By Arthur Hayes

Compiled by: Vernacular Blockchain

The highest form of human praise of the universe is the joy we get from dancing. Most religions incorporate music and dance into their worship rituals. My "organized religion" - house music, is not "tickling your body" in church on Sunday mornings, but in similar moments at Club Space.

During college, I admired rhythm by joining a ballroom dance club. Each ballroom dance has strict rules (for example, you can't step on your bent leg in a ballroom rumba), and the hardest part for beginners is completing the basic steps to the beat. A big part of the difficulty is determining the time signature of a song, and where each beat falls.

My favorite ballroom dance, the jive, is in 4/4, while the waltz is in 3/4. Once you know the time signature, your ears must detect which instrument emphasizes the first beat and count the remaining beats. If every piece of music was just a bass drum monotonously beating out "one, two, three, four," it would be very boring. Music is fascinating because composers and producers add depth and richness to songs by layering other instruments and sounds. But when dancing, listening to these secondary sounds is redundant to moving your feet at the right time and in the right place.

Just like music, price charts are waves of human emotion that our portfolios dance to. Like ballroom dancing, our decisions to buy and sell different types of assets must follow the time signature and beat of a particular market. If we get the beat wrong, we lose money. And losing money, like a dancer who gets the beat wrong, is ugly. So the question is: To which instrument in the financial markets should our ears be tuned if we want to remain beautiful and prosper?

If there is one axiom that underpins my investment philosophy, it is that the most important variable for profitable trading is understanding changes in the fiat money supply. This is particularly important for cryptocurrencies because, at least for Bitcoin, it is a fixed supply asset. Therefore, the rate of expansion of the fiat money supply determines the pace of Bitcoin's price appreciation. Due to the massive creation of fiat money since early 2009, bidding against the relatively tiny supply of Bitcoin, Bitcoin has become the best performing fiat-denominated asset in human history.

Right now, the noise generated by financial and political events is a triad. The market keeps going higher, but some very serious, seemingly negative catalysts are creating a dissonance. Should you go safe-haven because of tariffs and/or war? Or are these just extraneous instruments? If so, can we hear the guiding force of the bass drum - that is, credit creation?

Tariffs and wars are important because a single instrument or voice can ruin a piece of music. But the two issues are interrelated and irrelevant to Bitcoin’s continued climb. U.S. President Donald Trump cannot impose meaningful tariffs on China because China would cut off the supply of rare earths to the U.S. empire and its vassal states. Without rare earths, the U.S. cannot make weapons to sell to Ukrainian President “Slav Butcher” Zelensky or Israeli Prime Minister “Bedouin Butcher” Netanyahu. The U.S. and China are thus locked in a deadly tango, with both sides maintaining just enough trade to not destabilize the situation too much, both economically and geopolitically. That’s why the status quo — while tragic and deadly for civilians in both war zones — won’t materially affect global financial markets for the time being.

Meanwhile, the credit bass drum continues to mark time and rhythm. America needs industrial policy, a euphemism for state capitalism, technically known as that dirty word: fascism. America needs to move from a semi-capitalist to a fascist economic system because its industrial giants are spontaneously unable to produce sufficient quantities of war materiel required by the current geopolitical environment. The Israel-Iran war lasted only 12 days because Israel ran out of U.S.-supplied missiles and could not operate its air defense system perfectly. Russian President Vladimir Putin is unfazed by the continued threats of the United States and NATO to support Ukraine more deeply because they cannot produce weapons in the same quantities, speed and cheaply as Russia.

The US also needs a more fascist economic arrangement to boost jobs and corporate profits. From a Keynesian perspective, war is good for the economy. The low organic demand of the population is replaced by the government’s endless need for weapons. Ultimately, the banking system is willing to extend credit to businesses because they are guaranteed profits by producing the products the government needs. Wartime presidents are initially very popular because everyone seems to be richer. If we calculate economic growth in a more healthy way, it becomes clear that war is extremely destructive in net terms. But this kind of thinking does not win elections, and every politician’s primary goal is to be re-elected, if not for themselves, then for their party members. Trump is a wartime president, like most of his US presidential predecessors, and therefore he is putting the US economy on a wartime footing. Finding the beat becomes easy; we have to find ways to inject credit into the economy.

