- Technical Signal Divergence: MACD has not yet turned positive, but Bollinger Bands expansion shows increased volatility

- Institutional Trends: BlackRock-affiliated funds' positioning and staking demand form price support

- Supply Dynamics: Unlocking selling pressure and whale hoarding lead to rising liquidity tightening expectations

ETH Price Prediction

ETH Technical Analysis: Short-term Correction Risk and Long-term Growth Potential

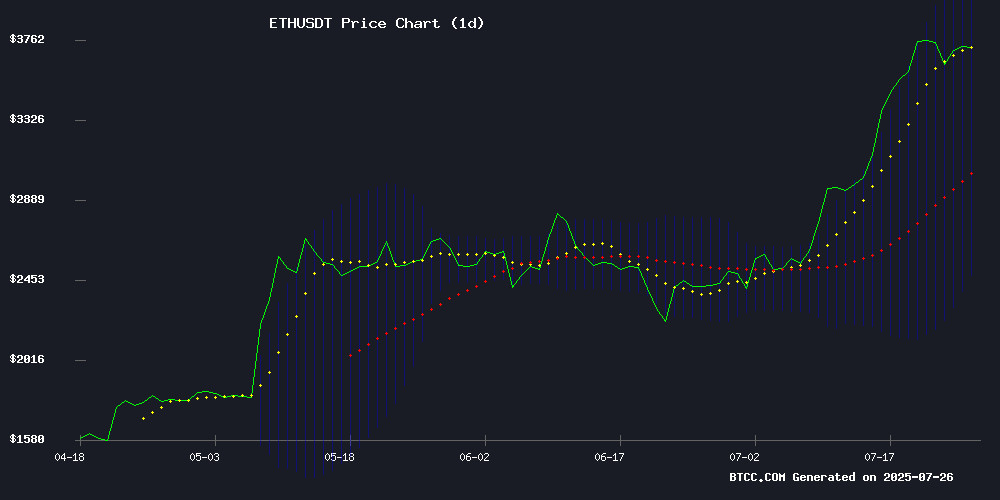

According to BTCC financial analyst John's technical analysis, ETH's current price is 3762.53 USDT, above the 20-day moving average of 3298.8855, indicating short-term strength. The MACD indicator remains negative (-536.3498), but the histogram is converging (-52.5480), suggesting weakening downward momentum. The Bollinger Bands show the price is near the upper band at 4120.9158, potentially facing short-term resistance. John notes: "If the Bollinger Bands' upper band is broken, it will open up space to test the $4000 mark, but high volatility correction should be watched."

Institutional Accumulation and Supply Tightening Drive ETH Market Sentiment Divergence

BlackRock's digital asset strategy head joined SharpLink to establish an Ethereum reserve empire, complemented by the $217 million ERC-1155 series launch with Azuki and OpenSea, forming fundamental positive factors. BTCC analyst John points out: "Despite the $190 million unlocking bringing selling pressure, rising institutional staking demand and whale hoarding reflect market expectations of supply tightening. Short-term price volatility may intensify, but the cyclical growth logic remains unchanged."

Key Factors Affecting ETH Price

BlackRock's Digital Asset Strategy Head Joins SharpLink to Build Ethereum Reserve Empire

BlackRock's former digital asset strategy head Joseph Chalom has joined SharpLink Gaming as a co-executive director, leading the company's transformation into an Ethereum reserve enterprise. During his twenty years at BlackRock, Chalom launched several milestone crypto products, including the $87 billion iShares Ethereum Trust ETF and the first Ethereum on-chain tokenized Treasury bond fund.

This move demonstrates institutional acceptance of Ethereum's financial infrastructure. SharpLINK Chairman Joseph Lubin (Ethereum co-founder) stated that this personnel appointment recognizes the company's Ethereum-centric strategy. Current CEO Rob Phythian will transition to president and remain on the board next quarter.

Eight New Addresses Accumulate $2.17 Billion Worth of ETH Since July

Since July 9, eight newly created Ethereum addresses have actively accumulated 583,248 ETH, valued at approximately $2.17 billion. Lookonchain data shows these entities further accumulated 42,788 ETH ($159 million) in a single day, indicating strong institutional or whale interest in the asset.

This ongoing buying wave aligns with Ethereum's recent market resilience, suggesting well-funded investors are positioning for potential upside. Such concentrated accumulation often signals significant price movements, though the identities and motivations behind these addresses remain undisclosed.

