Written by: Arthur Hayes

Translated and Compiled by: BitpushNews

Unveiling Trump's "Fascist Economy" and the Cryptic Waltz of the Crypto Bull Market - The Fatal Dance Steps of Bitcoin and the "Credit Drum", Have Your Investment Moves Kept Up?

[The rest of the translation continues in the same professional and accurate manner, maintaining the original text's style and meaning while translating it fully into English.]In the United States, private enterprises aim to maximize profits. From the 1970s to the present, companies have been conducting "knowledge" work domestically while outsourcing production overseas for higher profits. China is very willing to enhance its manufacturing skills by becoming the world's low-cost and increasingly high-quality manufacturing factory. However, producing a $1 Nike does not threaten the elites of the "beautiful country". The real issue is that the "beautiful country" cannot produce war materials at a moment when its hegemony is seriously threatened. Thus, all the noise about rare earth elements follows.

Rare earth elements are not rare, but processing is extremely difficult, largely due to massive environmental externalities and enormous capital expenditure requirements. Over 30 years ago, Chinese leader Deng Xiaoping decided that China would dominate rare earth production, and now this foresight can be utilized by current leadership. Currently, all modern weapon systems require rare earth elements; therefore, China, not the United States, decides how long a war will last. To correct this situation, Trump is borrowing from China's economic system to ensure increased US rare earth production, allowing him to continue his warlike behavior.

Here are the key points from Reuters regarding the MP Materials transaction:

The US Department of Defense will become MP Materials' largest shareholder

The transaction will boost US rare earth production and weaken China's dominance

The Defense Department will also provide a guaranteed price for critical rare earth products

The guaranteed price will be twice the current Chinese market price

MP Materials' stock price surged nearly 50% after the news was announced

The Trump administration's bubble will focus on the cryptocurrency field.

Before I delve into how the crypto bubble will achieve various policy goals of the Trump administration, let me first explain why Bitcoin and cryptocurrencies will surge as the United States becomes a fascist economic entity.

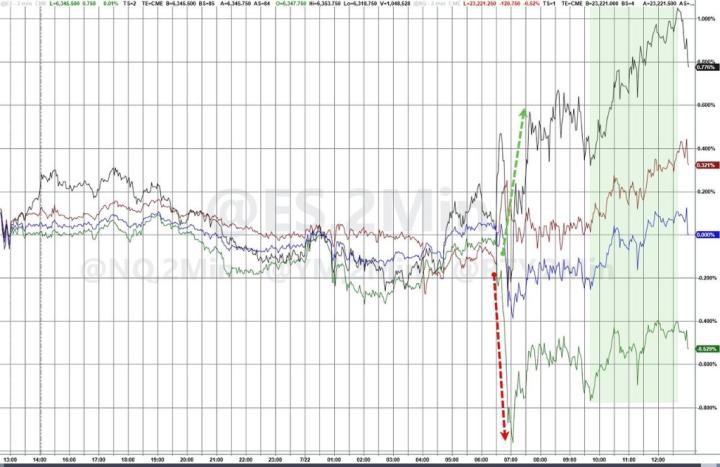

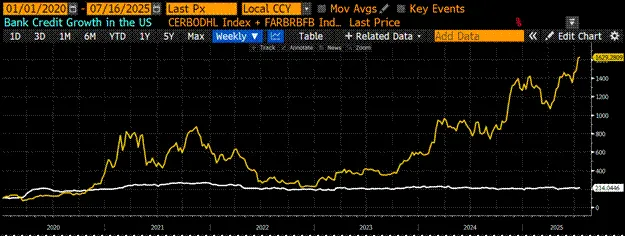

I created a custom index on the Bloomberg terminal called <.BANKUS U Index> (white line). This is the sum of bank reserves held by the Federal Reserve and other deposits and liabilities in the banking system, serving as a proxy for loan growth. Bitcoin is the gold line, with both lines indexed to 100 based on January 2020. Credit growth doubled, and Bitcoin grew 15-fold. Bitcoin's fiat price has a high leverage on credit growth.

At this point, neither retail nor institutional investors can deny that if you believe more fiat will be created in the future, Bitcoin is the best investment choice.

Trump and Benson have already been "orange-pilled". From their perspective, the best thing about Bitcoin and the entire cryptocurrency is that a higher proportion of traditionally non-stock-holding groups (young people, the poor, and non-whites) own cryptocurrencies compared to wealthy white baby boomers. Therefore, if cryptocurrencies prosper, it will create a broader, more diverse crowd who are satisfied with the ruling party's economic platform.

Moreover, to encourage savings investment in cryptocurrencies of all types, a recent executive order now explicitly allows 401(k) retirement plans to invest in crypto assets. These plans hold about $8.7 trillion in assets. Boom Shak-A-Laka!

