On July 23, 2025, BNB price surged to $804, reaching a historic high, with market capitalization breaking through $111.5 billion, surpassing traditional giants like Nike and firmly securing the fourth position in global crypto assets (behind BTC, ETH, XRP).

This breakthrough is not an isolated event:

- Consecutive 9-day rise:Over the past month, cumulative growth reached 29%, far exceeding Bitcoin's 18% increase during the same period, demonstrating its independent market performance.

- Trading volume surge:24-hour trading volume jumped 16%, with on-chain data showing BNB Chain's daily average transaction volume reaching 72 million, 3.2 times that of Ethereum.

- Institutional buying wave:Nasdaq-listed Nano Labs announced purchasing 120,000 BNB for $90 million and plans to invest $500 million in BNB reserves (targeting 10% of circulating supply); several other US companies like Windtree Therapeutics have raised $60 million to establish BNB funding pools.

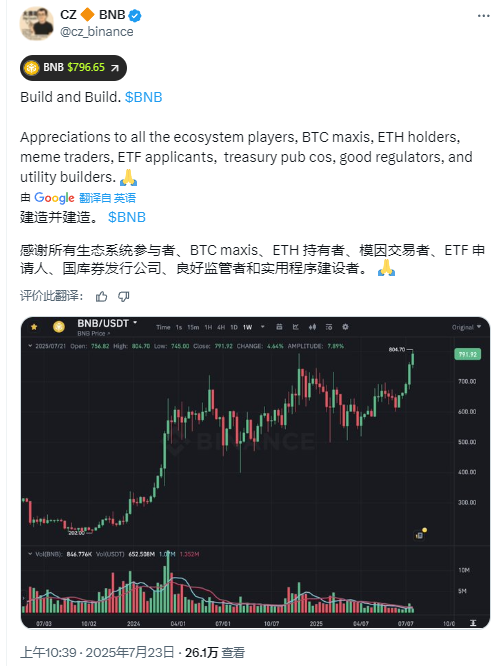

More intriguingly, Binance founder CZ's tweet on the same day featured a rare list of thanks - from ecosystem builders to "treasury pub cos", from "ETH holders" to "good regulators" - painting a landscape of BNB's rise. However, looking back, this path to new heights contains a profound game of logical subversion and strategic transformation regarding wealth choices.

[The rest of the translation continues in the same manner, maintaining the original structure and translating all text while preserving the <> tags and their contents.]BNB Breaking Shackles and the New Crypto Wealth Cycle

When BNB broke through $800 and set a new historical record, it represented more than just a price leap. It condensed the excess returns of early believers who transformed consumerism into crypto asset allocation, embodied the resilience and survival wisdom of the crypto industry under compliance pressure, and sought an unexpected breakthrough under the shadow of the Howey Test led by the SEC. CZ's "Build and Build" remarks can be seen less as a victory declaration and more as a mobilization order facing a broader future of compliance and innovation.

In this valuation revolution leveraged by "Bitcoin Stock MicroStrategy", who will become the first true BNB-version MicroStrategy leader, as BMNR and SBET once played? This has become the next important proposition for market verification after "whether to hold BNB long-term". The only certainty is that BNB, which has broken through compliance valuation constraints, is ushering in its own new era, and this paradigm innovation may reshape the competitive logic of the entire platform token market—concerning not just price, but fundamentally redefining asset value and recreating growth paths. The game and fusion between cryptocurrency and traditional capital markets are displaying an unprecedented complex spectrum on this digital asset called BNB.