- SPYx is a price-tracking token, not equity-backed—offering no shareholder rights, dividends, or governance despite mirroring real U.S. stock market movements.

- On-chain data shows USDC profits flow back to issuers, suggesting potential arbitrage or off-chain asset purchases, with unclear transparency and investor protection.

- Liquidity pools and secondary markets simulate activity, but large trades face risks like slippage, sandwich attacks, and high fees, limiting real adoption.

Recently launched on the Solana blockchain, SPYx—a price token corresponding to the U.S. S&P 500 ETF (SPY)—has sparked significant interest in the market.

By analyzing on-chain data and wallet behavior, this article unveils the structure, logic, and potential risks of this new wave of “stock price tokens,” and questions whether this trend is a true financial innovation or merely a cleverly disguised arbitrage tool.

IS U.S. STOCK TOKENIZATION A BREAKTHROUGH OR A DECEPTION?

Why has U.S. stock tokenization caused such a frenzy? Similar to the previous hype around real estate tokenization, both asset classes attract massive capital inflows. The underlying appeal of tokenization is twofold: it promises greater transparency and breaks away from traditional trading hours by enabling 24/7 trading.

However, weaknesses in the secondary market are immediately evident. Once tokenized, the first challenge will be liquidity. Next is the question of regulatory ambiguity—does tokenization truly make markets and assets more transparent, or is it simply taking advantage of the crypto market’s regulatory gray zones?

This question becomes even more complex considering Trump’s active push for the “Genius Act” and his interest-driven regulatory stance. These policies make the evolution of tokenized U.S. equities both exciting and unpredictable.

THE LOGIC BEHIND USDC OUTFLOWS TO CIRCLE AND COINBASE

On-chain data shows that after SPYx’s market-making activities conclude, the issuer often batches and transfers USDC to addresses associated with Circle and Coinbase. This behavior could have two possible meanings:

- Converting USDC to real USD: The issuer may be purchasing real SPY shares to back future SPYx issuances.

- Profit withdrawal: These funds might be the issuer’s profits, with no guarantee they’re used for asset purchases.

What stands out is that converting crypto profits to fiat means crossing into centralized financial oversight, which still lacks consensus between the fiat and crypto systems. This introduces investment risk.

On the flip side, converting to fiat could also be a method of cashing out, raising concerns over whether funds are being used for future infrastructure or simply profit-taking.

“STOCK PRICE TOKEN” VS. “EQUITY TOKEN”: A LEGAL AND RIGHTS-BASED GRAY AREA

While the term “equity token” is often used to describe assets like SPYx, in reality, these tokens lack any legal claim to actual shares. There are three major reasons why these do not represent real equity:

- Anonymous wallets can’t be incorporated into corporate governance structures.

- Even if the issuer claims to hold corresponding stocks, SPYx holders have no rights (e.g., dividends, voting, or share transfer restrictions).

- Only the issuer may retain shareholder rights and could potentially gain extra influence from holding stocks while circulating unbacked tokens.

As such, SPYx is more accurately defined as a stock price token, functioning as a price-tracking instrument rather than a token with real equity parity.

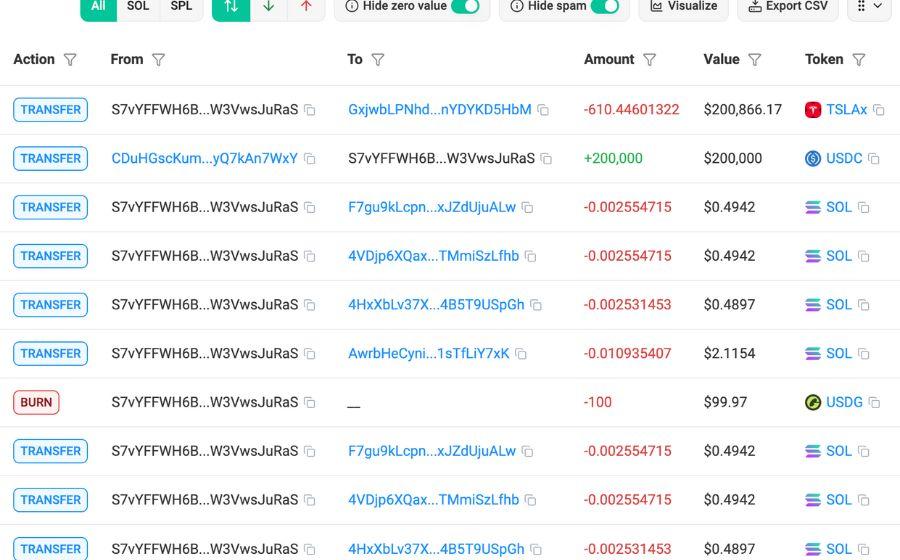

SPYX ISSUER WALLET ACTIVITY: FOLLOWING THE FLOW

The chart below highlights a few key features of U.S. stock tokenization. Notably, trading pairs like SPYx/USDC and SPYx/WSOL indicate a structure very different from traditional stock markets.This reinforces the idea that these are price tokens, not equity tokens.

Additionally, analysis of wallet flows shows that the majority of liquidity is centered around three tokens: USDC, SOL, and TSLAx (Tesla token). This hints at how the issuer may be managing liquidity pools and engaging in strategic market-making for SPYx.