The fatal blow is President Trump's proposal to eliminate capital gains tax on cryptocurrencies. Trump is offering credit growth driven by war, regulatory permits allowing retirement funds to invest cash in cryptocurrencies, and—damn it, no taxes! Hurrah!

All of this is great, but there's one issue. The government must issue more and more debt to fund procurement guarantees for the Department of Defense and other agencies to private enterprises. Who will buy these debts? Cryptocurrencies win again.

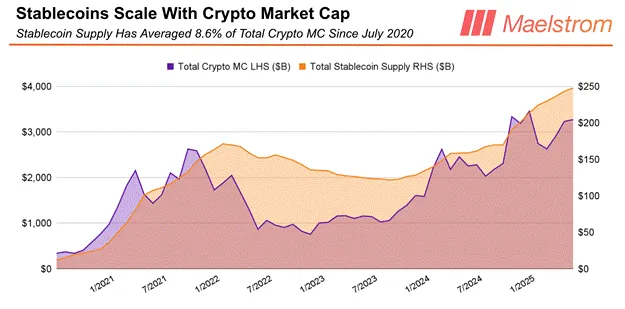

Once capital enters the crypto capital market, it usually doesn't leave. If an investor wants to sit on the sidelines, they can hold a stablecoin pegged to the dollar, like USDT.

To earn yields from its custodial assets, USDT invests in the safest traditional financial (TradFi) yield instruments: Treasury bills. Treasury bills have terms less than a year, so interest rate risk is near zero and are as liquid as cash. The US government can print dollars infinitely, so there will never be a nominal default. Currently, Treasury bill yields are between 4.25-4.50% depending on the term. Therefore, the higher the total cryptocurrency market value, the more funds accumulated by stablecoin issuers. Ultimately, most of these custodial assets will be invested in Treasury bills.

On average, for every $1 increase in total cryptocurrency market value, $0.09 flows into stablecoins. Let's assume Trump does his due diligence and pushes the total cryptocurrency market value to $100 trillion by the time he leaves office in 2028. This is about 25 times the current level;

If you think this is impossible, it means you haven't been in cryptocurrencies long enough. This will create about $9 trillion in Treasury bill purchasing power, achieved through global capital inflows by stablecoin issuers.

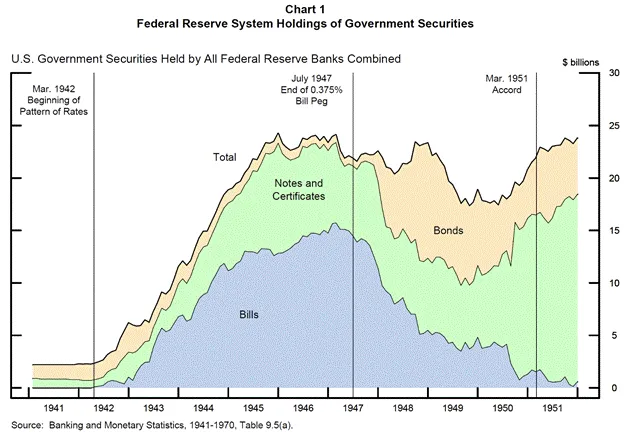

From a historical context, when the Federal Reserve and Treasury needed to fund the US World War II adventure, they also resorted to issuing far more Treasury bills than bonds.

Now, Trump and Benson have "squared the circle":

They copied the Chinese model, creating an American fascist economic system to produce materials.

The inflationary impulse of financial assets driven by credit growth is directed towards cryptocurrencies, with cryptocurrencies surging, making the masses feel richer due to their stunning returns. They will vote for the Republican Party in 2026 and 2028... unless they have a teenage daughter... or maybe people always vote with their wallets.

The continuously rising crypto market brings massive capital inflows into dollar-pegged stablecoins. These issuers will invest their custodial assets in newly issued Treasury bills, funding the ever-expanding federal deficit.

The drums are beating. Credit is being pumped. Why haven't you fully invested in cryptocurrencies yet? Don't be afraid of tariffs, don't be afraid of War, and don't be afraid of random social issues.

Trading Strategy

It's simple: Maelstrom is already fully invested. Because we are degens, the Altcoin realm offers amazing opportunities to outperform Bitcoin, this crypto reserve asset.

The upcoming Ethereum bull market will completely ignite the market.

Since Solana rose from $7 to $280 from the ruins of FTX, Ethereum has been the least favored among large cryptocurrencies. But now it's different; Western institutional investor groups, with Tom Lee as their main cheerleader, love Ethereum.

Buy first, ask questions later. Or don't buy, and sit in the club corner drinking beer that tastes like piss, while a group of people you think are less intelligent than you buy champagne at the next table.

This is not financial advice, so you decide. Maelstrom is doing everything about Ethereum, everything about DeFi, and everything driven by ERC-20 Altcoins for "degenerates".

My year-end targets:

Bitcoin = $250,000

Ethereum = $10,000

Yacht freedom, damn it!