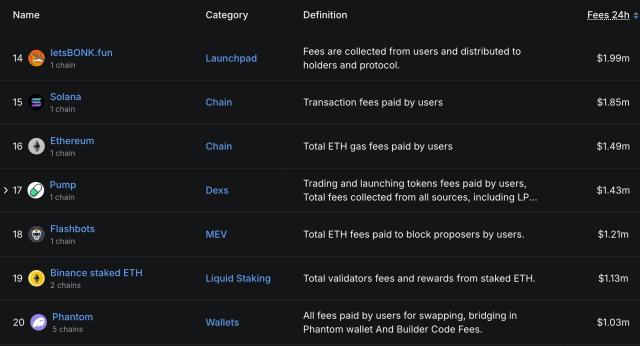

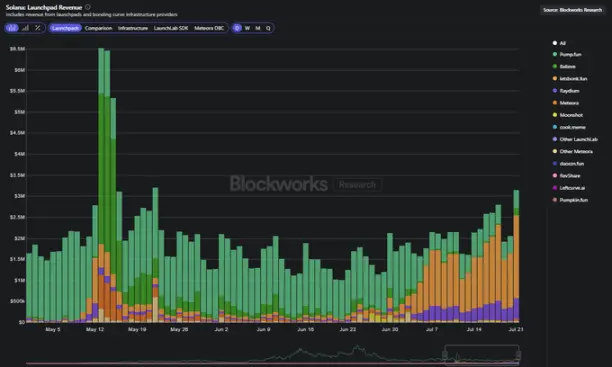

@bonk_fun and @pumpdotfun are competing for Launchpad dominance. Bonk's rise over the past month has solidified its leading position in Solana Launchpad revenue. What else can we discover by analyzing Bonk's growth? Let's delve deeper.

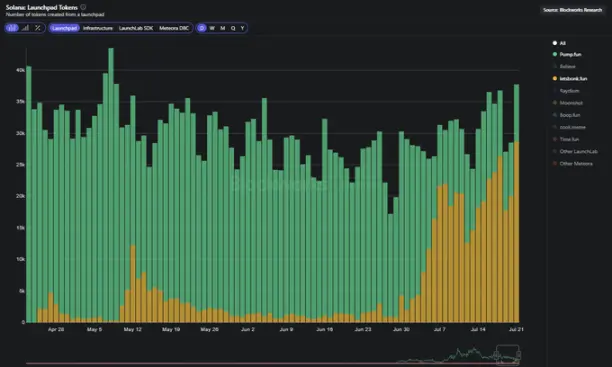

Before Bonkfun, Pumpfun consistently issued 30,000 to 40,000 tokens daily. Since Bonk's takeover, the total token issuance across platforms has remained relatively stable. However, Bonk now issues over 25,000 tokens daily, while Pump's daily token issuance is below 10,000.

As the number of tokens grows, Bonk's token market capitalization has also increased. With the platform's expanding market share, the number of tokens with a market cap exceeding $1 million is trending upward.

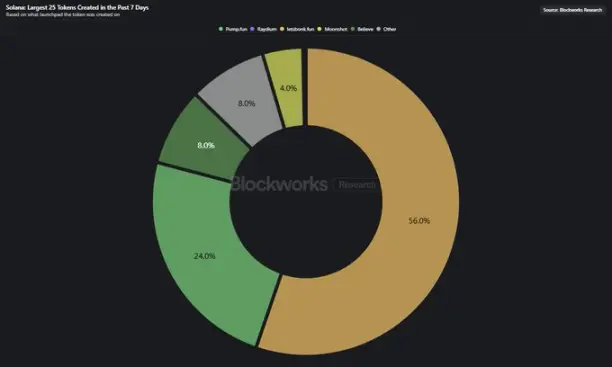

We also discovered that most of the highest market cap tokens issued in the past 7 days came from Bonkfun. The growth in issuance, trading volume, and market cap may be accelerating a flywheel effect, with traders favoring Bonk-based tokens due to their outstanding performance.

Interestingly, the proportion of high-frequency traders on the Pumpfun platform is higher than on Bonk. This might indicate an increasing presence of professional consumer traders or bots, which is intriguing considering Bonk's overall growth in tokens and trading volume.

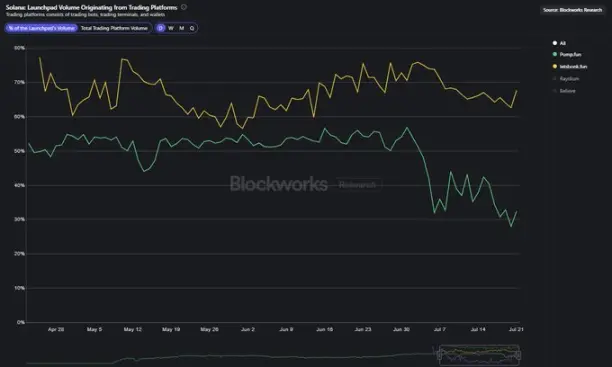

We also found that over two-thirds of Bonkfun's trading volume comes from third-party trading applications. Meanwhile, Pump's proportion has dropped from over half to around 30%.

A few months ago, Pump firmly controlled the market. But in recent weeks, Raydium and Bonk have swept the token issuance market, challenging Pump's position. With Pump's recent financing and token issuance, we can't help but wonder how the team will respond.