#BTC broke through $123,000 and then pulled back, currently in a daily oscillation structure with K-lines not yet rich enough to draw conclusions. But I want to say: bears are not that fierce. The 115,500 area is a dense liquidation zone, keep a close eye tonight, not ruling out a needle-like sweep. However, the overall bullish thinking remains unchanged, buy the dips, and don't go against the trend.

Go with the trend, against the trend you'll only get beaten! This is the iron rule! #ETH pulled from 2,400 to 3,860 with almost no rest, daily K-lines like a waterfall, now near the 4,000 round number, a proper rest is totally normal. Extreme branch support focuses on the 3,520-3,300 area, no problem if not broken.

I estimate truly breaking 4,000 will wait until August or even September, this is just the "first probe". After the main force completes this round of hand-changing, the next wave will be more stable and fierce.

Market frequently lures bulls, funds quietly retreating

In the past two days, we've seen: as soon as resistance is reached, big funds come in, dumping 500 million, 300 million in a day, looking like they'll break through, but selling out within hours. Clearly, this is a "lure and test".

Data confirms - AI fund monitoring system shows fund accumulation is gradually decreasing, so currently not recommended to blindly chase, especially altcoins. Main force's play is simple and brutal: if you're impulsive, they'll trap you.

Altcoins "can't be lifted"? Actually still waiting for ETH's orders

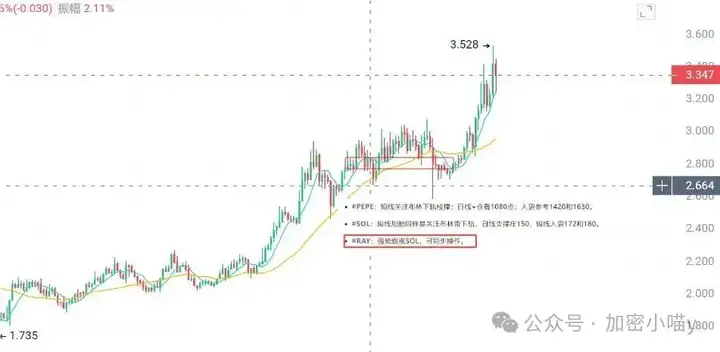

When Ethereum rests, altcoins directly lie flat. Currently, except for #SOL breaking against the trend and driving ecosystem coins to surge (like JUP, RAY, #JTO performing well), most altcoins still cower in corners. I've always said altcoin season never comes out of thin air, it must be driven by ETH. Now no big players dare to bet against the trend during ETH's adjustment, indirectly showing market sentiment is not yet hot enough.

However, #RAY I've recommended for long has finally started! This Solana ecosystem's AMM platform is actually benchmarking Uniswap, with a market cap of only $560 million, while #UNI is near $7 billion, such a "value depression" is worth long-term attention.

Finally, let's look at how the current market structure is becoming increasingly clear:

First Tier: BTC

Bitcoin is now the new "gold standard" in finance, with ETFs, national reserves, and crypto treasuries frantically allocating, potentially becoming a "fiat alternative asset".

Second Tier: ETH

If BTC is "digital gold", ETH is "crypto Wall Street": it's the infrastructure core for DeFi, RWA, Stablecoin and all hot spots, especially after the GENIUS bill passes, future tens of trillions of stablecoins will almost run on Ethereum. ETH's status might be like "English" in the international market.

Third Tier: ETF Potential Stocks

SOL, #XRP, #DOGE, #LTC, BNB are star projects with potential ETF themes or already in crypto treasury lists.

- SOL is a "hexagonal warrior", covering DeFi, Meme, AI, RWA, DEPIN, with ETF already traded;

- XRP bound to SWIFT replacement, political and business resources rock solid;

- DOGE is the Meme originator, Musk's dear son;

- #BNB is the only token capturing platform value, also collaborating with Trump's family;

- LTC is "digital silver", a 15-year-old project, winning by consensus alone;

Although policy support is slightly inferior to ETH, these will perform excellently during sector rotations.

Fourth Tier: ETF Applying + Treasury Heavy Holdings

$ADA, $AVAX, $APT, #SUI, $DOT, #FIL, $NEAR, #TRX, $BONK, $TRUMP etc., not yet significant but qualifying for "big capital's attention". Once ETF is approved, these altcoins might suddenly launch.

Fifth Tier: On-chain DeFi/RWA Core Assets

Like $AAVE, $UNI, #LDO, $ENA, $JUP, #ONDO etc., these projects will capture massive on-chain exchange and financial management funds after GENIUS lands, they're the "real estate stocks" of DeFi infrastructure.

Last tier, old altcoins/CEX hype coins - run away as early as possible

These coins have poor liquidity, scattered teams, lack innovation, each market cycle just "pretending not to be dead". Once the market declines, they'll crash the hardest. Recommend directly cutting losses and switching to mainstream, don't linger. At this point, it's no longer about "is it a bull market", but "which vehicle are you riding". True opportunities definitely brew in "divergence" and "explode in the main line". 1. Hold coins steady, following the main line is the hard truth. 2. Watch altcoin launch rhythm, funds will rotate back. 3. When seeing bull lures, don't forget how big players cut people. You can hold, then you deserve more.

Article ends here! If you're lost in crypto, consider planning and harvesting with me! Follow public account: Crypto Meow y