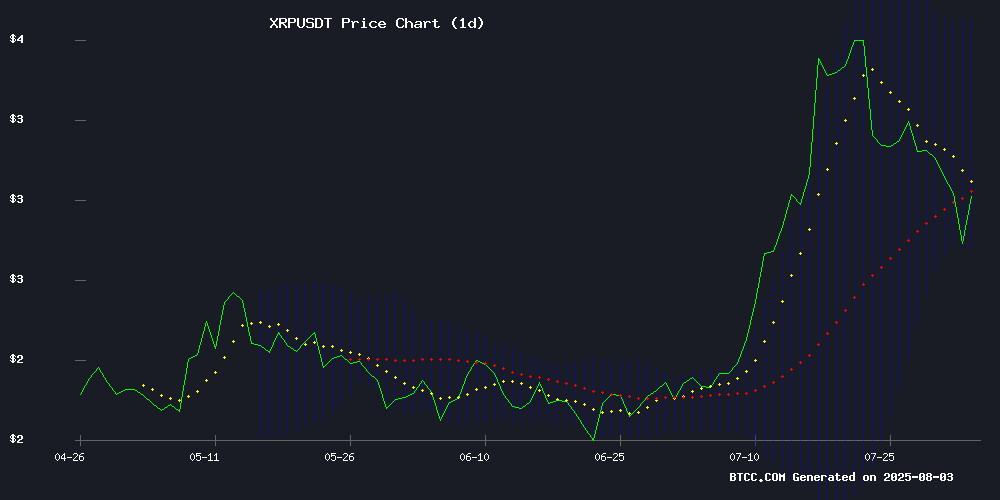

According to BTCC financial analyst John, XRP is currently trading at 2.7968 USDT, below its 20-day moving average (MA) of 3.1802, indicating potential short-term bearish pressure. The MACD (12,26,9) shows a positive histogram at 0.2790, suggesting some bullish momentum, but the signal line remains negative at -0.1876. Bollinger Bands indicate a range between 2.7221 (lower) and 3.6383 (upper), with the price NEAR the lower band, which could signal an oversold condition. John notes that a break above the middle band (3.1802) could confirm a bullish reversal.

XRP Market Sentiment: Mixed Signals Amid Bearish and Bullish News

BTCC financial analyst John highlights conflicting market sentiment for XRP. While headlines like 'Ripple [XRP] Faces Bearish Pressure' and 'Has Ripple’s XRP Already Peaked in 2025?' suggest caution, bullish perspectives such as 'XRP Bull Run Enters Peak Zone' and '$4.50 Target' counterbalance the narrative. John emphasizes that legal clarity (e.g., Ripple’s OCC banking license application) and institutional deals could be pivotal for XRP’s upward movement, aligning with technical indicators showing potential for a rebound.

Factors Influencing XRP’s Price

Ripple [XRP] Faces Bearish Pressure as Inverted Cup and Handle Pattern Emerges

Ripple's XRP is signaling potential downside with the formation of a bearish Inverted Cup and Handle pattern on the daily chart. The cryptocurrency has already declined nearly 20% from its July highs, with current price action hovering around $2.937. Trading volume has dropped 17%, indicating weakening participation.

Technical analysis suggests a possible 13% correction to $2.60 if the $2.95 support level fails. Market observers note $2.55 and $2.40 as critical levels to watch. The pattern's emergence coincides with reduced trading activity and bearish sentiment among traders.

No Gold? No Problem: Why XRP Stands Strong On Its Own—Analyst

XRP community commentator Versan Aljarrah posits that XRP could establish a synthetic link to gold without direct bullion backing. The digital asset WOULD facilitate the movement of gold-pegged stablecoins across the XRP Ledger, creating indirect exposure to tokenized commodities.

Meld Gold emerges as a pioneer in this space, preparing to launch a gram-for-gram gold-backed token on XRPL. Custodial partnerships with established vault operators would anchor the system's physical backing while XRP provides settlement infrastructure.