In Black or White I explained how government profit guarantees for “critical” industries led to the expansion of bank credit. I called it “poor man’s QE4” and it created a fountain of credit. I predicted that this would be the Trump team’s method for stimulating the US economy and the MP Materials deal was our first large-scale real-life example. The first part of this article will lay out how this deal expanded the supply of dollar credit and will serve as a template for the Trump administration’s attempts to produce critical commodities (semiconductors, rare earths, industrial metals, etc.) needed for 21st century warfare.

The war also requires the government to continue to borrow huge amounts of money. Even as capital gains tax revenues rise as the assets of the rich rise due to increased credit supply, the government will continue to increase its fiscal deficit. Who will buy this debt? Stablecoin issuers.

As the total market capitalization of cryptocurrencies rises, a portion of it is stored in stablecoins. The vast majority of these stablecoin asset custody (AUC) is invested in U.S. Treasury bills. Therefore, if the Trump administration can provide a favorable regulatory environment for traditional finance (TradFi) to participate in and invest in cryptocurrencies, its total market capitalization will surge. Then, the stablecoin AUC will automatically rise, creating more ability to buy Treasury bills. U.S. Treasury Secretary Bessant will continue to issue Treasury bills far more than Treasury bonds or bonds for stablecoin issuers to buy.

Let’s dance the credit waltz and I will instruct you on how to execute the serpentine dance steps perfectly.

Step One: Poor Man’s QE4

Central bank money printing could not produce a strong wartime economy. Finance replaced rocket engineering. To correct this failure of wartime production, the banking system was encouraged to provide credit to industries that the government considered critical, rather than to corporate raiders.

US private companies aim to maximize profits. From the 1970s to today, it is more advantageous to do “knowledge” work within the US and outsource production. The Chinese government is happy to upgrade its manufacturing skills by becoming a low-cost, increasingly high-quality workshop for the world. However, producing $1 Nike shoes is not a factor that threatens the US imperial elite. The empire cannot produce war materials when its hegemony is seriously threatened. Hence all the hoopla about rare earths.

Rare earths are not rare, but they are extremely difficult to process due to huge environmental externalities and high capital expenditure requirements. More than three decades ago, Chinese leader Deng Xiaoping decided that China would dominate rare earth production, and now this vision is being exploited by Xi Jinping. All modern weapons systems now require rare earths; therefore, Xi Jinping determines the duration of the war, not Trump. To correct this situation, Trump borrows from China's economic system to ensure that US rare earth production increases in order to continue his bellicosity.

Here are the highlights from Reuters on the MP Materials deal:

- US Department of Defense to become largest shareholder in MP Materials

- The deal would boost U.S. rare earth production, weakening China’s dominance

- The Ministry of Defense will also set a floor price for key rare earths

- The reserve price will be twice the current Chinese market price

- MP Materials' share price surged nearly 50% on the deal news.

This is all well and good, but where will the money come from to build the factory?

JPMorgan Chase and Goldman Sachs backed a $1 billion loan to build a facility 10 times the size, MP said.

Why do banks suddenly want to lend money to the real economy? Because the U.S. government guarantees that the project will be profitable for the borrower. The T-chart below explains how this transaction leads to the creation of credit out of nothing, thereby driving economic growth.

- MP Materials (MP) needs to build a rare earth processing facility and obtains a $1,000 loan from JPMorgan Chase (JPM). The act of taking out the loan creates $1,000 in new fiat currency, which is deposited with JPMorgan.

- MP then builds a rare earth processing facility. To do this, it needs to hire workers, the civilians. In this simplified example, I'm assuming that all costs are labor. MP has to pay the workers, which results in a debit of $1,000 to MP's account and a credit of $1,000 to the civilian's account at JPM.

- The Department of Defense (DoD) needs to pay for these rare earths. The funds are provided by the Treasury, which must issue debt to fund the DoD. JPM converts its MP corporate loan assets into reserves held at the Federal Reserve by using the discount window. These reserves are used to purchase debt, resulting in a credit to the Treasury General Account (TGA). The DoD then purchases rare earths, which becomes revenue for the MP and is ultimately deposited as a deposit with JPM.

The final fiat balance (EB) is $1,000 higher than JPM’s initial loan amount. This expansion is due to the money multiplier effect.

This is how government purchase guarantees finance the construction of new facilities and the hiring of workers through commercial bank credit. I did not include this example, but JPM will now lend money to civilians to buy assets and goods (houses, cars, iPhones, etc.) because they have stable good jobs. This is another example of new credit creation that ends up in the hands of other American companies who deposit the revenues back into the banking system. As you can see, the money multiplier is greater than 1, and this wartime production leads to increased economic activity that is counted as "growth."

