Title: The "ChatGPT" Moment for Crypto

Author: thedefireport

Translated by: Plain Blockchain

Last Friday, Trump officially signed the GENIUS Act, marking the birth of the first stablecoin law in U.S. history.

Stablecoins - long viewed as the pillar of on-chain finance by crypto native users - have now gained legal status in the eyes of U.S. regulators.

In the long run, this is the "ChatGPT moment" for cryptocurrency - the first crypto product with mainstream utility and institutional clarity.

01 New Legislation Overview

The GENIUS Act may be the most impactful legislation in crypto history.

This bipartisan bill establishes the first federal regulatory framework for payment stablecoins, aimed at injecting confidence, clarity, and institutional legitimacy into the $260 billion stablecoin market.

Key points:

Asset Backing: Issuers must fully back their stablecoins 1:1 with high-quality liquid assets. Acceptable reserve assets are limited to U.S. dollar cash, insured bank deposits, money market funds, or short-term government bonds. USDT currently does not meet this requirement.

Payment Only: Prohibits issuers from paying interest to stablecoin holders. This ensures stablecoins function only as digital cash equivalents. We view this as a strategic "concession" to banks, buying them time before stablecoins more deeply disrupt the financial system.

Bankruptcy Protection: Stablecoin holders have priority claims on reserve assets in case of issuer bankruptcy.

Transparency and Audit: Issuers must disclose reserve status monthly and undergo regular audits.

Anti-Money Laundering Measures: The bill includes strict AML and KYC rules, requiring issuers to implement Bank Secrecy Act compliance programs, verify customer identities, and report suspicious activities.

Regulatory Structure: The bill authorizes federal and state (for assets under $10 billion) regulatory bodies to oversee issuers, with the U.S. Treasury as the primary regulator.

Issuer Qualifications: The bill clearly allows banks, fintech companies, and even large retailers to issue stablecoins under clear rules. However, it prohibits publicly listed companies primarily engaged in technology, social media, or e-commerce and not "primarily engaged in financial activities" from issuing stablecoins. This means social media giants like Meta, Twitter, and Instagram are banned from launching stablecoins.

By combining the reliability of the U.S. dollar with modern public blockchain networks, this law paves the way for widespread adoption of stablecoins in commerce and finance, while under strict regulatory oversight.

02 Impact on USDC and USDT

Will the GENIUS Act give Circle an advantage?

We don't think so. Some might argue that since the new act requires 1:1 backing with U.S. dollar assets, and Tether currently does not meet this requirement (80-85% of its assets qualify, but gold, Bitcoin, and corporate debt are excluded), Circle would have an advantage.

Why this is not a problem for Tether?

According to the act, if overseas issuers want to enter the U.S. market, the U.S. Treasury can conduct a compliance comparison test. If their rules are consistent with U.S. rules, they can continue to operate in the U.S. market.

Therefore, Tether has multiple ways to become compliant. We expect they will do so.

Who will win the U.S. market: USDC or USDT?

Perhaps a better question is: which fintech company will first integrate stablecoins into mainstream products? Circle? Tether? Stripe? Paypal?

I don't know the answer, nor what the product will look like. But it seems there will be many stablecoin issuers, which will drive down their rates.

This means the winners are likely to be companies providing additional services around stablecoins.

Salary Payments?

The programmability of smart contracts + stablecoins for salary/contractor payments feels like a massive business opportunity emerging in the next few years. Imagine automatic payments to employees and contractors triggered by milestones and time delays. Smart contracts and public blockchains handle administrative and accounting work.

Faster payment speeds, higher monetary velocity, yield-generating money - stablecoins will ultimately unlock these potentials.

Emerging Markets

Emerging markets are not a "race to the bottom". These are more attractive blue ocean markets. And Tether dominates these markets.

In these markets, holders don't need to earn yields. Why? Because in these markets, stablecoin holders simply want to hold a stable currency, and that's where the value lies. For example, in Argentina, stablecoin holders can protect themselves from double or triple-digit inflation.

