Due to the recent market frenzy of listed companies expanding and buying cryptocurrencies, PIPE (Private Investment in Public Equity) and ATM (At-the-Market Offering) have been widely used by crypto concept stocks or crypto asset reserve companies in a short period of time. These two financing methods have direct and significant impacts on outstanding shares and shareholder value. Traditional stock market data platforms are inefficient, taking several days to update new share capital and market value, and currently lack complete and accurate real-time data.

To help readers keep track of the market, BlockBeats will continuously track the new share capital information of popular crypto stock concept companies during financing, manually calculate the market value and crypto asset holdings of each company, and provide a more precise basic mNAV value for reference.

Today's Crypto Stock Company Events Update

After SEC Chairman Launches Project Crypto, Multiple Listed Companies Expand "MicroStrategy" for Cryptocurrencies Today

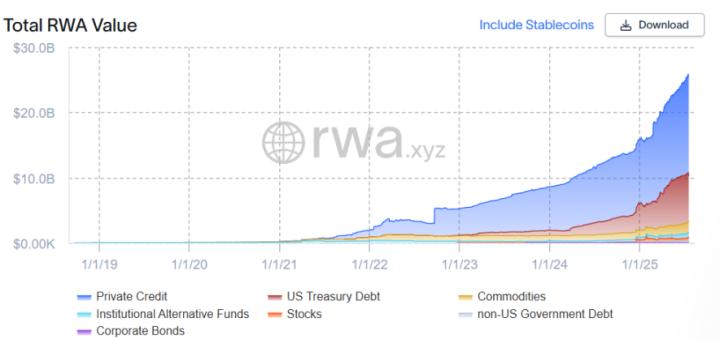

On August 1, U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins stated that we are at the beginning of a new era in market history. The SEC's Project Crypto will enable on-chain transformation of U.S. financial markets. This project will become the North Star of the SEC, helping President Trump build the United States into the "World Crypto Capital" and maintain U.S. leadership in the crypto asset market.

He said, "The SEC's primary task is to quickly establish a regulatory framework for U.S. crypto asset allocation, rather than restricting it with complex and one-size-fits-all rules. This represents not only a regulatory shift but also a historic opportunity." Companies worldwide chose to seize this "historic opportunity" on the same day, announcing updates to their cryptocurrency "MicroStrategy plans":

UK-listed Vaultz Capital raised 4.3 million pounds, with Aura Digital leading 2.6 million pounds, targeting a total financing of around 6 million pounds. Vaultz Capital added 20 bitcoins on July 21, bringing its total bitcoin holdings to 70.

London-based AI company Satsuma Technology appointed Kraken's Global Head of Policy, Jonathan Jachym, to its board as a non-executive director. His regulatory and crypto policy expertise will support Satsuma's expanding bitcoin treasury strategy. Previously, Satsuma Technology raised 100 million pounds (approximately 135 million USD) to establish a bitcoin treasury, setting a record for UK bitcoin treasury fundraising.

UK-listed Valereum plans to raise approximately 500,000 pounds by issuing about 16.129 million ordinary shares to accelerate its growth strategy, focusing on developing digital financial market infrastructure platforms and planning to establish a bitcoin treasury. Valereum expects most of its future revenue to be received in bitcoin, aligning with its strategy in physical asset tokenization.

French-listed Crypto Blockchain Industries added 21.52 bitcoins in the past three months, bringing its total holdings to 25.07 bitcoins. The company also announced a strategic partnership with SAFEbit, planning to acquire up to 2,000 bitcoins (valued over 200 million euros) by exchanging company shares at a discount, without cash payment.

Real estate investment company Cardone Capital's CEO Grant Cardone stated that on today's pullback, he has again added 100 BTC. Cardone Capital announced in June that it had purchased around 1,000 bitcoins and plans to add 3,000 more this year, becoming the first comprehensive company to combine real estate with bitcoin assets. The group owns 14,200 property units and over 500,000 square feet of A-grade office space, expecting to add 3,000 more bitcoins and 5,000 property units this year.

U.S.-listed Mill City Ventures, after completing a $450 million private placement, has officially established its SUI token reserve fund. Currently holding 76,271,187 SUI tokens at an average purchase price of $3.6389 per token, all acquired through over-the-counter agreements with the Sui Foundation. Mill City states it will continue to purchase SUI in the open market and plans to use approximately 98% of its private placement net proceeds for SUI token acquisition and reserve management.

U.S.-listed Intchains Group (ICG) announced a collaboration with FalconX to expand its ETH strategic reserve, aiming to improve ETH acquisition efficiency and launch structured ETH yield strategy products.

Strategy Plans to Raise Up to $4.2 Billion Through New Preferred Stock Issuance

According to documents submitted to the U.S. Securities and Exchange Commission (SEC) yesterday, Strategy (ticker: MSTR), the global listed company with the most bitcoin holdings, plans to raise up to $4.2 billion by issuing new series of preferred stocks. This financing plan comes just days after the company completed a nearly $2.5 billion STRC (Stretch) preferred stock issuance.

SharpLink Considering Convertible Notes to Stabilize Stock Price

SharpLink's Board Chairman, ConsenSys CEO and Founder Joseph Lubin, stated in an interview that SharpLink is considering financing through convertible notes to stabilize its stock price. So far, SharpLink has been selling its stocks through At-The-Market (ATM) offerings, which has diluted SBET investors' equity. This has caused panic and concerns, leading to a stock price drop from $37 to below $20 in less than two weeks.

SharpLink issuing convertible notes means they can raise funds without immediately diluting equity (convertible bonds carry debt risks and may cause future dilution), but in the short term, this could stabilize the market (reducing stock entering the market).

Crypto Stock Company Market Value and Premium Rate

Click to learn about BlockBeats job openings

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia