Written by: Zz, ChainCatcher

Edited by: TB, ChainCatcher

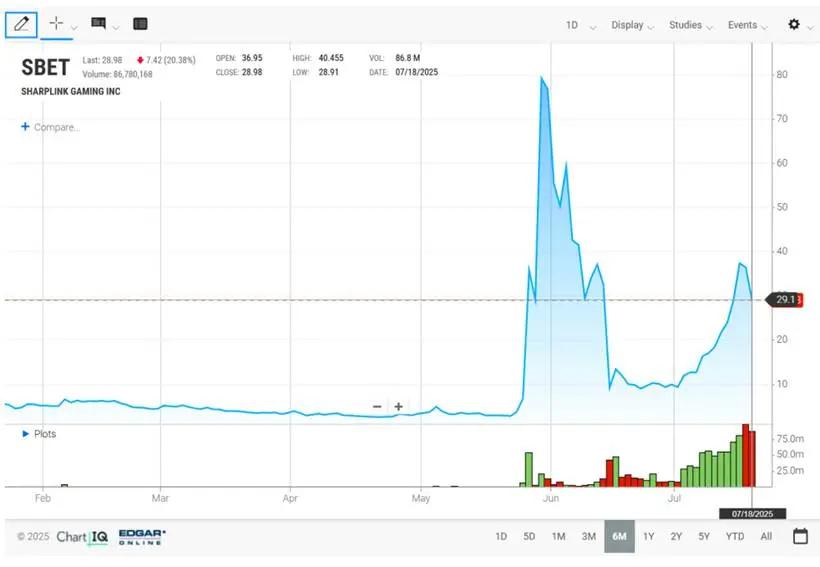

On July 15, 2025, a shocking news rocked the market: the near-delisted gaming company SharpLink announced that it would use all $413 million raised within a week to buy Ethereum. The capital market responded with the most enthusiastic reaction - according to Investing and Nasdaq data, its stock price soared 528% in six months, surging over 150% in a single month.

However, SharpLink's comeback story is just the tip of the iceberg. Almost simultaneously, a broader capital alchemy is quietly unfolding across different industries: a traditional consumer goods company (Upexi) ingeniously incorporated SOL tokens into its reserves through a clever bond design; a crypto mining giant (Bitdeer) successfully connected with Wall Street's traditional capital; a Canadian frontier technology company (BTQ) raised millions from US investors by exploiting regulatory loopholes.

From a near-delisted "junk stock" to a stable consumer brand, from crypto-native enterprises to cross-border tech newcomers. When people try to find the mastermind, the spotlight does not shine on Goldman Sachs or Morgan Stanley, but on a mid-sized investment bank that was not previously prominent in public view: A.G.P. (Alliance Global Partners).

As the trader or key participant in all these transactions, A.G.P. has played this model to perfection. On the SharpLink project alone, based on its commission rate, it may have earned over $8 million in commissions within a week, which is just the beginning of its massive $6 billion plan.

While Wall Street giants were building compliance bridges for institutional clients, A.G.P. took a more aggressive route: batch transforming various listed companies into "cryptocurrency proxy stocks" and sitting at the table as the rule-maker.

Batch Operation: Building Crypto Vaults for US-Listed Companies like SharpLink

A.G.P. demonstrates its trading methods through four cases. Its model is not a standardized strategy, but highly customized: judging customer pain points and market hotspots, flexibly using tools like ATM protocols to design fee schemes that maximize its own interests for each transaction.

The most typical case is SharpLink. On May 27, 2025, SharpLink announced: completing a $425 million private placement, led by ConsenSys, with Ethereum founder Joseph Lubin serving as chairman. According to the 8-K filing, A.G.P. served as the exclusive placement agent, earning 5-7% underwriting fees. However, the real main course is the subsequent ATM protocol.

[The rest of the translation follows the same professional and accurate approach]

Bitdeer Technologies itself is a giant in the crypto mining industry, with no shortage of crypto stories. A.G.P. chose it to prove that it can not only transform "outsiders" but also serve "insiders", taking on the role of a "bridge" connecting the crypto world with Wall Street's traditional capital.

For crypto-native enterprises like Bitdeer, the core pain point of financing needs is obtaining a "trust endorsement" from traditional financial markets. A.G.P., as a joint lead manager, participated in its convertible bond issuance, essentially using its reputation as a licensed investment bank to increase Bitdeer's credibility and make it easier to gain approval and funding from mainstream institutional investors. This move aims to establish A.G.P.'s authoritative position in crypto infrastructure financing.

