Ethereum (ETH) continues to attract institutional interest despite recent price adjustments. In just this week, over $1 billion has flowed into ETH investment funds, showing increasing institutional interest in this asset.

However, the coin's price performance does not reflect this positive investment activity. Despite significant inflows, ETH remains under pressure, mainly due to increased profit-taking by long-term investors (LTHs)).

Ethereum Inflows Reach 11-Week Chain When Price Drops Below $3,$3,600

According to SosoValue, the second-largest cryptocurrency by market capitalization is currently experiencing its eleventh consecutive week of net inflows into ETH ETFs. This is in stark contrast to Bitcoin (BTC), which has recently seen significant net outflows as the price decline seems to have shaken investor confidence.

To update TA and token market: Want more information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

< img alt="Total net inflows into Ethereum Spot ETF." src="https://static.fwimg.io/img/feed/b45a93f378931ef9e8e64ddfa5ff96b1..jpg">Total net inflows into Ethereum Spot ETF. Source: SosoValueHowever, despite the strong institutional support for ETH, the inflows have not translated into price momentum. On the contrary, ETH's price continues to decline, weighed down by increased profit-taking activity.

At the, altcat $, down 5% since Monday. What is causing this price decline?

< h2>Smart Money Quietly WithdrawingOn-chain data shows an increase in ETH Liveliness, which implies that long-term investors (LTHs), typically the most steadfast in the market, are increasingly sellingelling their coins. At the time of writing, this indicator stands at 0.69.

ETH Liveliness. Source: glassnode

ETH Liveliness. Source: glassnodeLiveliness measures the movement of long-held tokens by calculating the ratio between the number of days coins are destroyed and the total number of days coins are accumulated. When it decreases, LTHs are moving their assets off exchanges and choosing to hold.

Conversely, when it increases like this, many inactive tokens are being moved or sold, long signaling profit-taking from long-term investors.

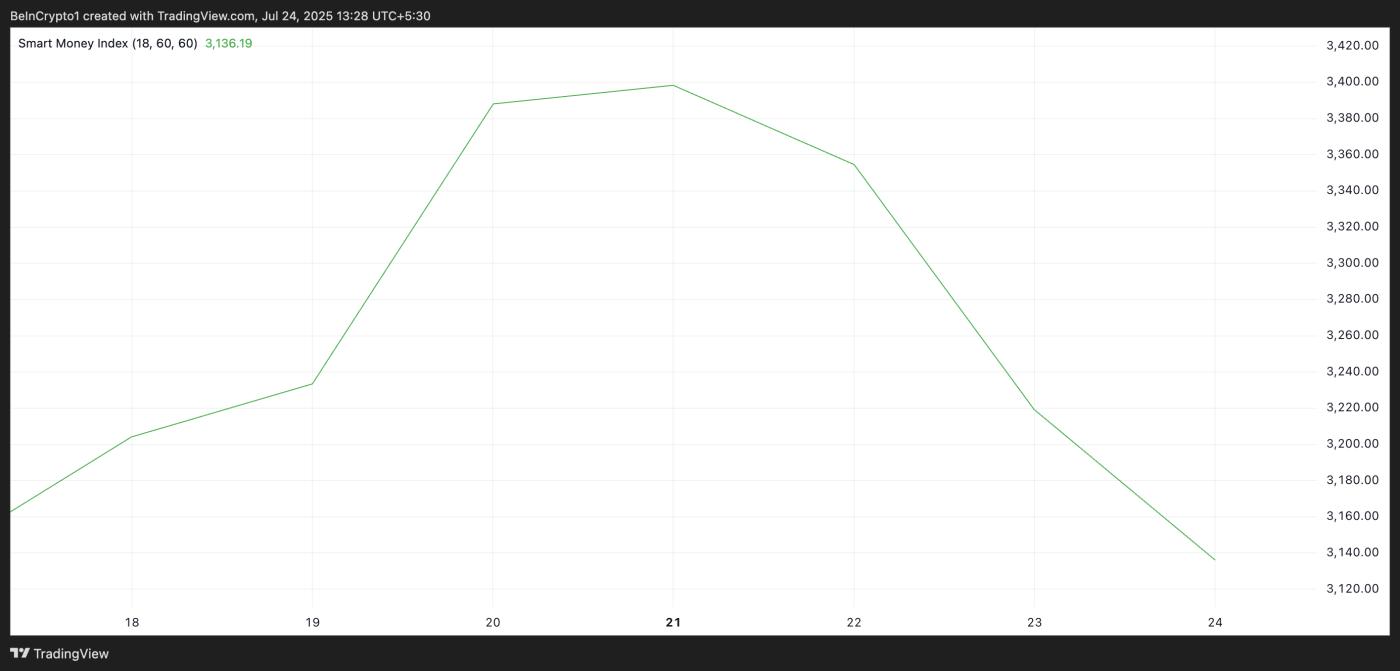

Moreover, on the ETH/USD daily chart, the decline of ETH's Smart Money Index (SMI) confirms selling among key investors. Indicators from this indicator show its value has dropped 7% since 07/20.

ETH SMI. Source: TradingView

ETH SMI. Source: TradingViewSmart money to controlled by investors or experienced traders who have a deeper understanding of market trends and timing. SMI tracks these investors' behavior by analyzing daily price fluctuations.

Specifically, it measures selling in the morning (when retail traders dominate) versus buying in the afternoon (when institutions are more)more p><>an asset's SMdeclines like this, smart money is selling its position and ETH's case this seems driven by a desire to take profits from the recent price increase.

<2>ETH Faces Tug of of War Between Smart Sellers and Small Investors Buying the DipH could drop below below $3,524 if key investors continue selling. If this level is broken, the trade around $3,314. If the bulls cannot support at that point, it could trigger a deeper correction to $3,067.