Sharing a video I recently saw with everyone.

A private fund manager recently talked about a case in an interview:

In 2012, he studied Maotai, and for the next 3 years, Maotai had almost zero growth. But during the same period (2012 to 2015), Letv rose nearly 30 times.

At that time, those who bought Maotai were mocked by those who bought Letv when they sat together for a meal.

This situation easily gives people a feeling that:

Just look at capital flow, forget about fundamentals. You can still buy a shit coin and rise several times, holding onto a performance stock for years is not as good as buying a shit coin for a few months.

However, this manager precisely believes that the more such a market is, the more one should pay attention to risks. Because when a shit coin rises to the sky, common sense should tell you whether this is an opportunity or a risk.

The long-term result of such a market is definitely a zero-sum game. Interestingly, most active participants in such a market will believe they are smarter than others, but the final result is almost always a complete mess, with no one spared.

After the fact, this fund manager investigated the people around him who bought Letv and were once proud of its rise of tens of times, and the result was that no one made money from this stock.

The principle reflected in this example is actually very simple:

The market is often very irrational, especially when the bubble is huge, and this performance is even more severe. Worse, whenever such a bubble is blown up, many participants believe they are good at using this bubble and rush into it without hesitation. At this time, understanding and adhering to the value of the investment target becomes incredibly important and precious. It is not only the last line of defense for investors but also the only way to avoid falling into traps.

Such stories are repeatedly staged in various investment markets, in different periods. Although many investors have learned and even repented of such lessons repeatedly, whenever history repeats itself, human greed immediately makes most participants forget history and lessons, and plunge in again with great enthusiasm.

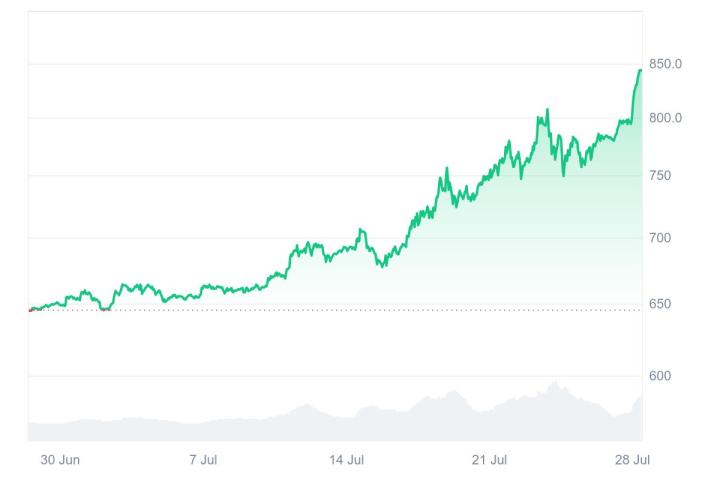

Comparing with the crypto ecosystem, thinking about my past experiences. At least so far, the assets I have a large position in (Bitcoin and Ethereum) seem to have not experienced a case like Maotai: from the beginning of buying (starting regular investment), the price does not rise at all after three years.

I'm wondering, if one day the Bitcoin and Ethereum I bought are like Maotai in the previous example, with fundamentals continuing to improve but the price not rising for three years, will I still believe Bitcoin and Ethereum have value?

Moreover, if at the same time, another potential shit coin rises tens of times in these three years, although I know from the bottom of my heart and can judge that it has no value, will I waver in my judgment standards and value orientation due to the extreme irrationality of the market, and go with the flow and change my behavior?

At this moment, I cannot give a definitive answer.

From this perspective, for predecessors like Buffett, Munger, and Duan Yongping who have experienced investment markets for decades, seen countless cases of Maotai and Letv, and withstood numerous irrational market baptisms, yet remain so calm in adhering to their methods and beliefs, this is not something ordinary people can do.

If viewed by current correct standards, belief, faith, and values for them truly have penetrated their mind, heart, and soul.