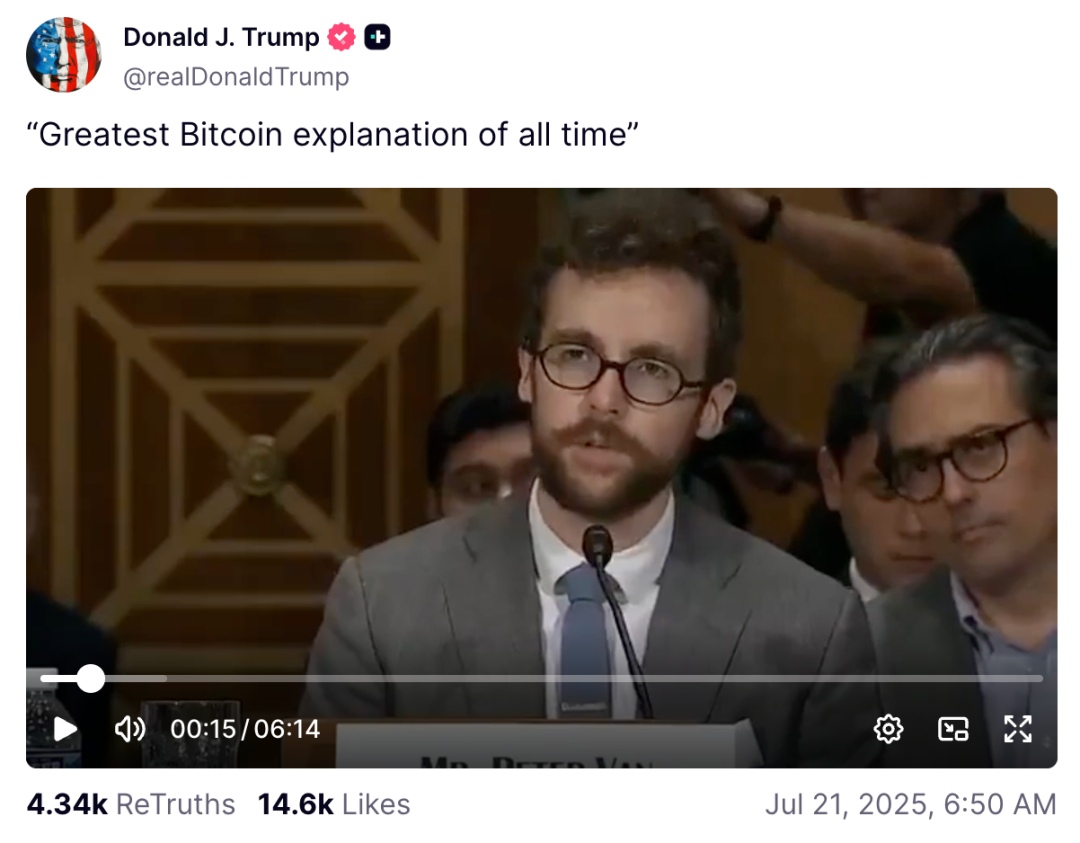

US President Trump retweeted a video testimony by Peter Van Valkenburgh explaining BTC at a US Senate hearing, commenting that it was the "best explanation of Bitcoin ever".

What exactly did this highly praised testimony say? The following article will reveal it.

First, this testimony was not recent, but from 7 years ago, specifically on October 11, 2018.

Second, the location was a hearing held by the Senate Committee on Banking, Housing, and Urban Affairs. The theme was "Exploring the Cryptocurrency and Blockchain Ecosystem". The hearing content is publicly available on the US Senate website, and those with English reading ability can find the original video and related materials through Reference 1.

* Reference 1: https://www.banking.senate.gov/hearings/exploring-the-cryptocurrency-and-blockchain-ecosystem

Third, the speaker of the testimony retweeted by the president was Peter Van Valkenburgh, who was the Research Director of Coin Center at the time.

So, how did he explain BTC at that time? Below is the Chinese translation of his testimony, shared with readers of this article.