The key characteristic of BTQ Technologies, this Canadian post-quantum cryptography company, lies in its "non-US" jurisdiction. A.G.P. chose it to demonstrate its ability to navigate complex cross-border regulations, a highly challenging professional skill.

Because directly introducing US capital into a small Canadian tech company involves a complicated process. A.G.P. precisely utilized Canada's LIFE exemption mechanism, a regulatory shortcut that can bypass full prospectus requirements and quickly, cost-effectively introduce US capital to BTQ. This is essentially a sophisticated "regulatory arbitrage", where A.G.P. creates excess returns and efficiency unmatched by traditional IPOs through its mastery of financial rules across different countries.

Behind the Golden Touch: Wall Street's Money Thirst and Radical Transformation

In the post-pandemic macroeconomic environment, traditional small and medium-sized companies generally face growth bottlenecks. When traditional paths to improve core business become extraordinarily difficult, they urgently need a new story that can instantly ignite market enthusiasm. Cryptocurrencies, especially Ethereum and Bitcoin, provide the most sexy and easily understood "growth narrative" by capital markets.

Rather than investing years in difficult business transformation, directly announcing cryptocurrency purchases - this radical "balance sheet revolution" can instantly reshape an ordinary company into a tech pioneer overnight, which is the fundamental driving force behind the crypto-stock linkage model.

The current market's core contradiction lies in the massive time difference between regulatory actions (such as the US SEC) and market speculation speed.

Institutions like the SEC have indeed expressed "serious concerns" about issues such as massive shareholder dilution, misleading marketing, and potential market manipulation. However, these warnings in the first half of 2025 remain more at the level of risk alerts and framework discussions, not yet transformed into specific, enforceable regulations that could comprehensively prohibit such operations.

From issuing warnings to legislation and then effective enforcement, there is a long process. It is precisely this regulatory vacuum that investment banks like A.G.P. have keenly captured, seen as a fleeting golden window. Rather than "defying the wind", it's more like "harvesting the last wave of dividends before the storm arrives".

Market participants' strategies perfectly demonstrate everyone racing to accelerate before this wave window closes:

As a pioneer, A.G.P. deeply understands this feast has a time limit. Therefore, it is expanding its ATM protocol business at an unprecedented speed, extending customers from tech companies to broader traditional industries like retail, manufacturing, and biotechnology. Its logic is very clear: complete as many transactions as possible before the regulatory "gate" falls, securing profits.

When institutions like B. Riley Securities and TD Cowen form specialized teams to enter, it precisely shows that all of Wall Street sees the current as a special period of "permitted unless prohibited". First-mover advantages are disappearing, and while commission rates will decline due to competition, the certainty dividend of this wave attracts everyone.

Upgrade and Risk: A "Noah's Ark" When the Storm Arrives?

When the crypto market enters a bear market, or regulatory heavy-handed measures finally fall, this carnival supported by leverage and narrative will come to an end. At that time, dried-up financing channels, significant asset devaluation, stock price collapse, and collective lawsuits will form a "perfect storm".

Simply betting on A.G.P.'s future on the current crypto-stock linkage's success might underestimate this investment bank's core capabilities. Reviewing its operational cases reveals that A.G.P.'s true "golden finger" is not a magical touch, but a replicable, highly flexible methodology.

For A.G.P., the true "Noah's Ark" is not a specific asset or business, but this methodology itself. When the "crypto-stock linkage" wave recedes, it will almost certainly apply this approach to the next trend, whether real-world asset tokenization (RWA), carbon credits, or any other new field with "narrative potential" and "regulatory ambiguity".

Data from S3 Partners shows that SharpLink's short interest has surged 300% in the past month, indicating that "smart money" has sensed danger, quietly withdrawing before the countdown ends and betting on the ultimate collapse of this carnival.

In Conclusion

A.G.P.'s story is a microcosm of Wall Street seeking survival space in a new era. This mid-sized investment bank has carved out a unique track through market positioning and a profit model that ensures returns in all conditions.

However, the crypto-stock linkage model walks the edge between opportunity and risk, innovation and speculation. For investors, understanding who the true winners are is more important than participating in the game.

As Wall Street's iron rule shows: in financial markets, those who design the game rules are always the ones truly making stable profits.