Just by holding U.S. dollar stablecoins as a store of value, that is their "yield".

We believe Tether will continue to dominate emerging markets, and we also anticipate Tether's relationship with the U.S. government will become closer.

03 Impact on Fintech Companies

We believe every major fintech company will launch its own stablecoin in the coming years. Paypal has already taken the lead.

We think Stripe will be next.

Block (Square/Cash App), Robinhood, SoFi/Chime, and international fintech companies are also potential candidates.

Why?

They have massive user bases, global infrastructure, strong balance sheets, and banking partners.

Stablecoins will provide merchants and e-commerce customers with a global, 24/7 payment channel at lower costs. Additionally, they will bring new revenue streams (under the GENIUS Act, fintech companies will retain earnings).

04 Impact on U.S. Banks

Banks are facing challenges, and in our view, future banks will be fintech companies built on crypto rails, potentially looking very different from today.

However, remember that email became mainstream 20 years ago, but post offices are still operating.

We believe banks will be similar. Innovative banks and fintech companies will perform well, while slow-moving banks will be like post offices in five years.

Why are U.S. banks in trouble?

They can't innovate. Not because they don't want to, but because they're too large, too bureaucratic, with employees lacking incentives to take risks - anyone who has worked in a large corporation understands this.

They have no motivation to launch stablecoins. Why? Because it would disrupt their business model.

Banks' profit model is:

Absorb deposits,

Invest deposits,

Earn net interest margin (asset return - deposit interest).

If banks issue stablecoins, these funds cannot be used for lending. They can't "magically" multiply like dollars, which is "dead capital" for banks. Of course, we believe banks will eventually issue stablecoins (to earn interest and offset some lending income loss), but ultimately, they'll have to share interest with stablecoin holders.

Banks won't disappear - but a storm is coming for slow-moving banks. The GENIUS Act is only accelerating this process.

05 Impact on Visa/Mastercard

Reminder: Stablecoins can settle almost instantly, peer-to-peer, globally, and at low cost.

Currently, traditional card payment costs are 200-300 basis points, including issuer/acquirer fees, forex spreads, and interchange fees. Not to mention settlement takes 2-3 days.

Stablecoins are clearly a better product.

We believe stablecoins will be used for merchant payments, e-commerce, remittances, subscriptions, cross-border payments, salaries, and more.

This will completely bypass card payment rails, with almost instant global settlement. The cost is only a fraction of traditional card payments.

You can be completely sure that this poses a significant threat to the $200 billion card payment fee industry.

Why?

And they can build better products.

Of course, Visa and Mastercard are not sitting idle.

They are integrating services into public blockchains through the following methods:

Shifting from "card payments only" to multi-rail infrastructure to support stablecoins as "another settlement currency".

Compliance: fraud detection, chargebacks/disputes, identity services.

Launching branded cards supported by USDC and PYUSD, which keeps them relevant on the front end, even if they no longer control the rails/infrastructure.

What does this mean?

Stablecoins seem to be forcing Visa/Mastercard to transform from a "value transfer" network to merely providing "trust and tools".

Savings in card payment fees could benefit merchants, stablecoin issuers, consumers, and fintech companies that can integrate new services with stablecoin products.

06 Impact on US Dollar Dominance

Stablecoins are extremely bullish for the US and the US dollar, like a savior from crypto heaven.

Why?

Tether was the fifth-largest buyer of US debt last year!

If Tether were a country, they would be the 18th largest holder of US debt.

This story is just beginning.

This might be a bold perspective. But we believe Tether could be one of the most important innovations in US dollar growth history.

We believe the current government wants to support Tether's growth in the US and overseas. We must mention that Cantor Fitzgerald provides custody services for Tether's reserves. Let's consider that Tether has 450 million global users, with the vast majority outside the US.