「Chairman Crapo, Mr. Brown, distinguished members of the committee, thank you for the opportunity to speak today.

I am Peter Van Valkenburgh, Research Director of CoinCentre. We are an independent non-profit organization focused on researching public policy issues affecting cryptocurrencies and public blockchain networks.

What is Bitcoin?

Bitcoin is the world's first cryptocurrency, operating on the first public blockchain network.

What can Bitcoin do?

Simply put. With just a computer connected to the internet, you can transfer value to anyone anywhere in the world.

Why is it revolutionary?

Because in the internet payment realm, it is the first tool that can operate without trusting a middleman. This characteristic of not requiring any intermediary enterprise makes Bitcoin the first public digital payment infrastructure. By "public", I mean accessible to everyone and not monopolized by a single entity.

We already have a public infrastructure for the information age - the internet that supports websites and email.

But before Bitcoin, the only public payment infrastructure was cash (paper money), and it only worked for face-to-face transactions. Before Bitcoin, if you wanted to pay remotely by phone or internet, you couldn't use public infrastructure. You had to rely on private banks: they record your debits and credits through internal ledgers. If the transaction parties have accounts in different banks, it needs to go through multiple banking systems and ledger records.

Bitcoin's ledger is a public blockchain. Anyone can transfer Bitcoin on this ledger. Regardless of nationality, race, religion, gender, or credit rating, everyone can create a Bitcoin address at zero cost to receive digital payments.

Bitcoin is the first globally universal public money.

Is it perfect? No.

Email, born in 1972, was also not perfect. Bitcoin is not the best currency in all dimensions: it has not yet achieved global adoption, has not become a mainstream unit of account, and its value storage function is volatile. But its greatness lies in its ability to operate without trusted intermediaries.

This is a breakthrough in computer science, and its significance for freedom, prosperity, and human development will be no less than the birth of the internet. Bitcoin is just the beginning. By reconstructing private payment infrastructure, we can transform other private monopoly nodes that hinder human interaction.

Why build more public infrastructure? Why choose blockchain over corporate intermediaries? Why tolerate current technical deficiencies and continue to improve? Why let the pioneers of this technology take root in the United States rather than scatter overseas?

The answer is simple:

Because the current private intermediary institutions providing key infrastructure are becoming fewer in number, larger in size, and more concentrated in power - and their failures are causing increasingly serious consequences.

1.43 billion Americans (about half the population) had their Social Security numbers obtained by hackers due to an Equifax data breach.

The SWIFT network was hacked through member banks in Bangladesh, Vietnam, Ecuador, and Russia, transmitting hundreds of millions of dollars in fraudulent transactions. The FBI now suspects that the largest of these hacking attacks came from North Korea.

Grassroots employees of Punjab National Bank in India forged SWIFT certifications to steal $1.8 billion, creating the largest electronic bank robbery in history. In fact, this is the largest bank robbery in human financial history.

In October 2016, about 1.2 million networked devices were hacked to form a botnet, causing major European and American websites like CNN, Fox News, New York Times, and Wall Street Journal to be paralyzed for hours.

As the Internet of Things (IoT) develops, more and more physical devices access the internet through private intermediary servers:

St. Jude Medical's pacemakers were hacked.

TRENDnet's baby monitors were hacked.

Jeep Cherokee was remotely hijacked, causing vehicle failure.

These systemic vulnerabilities all stem from single points of failure - whether this failure point is a corporation or a government. Critical systems should never have single points of failure.

Before the internet, information transmission had to go through three major TV networks or a few newspapers. Private enterprises are important, but key infrastructure must not depend on one or two institutions.

The internet eliminated single points of failure in communication infrastructure, spawning a new wave of media companies competing on a public protocol layer.

Blockchain can similarly eliminate intermediary monopolies in payment and IoT fields. Although this technology is not yet mature, it represents the brightest future.

Just as we treated the internet in the 1990s, we need to implement lenient policies that encourage innovation, ensuring these technologies flourish in the United States, ultimately benefiting and protecting all citizens.」