Written by: Lao Bai

It's been two years since I wrote the diamond hands series, and this is the third version, likely the last one. In this crypto cycle, only diamond hands for BTC have been rewarded, while others have been ruthlessly cut. The previous diamond hands series focused on finding Alpha, but this one leans towards Beta, as some previous Alpha investments were brutally slashed.

The biggest Beta is still the top three: BTC + ETH, SOL, BNB. For altcoin Betas, I currently favor these four and plan to continue investing.

1. AAVE - AAVE is one of the few assets outside the top three that you can hold long-term and sleep well, with TVL breaking previous highs to over $30 billion. More impressively, it hasn't had a major security incident in all these years. Traditional financial institutions like JP Morgan prioritize AAVE when testing blockchain waters.

The wave of RWA+ stablecoins, combining blockchain with traditional finance to improve efficiency, is undoubtedly the primary direction of blockchain development. Among the assets that can ride this wave, besides public chains, the certainty of Uniswap/Curve is less clear, while AAVE is a definite leader. The upcoming V4 launch in the next few months is also highly anticipated, making it worth investing in.

2. Pendle - TVL has reached $6 billion, close to its previous high, stable and poised for its third wave

Pendle's first wave was backed by SushiSwap and some DeFi protocols, splitting liquidity mining and other yields, but without much buzz due to the vague returns.

The second wave was based on Lido and Eigenlayer's LST/LRT, which soared as returns became more tangible.

The future third wave will be about RWA and stablecoins. In traditional finance, yield stratification and risk separation are crucial tracks with a massive market (over $10 trillion). As more on-chain RWA and stablecoin assets emerge, this track will rise, and unlike AAVE facing competition from Compound and Morpho, Pendle is essentially unchallenged in this space.

The only downside is its price stability, with minimal price fluctuations. I'll invest for a few months and see.

3. Hyperliquid - The strongest token project this cycle, without a doubt

Its crushing user experience and trading depth on other chains have led to dominant trading volumes and market cap.

Hyperliquid is positioned not just as a Perp but as an on-chain Liquidity Layer. Phantom's recent integration is proof, with more front-ends likely to connect to Hyperliquid's liquidity backend.

Besides current buybacks, future plans include HyperEVM ecosystem development, HIP-3 RWA Perp, and other strategic moves.

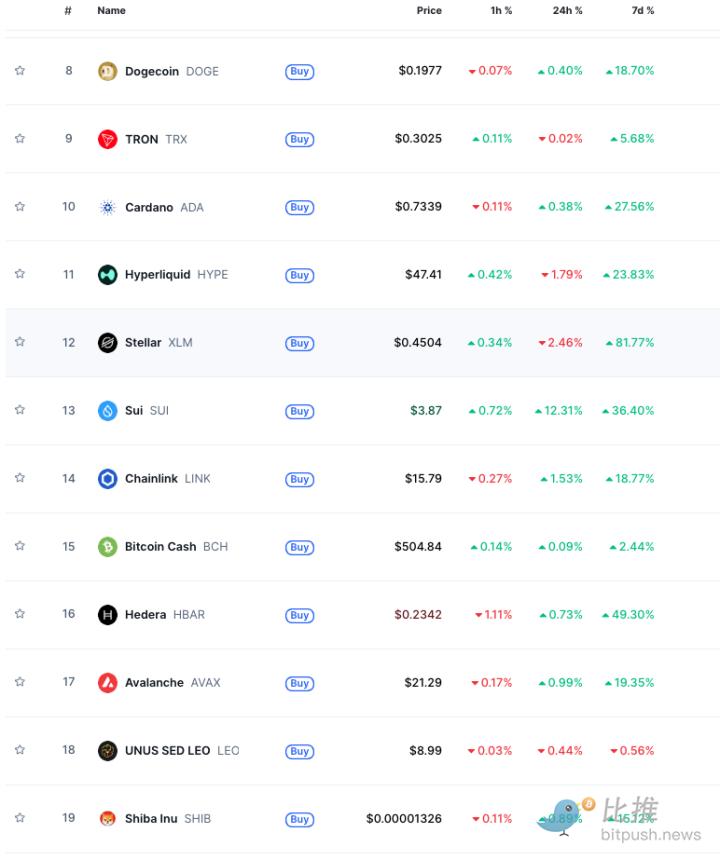

Hyperliquid is the only one I haven't invested in yet, as I sold all airdrops from 4-10 and feel resentful looking at its nearly $50 billion market cap. I hope to find a good entry point, and I'll definitely invest - worst case, I'll wait for the next bear market.

4. Bittensor - I was previously critical, but recently changed my mind and plan to invest for 6-12 months.

My criticism was about its Product-Market Fit (PMF), which I questioned in 2023 and still doubt, finding similarities with Filecoin.

Like Filecoin filling space with useless data, Bittensor creates demand and has miners generating pointless inference results, with past dramas involving miner and validator collusion.

So, why the change of heart?

This crypto cycle has disproved many tracks and confirmed two:

One is finance (DeFi, RWA, stablecoins), the other is Gamble (meme, PolyMarket, on-chain Casino formats).

Crypto+AI is likely the largest unproven track, difficult to completely disprove in the short term.

Among AI+Crypto projects, Bittensor is the hardest to disprove.

Reasons include:

It leads in market cap and mindshare in this track

Few can clearly explain Bittensor's purpose

Nearly 100 subnets, potentially 200-300 next year, with some showing PMF and revenue

Halving in January-February, similar to BTC with a 21 million hard cap

In emission mechanism and mindshare, it's like the BTC of AI+Crypto. Its subnet design, consensus, and proof mechanism resemble ETH - a breakthrough subnet could emerge like Uniswap or AAVE on ETH. Its subnets cover decentralized training, data, computing power, inference, and various AI+Crypto domains.

However, its high market cap and daily emissions of over $1 million make absorption challenging. Consider investing in the first half of next year if it seems expensive.

This concludes the diamond hands series. Let's see if this version can outperform BTC in the next year or two. Recording today's prices - BTC-118275, AAVE-312.7, Pendle-4.43, Hyper-44, TAO-433.