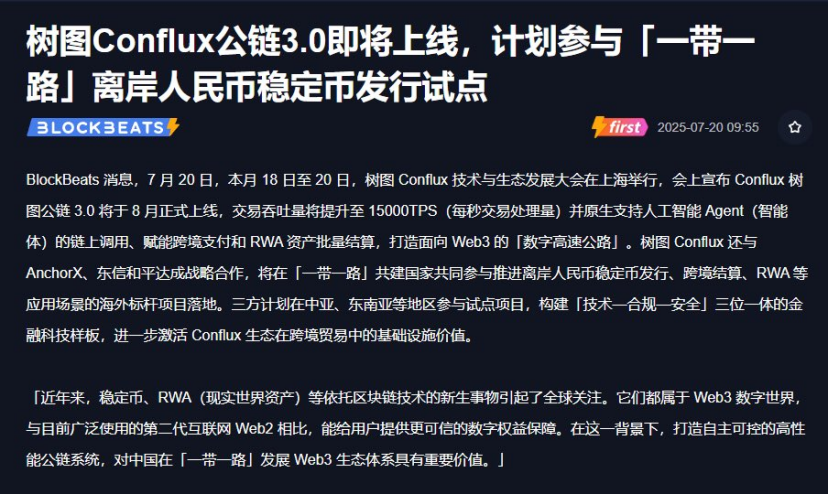

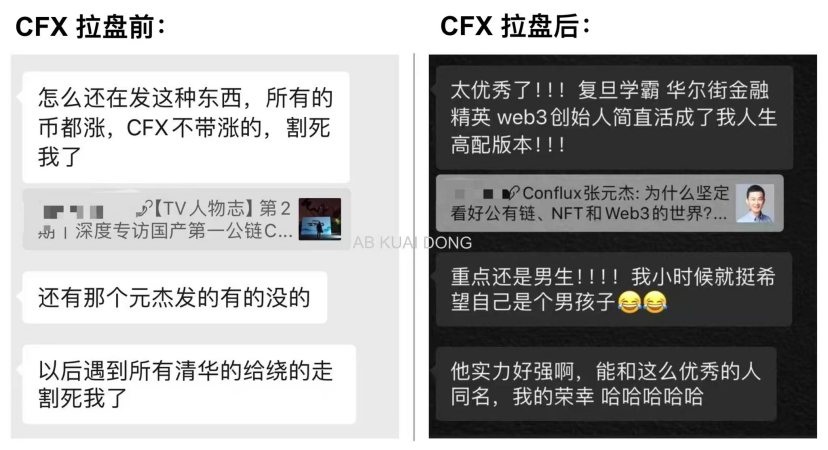

From July 20 to July 21, CFX (Conflux) price suddenly surged, with an intraday increase of over 100%, leading the altcoin sector and immediately sparking heated discussion in the WEEX global community. As a domestic public chain that gained popularity in 2021, Conflux once again made headlines, with the key reason behind its price movement being the upcoming Conflux 3.0 mainnet upgrade and the landmark overseas project to be implemented in "Belt and Road" co-building countries, involving offshore RMB stablecoin issuance, cross-border settlement, and RWA application scenarios. According to official information, Conflux 3.0 will be released soon, and the WEEX exchange official community believes that this upgrade has strengthened Conflux's long-term imagination space, making its strategic position in emerging scenarios such as stablecoins and RWA more prominent, with market expectations significantly boosted!

What "qualitative changes" will the Conflux 3.0 upgrade bring?

Conflux 3.0 is one of the most significant technical upgrades since the mainnet launch, comprehensively innovating around performance, security, and developer experience, marking the network's official entry into the "parallel multi-virtual machine" stage. Here are the three core changes in this upgrade:

• Introducing EVM and Conflux Dual Virtual Machine Parallel Architecture: In the past, the Conflux mainnet primarily ran its self-developed Conflux Virtual Machine (CVM), whose independent ecosystem created significant compatibility barriers. After the 3.0 upgrade, the Conflux network officially supports the Ethereum-compatible EVM, running in parallel with CVM, allowing developers to deploy contracts in any virtual machine environment, significantly lowering development thresholds and migration costs.

• Network Architecture Reconstruction: From Single Chain to Twin Chain Collaborative Mechanism Conflux 3.0's core architecture is a new paradigm of "Conflux Native" and "Conflux eSpace" coexisting and collaborating. The Native chain continues to carry out original high-performance transaction tasks, while the eSpace chain handles the EVM-compatible contract ecosystem. The two chains complete asset and data interoperability through a message bridge, with contracts deployed in different virtual machines capable of cross-chain calls, building a underlying system that balances compatibility and performance.

• Cross-chain Bridge, Security Model, and PoS Mechanism Enhancement On the security and asset interoperability level, Conflux 3.0 has optimized its cross-chain bridge design, improving inter-chain communication efficiency and attack resistance. Simultaneously, details of the PoS proof-of-stake mechanism have been adjusted to further encourage long-term stakers to participate in consensus verification, helping to enhance network stability and resistance to Sybil attacks.

Overall, Conflux 3.0 is a platform-level technological reconstruction that not only improves the original chain's performance and scalability but also opens the door to multi-chain ecosystem compatibility, laying a stronger foundation for ecosystem expansion and international application implementation.

How should retail investors position themselves? WEEX's CFX trading data provides the answer

Under the impact of this hot topic, the CFX/USDT trading pair's 24-hour trading volume on the WEEX exchange doubled, rising to become the platform's popular cryptocurrency and top gainer. It's worth noting that WEEX currently supports multiple order mechanisms including limit orders, take-profit and stop-loss orders, suitable for short-term swing trading and medium-term position holding. Additionally, WEEX provides USDT margin contracts and CFX spot trading synchronously, allowing users skilled in risk management to build long-short hedging strategies and more effectively capture market volatility dividends.

Will the heat continue? It depends on the narrative's sustainability

Although the short-term rise is driven by technical upgrades, in the medium to long term, Conflux still faces challenges in ecosystem expansion and on-chain application activity. The current limited TVL scale and slow DeFi application development remain its growth "ceiling". However, precisely because of this, if the 3.0 upgrade can attract developers back and reactivate funds, CFX's "second takeoff" is not without foundation. For retail investors, establishing cognition in advance when the trend is unclear will be the real advantage.

Follow WEEX official blog, community, and social media to timely obtain professional industry reports!