- Technical aspect shows a bullish arrangement: Price stabilizes above the 20-day moving average with the Bollinger Bands opening upward

- Increased institutional activity: Large exchange transfers and treasury strategies indicate accumulation intentions

- Ecosystem upgrade: AI and Layer2 collaboration enhances Ethereum infrastructure value

ETH Price Prediction

Ethereum Technical Analysis: Short-term Bullish Signals Emerge

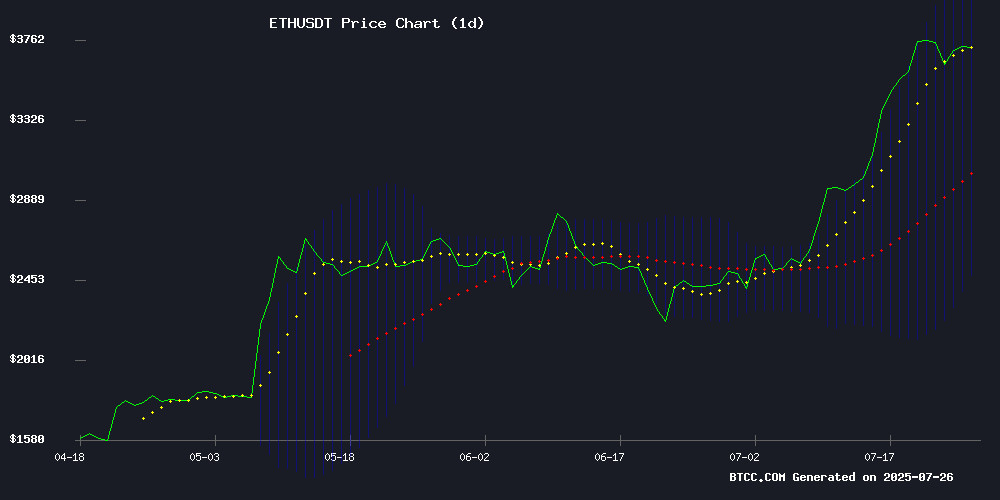

According to BTCC financial analyst Robert, ETH's current price of 3741.26 USDT has broken through the 20-day moving average of 3297.82, forming a golden cross. Although the MACD histogram is negative (-51.2875), the fast line (-534.7742) and slow line (-483.4867) are converging, indicating weakening downward momentum. The Bollinger Bands channel is expanding (upper band 4117.50/middle band 3297.82/lower band 2478.14), with the price stabilizing above the middle band, potentially testing the upper band resistance in the short term.

Institutional Trends and Ecosystem Development Boost Ethereum Demand

BTCC analyst Robert interprets that recent large ETH transfers on Coinbase may signal institutional positioning, and Sandclock's ETH treasury strategy has accumulated 2,477 ETH. More notably, the collaboration between AIDEN and INTMAX will enhance Ethereum's AI application infrastructure, potentially driving ETH's transformation from a "misunderstood asset" to an on-chain reserve currency, with its long-term ecosystem value being re-evaluated by the market.

Key Factors Affecting ETH Price

Massive Ethereum Transfer to Coinbase Draws Market Attention

A significant Ethereum transaction has caught market attention, with 3,581 ETH (worth approximately $50.7 million) transferred from an unknown wallet to Coinbase exchange. This transaction was tracked by the WhaleAlert monitoring system, becoming one of the largest institutional-level Ethereum transfers this week.

Such large fund deposits to regulated exchanges typically signal institutional asset reallocation or strategic positioning. This comes at a time when speculation is heating up about the potential approval of an Ethereum ETF and renewed institutional interest in digital asset infrastructure.

Sandclock Launches ETH Treasury Strategy, Accumulates 2,477 ETH

Sandclock, a decentralized wealth management platform with SOC-2 certification, has officially launched its ETH treasury strategy. The platform currently holds 2,477 ETH, surpassing API3 DAO and ranking 34th in Ethereum reserves.

This move highlights the growing institutional confidence in Ethereum as a reserve asset. Sandclock's compliance-oriented operation model, including on-chain insurance support, makes it a noteworthy participant in the decentralized finance space.

AIDEN and INTMAX Collaborate to Enhance AI-Driven Decentralized Applications on Ethereum

AIDEN, an AI-driven Web3 search engine, has formed a strategic alliance with INTMAX Hub, a privacy-focused Layer 2 scaling solution on Ethereum. This collaboration aims to combine AIDEN's AI capabilities with INTMAX's high-speed, low-cost infrastructure to develop more intelligent and scalable decentralized applications.

INTMAX Hub utilizes zero-knowledge proofs and Plasma architecture to provide efficient, secure transactions. This integration will enable AI-driven services in the decentralized ecosystem, offering users enhanced functionality and engagement.

This collaboration reflects the growing convergence of AI and blockchain scaling solutions. As projects seek to address throughput limitations while maintaining privacy and security, Ethereum's Layer 2 ecosystem continues to evolve.

Ethereum's Evolution: From Misunderstood Asset to On-Chain Reserve Currency

Ethereum (ETH) is undergoing a fundamental transformation, gradually becoming a scarce, programmable reserve asset that underpins the security and functionality of a rapidly expanding on-chain economic system. Its adaptive monetary policy is expected to see inflation steadily decline to just 0.89% by 2125, far below the historical growth rate of 6.36% for traditional fiat monetary systems like the US M2 money supply.

Institutional adoption has been a key catalyst, with financial giants like JPMorgan and BlackRock building infrastructure on Ethereum. This drives continued demand for ETH as an on-chain value settlement layer. The 88% correlation between staking activity and on-chain asset growth highlights its core economic position.

On May 29, 2025, regulatory transparency advanced as the SEC released guidelines on staking terms. This development paved the way for Ethereum ETF applications to include staking provisions, further establishing ETH's role in institutional portfolios.

Is ETH a Good Investment Right Now?

From a risk-reward perspective, ETH currently offers a triple advantage:

| Indicator | Value | Implied Signal |

|---|---|---|

| Price/20MA | +13.4% | Medium-term trend strengthening |

| Bollinger Bands Position | Upper band 4117.5 | Short-term upside potential of about 10% |

| MACD Divergence | Fast and slow lines converging | Downward momentum weakening |

In conjunction with ecosystem development, Robert suggests adopting a 'gradual positioning on pullbacks' strategy, with strict stop-loss measures if the price breaks below the 20-day moving average.