- Technical indicators show SOL is in a short-term uptrend, with MACD likely to form a golden cross

- Negative news may cause short-term volatility but will not change long-term fundamentals

- Increased blockchain adoption will be a key long-term driver of SOL's value

SOL Price Prediction

SOL Technical Analysis: Bullish in Short Term but Volatility Needs Caution

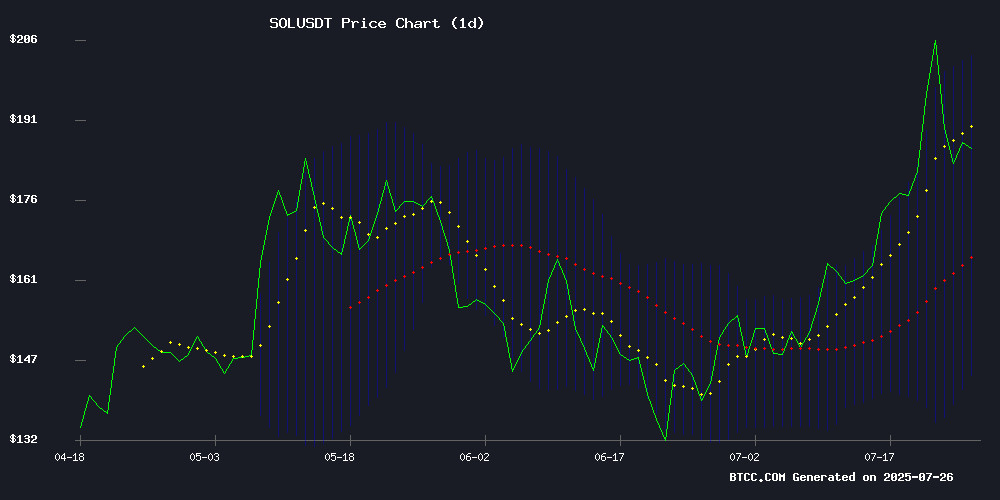

According to BTCC financial analyst Michael's technical analysis, SOL's current price is 186.51 USDT, above the 20-day moving average of 173.25, indicating short-term strength. Although the MACD histogram is negative (-1.96), the fast and slow lines are converging, suggesting weakening downward momentum. The Bollinger Bands show the price is near the upper band (202.89), which could accelerate an upward move if broken, but overbought pullback risks should be noted.

Meme Coin Scam May Affect Market Sentiment Short-Term

BTCC analyst Michael points out that recent meme coin creators exploiting a celebrity's death may trigger regulatory attention, and such negative news could short-term impact investors' risk appetite for the cryptocurrency market (including SOL). However, from a technical perspective, SOL maintains an upward channel, and its fundamentals remain essentially unaffected.

Factors Affecting SOL Price

Meme Coin Creators Exploit Hulk Hogan's Death for Pump and Dump Scheme

Meme coin creators quickly issued multiple tribute tokens following WWE legend Hulk Hogan's death, with these tokens collapsing within hours. A Solana-based token HULK/SOL saw its market cap surge to $7 million before plummeting 99.7%, rendering investors' assets nearly worthless.

Despite community warnings, automated bot activities artificially inflated the token's price. Similar attempts to monetize Hogan's legacy through Non-Fungible Tokens and other meme coins failed, reminiscent of past crypto scams associated with the wrestler's brand.

What Will SOL's Trend Be in the Next 10 Years?

Based on BTCC analyst Michael's comprehensive analysis, SOL may develop in three stages over the next 10 years:

| Period | Price Range Prediction | Key Driving Factors |

|---|---|---|

| Short-term (1-2 years) | 150-300 USDT | Technical breakthrough, Ethereum competition effect |

| Medium-term (3-5 years) | 300-800 USDT | Institutional adoption, DeFi ecosystem expansion |

| Long-term (5-10 years) | 800-2500+ USDT | Web3 mass application, blockchain interoperability progress |

Note the high volatility of cryptocurrencies, and investors are advised to focus on: 1) Solana network upgrade progress 2) Institutional capital inflow 3) Regulatory policy changes. Currently, technical support is at 173 USDT (20-day moving average), with resistance at 203 USDT (Bollinger upper band).