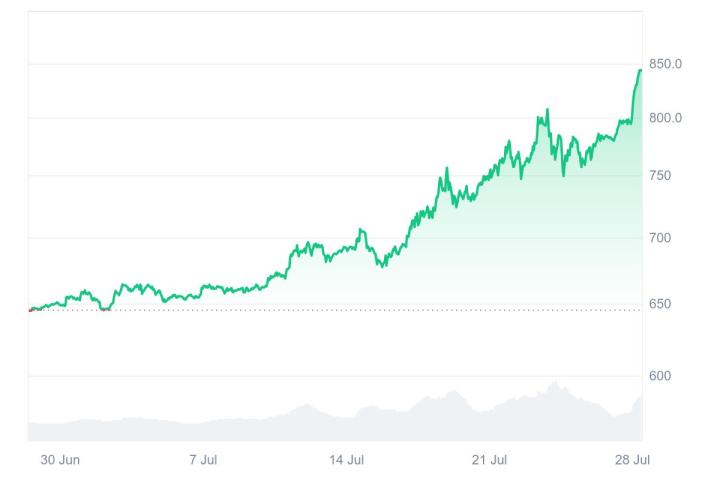

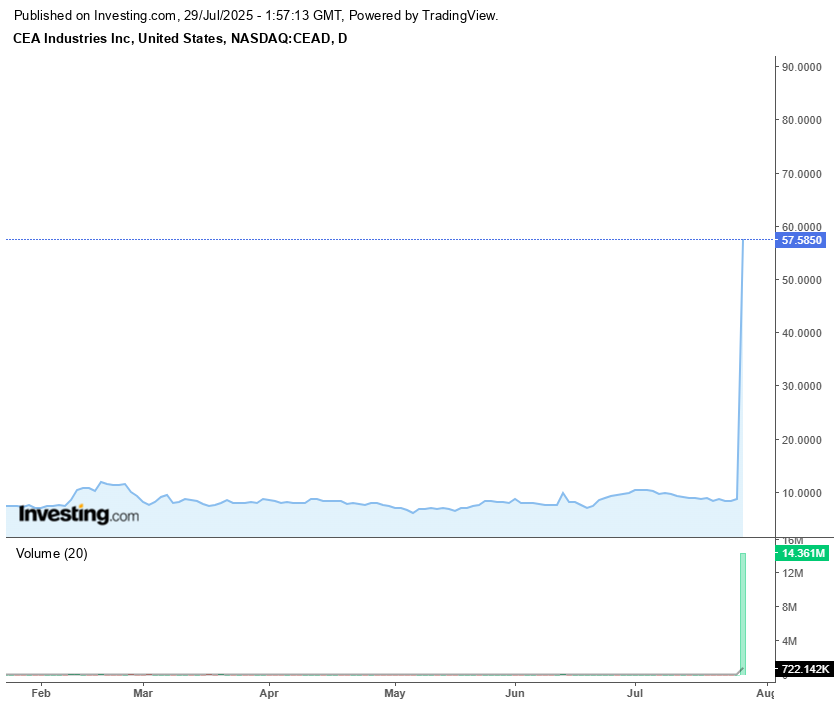

For months, speculation about which listed company BNB would use to break through Wall Street channels has been a hot topic in the crypto market. Now, the mystery is finally solved. On July 28, a Nasdaq company called CEA Industries (stock code: VAPE) provided the answer with a thrilling capital performance. Its stock price soared over 500% overnight, directly and passionately declaring that BNB's "MicroStrategy" script has officially begun, with VAPE being the protagonist of this grand drama.

This thunderous outbreak ultimately drew a conclusion for the market with a closing price of $57.585 and a single-day trading volume exceeding $910 million. This was not an ordinary speculative frenzy, but a collective vote by the capital market with real money, providing the most solid evidence for the previous concept of BNB's "reserve asset constellation". This former e-cigarette company has officially become the "MicroStrategy" flagship approved by the BNB ecosystem and led by Wall Street's top talents. If Nano Labs (NA) and Windtree (WINT)'s actions were courageous pioneer reconnaissance, VAPE's appearance marks the landing of a well-equipped "regular army". BNB's trillion-dollar capital pathway to traditional finance is no longer just a blueprint, but a reality being laid out.

Wall Street's "Bloodline Certification"

The leadership lineup of this "regular army" itself is a weighty "bloodline proof" handed to the traditional financial world.

