Author: TechFlow

Original Title: XRP Breaks New High, the Crypto Parallel World Behind Veteran Coins' Fierce Performance

Between the rises and falls of each crypto market cycle, some familiar names repeatedly appear at the top of the gains list.

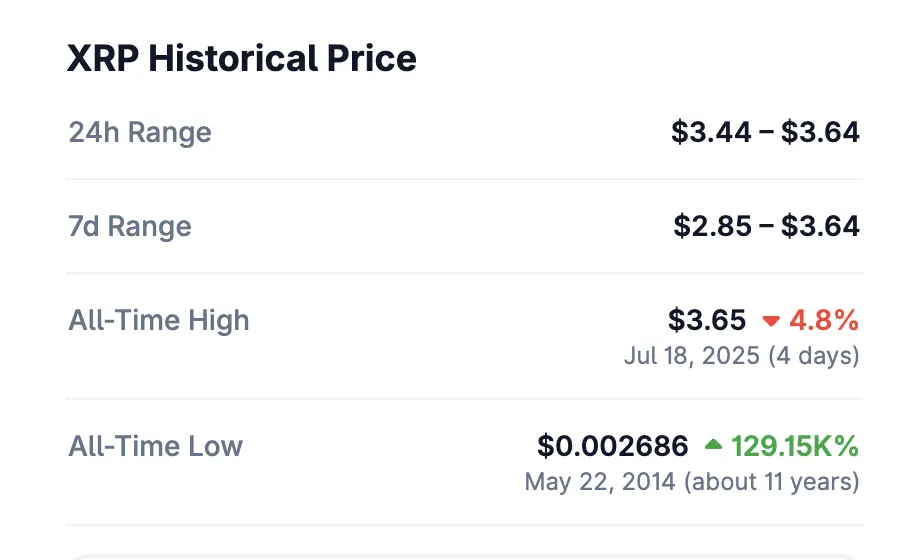

XRP, XLM, ADA... These projects considered "having no future" in mainstream crypto circles still manage to refresh their presence in the new bull market wave.

They are not new innovative public chains, nor are they currently hot narrative darlings, and they certainly cannot boast of any powerful ecosystem or technological breakthrough. But at a certain stage of the bull market,

They always seem to rise against the trend in an inexplicable way, returning to the center of attention, and even breaking new highs like XRP.

This is not just "speculation inertia" in the financial market, but more like a hidden parallel world in the crypto industry.

In this parallel world, XRP is the future of cross-border payments, XLM is the hope for global micro-payments, and ADA is the new order of smart contract governance.

Old coins never die, they must be extraordinary.

Crypto Parallel World

If the crypto market is a stage full of hot topic rotation and technological innovation, then the survival soil of old coins often exists behind this stage - a world almost parallel to the mainstream crypto community.

We are accustomed to discussing new narratives and new projects on Twitter, Discord, Telegram, WeChat groups, and are used to switching between Ethereum, Solana ecosystems or meme coins.

Yet we rarely realize that these assets called "old coins" also have massive and stable communities, just that their active spaces are not in the circles we are accustomed to.

XRP, XLM, ADA, HBAR... The users of these old coins have never been active Twitter participants, nor speculators who buy coins based on KOL promotions.

They have their own information channels, community networks, and judgment logic - or, more directly, they don't care what's currently popular in the industry.

The XRP community is active in WhatsApp groups, Line groups, and Facebook communities in Japan, the United States, and even Latin America.

Most of these users are not concerned about crypto's technical logic, nor do they chase industry hotspots, but they are familiar with XRP's cross-border payment story, recognize Ripple's cooperation model with banks, and even view XRP as a "long-term asset of financial innovation".

Whether XRP is sued by SEC or faced with various bearish voices in the market, these users' beliefs are basically unaffected.

The Stellar (XLM) community is similar.

In some developing countries, Stellar's cooperation with local financial service providers gives it a real user base. They may not know about Staking or DeFi, and might know nothing about the chain's innovative ecosystem, but Stellar is already a cutting-edge brand and asset in their perception.