When international users buy USDT as a store of value, Tether purchases US debt.

Therefore, Tether is decentralizing the base of US debt holders, shifting from sovereign nations to global individuals, and you can imagine the US government would want to establish a close relationship with this.

Stablecoins are not only expanding the global network effect of the US dollar, but they are also decentralizing the base of US debt holders.

Scott Bessent understands this.

That's why he has become an advocate for stablecoins and the GENIUS Act.

All stablecoin issuers are important to the US dollar.

But overseas issuers like Tether are especially important - new buyers are emerging here, the network effect of the US dollar is expanding here, and unbanked populations are being banked here.

I believe Tether and the US government will ultimately form a very close relationship, and we should pay close attention to this.

07 Summary

The vast majority of stablecoins are on Ethereum, and moreover, Ethereum has already captured the "stablecoin narrative".

Personally, I prefer USDC on Solana for a better user experience. Nevertheless, only 4.2% of stablecoin supply is on Solana today.

ETH/SOL might be the safest long-term way to gain stablecoin exposure.

Further down the risk curve are two crypto-native companies with strong fundamentals: Ethena and Sky.

We like Ethena as a high-risk/high-reward option, and you can check our recent coverage of the project. We believe the GENIUS Act will create regulatory arbitrage opportunities for stablecoin issuers like Ethena who share revenues.

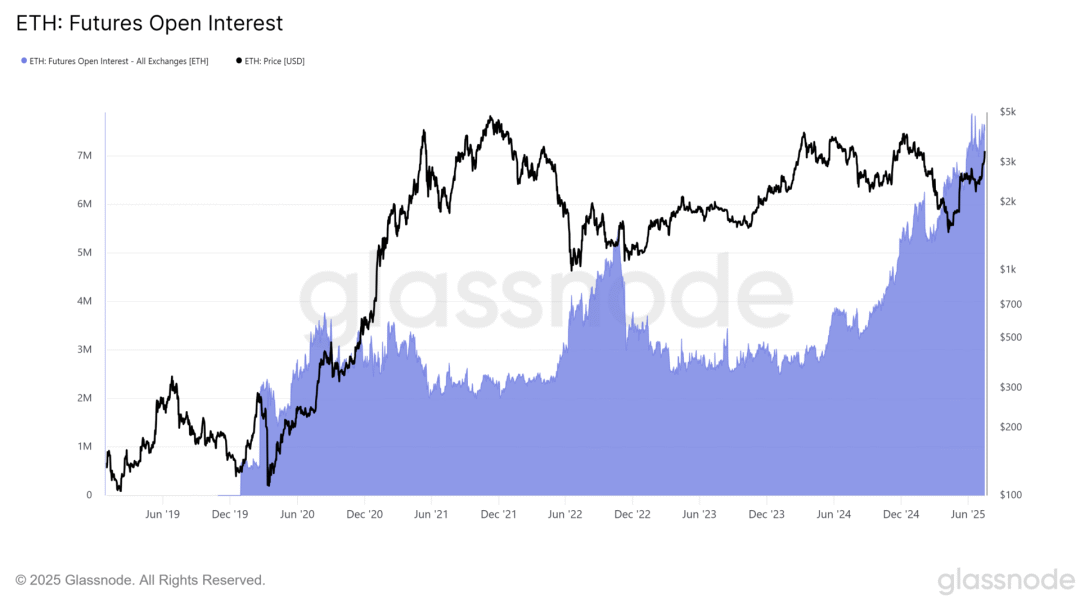

Not to mention the correlation between USDe demand, ENA price, and rising ETH open interest.

Data: glassnode

Ultimately, stablecoin supply in the crypto ecosystem is rising, on-chain circulation speed is rising, prices are rising, and volatility is also rising.

It's time to buckle up.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush Telegram Group: https://t.me/BitPushCommunity

Bitpush Telegram Subscription: https://t.me/bitpush