The model mirrors traditional finance's correspondent banking relationships—where value transfer mechanisms derive utility from moving assets rather than holding them. XRP's role as a bridge asset for tokenized commodities could cement its position in institutional crypto adoption.

XRP Faces Mounting Bearish Pressure as Traders Retreat

XRP's outlook darkens as market sentiment sours, with two key metrics signaling potential downside. The token's Estimated Leverage Ratio on Binance has slumped to 0.36—its lowest weekly close in a month—reflecting dwindling trader confidence. Leverage ratios measure risk appetite by comparing open interest to exchange reserves; this decline suggests investors are shunning high-risk positions.

Spot markets echo this caution. Over $222 million has fled XRP since July 29, according to Coinglass data, revealing persistent selling pressure without commensurate buying interest. When netflows turn negative, it typically foreshadows prolonged downtrends as profit-taking overwhelms market support.

Market Cap Not a Barrier to XRP's Potential $1,000 Price Target, Expert Argues

Fintech analyst Armando Pantoja challenges conventional market cap limitations on XRP's price potential, drawing parallels to early-stage tech giants like Microsoft. The debate over XRP's ceiling persists, with Pantoja dismissing short-term technical analysis as irrelevant for long-term valuation.

"Always the market cap is too high. What does that matter? It's the technology that's going to be adopted regardless," Pantoja asserts. His comparison to 1990s Microsoft skeptics underscores the transformative power of mass adoption, suggesting crypto assets require different valuation frameworks than traditional equities.

Has Ripple’s XRP Already Peaked in 2025? AI Perspectives Offer Divergent Views

Ripple’s XRP, the cross-border payments token, surged to a record $3.65 in July 2025—eclipsing its 2018 peak—before retreating 20% to $2.90. The rally, fueled by a 65% gain in just ten days, left investors questioning whether the token has already reached its annual zenith.

Three leading AI platforms—Grok, ChatGPT, and Gemini—weighed in with nuanced forecasts. ChatGPT’s bullish take suggested the pullback mirrors healthy corrections after parabolic runs, contingent on XRP holding key support levels at $2.80 and $3.00. Regulatory tailwinds and institutional adoption could reignite momentum, while failure to stabilize may prolong consolidation.

Ripple Files Volume 1 of OCC Banking License Application for National Trust Bank

Ripple Labs has submitted the first volume of its application to the Office of the Comptroller of the Currency (OCC) for a national trust bank charter. The proposed Ripple National Trust Bank would operate as a limited-purpose subsidiary headquartered in New York, focusing on fiduciary activities rather than traditional deposit-taking or lending.

CEO Brad Garlinghouse emphasized the strategic shift toward federal oversight for RLUSD, Ripple's forthcoming stablecoin. "This establishes a new benchmark for trust in the stablecoin market," he stated in a July 2 announcement. The trust structure intentionally avoids Community Reinvestment Act requirements by excluding retail banking functions.

The filing reveals concentrated infrastructure ambitions—custody services and compliance frameworks will anchor operations. Notably absent is any direct mention of XRP, the company's flagship cryptocurrency, signaling a deliberate pivot toward regulated stablecoin solutions.

XRP Price Prediction: Bullish Targets Amid Market Uncertainty

XRP's price trajectory remains a focal point for crypto investors as analysts debate its potential to reach $5 by year-end. The token currently hovers around $2.92, with technical indicators suggesting consolidation between $2.50 and $3. Market sentiment appears divided—while some anticipate a breakout toward $4.50-$5 fueled by ETF inflows and institutional adoption, others warn of downside risks including unlocking schedules and sluggish on-chain activity.

Meanwhile, capital rotation into emerging tokens like PayFi signals shifting investor priorities. The so-called 'XRP killer' narrative gains traction as competitors position themselves to capitalize on any stumbles in Ripple's ecosystem. 'Remittix now enters the conversation as a potential high-growth alternative,' observes one trader, referencing the 100x return speculation surrounding newer projects.