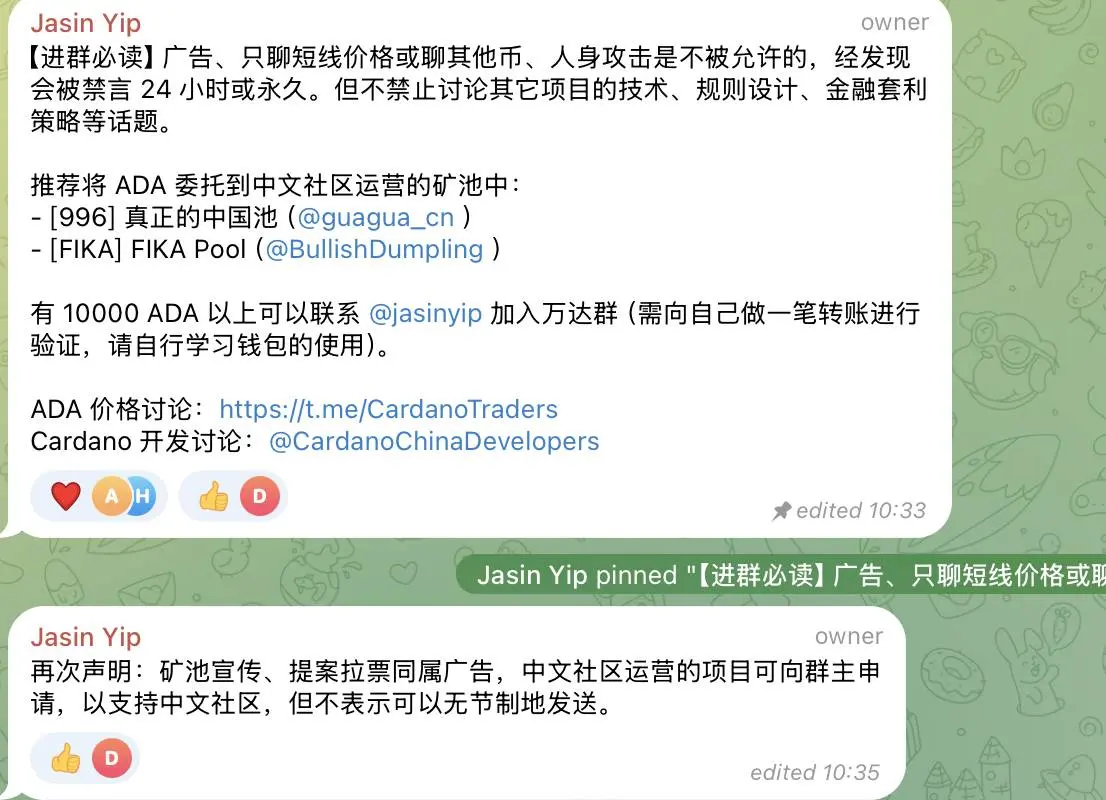

Cardano (ADA) has an even more typical "die-hard fan" phenomenon.

In Japan, Africa, Eastern Europe, and some English-speaking countries, Cardano's educational, governance, and community projects have accumulated a large number of loyal users. Even in China, there is an ADA community mainly led by internet company programmers.

These people are active year-round on Reddit, Telegram, and local forums, knowing Cardano's technical route and founder Charles Hoskinson's speeches by heart. Even with slow ecosystem development and constant industry doubts, they remain steadfast in holding.

These perceptions might seem disconnected from reality to outsiders, but they constitute a deeply rooted reason for holding coins.

All of this forms an ecosystem parallel to the mainstream crypto world.

