Recently, the market has been scorching hot, but to be honest, not many are truly making money. Many are still wavering, with mainstream cryptocurrencies frequently hitting new highs, Altcoins rotating rapidly, opportunities emerging, but many missing the pump! Actually, there's always a "hidden iron rule" in the crypto market that every bull and bear market follows. Today's article will mainly discuss this "doubling law". If you understand it, you might achieve a wealth transformation in the next wave.

Iron Rule One: Bitcoin Always Tops After Doubling, Without Exception

From 2022, BTC rose from $15,000 to $30,000, plateaued and corrected after doubling. After retracing to 0.382, it then rose from $25,000 to $49,000, continuing to double. Then it sharply declined. Last year was similar, rising from $50,000 to $100,000 - doubling, topping, and crashing.

After dropping from $74,000, if it doubles again, the top will be at $140,000! So I'm very clear: I won't move until $140,000 arrives, and when it does, I'll carefully consider.

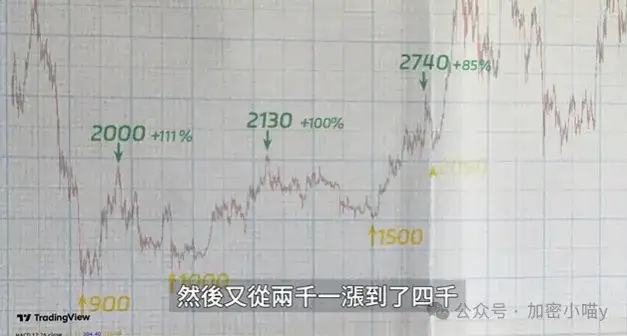

Iron Rule Two: Ethereum Also Follows the "Doubling Law"

#ETH's trend is almost synchronized with BTC. Historically, every major rise tops after doubling from the low point:

- From $1,000 to $2,000: topped;

- From $1,500 to $2,800: doubled again;

- Recently starting from $2,100, now around $4,000: almost doubled.

So, if your ETH position is below $2,900, you're comfortable, with a target around $4,200. Once it reaches there, be cautious and secure profits, don't be too greedy!

More aggressive investors might consider a small position. Conservative ones can wait for it to retrace to the 3300-3400 Fibonacci level before re-entering to ride the next wave.

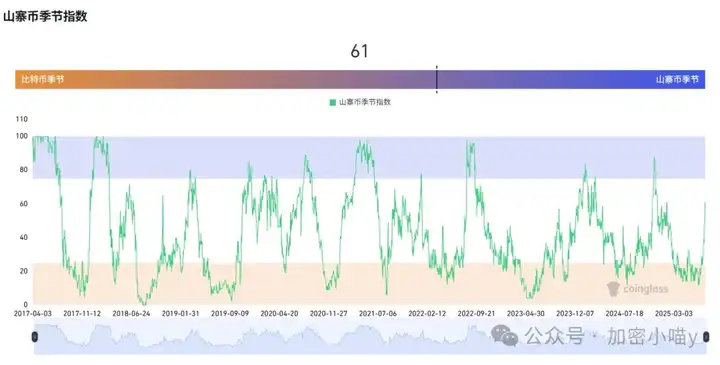

Altcoins Are Now the Core Battlefield!

Have you noticed, BTC is stagnant, ETH has finished its rally, XRP and LTC are rotating, funds gradually flowing into Altcoins - this is a typical pre-Altcoin season signal.

The #PENGU, #SOL, #DOOD we've been talking about for days have all gone crazy, with community heat, social data, and trading volume all online, especially little penguin PENGU, which has spread from Wall Street to Malaysian landmarks, creating cultural consensus.

#DOOD is very strong today, breaking through the W bottom neckline, heading to 0.0052.

And the frog #PEPE we positioned last week has already had a big wave, waiting for it to retrace to 0.15-0.16, which would be the most comfortable harvesting point.

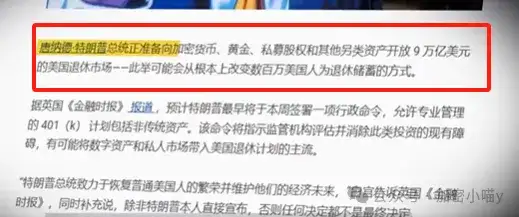

Final Reminder of a Potential Super Positive News: Trump is pushing an executive order to allow Fidelity's retirement funds to invest in crypto assets.

What does this mean? Even if you don't understand the crypto market, your retirement fund might automatically buy BTC and ETH. And it would be long-term, non-selling. Once implemented, the scale could reach $270 billion! BTC would be directly locked by 10%, stablecoin demand would surge, and US bonds could leverage this. This is a super dividend-level event, beneficial for 10 years in the long term!

Now, it's not about whether you should buy, but whether you know how to play!

Bitcoin and Ethereum have patterns to follow, mainstream cryptocurrencies rotate, then Altcoins, then Non-Fungible Tokens - making money has a rhythm, not luck. We've caught the ETH doubling logic and eaten the Altcoin breakout, and there will be another wave. As long as you follow the right people, have a strategy, and understand, the bull market opportunities are far from over, true financial freedom is just beginning!

The article ends here! If you're lost in the crypto market, consider joining our community for market analysis and Altcoin operations... WeChat: c13298103401 or QQ: 3806326575

Public Account: Crypto Meow y