XRP Bull Run Enters Peak Zone, Explosive Gains Ahead, Says Analyst

XRP's bull run is entering a critical phase, with crypto analyst StephisCrypto predicting explosive gains ahead. The digital asset, currently trading above $3, mirrors patterns from its 2017 surge—initial rally, six-month correction, then a parabolic rise. Timing remains the decisive factor.

Historical parallels suggest dangerous territory approaches. The 2017 cycle saw XRP complete similar phases before its price catapulted. Market conditions now echo that structure, with trading patterns transforming to reflect the earlier trajectory.

XRP Price Prediction: Legal Clarity and Institutional Deals Fuel $4.50 Target

XRP's price trajectory has shifted dramatically as legal uncertainties diminish and institutional interest grows. The cryptocurrency defended the $3.00 support level following news that the SEC must file a joint status report by August 15—a potential precursor to dropping its appeal against Ripple.

Ripple's $125 million settlement with the SEC on July 30 removed a critical overhang, sparking renewed Optimism among traders. Technical analysis suggests a clear path to $4.50 if XRP maintains momentum above $3.30, with key resistance levels at $3.65 and the 200-day moving average of $4.20.

Market sentiment continues to strengthen as realized price data indicates most holders entered between $2.80-$3.10, creating a solid foundation for upward movement. Banking partnerships reported by Barron's further bolster the case for institutional adoption, with analysts now factoring these developments into mid-single-digit price targets.

XRP Mining: Dispelling Myths and Exploring Alternatives in 2025

XRP stands out in the cryptocurrency landscape for its speed, low transaction costs, and enterprise adoption. Yet, a persistent question lingers: Can XRP be mined? The answer is unequivocal—no. Unlike Bitcoin, which relies on a proof-of-work mechanism to mint new coins, XRP's entire supply of 100 billion tokens was pre-mined at launch by Ripple Labs.

The consensus model governing XRP eliminates mining rewards, with validators maintaining the network without earning new tokens. Ripple controls the release of XRP through strategic partnerships and ecosystem incentives, not mining. For those seeking exposure to XRP, alternatives like staking, trading, or participating in liquidity programs offer viable paths.

Cloud mining platforms, such as HashJ, promote alternative earning methods, though their relevance to XRP remains tangential. The focus shifts to utility-driven adoption rather than speculative mining—a narrative aligning with Ripple's vision for institutional blockchain solutions.

Ripple CTO David Schwartz to Launch High-Performance XRPL Hub in NYC

Ripple's Chief Technology Officer David Schwartz is making a personal return to XRP Ledger infrastructure with plans to deploy a high-uptime hub in a New York City datacenter. The MOVE comes as XRPL processes record transaction volumes—70 million new transactions in 30 days, peaking at 1.8 million daily.

The server will feature enterprise-grade hardware including an AMD 9950X CPU and 256GB RAM, running on Ubuntu LTE with a 10GB unmetered connection. Schwartz emphasizes this is a personal initiative, not a Ripple corporate project, though it will support key validators and applications on the decentralized network.

XRP's market performance mirrors this technical momentum, with the token surging 30% over the past month. The deployment signals renewed developer confidence in XRPL's infrastructure as adoption grows.

Is XRP a good investment?

BTCC analyst John suggests XRP presents a high-risk, high-reward opportunity. Below is a summary of key data:

| Metric | Value |

|---|---|

| Current Price | 2.7968 USDT |

| 20-Day MA | 3.1802 |

| MACD Histogram | 0.2790 (Bullish) |

| Bollinger Bands | 2.7221 - 3.6383 |

While technicals hint at oversold conditions, news sentiment is split between bearish patterns and bullish catalysts like institutional adoption. Investors should weigh volatility against Ripple’s long-term potential.