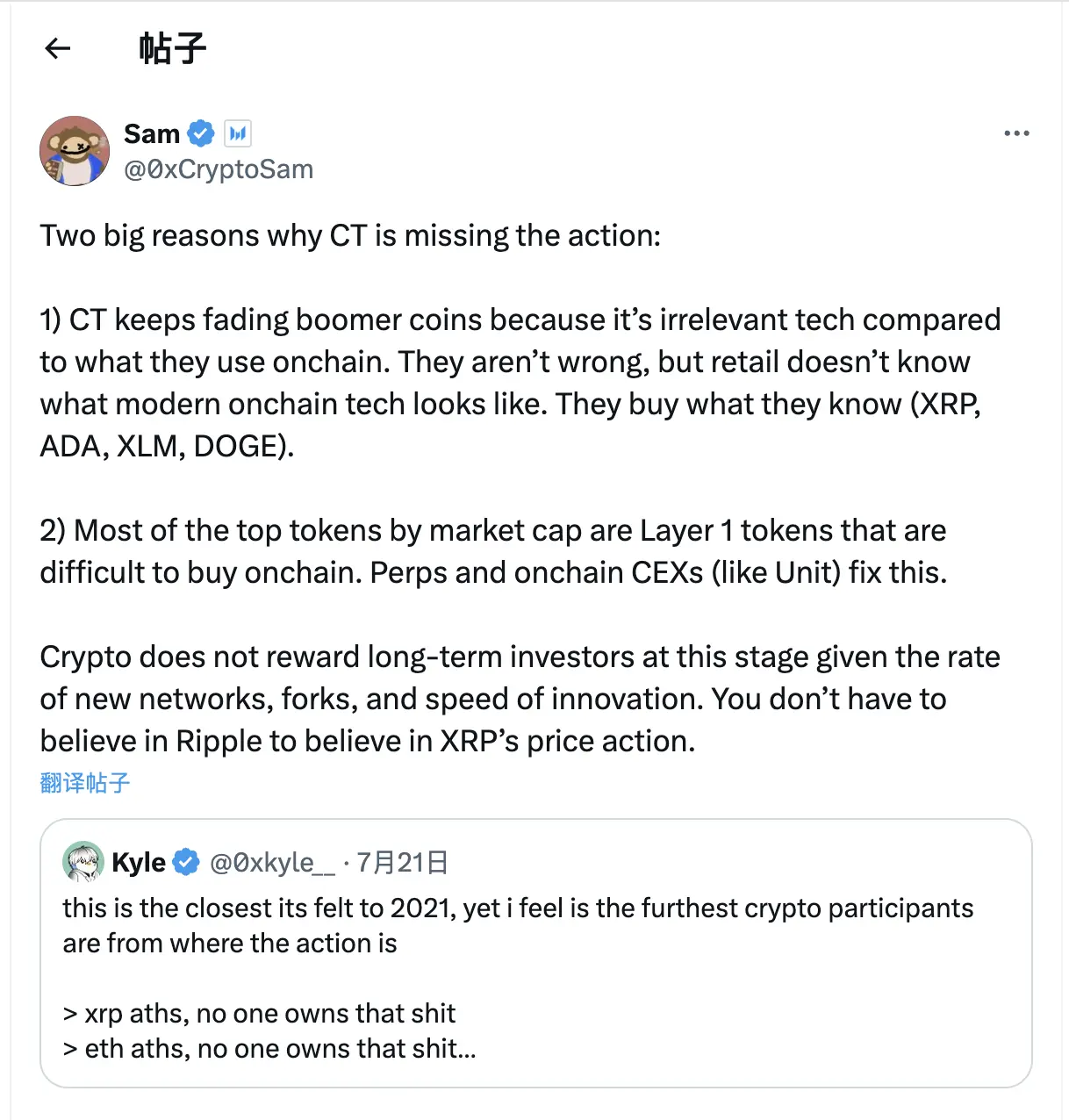

Messari analyst Sam stated on X that crypto Twitter always looks down on these "veteran coins" because compared to the new technologies they use on-chain, these coins are already outdated. Their judgment is not wrong, but ordinary retail investors actually do not understand modern chain technology and will only buy coins they are familiar with (like XRP, ADA, XLM, DOGE).

It does not survive on popularity, nor does it rise and fall with market narratives. The community operation logic of these old coins is more akin to the user culture of the Web2 era: brand, habits, emotional identity, and even psychological inertia of "already being used to it".