Money supply, economic activity, and government debt piles are all growing. Everyone is happy. Civilians have jobs, and financiers/industrialists have government-guaranteed profits. If these fascist economic policies provide benefits to everyone out of thin air, why isn't this the global economic policy of every country? Because it creates inflation.

The supply of labor and raw materials required to produce goods is finite. By encouraging the commercial banking system to create money out of thin air, the government crowds out the financing and production of other goods. Eventually, this leads to a shortage of raw materials and labor. However, there is no shortage of fiat money. Therefore, wage and commodity inflation will ensue, ultimately causing pain for any person or entity not directly associated with the government or banking system. If you don't believe me, read the daily history of the world wars.

The MP Materials deal is the first major transaction that embodies the poor man’s QE4 policy. The best thing about this policy is that it does not require congressional approval. The Department of Defense, under the direction of Trump and his 2028 successor, can issue guaranteed purchase orders in the normal course of its business. The profit-seeking banks will follow and do their patriotic duty to finance businesses that rely on the government. In fact, elected representatives of all political parties will scramble to argue why companies in their constituencies should get Department of Defense purchase orders.

If we know that this form of credit creation is not politically objectionable, how can we protect our portfolios from the inflation that would ensue?

Blow bubbles

It’s not like politicians don’t know that accelerating credit growth to stimulate “critical” industries is inflationary. The challenge is to use excess credit to blow up an asset bubble that doesn’t destroy society. If wheat prices had risen like Bitcoin has over the past 15 years, most governments would have fallen by popular revolution. Instead, governments are encouraging citizens who feel increasingly poor in a real sense to play the credit game by profiting from the rise of state-sanctioned inflation-hedge assets.

Let's look at a real-world, non-crypto example: China. China is the best example of a fascist economic system. From the late 1980s to today, their banking system has created the largest amount of credit in the shortest amount of time, mostly to state-owned enterprises. They have managed to become the world's low-cost, high-quality workshop; currently, one-third of manufactured goods are produced in China. If you still think Chinese companies produce inferior goods, go test drive a BYD or a Tesla.

China's money supply (M2) has grown 5,000% since 1996. Commoners looking to escape this credit-driven inflation face extremely low bank deposit rates. So they flock to buy apartments, a behavior encouraged by the government as part of its urbanization push. House prices continue to rise until at least 2020, helping to curb the desire of comrades to hoard other physical goods. House prices in China's first-tier cities (Beijing, Shanghai, Shenzhen and Guangzhou) have become the most expensive in the world on an affordability basis.

Land prices have increased 80 times in 19 years, with a compound annual growth rate of 26%.

This housing price inflation did not destroy society, because ordinary middle-class comrades were able to borrow money to buy at least one apartment. Therefore, everyone participated. An extremely important second-order effect is that local governments finance social services primarily by selling land to developers, who build apartments and sell them to ordinary people. As housing prices rise, land prices and sales revenues, as well as tax revenues, rise in tandem. This gives the central government in Beijing less revenue from direct taxation. Taxes are never popular, and in some ways the Chinese Communist Party is the ultimate populist government.

The recent Chinese example shows that if the Trump administration is serious about pursuing a completely fascist economic system, excess credit growth must blow a bubble that makes ordinary people money while funding the government. The bubble that the Trump administration will blow will be centered around cryptocurrency. Before I delve into how the cryptocurrency bubble can achieve the various policy goals of the Trump administration, let me first explain why Bitcoin and cryptocurrencies will soar as the United States becomes a fascist economy.

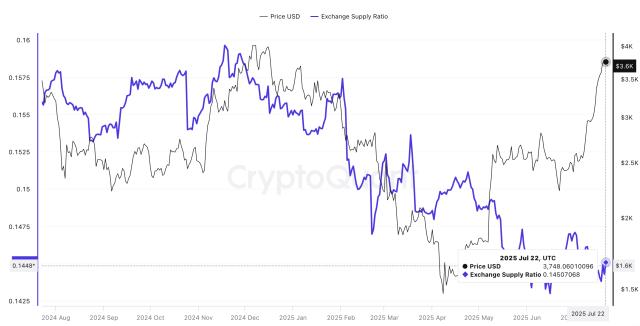

I created a custom index (in white) on Bloomie called <.BANKUS U Index>. This is the sum of bank reserves held by the US Federal Reserve Bank and other deposits and liabilities of the banking system, a proxy for loan growth. Bitcoin is shown in gold, and both lines are based on 100 since January 2020. Credit growth doubled, and Bitcoin went up 15 times. The fiat price of Bitcoin is highly levered to credit growth. To this point, no retail or institutional investor can deny that Bitcoin is the best investment option if you believe that more fiat units will be created in the future.

