Bitcoin records a 0.81% increase while ether and XRP weaken after a prolonged altcoin recovery.

Bitcoin demonstrated its ability to go against market trends in Tuesday's trading session, recording a 0.81% increase to $118,711.71, while the overall cryptocurrency market declined by 0.42%. This movement occurred after the strong altcoin recovery that started last week began to cool down, reflecting the characteristic cyclical nature of the digital asset market.

Two major cryptocurrencies in the altcoin group, ether and XRP, experienced selling pressure with declines of 1.40% and 2.20% respectively, according to Coinmarketcap data. Meanwhile, among the top 10 cryptocurrencies by market capitalization, only Bitcoin and Solana maintained a positive trend, showing a clear divergence in investor sentiment.

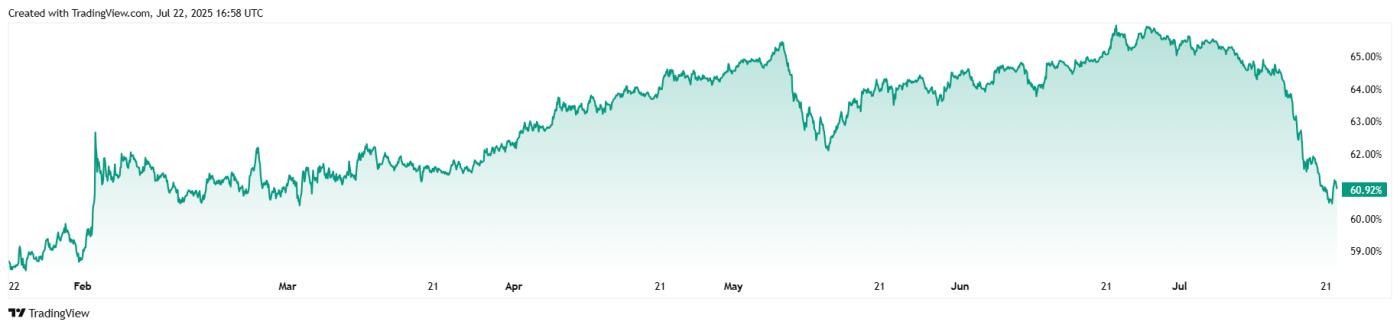

Coinmarketcap's Altcoin Season Index retreated to 50 after reaching a peak of 56 in recent days. This index measures the price performance of the top 100 altcoins compared to Bitcoin over 90 days, with a threshold of 75 marking the official entry into altcoin season. This decline indicates that Bitcoin is regaining market share from alternative coins.

Bitcoin's trading volume increased significantly by 9.54% to $76.18 billion, reflecting growing investor interest in the top digital asset. Bitcoin's market capitalization also rose 0.81% to $2.36 trillion, consolidating its dominant position in the cryptocurrency ecosystem.

Technical Indicators and Derivative Market

Bitcoin's dominance ratio reached a peak of 61.14% before adjusting to 60.91%, still increasing 0.58% in the past 24 hours. This figure shows Bitcoin reaffirming its leading position after a period of altcoin dominance. The daily price range from $116,233.23 to $119,603.76 demonstrates Bitcoin's relative stability compared to other assets.

The Bitcoin derivatives market also showed positive signals, with the total value of open Futures Contracts slightly increasing by 0.44% to $85.13 billion, according to Coinglass data. Liquidation activity in the past 24 hours reached $104.25 million, with short positions being liquidated more than long positions ($59.66 million compared to $44.59 million), indicating some relief in selling pressure.

This movement reflects the natural cycle of the cryptocurrency market, where Bitcoin typically reclaims dominance after periods of altcoin waves. With increasing trading volume and signs of dominance recovery, Bitcoin may be preparing for a new price surge amid market adjustments. Bitcoin's 1.09% increase over the past 7 days suggests that the growth trend is maintained despite short-term market fluctuations.