The survival of old coins has never depended on the mainstream stage of the industry; their vitality is hidden in those "secret corners" overlooked by the mainstream crypto world.

Because of this, no exchange will easily delist XRP, XLM, or ADA.

The trading volume, active users, market depth, and hedging needs they bring are important components of trading platforms.

Even if the project side has no technological breakthrough, old coins still have an undeniable position on spot, leverage, and perpetual contract trading lists.

They have become part of the market, passive fund allocation habits, and even "old friends" in speculators' minds - as long as the market starts, funds will always flow back.

Not Just Capital, But Politics

Beyond users and communities, these project teams' economic and political strength far exceeds external imagination.

These crypto projects considered "out of fashion" continue to shine not just because of old users, but because they have long secured a place in traditional finance and political capital.

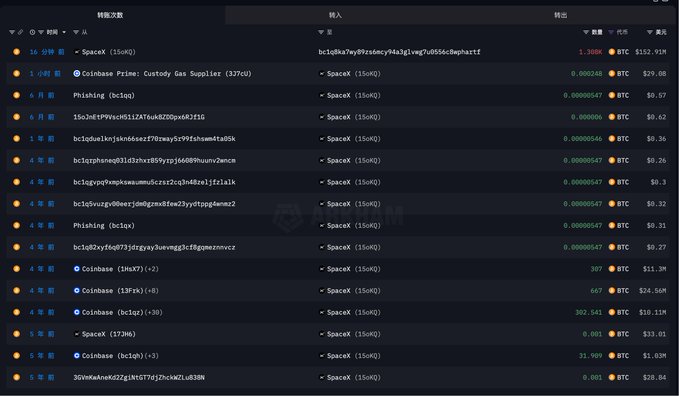

Taking XRP as an example, Ripple is not an isolated technical and commercial organization, but a long-term "veteran player" participating in traditional finance and policy formulation.

The Ripple founding team and executives frequently appear on speaking platforms at international payment forums, US Congressional hearings, and fintech summits, and have deep interactions with the Trump administration.

In January 2025, Ripple CEO Brad Garlinghouse was invited to the Trump dinner at Mar-a-Lago resort and posted a dinner photo on Twitter with "Strong start to 2025!"

On July 19th, Trump officially signed the Genius Act at the White House, and Ripple's Chief Legal Officer Stuart Alderoty was invited to the scene, one of the few witnesses from the crypto industry.

In the long-standing SEC lawsuit against Ripple, not only was Ripple not crushed, but it obtained a favorable result, further consolidating its political position in "compliant crypto asset" discussions.

Moreover, Ripple has collaborated with hundreds of financial institutions globally over the years, including traditional financial giants like Santander, PNC, Standard Chartered Bank, and SBI Holdings. This extensive commercial network has become crucial support for XRP market confidence.

Cardano promotes blockchain education and digital identity projects in countries like Ethiopia and Rwanda, connecting with local national policies and governance.

Hedera's governance committee consists of global renowned enterprises like Boeing, Google, IBM, and Deloitte, and has participated multiple times in digital asset and distributed ledger policy discussions in the US. Hedera board member Brian Brooks is a former Acting Comptroller of the Currency and a close partner of current SEC Chairman Paul Atkins.

These projects do not just operate within the crypto circle but build solid foundations in multi-dimensional spaces of political systems, compliance consulting, and business cooperation. They have the ability to influence policies, seek regulatory compromise, and obtain a "chosen" status through political and capital networks.

Therefore, when people question these old coins from technological and narrative perspectives, they often overlook the moats these projects have long established in policy and capital layers.

In such a framework, what these old coins demonstrate is not technological obsolescence, but another strategy of "living long and stable" - the real trump card lies in capital, commercial resources, and political shields.

So, the next time you see XRP, XLM, ADA, HBAR, etc., appearing on the market list, don't be surprised, and don't rush to explain it with technology and narrative.

They don't need to be acknowledged, just being alive is enough.

Sometimes, simply "living long enough" is an underestimated competitive advantage.