After Bitcoin (BTC) surpassed the 120,000 USD mark in July, on-chain data reveals a series of notable profit-taking activities by whales.

In this context, closely monitoring whale behavior and capital flows in and out of major platforms will be key to determining the market's next moves.

Market in a Short-Term Distribution Phase

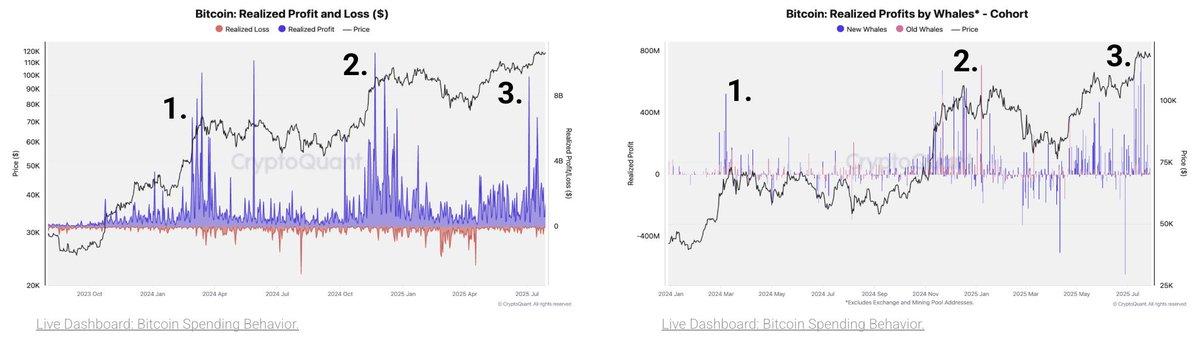

After the recent market correction, Bitcoin is trading around 115,000 USD. According to CryptoQuant, Bitcoin is entering the "third large profit-taking wave" of this price increase cycle.

Bitcoin just experienced the third large profit-taking wave in this price increase. Source: CryptoQuant

Bitcoin just experienced the third large profit-taking wave in this price increase. Source: CryptoQuantCryptoQuant notes that the profit-takers are primarily new whales who have recently accumulated and are now seeing significant profits.

Additionally, the market continues to witness some whales from the Satoshi era selling. The account ai_9684xtpa on X confirmed that some old wallets from the early days of Bitcoin are moving BTC and selling after many years of inactivity.

These wallets typically attract attention due to their potential psychological impact on the market, although their size remains small compared to the total circulating supply.

Long-Term Sentiment Remains Positive

Alongside the short-term profit-taking wave, the market still shows some notable price increase indicators. Data from glassnode shows that the current Bitcoin price is higher than the base price range of short-term holders (STH)—an important factor in forming strong support zones if the market corrects.

Cost basis of the STH group. Source: glassnode

Cost basis of the STH group. Source: glassnodeMeanwhile, Coin Bureau cited Bernstein's analysis, suggesting that the cryptocurrency price increase is still early. This perspective reinforces long-term investors' confidence, especially as institutional Capital continues to flow into the market through ETFs and platforms like Coinbase and Robinhood.

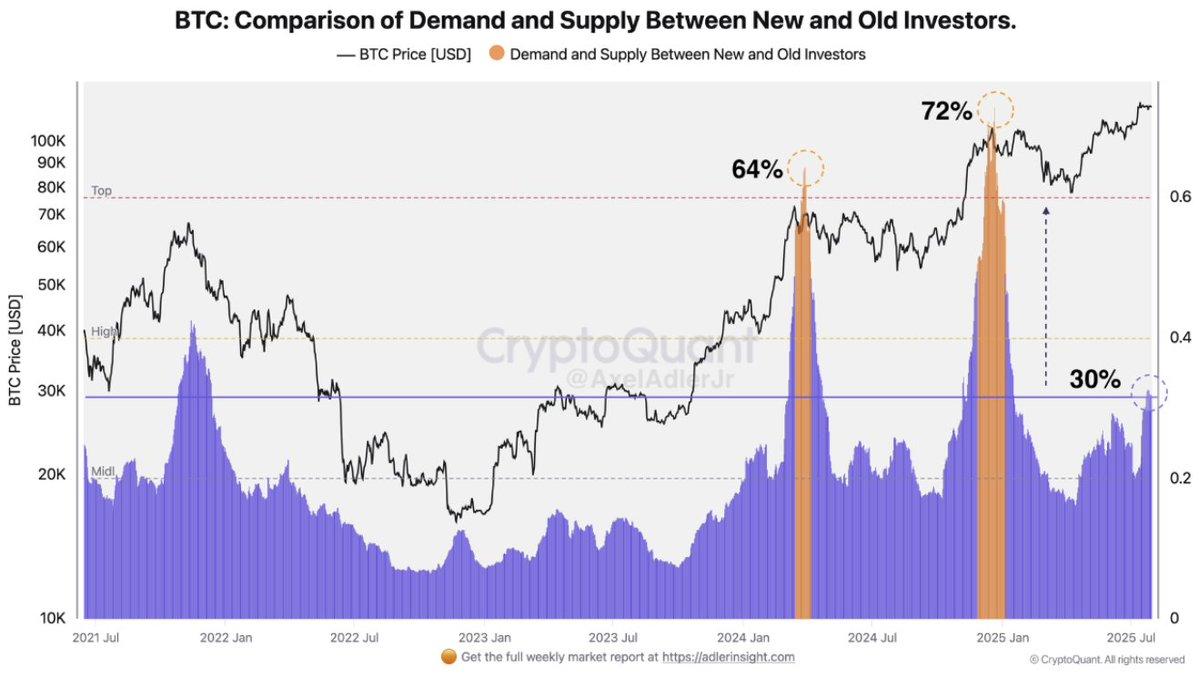

CryptoQuant also notes that new investor dominance is increasing but still has room to grow before reaching extreme levels. This indicates that the current cycle is attracting a large number of new participants, rather than revolving only around long-term holders as in previous cycles.

New investor dominance is increasing. Source: CryptoQuant

New investor dominance is increasing. Source: CryptoQuantWith the significant price increase in recent months, some analysts warn that Bitcoin may need a correction phase to regenerate buying momentum.

"July marks a shift from trend to consolidation. High speculation and profit-taking are prolonging momentum, signaling that BTC may need a correction or sideways movement before the next breakout attempt," analyst Willy Woo said.

Additionally, on-chain data from Santiment shows that whales have accumulated around 0.9% of Bitcoin's total circulating supply in just four months. This indicates that long-term confidence remains intact despite technical corrections.