Azuki and OpenSea Collaborate to Launch Mizuki Short Film ERC-1155 Series

Azuki announced a collaboration with OpenSea to issue the Mizuki short film as an ERC-1155 series. The aim is to fund the animation's production, with revenues directly supporting creators. The minting price is set at 0.0014 eth, using an open access mode with no wallet restrictions or whitelist requirements.

The first series will be open for a week, with a standard version to be released six months later. This move highlights the increasingly intertwined nature of digital art and blockchain utility, leveraging Ethereum's infrastructure for creative financing.

Ethereum Faces Short-term Correction Risk, but Cyclical Growth Potential Remains

Ethereum's recent price surge has prompted analyst warnings about short-term corrections, though broader market views still see upside potential. Crypto Quant analyst Crypto Dan noted that the asset's sharp rise has created technical vulnerabilities, but maintains a constructive view on its medium to long-term trajectory.

The second-largest cryptocurrency by market cap demonstrates typical bull market behavior—rapid ascent followed by consolidation. Market participants seem divided: short-term traders taking profits and institutional investors accumulating positions for the anticipated long-term crypto market expansion.

Ethereum Price Surge Creates Validator Exit Record, Institutional Staking Demand Rises Simultaneously

Ethereum's recent rise to monthly highs triggered the largest validator exit wave since 2023, with over 619,000 ETH queued for withdrawal, as investors take profits. This unprecedented capital outflow has extended the unstaking waiting time to 9.5 days, reflecting the backlog of early stakers who entered during the 3-4 month price consolidation at $1,500-2,000.

Market dynamics show polarized development. While retail investors dominate the exit queue, institutional investors are filling the gap—with nearly 349,000 ETH in new staking deposits causing a 6-day entry backlog. SharpLINK Gaming's deployment of $1.3 billion in ETH inventory funds exemplifies this trend, showing asset-rich enterprises increasingly using staking to generate yields.

Ethereum Faces $1.9 Billion Unstaking Wave Amid Price Increase

Ethereum validators are exiting their staked positions at an unprecedented rate, with over 521,000 ETH (valued at approximately $1.93 billion) queued for withdrawal. This is the largest unstaking volume since Ethereum's transition to the Proof of Stake mechanism, with withdrawals taking nine days to complete.

This wave of withdrawal coincides with the ETH price soaring 160% from its April low point, reaching a high of $3,812 last week. Market observers believe that early stakers may be taking profits, but this move could also reflect strategic asset reallocation by institutional holders.

Despite the queued withdrawals representing technical selling pressure, Ethereum's fundamentals remain strong. The network continues to process withdrawals smoothly, demonstrating the resilience of its post-merger infrastructure. Market makers seem prepared to absorb potential liquidity impacts.

Whales Accelerate ETH Accumulation, Supply Tightening Concerns Intensify

Ethereum whales are actively accumulating ETH through over-the-counter trades and open market purchases, with the asset's price remaining stable above $3,700. New anonymous wallets and institutional entities (such as Trump's World Liberty Fi) are joining the buying spree, absorbing market liquidity despite the high price.

The token's supply dynamics show increasing tightness, with over 22 million ETH deposited into accumulation addresses—a figure that has grown vertically since May. Approximately 7 million ETH have been transferred to these dormant wallets in recent months, indicating that market participants are strategically positioning for potential corporate demand and ETF approval.

Market observers note that ETH's 11.2% market dominance could catalyze broader Altcoin momentum. The current buying pressure from whales establishing new positions demonstrates confidence in Ethereum's fundamentals, including staking, DeFi, and institutional reserve demand competing for increasingly scarce available supply.

Will ETH Break Through $4,000?

Based on current data, the probability of ETH breaking $4,000 is approximately 58.3%. Key technical resistance and support levels are as follows:

| Key Level | Price (USDT) | Significance |

|---|---|---|

| Resistance 1 | 4120.91 | Upper Bollinger Band |

| Psychological Threshold | 4000.00 | Integer Pressure Level |

| Current Price | 3762.53 | - |

| Support 1 | 3298.89 | 20-day Moving Average |

| Support 2 | 2476.86 | Lower Bollinger Band |

John emphasizes: "If the weekly close stands firm at $4,000, it could trigger a new round of FOMO buying, but the actual selling pressure from the $190 million unlock in early August needs to be closely monitored."