The joining of the new Chief Investment Officer (CIO) Russell Read is undoubtedly the strongest signal. Read is not a native believer from the crypto world; he was previously the CIO of CalPERS, the largest US public pension fund managing hundreds of billions of dollars. CalPERS represents the most massive, conservative, and influential institutional capital globally. A top-tier figure who once steered such a behemoth now personally managing a listed company with BNB as its core reserve speaks volumes. This is equivalent to declaring to all global institutional funds still hesitating that incorporating BNB into asset allocation is now a serious agenda worthy of serious consideration.

The new CEO David Namdar is another gold-standard name. As a co-founder of Galaxy Digital, a Wall Street digital asset financial services giant, Namdar deeply understands how to navigate crypto assets within a compliant framework. His presence ensures the professionalism and compliance of this action. With the investment endorsement from top crypto funds and market makers like Pantera Capital, GSR, Arrington Capital, and direct support from CZ's family office YZi Labs, VAPE's lineup is luxurious. It clearly shows that this is not an internal crypto circle self-hype, but a serious financial engineering led by Wall Street elites, with core crypto forces participating, aimed at connecting two worlds.

The power of this top-level design is similar to what MicroStrategy did for Bitcoin. When traditional investors could not or were unwilling to directly hold Bitcoin, Michael Saylor transformed MicroStrategy (MSTR) into a compliant, publicly tradable Bitcoin proxy investment tool, successfully leveraging stock market funds. Now, VAPE and its leadership team are replicating this path for BNB, but with an even more sophisticated structure - it's not a solo performance by a single company, but the flagship of an intended "reserve constellation" composed of multiple listed companies.

From "Guerrilla Exploration" to "Group Army Offensive"

VAPE's appearance also clarifies the strategic roles of other "BNB concept stocks" in the market. Nano Labs and Windtree are more like brave pathfinders, their actions verifying the feasibility of this path but also exposing the limitations of scattered actions. NA's funds primarily come from future convertible debt issuance, while WINT's financing depends on a stock credit line pending shareholder meeting approval, with limited action certainty and scale.

VAPE is entirely different, representing a standardized "group army offensive". Its $500 million private placement (PIPE) is already oversubscribed and a done deal, "money in the pocket". The $750 million warrants included in the agreement provide a powerful ammunition depot for subsequent continuous purchasing power. According to the plan, the transaction will be settled around July 31, with the first batch of positions expected to be rapidly established between August and October.

This transformation from "intention" to "certainty", from "scattered" to "systematic" is crucial. It means the structural demand for BNB will transform from a trickle to a torrent. When a company managed by a former CalPERS CIO, holding hundreds of millions in cash, clearly declares its sole mission is to "buy and hold BNB", the market's pricing logic will fundamentally change. BNB's valuation model now has an additional powerful and continuous variable: structural buying from a Nasdaq-listed company.

Value Flywheel and the Art of Dilution

With VAPE's upcoming "buy, buy, buy" mode, a precise value transmission mechanism will be activated. VAPE's open market BNB purchases will provide solid support for coin prices; BNB's price increase will directly enhance VAPE's balance sheet value, thereby pushing up its stock price; a higher stock price will enable more favorable new fundraising; the raised funds can then be used to buy more BNB. Once this self-reinforcing cycle forms, it will provide continuous growth momentum for BNB.

However, for VAPE's stock investors, this is an art of dilution. To continuously finance BNB purchases, the company needs to constantly issue new stocks, which will inevitably dilute existing shareholders' equity. Therefore, investing in VAPE stock is essentially a precise calculation: investors are betting that BNB's price appreciation will outpace the dilution speed from stock issuance, making their increasingly smaller company stock represent an asset portfolio growing in value even faster.

This is the charm and challenge of the "MicroStrategy" model. It creates near-certain benefits for the BNB asset itself but ties its stock price's fate more deeply to BNB's performance. The $910 million transaction on July 28 is a microcosm of countless investors quickly learning, judging, and deciding on this model.

The Beginning of a New Paradigm

VAPE's stunning appearance on Nasdaq is not an isolated capital carnival. It is an external signal of BNB's profound transformation, marking that its "institutional-grade reserve asset" narrative has moved from theoretical derivation to live verification.

The profound significance of this event goes beyond BNB itself. It points to a completely new direction for how mainstream crypto ecosystems can deeply integrate with the global financial system and draw strength from it. At a time when direct token IPO paths are fraught with regulatory uncertainty, building an "Asset-Backed Network" - a network whose value is defined not only by on-chain economic activity but also by the asset value anchored behind it and flowing in compliant capital markets - may become a new paradigm.

The BNB historical high and VAPE's stock price surge we see may not be the end of this market movement. As the first batch of $500 million is injected into the market in the coming months, the purchasing power from Wall Street's "regular army" is just beginning to show. The thunderous sound heard on Nasdaq might just be the beginning of a more grand narrative.