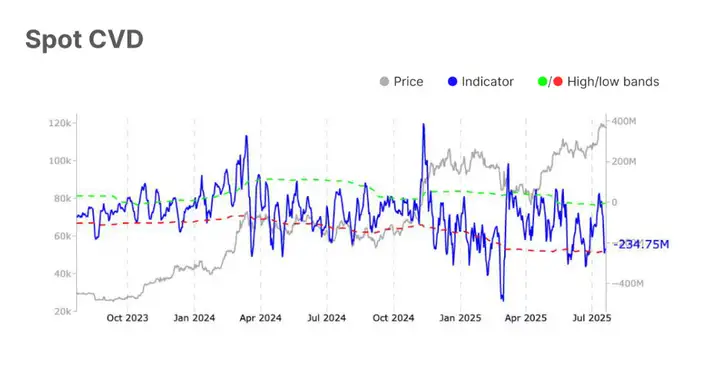

After touching a historical high, Bitcoin's price slightly pulled back and entered a consolidation phase. Although the Relative Strength Index (RSI) of the spot market has cooled down from an overheated level, and the Cumulative Volume Difference (CVD) indicator has significantly turned negative, reflecting active selling pressure, spot trading volume remains high, indicating active market participation and considerable demand resilience, which has not significantly retreated due to price pullback.

VX: TZ7971

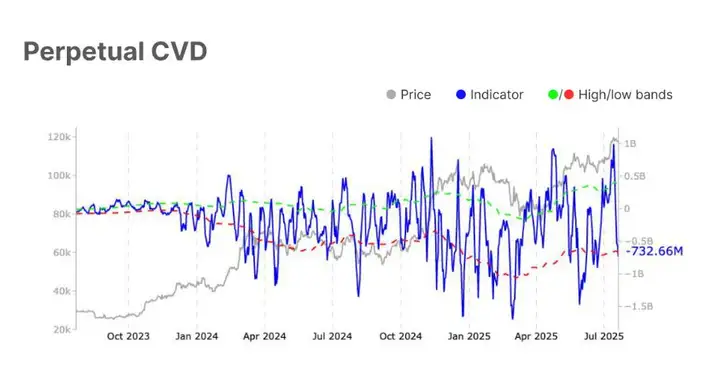

In the derivatives market, futures open interest has surged to the high range, and funding rates have simultaneously risen, proving that speculative positions are growing. However, the sharp reversal of perpetual contract CVD reveals large-scale profit-taking behavior, which may have led to seller exhaustion, making the market more prone to short-term volatility. Meanwhile, the narrowing volatility spread and negative skew in the options market reflect that while investors remain generally bullish, their attitude has become more cautious, and they have started hedging downside risks.

Institutional fund movements are also worth noting. US-listed Bitcoin spot ETFs have recorded significant growth in both net inflows and trading volume, demonstrating strong institutional demand. On-chain activities show divergence: daily active addresses and transaction fee income have decreased, which might indicate cooling retail or trading-type demand; on the other hand, transfer volumes adjusted for entity activity have dramatically surged, suggesting that large participants may be conducting strategic fund reallocation.

The current market presents a healthy but fragile balance. Although capital flow remains strong and speculative participation is moderately increasing, long-term holders still dominate the market. While profitability indicators have retreated from their peaks, showing some investors are locking in profits, market sentiment remains in the optimistic range.

Seller exhaustion signs are emerging, and the market may be ready for the next rally. Key cryptocurrencies to watch include: XRP, SOL, ADA, SUI, LINK, AVAX, LTC, DOT (these are promising for ETF and have institutions and companies starting to move and reserve), additionally, Ethereum approaching 4000, SOL stabilizing at 200, DeFi, public chains, Ethereum and SOL ecosystems - one must find opportunities during pullbacks.