Image source: CoinRank

THE LIFE CYCLE OF SPYX TOKEN ISSUANCE AND MARKET-MAKING

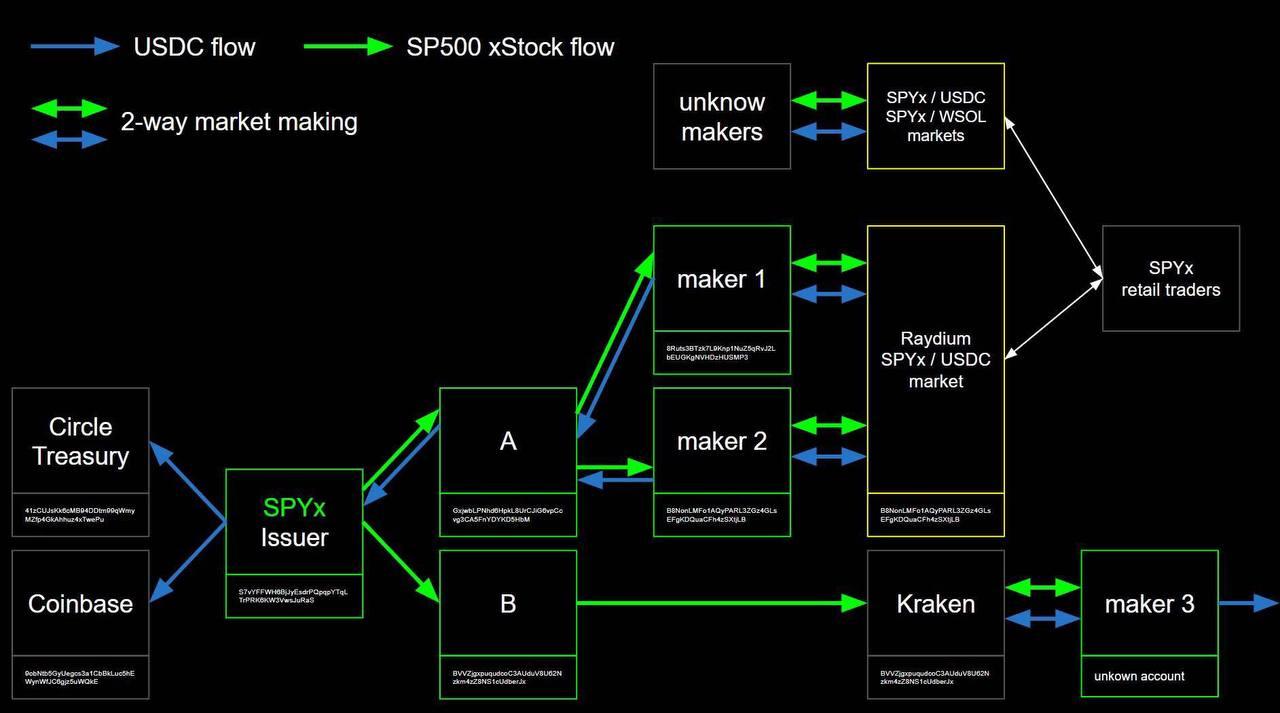

From the chart below, we can break down the issuance and market-making cycle of SPYx as follows:

- The SPYx Issuer mints tokens, distributing them to two wallets (A and B).

- Wallet A transfers SPYx to Maker 1 and Maker 2, who act as market makers.

- Wallet B deposits SPYx to Kraken for off-chain selling.

During the market-making phase, Maker 1 and Maker 2 provide liquidity on Raydium’s SPYx/USDC pool. They earn arbitrage profits from bid-ask spreads. The USDC received is returned to the SPYx Issuer wallet, which then batches the stablecoins and sends them to Circle and Coinbase.

Image source: Facebook Yu Zhe’an

ISSUER PROFIT MODEL AND FUTURE CONTROVERSIES:

A CRISIS OF TRUST AND GOVERNANCE

Though SPYx is still in its experimental phase, its profit structure is already becoming clear. Here are three key takeaways:

- Market-making arbitrage: Official market makers can profit from liquidity spread trading.

- USDC recycling mechanism: Stablecoins eventually flow back to the issuer, centralizing control over the entire value loop.

- Hidden governance rights: Tokens are widely circulated, but actual shareholder rights remain with the issuer, potentially creating a silent concentration of control.

Current behavior suggests that the issuer might also create derivative products and build a secondary market to simulate liquidity. This could give potential buyers a false sense of depth.

For large investors who care about fees and price slippage, minting derivatives directly would be more cost-effective than trading on the secondary market. In fact, high-volume traders risk slippage and sandwich attacks in secondary markets, making them less appealing.

FROM ABSTRACTION TO MATURITY: TOKENIZATION IS GOING MAINSTREAM

The rise of blockchain technology is driving a surge in the cryptocurrency market, with tokenization now extending beyond digital assets to real estate and U.S. equities. As the crypto space matures, the vision of tokenizing tangible assets and bringing traditional finance on-chain is gradually becoming a reality.

However, this transition raises critical issues—whether regulatory transparency can align with blockchain’s decentralized nature, and how the technical differences between equity tokens and price tokens will be reconciled. These distinctions are key hurdles that investors must understand and accept as tokenization moves toward mainstream adoption.

〈SPYx: Is the “Stock Price Token” on Solana the Future of Finance or Just an Issuer’s Arbitrage Machine?〉這篇文章最早發佈於《CoinRank》。