Trump and Bessant are also “orange inspired.” From their perspective, the beauty of Bitcoin and cryptocurrencies is that groups that traditionally don’t own stocks (young, poor, and non-white) own cryptocurrencies at higher rates than wealthy white baby boomers. Therefore, if cryptocurrencies boom, it will create a broader, more diverse group of people who are satisfied with the ruling party’s economic platform. In addition, in order to encourage savings of all kinds to invest in cryptocurrencies, 401(k) retirement plans now explicitly allow investments in crypto assets, per a recent executive order. These plans hold about $8.7 trillion in assets. Boom Shak-A-Laka!

The coup de grace was Trump’s proposal to eliminate capital gains taxes on cryptocurrencies. Trump offered crazy wartime-driven credit growth, regulatory approval for retirement funds to invest in cryptocurrencies, and zero taxes. Hooray!

This is all well and good, but there is a problem. The government must issue more and more debt to finance the procurement guarantees that the Department of Defense and other agencies provide to private industry. Who will buy this debt? Cryptocurrency wins again.

Once capital enters the crypto capital markets, it usually doesn’t leave. If investors want to take a break on the sidelines, they can hold stablecoins pegged to the U.S. dollar, such as Tether. In order to earn yields on its AUC, Tether invests in the safest traditional financial yield instrument: Treasury bills. Treasury bills have a maturity of less than a year, so the interest rate risk is almost zero, and the liquidity is comparable to cash. The U.S. government can print unlimited dollars for free, so it will never default on a nominal basis. Treasury bills currently yield between 4.25-4.50%, depending on the maturity. Therefore, the higher the total market value of cryptocurrencies, the more funds stablecoin issuers accumulate. Ultimately, the majority of these AUCs will be invested in Treasury bills.

On average, for every $1 increase in total cryptocurrency market cap, $0.09 goes into stablecoins. Assuming Trump performs his duties, he pushes total cryptocurrency market cap to $100 trillion by the time he leaves office in 2028. That's about 25 times the current level; if you think that's impossible, you haven't been in crypto long enough. This would create about $9 trillion in Treasury buying power from global inflows to stablecoin issuers.

For historical context, during World War II, when the Federal Reserve and the Treasury needed to finance America’s war adventure, they issued far more Treasury bills than bonds.

Now Trump and Bessant have solved the dilemma:

- They copied China and created the American fascist economic system to produce the wartime supplies needed to continue dropping bombs indiscriminately.

- The inflationary impulse of financial assets induced by credit growth is directed towards cryptocurrencies, which are soaring in price, and the general public feels richer due to their amazing gains. They will vote Republican in 2026 and 2028... unless they have teenage daughters... or the common people always vote with their wallets.

- The rising cryptocurrency market created huge inflows for stablecoins pegged to the U.S. dollar. These issuers invested their AUCs in newly issued Treasury bills to finance the widening federal deficit.

The bass drum is booming. Credit is surging. Why aren't you all in on crypto yet? Don't be afraid of tariffs, wars, or random social issues.

Trading strategies

It’s simple: Maelstrom is fully invested. Because we are “degen” (activist investors), the shit coin space offers amazing opportunities to outperform Bitcoin (the cryptocurrency reserve asset).

The coming Ethereum bull run will tear the market apart. Ever since Solana rose from the ashes of FTX from $7 to $280, Ethereum has been the least loved of the big cryptocurrencies. Not anymore; the Western institutional investor class, led by Tom Lee, is in love with Ethereum. Buy first, ask questions later. Or don't buy, and sit in the corner drinking ale that tastes like piss while watching a bunch of humans you don't think are that smart burn money on sparkling water at the next table. This is not financial advice, decide for yourself. Maelstrom is doing all things Ethereum related, all things DeFi related, all degen investing driven by ERC-20 shit coin.

My year-end goals:

Bitcoin = $250,000

Ethereum = $10,000

Link to this article: https://www.hellobtc.com/kp/du/07/5983.html

Source: https://substack.com/@cryptohayes/p-168996773